We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Financial health can be the difference between taking charge of your money and the money taking charge of you. The key to avoiding the latter lies in the art of Personal Finance. Whether you are saving, budgeting, or investing, Personal Finance is the path to mastering the art of managing money and ensuring your money works for you.

This blog is the ideal beginner's roadmap to uncovering What is Personal Finance, encompassing everything from income awareness, budget planning, credit monitoring and beyond. So, dive in and create a game plan to destroy debt, grow your savings, and set yourself up for long-term financial success.

Table of Contents

1) What is Personal Finance?

2) Importance of Personal Finance

3) Personal Finance Affected Areas

4) Personal Finance Process

5) Personal Finance Strategies

6) Conclusion

What is Personal Finance?

Personal Finance is about managing money to meet your financial goals. It involves evaluating income, recurring expenses like rent or insurance payments and the amount planned for saving or investing. A financial goal could be something big, like saving up for a car or planning for retirement fund, or something smaller, like saving £50 every month or buying your first stock.

Personal Finance is not a one-and-done deal and keeping track of finances is a lifelong practice. As circumstances change, our financial needs may change too, so reevaluating Personal Finance goals every few years is essential.

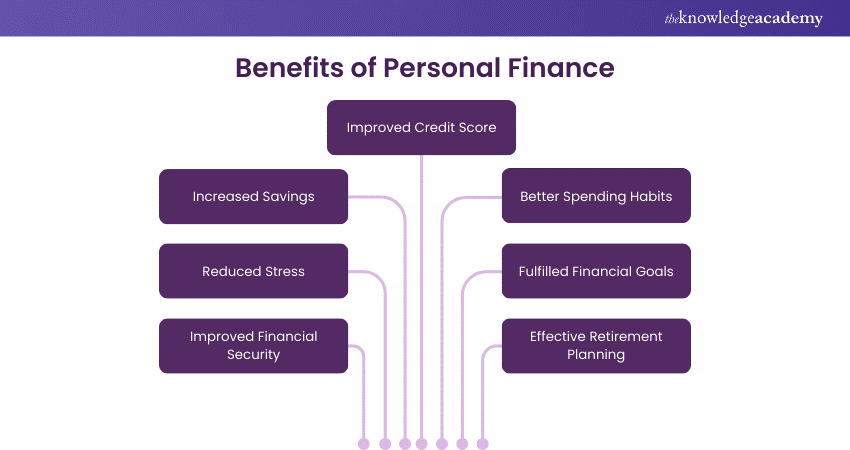

Importance of Personal Finance

The following aspects cover the importance of Personal Finance:

1) Financial Security: Personal Finance helps individuals take control of their financial situation.

2) Financial Goals: It helps individuals set and achieve their financial ambitions.

3) Wealth Building: Personal Finance offers tools and knowledge for effective financial decisions such as saving and investing.

4) Lifestyle Security: Handling Personal Finances ensures a financially secure life without the fear of running out of funds.

Struggling to navigate the complex world of Asset Management? Our Certified Wealth Management Course will guide you - Sign up now!

Personal Finance Affected Areas

It is important to learn about the most important areas affected by Personal Finance. The key areas are income, spending, saving, investing, and protection. Each of these areas is explored in detail below.

Income

Income refers to a source of cash inflow an individual receives in exchange for work that they use to support themselves and their family. It's the ideal starting point for the financial planning process. Familiar sources of income are:

a) Salaries

b) Hourly wages

c) Bonuses

d) Pensions

e) Dividends

These sources of income generate cash that an individual can use to save, spend, or invest. Income can be considered the first step in the Personal Finance roadmap.

Spending

Spending includes the expenses that an individual incurs for buying goods and services or anything consumable. All spending falls under two categories:

a) Cash (paid for with cash on hand)

b) Credit (paid for by borrowing money)

The majority of most people’s income is allocated to spending and

the common sources are:

a) Food

b) Rent

c) Mortgage payments

d) Taxes

e) Entertainment

f) Travel

g) Credit card payments

If expenses are bigger than income, the individual has a deficit. So, good spending habits are vital for good Personal Finance management.

Saving

Saving refers to excess cash retained for future spending or investing. If a person's income is greater than the spending, the difference can be siphoned towards investments or savings. Managing savings is a crucial area of Personal Finance.

Common forms of savings include:

a) Physical cash

b) Savings bank account

c) Checking bank account

d) Money market securities

Investing

Investing refers to purchasing assets that are expected to generate a rate of return. This process is done with the hope that, over time, the individual will receive back more money than they initially invested. Common forms of investing include:

a) Stocks

b) Bonds

c) Mutual funds

d) Real estate

e) Private companies

f) Commodities

g) Art

There are significant differences in risk and reward between different investments, and most people need professional guidance in this area of their financial plan.

Explore the rewarding world of retirement planning in our comprehensive Retirement and Pensions Training – Register now!

Protection

Personal protection refers to a broad range of products used to guard against unforeseen events. Common protection products include:

a) Health insurance

b) Life insurance

c) Estate planning

Much like investing, this is an area of Personal Finance where people typically seek professional guidance. A series of analyses is needed to properly assess an individual’s insurance planning needs.

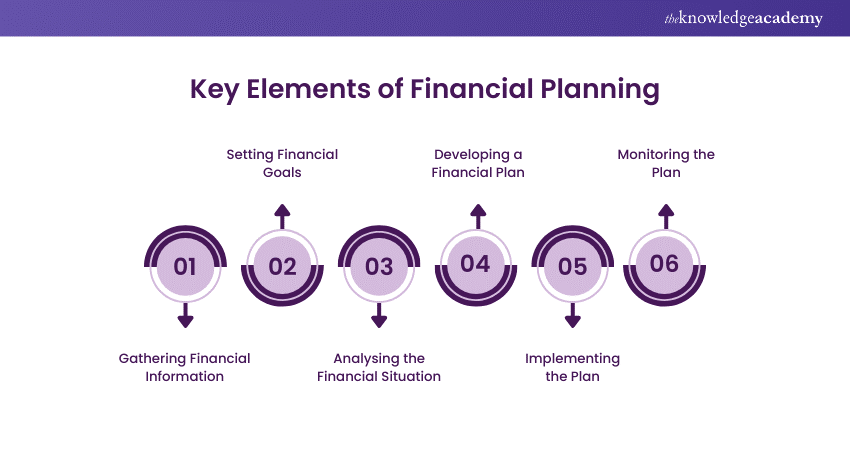

Personal Finance Process

Good Financial Management involves having a solid plan and sticking to it. All of the areas of Personal Finance mentioned above can be incorporated into a budget or formal financial plan. These plans are commonly prepared by investment advisors or personal bankers working with clients to understand their needs.

The key components of the financial planning process are:

1) Assessment

2) Goals

3) Plan development

4) Execution

5) Monitoring and reassessment

Personal Finance Strategies

The sooner you begin financial planning, the better. However, it’s never too late to build financial goals to give yourself and your family financial freedom and security. Here are the best strategies for Personal Finance:

1) Income Awareness

Knowing how much you bring home after taxes and withholding is essential. So before deciding anything, ensure you know the exact amount of the take-home pay you receive.

2) Budget Planning

A budget is essential for living within your means and saving enough to fulfil your long-term goals. The 50/30/20 budgeting method provides the ideal framework which is detailed below:

a) 50% of your net income (after taxes) goes toward living essentials, such as utilities, groceries, rent, and transport.

b) 30 % is allocated to discretionary expenses, such as shopping for clothes, dining out and giving to charity.

c) 20% goes toward the future through paying down debt and saving for retirement and emergencies.

3) Save First

It’s important to save first to ensure money is set aside for unexpected expenses, including medical bills, day-to-day expenses (if you get laid off), and more. The ideal safety net is considered three to 12 months of living expenses. Financial experts typically recommend putting away 20% of each paycheck every month.

However, there's no need to stop once the emergency fund is filled. It's advisable to continue funnelling the monthly 20% toward other financial goals, such as a home or retirement fund down payment.

4) Debt Management

The simple rule is that you only spend what you earn to keep debt from getting out of hand. But most people must borrow from time to time for different reasons. Minimising debt can free up income to be invested elsewhere or put into retirement savings while you’re young.

5) Borrow Wisely

Credit must be managed correctly, meaning you must pay off your balance every month or keep your credit utilisation ratio at a minimum. While credit cards can be significant debt traps, they have applications beyond buying things. They are vital for establishing your credit rating and a good way to track spending.

Using a debit card (which takes money directly from a bank account) is another way to ensure you won't be paying for accumulated small purchases over an extended period.

6) Credit Monitoring

Credit cards are the primary method for building and maintaining credit scores. A solid credit report is needed to obtain a mortgage, lease, or other type of financing. While various credit scores are available, the most popular one is the FICO score. Factors that determine your FICO score include:

a) Payment history

b) Amounts owed

c) Length of credit history

d) Credit mix

e) New credit

7) Future Planning

Along with insurance, making a will and setting up one or more trusts can help protect your assets. Additionally, a living will and healthcare power of attorney can save your next of kin significant time and expense in case you fall ill or become incapacitated. Setting aside money for retirement allows it to grow over the long term and reduce current income taxes if the funds are placed in a tax-advantaged plan.

8) Get Insurance

Insurance can cover most hospital bills as you age, leaving your hard-earned savings secure in your family's hands. After all, medical expenses are one of the leading causes of debt. If something happens to you, life insurance can give your loved ones a buffer zone to deal with the loss and financially get back on their feet.

However, Waiting too long is a bad idea as insurance can be expensive. Long-term care, health, and life insurance can increase in cost the older you get.

9) Tax Benefits

By maximising tax savings, enough money can be freed up to be invested in the reduction of past debts and future plans. You must start saving receipts and tracking expenditures for every possible tax deduction and tax credit. In fact, many office supply stores sell helpful “tax organisers” with the main categories already labelled.

10) Self-Care

Since budgeting and planning can be full of deprivations, it's okay to reward yourself every now and then, be it a vacation, a purchase, or an occasional night on the town. Engaging in such activities offers a taste of the financial independence you’re working for.

Additionally, remember to delegate when needed, even though you might be competent enough to do your own financial planning and management. Setting up an account at a brokerage and spending some pounds on a financial planner or a certified public accountant (CPA) can be a good way to jump-start your planning.

Conclusion

In conclusion, exploring What is Personal Finance can help you get a firm grasp on your income, expenses, savings, and investments and make smart financial decisions. The diverse aspects of Personal Finance outlined in this blog will guide you towards controlling your financial journey and building a secure future for you and your family.

Equip yourself with advanced risk assessment techniques in our detailed Financial Risk Management Certification Training - Sign up now!

Frequently Asked Questions

The four principles of Personal Finance are:

a) Creating a budget

b) Saving for long-term goals and emergencies

c) Managing credit

d) Investing in the future

The 10% rule in Personal Finance recommends putting 10% of your income toward investments and savings as a way of encouraging financial responsibility.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Finance Courses, including the Financial Management Course and the Financial Modelling Course. These courses cater to different skill levels, providing comprehensive insights into What is Financial Modelling.

Our Accounting and Finance Blogs cover a range of topics related to Financial Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your financial skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please