We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Have you ever wondered why and how inflation takes place? This negative force usually arises because of the Budget Deficit. Now, What is Budget Deficit? It’s a situation where the government overshoots expenses over the revenue generated from various sources. Budget Deficit is a crucial Gross Domestic Product (GDP) factor as it reflects the management of any country's finances. Financial issues like inflation occur when the government runs in such a situation.

Budget Deficit can also be applied to businesses and individuals but primarily used in a context related to government. Let’s learn more about What is Budget Deficit and how the government handles this shortfall to safeguard its economy.

Table of Contents

1) What is a Budget Deficit?

2) Components of Budget Deficits

3) Types of Budget Deficits

4) Implications of Budget Deficit

5) The Risks Associated with Budget Deficits

6) Methods for Calculating Budget Deficits

7) Conclusion

What is a Budget Deficit?

Budget Deficit is a budgetary term used to indicate the difference between the spending and the revenue made. You can consider it as a economic factor of any country. As mentioned earlier, the term applies to organisations, and individuals as well.

A Deficit can create debt. As the debt complies, the interest increases, making it difficult for the government to raise funds. Usually, creditors doubt the borrower’s ability to repay.

Just like a Budget Deficit, we have a Budget Surplus. It’s entirely the opposite of the former one. It happens when revenue exceeds expenditure. The remaining sum can be saved to create a better economy.

Both government spending and taxation cause a Budget Deficit. Some of the scenarios that contribute to the Deficit include:

1) Tax: A complex tax structure increases spending and reduces revenue

2) Schemes: Military spending, social security and health management also contribute to the causes

3) Subsidies: Government subsidies targeting industries and individuals

4) GDP: Low gross domestic product (GDP) wipes out the tax revenue

Furthermore, Budget Deficit can also arise because of unanticipated policies and events like terrorist attacks.

Components of Budget Deficits

Budget Deficits have two major components, namely:

1) Revenues

Most of the revenue gets generated either through corporate taxes, social insurance taxes, income taxes, or consumption taxes. In the case of companies and enterprises, services and goods sales make up the revenues.

2) Expenses

Government expenses arise when spending is done on infrastructure, pensions, subsidies, defense, and healthcare. Another type of spending also exists to support the overall economy. In the case of businesses, the expense arises because of daily operations happening inside the company. Also, the production factors, wages, and rent happen to increase spending.

Additionally, Structured Budget Deficits and cyclical budget Deficits also exist. When long lasting factors such as excessive public spending and failure in tax system is prevalent, it is called Structured Deficit. On the other hand, The Cyclical Deficit is when economic factors such as recessions and boons influence the budget.

Types of Budget Deficits

Budget Deficit has five key types that affect the economy. All of them are explained below in detail here:

1) Primar Deficit

The Primary Deficit emphasis on the difference between the government spending, and revenues. However, it doesn’t include interest payments. To assess the situation, total Deficit is taken into consideration.

2) Revenue Deficit

Revenue Deficit is a specific type of Budget Deficit that refers to the difference between a government's revenue receipts and its revenue expenditures. It excludes the borrowing and capital receipts.

3) Fiscal Deficit

The shortfall arose in total revenue of government in comparison to the total expenditure results in Fiscal Deficit. It encompasses both capital and revenue transactions. The difference between the income and spending from taxes makes up the Fiscal Deficit.

4) Trade Deficit

When the export of goods/services becomes higher than the import, a Trade Deficit occurs. It also results in the outflow of exchange. Variables of both imports and exports are taken into consideration.

5) Current Account Deficit

When the receipts from abroad are lower than the payments it generates, the Current Account Deficit is seen. Trade Deficit makes up the largest factor of a current account Deficit.

Boost management skills with our Introduction To Managing Budgets Course- sign up today!

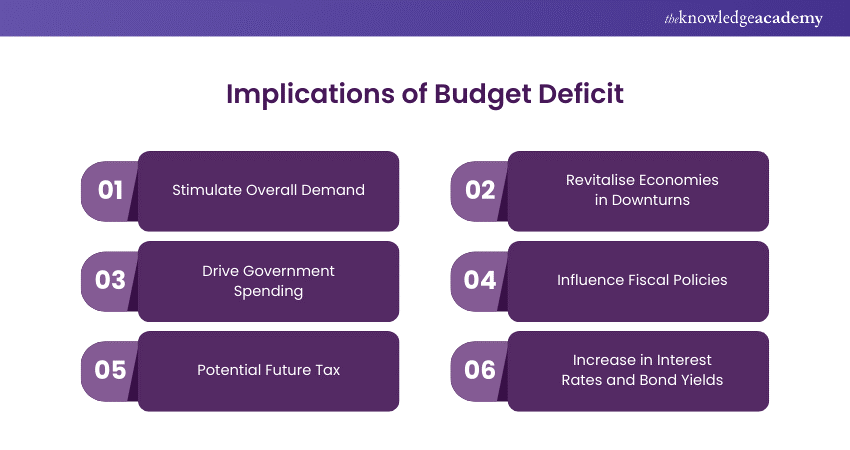

Implications of Budget Deficit

A Budget Deficit sounds like a negative factor; however this is not the case always. Given below are the top six implications of Budget Deficit:

1) Stimulate Overall Demand

Budget Deficit stimulates overall demand as taxes get reduced. This subsequently contributes to the increase in aggregate demand of the country.

2) Revitalise Economies in Downturns

In a recession, the private sector decreases investment, which lowers demand and consumption in an economy. To fight back, the government can either borrow from the international market or take other measures.

3) Drive Government Spending

Spending by the government is done for various purposes like healthcare, pension programs, human capital, etc. A Deficit consists of the government to spend more than its overall revenue.

4) Influence Fiscal Policies

Expansionary fiscal policies can be financed during a Deficit. The result is a reduction in corporate and income taxes. To boost growth of the economy, the government increases spending on investment and infrastructure.

5) Potential Future Tax

A persistent Deficit increases the chances of tax increment in future. Generally, it’s done to pay off the accumulated debt.

6) Increase in Interest Rates and Bond Yields

The government charge higher interest rates to banks and investors to borrow in large quantities. This strategy can compensate for the risk associated with the Deficit.

The Risks Associated with Budget Deficits

Budget Deficits carry risks like currency devaluation and lowered economic growth rates. Apart from this, Aggregate Demand (A.D) surges because of debt compilation. For businesses, a low share price or bankruptcy-like situation arises.

Methods for Calculating Budget Deficits

Budget Deficits can be calculated using the following methods. Have a look at calculations for different Deficit types:

Budget Deficit = Total government expense – Total government income

Fiscal Deficit = Total expenditure – Total receipts (no borrowing included)

Revenue Deficit = Total revenue spending – Total revenue receipts

Primary Deficit = Fiscal Deficit – Interest payments

Trade Deficit = Import value – Export value

Current Account Deficit = Trade gap + Net current transfers + Net income abroad

Conclusion

In conclusion, when government or business outlay overshoots earnings, a Budget Deficit occurs. Fiscal Deficit and Revenue Deficit are two Deficit types under the Budget Deficits. The government takes effective measures to overcome Deficits so that the economy remains stable. Increment in revenue inflow and reduction in revenue outflow also suppress the Deficit. That is all about What is Budget Deficit and how it can raise issues like inflation.

Learn about Management with our Personal Development Courses- join now!

Frequently Asked Questions

Government spending exceeding revenue results in Budget Deficit. You can also call it simply a Deficit that indicates the financial health of a country. Budget Deficit affects not only the economy but also individuals and businesses. To counter Deficits, fiscal policies are established.

The Budget Deficit shows the shortage in government outlays and earnings generated. Fiscal Deficit shows how much dependency the government have on borrowings. To counter the Deficit, reductions in bonuses, subsidies, and leave encashments must be made.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Personal Development Courses , including the Introduction to Managing Budgets and Strategic Planning and Thinking Course. These courses cater to different skill levels and provide comprehensive insights into What is Budget.

Our Business Skills Blogs cover a range of topics related to Personal Development, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Introduction to Managing Budgets

Introduction to Managing Budgets

Fri 22nd Nov 2024

Fri 14th Feb 2025

Fri 11th Apr 2025

Fri 13th Jun 2025

Fri 8th Aug 2025

Fri 10th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please