We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Accurate financial information and strategic decision-making are important for an organisation's success in this ever-evolving business landscape. This is where Management Accounting steps in as a powerful tool for managers and executives to make informed decisions and steer the company towards its goals.

According to the Institute of Management Accountants (IMA), nearly 75% of financial professionals working in business are Management Accountants. These include the likes of Accounting Managers, Financial Analysts, Controllers and even Chief Financial Officers (CFO). If you, too, are interested in starting a career in Management Accounting, then this blog is for you. By reading this blog, you will get an understanding of What is Management Accounting, its techniques and its importance in a company's performance and growth.

Table of Contents

1) What is Management Accounting?

2) Management Accounting techniques

3) Management Accounting reports

4) Role of Management Accountant

5) Importance of Management Accounting

6) Challenges in Management Accounting

7) Management Accounting vs Financial Accounting

8) Essential skills to succeed in Management Accounting

9) Conclusion

What is Management Accounting?

Management Accounting engages in collection, analysis, and interpretation of financial data. This aims at assisting managers and executives in making internal decisions that drive the performance and growth of an organisation. Even though Management Accounting and Financial Accounting are both concerned with financial data, they serve different functions and have different target users. Financial Accounting majors on preparing financial statements for external stakeholders, while the Functions of Management Accounting focus on providing insights and information for internal decision-making, planning, and control. At the same time Management Accounting team provides information to the management team of a company. It covers activities like budgeting, costing, and performance evaluation, strategic planning, etc.

An important function of Management Accounting is to support decision-making processes within the organisation. By presenting relevant data in a concise and understandable manner, Management Accountants enable managers to make critical decisions that align with the goals and strategies of the company.

For instance, Management Accounting helps in analysing the profitability of different products or services, evaluating the cost implications of various business strategies, and identifying opportunities to improve cost efficiency. Armed with this information, managers can implement effective cost-control measures, optimise resource allocation, and identify growth opportunities.

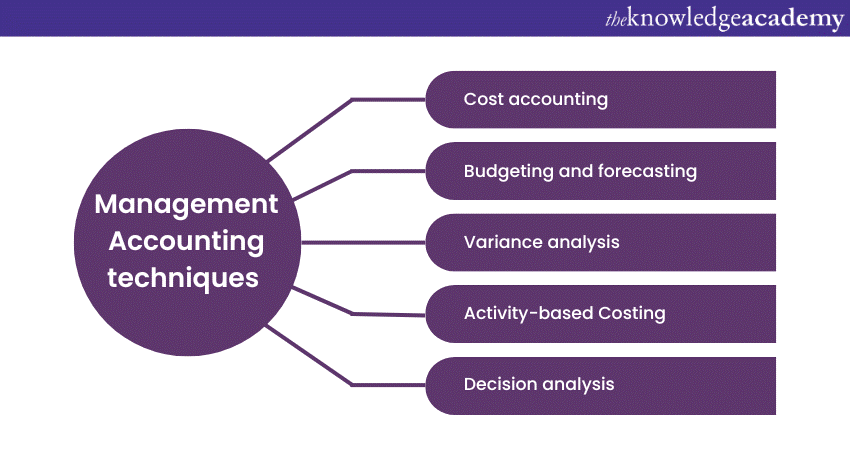

Management Accounting techniques

Management Accounting employs various techniques to analyse and interpret financial data to aid decision-making. Some of the essential Management Accounting techniques include:

Management Accounting employs various techniques to analyse and interpret financial data to aid decision-making. Some of the essential Management Accounting techniques include:

Cost accounting

This technique involves tracking, measuring, and evaluating expenses related to the production of a product or delivery of a service. It provides detailed insights into a company’s cost structure. Apart from that, it objects an overview of where money is spent on a variety of activities, manufacturing, or departments. These data have a weighty role in the integration of pricing lists, profitability levels, and accurate cost-cutting.

2) Budgeting and forecasting

Budgeting is simply about having a plan to help you have enough money to achieve your financial goal in an organised manner. Management accountants work together with managers in the preparation of budgets that coordinate resource allocation and are in tandem with the business’ strategic objectives. On the other side, Forecasting is using historical data and market trend to predict the future financial performance. Budgeting and forecasting allows organisations to predict and plan for coming challenges, making it possible for them to create solutions to these problems.

3) Variance analysis

This process involves comparing the actual results with budget or planned performance. It identifies gaps and helps managers understand why and where performance deviates from the expected levels. Recognising these discrepancies is critical for the purpose of taking appropriate actions to align operations in alignment of company goals.

4) Activity-Based Costing (ABC)

ABC determines cost via activities involved in the production procedure and their respective resources. This approach is more accurate in measurable cost drivers compared to costing based on volume, helping thus managers make better decisions such as pricing, product mixes, and resource allocation.

5) Decision analysis

This method employs the use of quantitative methods including cost-benefit and sensitivity analysis to assess the decision-making scenarios and possible consequences. It serves management accountants in the employment of financial analysis functions in order to identify the financial ramifications of strategic choices such as releasing new products, entering new markets, as well as investing in technology that produces informed choices and results in their alignments with strategic goals.

These techniques collectively empower managers and accountants to make well-informed financial decisions that optimise operational efficiency and strategic alignment.

Bring the best out of people with our Introduction to Managing People Course!

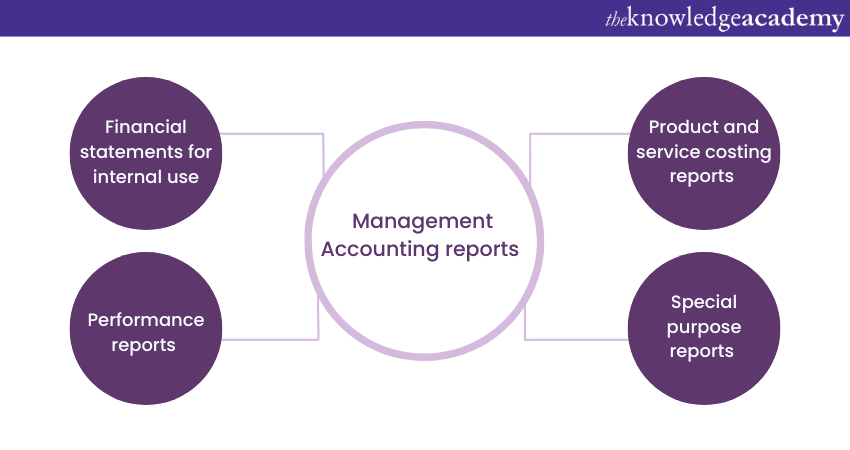

Management Accounting reports

Management Accounting reports provide valuable insights to aid managerial decision-making. These reports are tailored to the particular needs of managers and executives and can vary depending on the nature of the business. Some of the common types of Management Accounting reports include:

1) Financial statements for internal use

Management accountants prepare internal financial statements that differ from the external financial statements prepared for stakeholders. These statements provide a more detailed view of the company's financial performance, allowing managers to assess the financial health of the organisation and its progress towards achieving strategic goals.

2) Performance reports

Performance reports provide information on key performance indicators (KPIs) and metrics that measure the company's operational and financial performance. These reports enable managers to track progress, identify the reasons for concern, and take corrective actions to improve performance.

3) Product and service costing reports

Product and service costing reports break down the costs associated with producing each product or providing a service. These reports help with evaluating the profitability of different offerings and identifying opportunities for cost optimisation.

4) Special purpose reports

Special purpose reports are customised reports that address specific management needs or address unique challenges faced by the organisation. Examples of special purpose reports include risk assessment reports, capital expenditure reports, and investment appraisal reports.

Master verbal and non-verbal communication with our Senior Management Training!

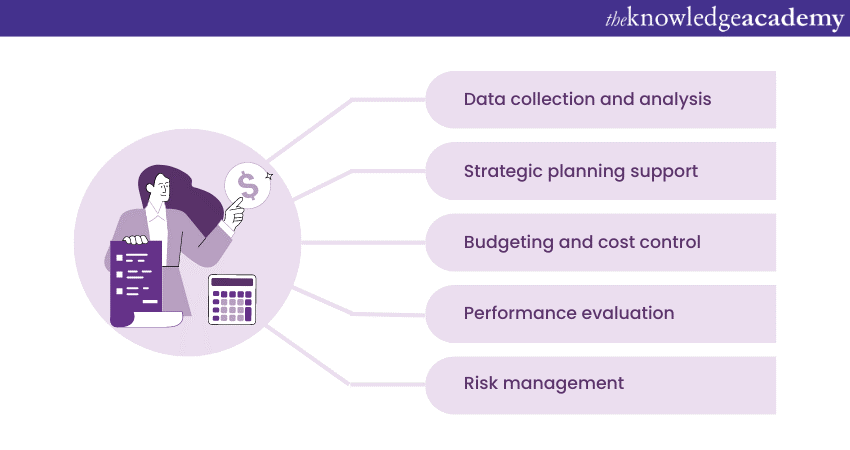

Role of Management Accountant

Management Accountants act as strategic partners, providing financial expertise and insights to support decision-making. Some of the key roles of Management Accountants include:

1) Data collection and analysis

Management accountants are responsible for collecting and analysing financial and non-financial data from various sources within the organisation. They use this data to generate meaningful reports and analyses that inform managerial decision-making.

2) Strategic planning support

Management accountants collaborate with top management to develop strategic plans and set financial objectives. They participate in the budgeting and forecasting processes to keep track of the financial plans and align them with the company's strategic goals.

3) Budgeting and cost control

Management accountants play an important role in the budgeting process. They work closely with managers to prepare budgets and monitor actual performance against budgeted targets. Additionally, they identify areas of cost overruns and recommend cost control measures.

4) Performance evaluation

Management accountants are involved in evaluating the company's performance against key performance indicators (KPIs) and benchmarks. They prepare performance reports and conduct variance analysis to identify areas of improvement and ensure the company's performance aligns with its goals.

5) Risk Management

Management accountants assess and manage financial risks faced by the organisation. They provide valuable insights into potential risks and help design risk mitigation strategies.

Unlock new sets of managerial skills with our Management Courses!

Importance of Management Accounting

Management Accounting plays a crucial role in guiding strategic decisions and optimising resource allocation, making it indispensable for business growth and profitability.

1) Facilitating decision-making

The major purpose of Management Accounting is to lay out timely and accurate information to support decision-making processes. By presenting relevant data and insights, Management Accounting empowers managers to make informed decision that drive the organisation towards its objectives.

2) Improving resource allocation

Effective resource allocation is vital for maximising productivity and profitability. Management Accounting techniques, such as cost accounting and activity-based costing, help managers understand the costs associated with different activities and products, enabling them to allocate resources efficiently.

3) Enhancing cost efficiency

Cost efficiency is essential for sustainable business growth. Management Accounting aids in identifying cost-saving opportunities and optimising the allocation of resources to reduce wastage and improve cost efficiency.

4) Supporting business growth

Management Accounting contributes to business growth by providing insights into the company's financial performance, identifying growth opportunities, and evaluating potential investment projects. It helps in formulating strategic plans to expand the business and gain a competitive advantage.

Challenges in Management Accounting

Despite its significant benefits, Management Accounting faces several challenges. Some of the common challenges include:

Data accuracy and reliability

Management Accounting relies heavily on data, and inaccurate or unreliable data can lead to flawed decision-making. Ensuring data accuracy and reliability is critical to the success of Management Accounting practices.

Information overload

The abundance of data can overwhelm Management Accountants and make it challenging to identify the most critical information for decision-making. Streamlining data collection and analysis processes can help overcome this challenge.

Technological advancements

As technology evolves, Management Accountants must stay updated with new tools and techniques to effectively analyse data and generate meaningful insights.

Management Accounting vs Financial Accounting

If you are considering pursuing a career in Management Accounting, it is crucial to understand its distinction from Financial Accounting. Management Accounting focuses on refining internal financial processes for product or service development. It fosters operational efficiency to manage costs and boost revenue internally, which can be enhanced by using Excel Shortcuts for Accountants.

Conversely, Financial Accountants focus on external financial records like invoices, delineating a company's expenditures and earnings to external entities. They handle tasks such as tax reporting. Despite their differences, both Management and Financial Accountants play vital roles in safeguarding a business's financial well-being.

Essential skills to succeed in Management Accounting

Here are some essential accounting skills to enhance your success in management Accounting:

1) Strong Numeracy Skills

Numeracy forms the backbone of accounting, aiding in data analysis and financial reporting. A solid grasp of mathematics enables you to interpret figures and understand internal calculations. Consider enrolling in online courses focusing on maths for accounting to bolster this skill.

2) Teamwork and Interpersonal Skills

Collaboration is key in management Accounting, often requiring interaction with financial analysts, managers, and accountants. Effective communication, including both written and verbal, is necessary for creating financial statements, budgets, and project updates. Continuously honing these skills enhances your effectiveness within a team.

3) Ability to Work Under Pressure

Management Accounting is dynamic, often involving tight deadlines for financial reporting. Developing strategies for task prioritisation and time management is crucial. Practising mindfulness techniques and maintaining motivation can help alleviate pressure during demanding periods.

4) IT Proficiency

Management accountants utilise various IT solutions for their daily tasks, including accounting software and integrated platforms like CRM and reporting applications. Strengthening your computer skills enables you to adapt to new software efficiently. Seeking guidance from the IT department and ongoing self-learning can enhance your IT proficiency.

By focusing on these skills, you'll be better equipped to excel in the dynamic field of Management Accounting and contribute effectively to your organisation's financial health.

Conclusion

"Management Accounting" is one of the modern essential business tools for making informed decisions involving effective allocation of resources, thereby driving growth in business. In general, management accountants provide relevant financial data and strategic insights to support managers' decisions in an organisational setup. We hope this blog about What is Management Accounting has been very informative and helped you decide your career path.

Master the art of pricing with our Costing and Pricing Training now!

Frequently Asked Questions

Why is Management Accounting important?

Management Accounting is crucial as it provides detailed insights into financial health, guiding strategic decisions. It supports effective resource allocation, cost management, and enhances operational efficiency, ultimately driving organisational growth and profitability.

Why are Management Accounting reports prepared?

Management Accounting reports are prepared to provide managers with timely, relevant financial data and analytics. These reports help in monitoring performance, controlling costs, and planning future activities. They are essential tools for day-to-day decision-making and strategic planning.

What are the other resources and offers provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is the Knowledge Pass, and how does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the related courses and blogs provided by The Knowledge Academy?

The Knowledge Academy offers various Management Courses, including the Performance Management Training, Business Process Improvement Training, and Productivity and Time Management Training. These courses cater to different skill levels, providing comprehensive insights into Transformational Leadership.

Our Business Skills Blogs cover a range of topics related to Management Accounting, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Introduction to Management

Introduction to Management

Fri 11th Apr 2025

Fri 13th Jun 2025

Fri 8th Aug 2025

Fri 10th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please