We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Ever wondered who’s behind the scenes, ensuring that businesses navigate the complex maze of regulations and standards with finesse? This is where a Compliance Manager steps in. Curious about “What Does a Compliance Manager Do?” think of them as the architects of trust and transparency within a company. They not only monitor compliance but also shape policies and foster a culture of adherence to legal standards.

In this blog, we dive deep into the world of compliance management to uncover “What does a Compliance Manager do?” Discover how these experts transform regulatory hurdles into opportunities, guiding companies through the complexities of law and ethics to build a robust framework for success.

Table of Contents

1) Who is a Compliance Manager?

2) What Does a Compliance Manager Do?

3) Skills Required for a Compliance Manager

4) Compliance Manager Educational Requirements

5) Types of Compliance Managers

6) Duties of Compliance Managers in Different Industries

7) Conclusion

Who is a Compliance Manager?

A Compliance Manager ensures an organisation follows relevant laws, regulations, and industry standards. They play a key role in upholding ethical behaviour, reducing risks, and fostering a compliance culture.

Key Responsibilities:

a) Regulatory Knowledge: Stay updated on legal requirements and their impact

b) Policy Implementation: Develop and enforce compliance policies and procedures

c) Advisory Role: Guide departments on compliance issues and support initiatives

d) Risk Management: Identify and mitigate compliance risks

e) Training: Educate employees on compliance and ethical standards

f) Monitoring: Track compliance activities and report to management

Importance:

a) Ethical Standards: Ensure responsible operations

b) Risk Reduction: Minimise legal and financial risks

c) Reputation Management: Protect and enhance the organisation’s reputation

d) Operational Efficiency: Align processes with regulatory requirements

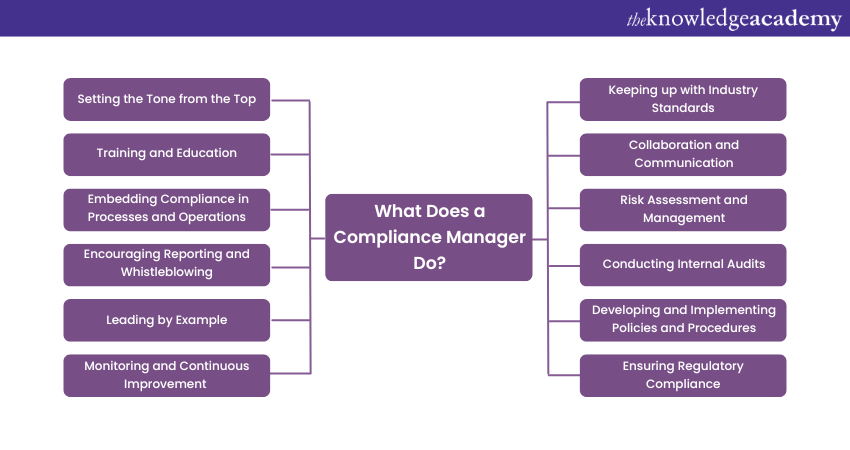

What Does a Compliance Manager Do ?

A Compliance Manager plays a vital role in shaping the culture and performance of an organisation by ensuring compliance with legal, regulatory, and ethical standards. They have a range of responsibilities that enhance the integrity and efficiency of the organisation. Here are some of the key functions and responsibilities of a Compliance Manager:

1) Setting the Tone from the Top

Compliance Managers work with senior leaders to create a culture of compliance that aligns with the organisation’s values:

a) Working with leadership: Compliance Managers collaborate with senior leaders to set goals, policies, and expectations for ethical conduct.

b) Aligning with organisational values: They make sure that compliance efforts are consistent with the organisation’s vision and values, creating a solid base for a compliance culture.

2) Training and Education

Compliance Managers design and conduct training programs to educate employees on compliance requirements and ethical issues:

a) Creating training programs: Compliance Managers design training programs to teach employees about regulatory requirements and ethical issues.

b) Conducting regular training sessions: They hold regular sessions to help employees learn their compliance duties and the outcomes of non-compliance.

3) Embedding Compliance in Processes and Operations

Compliance Managers cooperate with various departments to incorporate compliance aspects into daily operations and provide guidance and review:

a) Working across departments: Compliance Managers cooperate with various departments to incorporate compliance aspects into daily operations.

b) Providing guidance and review: They offer advice on compliance matters, check policies and procedures, and ensure alignment with business practices.

4) Encouraging Reporting and Whistleblowing

Compliance Managers establish and promote reporting mechanisms for potential violations and ensure the safety of whistle-blowers:

a) Developing reporting mechanisms: They establish secure reporting channels for possible violations, ensuring safety for whistle-blowers.

b) Creating a reporting culture: Compliance Managers promote an atmosphere where reporting is appreciated and supported.

5) Leading by Example

Compliance Managers demonstrate integrity, transparency, and ethical decision-making as role models and embody the organisation’s values:

a) Role modelling: Compliance Managers show integrity, transparency, and ethical decision-making as role models.

b) Embodying organisational values: Their dedication to ethical behaviour sets a standard for employees.

6) Monitoring and Continuous Improvement

Compliance Managers monitor and evaluate the efficiency of compliance programs and perform audits and risk assessments to improve and update compliance frameworks:

a) Assessing compliance programs: Compliance Managers frequently monitor and evaluate the efficiency of compliance programs.

b) Finding and addressing gaps: They perform audits and risk assessments to improve and update compliance frameworks.

8) Ensuring Regulatory Compliance

Compliance Managers ensure the organisation follows the changing regulations and industry standards and stay informed of legislative and regulatory changes:

a) Guardians of compliance: Compliance Managers make sure the organisation follows the changing regulations and industry standards.

b) Staying informed: They keep track of legislative and regulatory changes to stay compliant.

9) Developing and Implementing Policies and Procedures

Compliance Managers develop and customise policies that match legal and ethical standards and work with legal teams and experts:

a) Creating policy frameworks: They develop policies that match legal and ethical standards.

b) Working with stakeholders: Compliance Managers work with legal teams and experts to customise policies to the organisation’s needs.

9) Conducting Internal Audits

Compliance Managers perform regular internal audits to measure adherence to policies, identify non-compliance areas, and take corrective actions:

a) Performing audits: Regular internal audits are performed to measure adherence to policies and identify non-compliance areas.

b) Taking corrective actions: They give recommendations and actions to improve compliance efforts.

10) Risk Assessment and Management

Compliance Managers identify and manage Compliance Risks and work with departments for integrated Risk Management:

a) Identifying risks: Compliance Managers identify potential risks within the organisation.

b) Managing risks: They devise strategies to reduce Compliance Risks and work with departments for integrated Risk Management.

11) Collaboration and Communication

Compliance Managers collaborate and communicate effectively with various stakeholders and foster a culture of compliance and support across the organisation:

a) Collaborating across departments: Effective collaboration and communication with various stakeholders are essential.

b) Fostering compliance culture: They cultivate a culture of compliance and provide support across the organisation.

12) Keeping up with Industry Standards

Compliance Managers stay updated on industry standards and trends, pursue continuous development, and implement innovative compliance strategies:

a) Staying updated: Compliance Managers stay updated on industry standards and trends.

b) Professional development: They pursue continuous development and implement innovative compliance strategies.

Master the art of security with our industry-leading Security Governance and Compliance Training. Join today and safeguard your organisation!

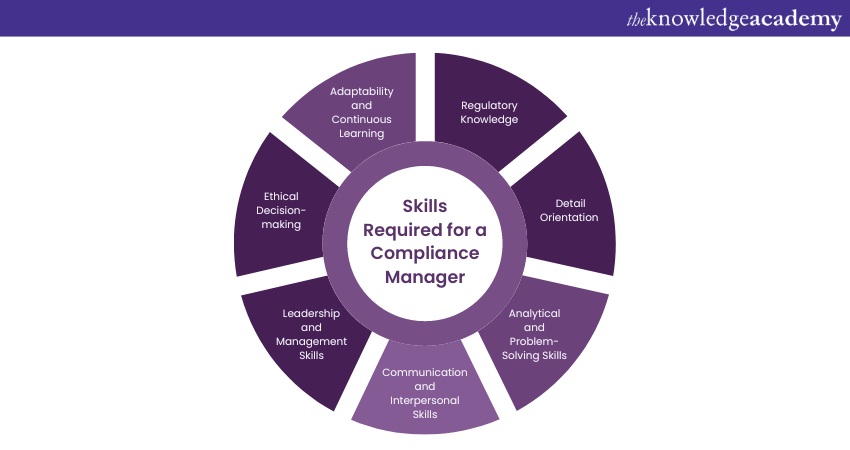

Skills Required for a Compliance Manager

Compliance Managers need various skills to perform well in their role and comply with the complex and changing regulations in their industry. These skills include technical, interpersonal, and analytical aspects. Here are the main skills that Compliance Managers should have:

1) Regulatory Knowledge

Compliance Managers should know the laws, regulations, and standards that apply to their organisation. They should keep up with the changes in the regulatory environment and ensure compliance. They should do research, attend conferences, and network with professionals to learn more.

2) Detail Orientation

Compliance Managers should pay attention to compliance details. They should review documents carefully and spot any issues or areas for improvement. They should understand the nuances of regulations and interpret and implement them correctly.

3) Analysis and Problem-Solving

Compliance Managers should have strong analysis and problem-solving skills to deal with challenges. They should analyse information, understand regulatory requirements, and find practical solutions. They should evaluate processes, identify compliance risks, and plan strategies to reduce them. They should think critically, logically, and creatively.

4) Communication and Interpersonal Skills

Compliance Managers should communicate effectively with different audiences. They should explain complex regulatory information clearly and concisely. They should interact with stakeholders, such as leaders, employees, regulators, and auditors. They should build good relationships, listen actively, and communicate clearly.

5) Leadership and Management Skills

Compliance Managers often lead or work with other teams in the organisation. They should have leadership and management skills to ensure the success of compliance initiatives. They should motivate and guide their team members, assign tasks efficiently, and provide support. They should also organise and manage their time well to handle multiple projects and deadlines.

6) Ethical Decision-Making

Compliance Managers should make ethical decisions in their role. They should have a strong sense of morality and make decisions that benefit the organisation. They should face ethical dilemmas and balance compliance requirements and business goals. They should show integrity and ethical judgment.

7) Adaptability and Continuous Learning

Compliance Managers work in a dynamic and evolving regulatory environment. They should be adaptable and willing to learn new things. They should stay informed on the latest regulatory developments, industry trends, and best practices. They should seek professional development opportunities, attend workshops, and learn continuously.

Stay compliant and ensure the highest standards of medical practice with our comprehensive Medical Compliance Training. Sign up now!

Compliance Manager Educational Requirements

While there is no one-size-fits-all educational requirement for Compliance Managers, a strong educational background can provide a solid foundation for a career in compliance. Here are some educational paths that individuals pursuing a career as a Compliance Manager may consider:

1) Bachelor's Degree: A bachelor's degree in a relevant field such as business administration, finance, law, or a related discipline can provide a solid educational foundation. Coursework in areas such as legal studies, Risk Management, ethics, and regulatory compliance can be particularly beneficial.

2) Master's Degree: Pursuing a master's degree, such as a Master of Business Administration (MBA) with a specialisation in compliance or a Master of Laws (LLM) in Compliance and Regulation, can provide advanced knowledge and specialisation in compliance management. These programs delve deeper into strategies, legal frameworks, and ethical considerations.

3) Specialised Compliance Programs: Some universities and educational institutions offer specialised programs that focus on the intricacies of compliance management. These programs provide in-depth knowledge of regulatory requirements, risk assessment, policy development, and other essential skills.

While formal education is valuable, practical experience and continuous professional development are equally important for Compliance Managers. Gaining hands-on experience through internships, entry-level roles, or working with regulatory bodies can provide valuable insights and enhance one's expertise in the field.

Equip yourself with our Effective Compliance Training for sustainable business success. Join today!

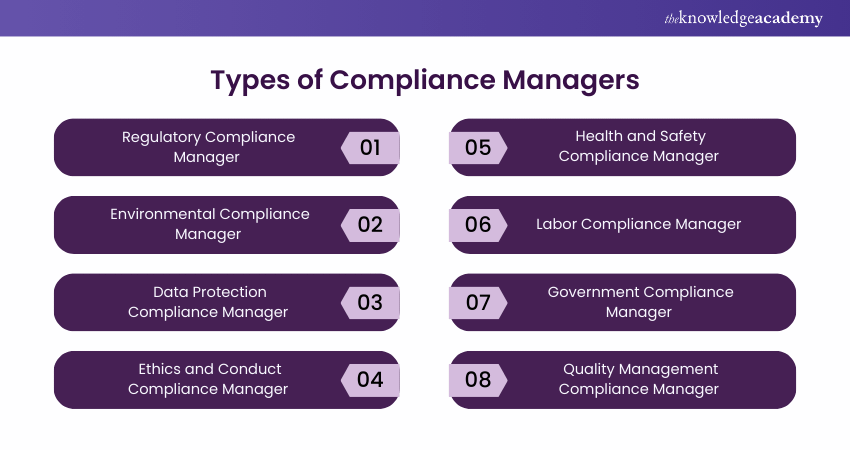

Types of Compliance Managers

Compliance management is often highly specialised, with distinct roles addressing specific regulatory areas. Below are the key types of compliance managers and their focus areas:

1) Regulatory Compliance Manager

Regulatory compliance managers ensure that an organisation adheres to industry-specific rules and standards. They monitor and interpret relevant laws to prevent violations that could result in fines, legal action, or reputational damage.

For example, healthcare compliance managers enforce HIPAA (Health Insurance Portability and Accountability Act) regulations to protect patient privacy. In the financial sector, compliance managers ensure adherence to laws like the Sarbanes-Oxley Act (SOX), which governs financial reporting and accountability.

2) Environmental Compliance Manager

Environmental compliance managers focus on laws and regulations designed to protect the environment. They oversee initiatives related to waste management, pollution reduction, and adherence to sustainability standards.

These managers ensure the organisation minimises its environmental footprint while avoiding penalties for non-compliance with laws like the Clean Air Act or the Resource Conservation and Recovery Act.

3) Data Protection Compliance Manager

As data privacy becomes increasingly critical, data protection compliance managers play a key role in safeguarding sensitive information. They develop policies and systems to comply with regulations like GDPR (General Data Protection Regulation) in Europe or CCPA (California Consumer Privacy Act) in the US. These managers help organisations avoid breaches that could lead to severe financial penalties and loss of customer trust.

4) Ethics and Conduct Compliance Manager

Ethics and conduct compliance managers foster a workplace culture grounded in integrity. They establish and enforce policies related to ethical behaviour, including managing conflicts of interest and setting guidelines for gifts and hospitality.

Their work ensures employees act in alignment with the company’s values, promoting trust among stakeholders and preventing reputational risks.

5) Health and Safety Compliance Manager

Health and safety compliance managers ensure a safe work environment by adhering to occupational health and safety regulations. They design safety protocols, conduct risk assessments, and provide training to prevent workplace injuries and illnesses.

Compliance with standards like Occupational Safety and Health Administration (OSHA) regulations is vital to protect employees and avoid costly liabilities.

6) Labor Compliance Manager

Labor compliance managers focus on employment laws and regulations to ensure the organisation treats its workforce fairly. They oversee compliance with wage and hour laws, workplace safety standards, and collective bargaining agreements.

By addressing labour concerns proactively, they mitigate risks of disputes, penalties, and damage to employee relations.

7) Government Compliance Manager

Government compliance managers specialise in meeting the regulatory requirements of contracts and grants issued by public agencies. These managers navigate complex guidelines, reporting obligations, and audits to ensure adherence. Failure in this area can result in contract termination, penalties, or loss of future opportunities.

8) Quality Management Compliance Manager

Quality management compliance managers oversee systems that ensure products and services meet established standards, such as ISO certifications. They implement quality assurance protocols, lead audits, and align processes with industry benchmarks. Their role helps maintain consistency, customer satisfaction, and a competitive edge.

Duties of Compliance Managers in Different Industries

Compliance Managers play a critical role in various industries, ensuring adherence to industry-specific regulations and standards. Let's explore how Compliance Managers operate in different sectors and adapt their responsibilities to meet specific requirements:

Healthcare

Healthcare Compliance Managers ensure organisations adhere to laws like HIPAA and GDPR, safeguarding patient data privacy, accurate billing, and regulatory compliance. They collaborate with medical staff, administrators, and IT professionals to develop policies and procedures, ensuring confidentiality, proper documentation, and alignment with healthcare standards.

Finance

Finance Compliance Managers oversee adherence to financial regulations, AML laws, and market conduct. They develop systems to monitor transactions for fraud, ensure customer due diligence, and meet reporting requirements. Working with banks, investment firms, and insurance companies, they help maintain ethical and legal compliance in all financial operations.

Information Technology

IT Compliance Managers ensure compliance with data security laws, software licensing, and industry standards like PCI DSS. They collaborate with IT teams to develop security protocols, conduct risk assessments, and implement measures for secure data storage and transmission, protecting organisations from breaches and emerging cyber threats.

Manufacturing

Manufacturing Compliance Managers ensure adherence to workplace safety, environmental laws, and product quality standards. They work with production, quality control, and safety teams to create policies and practices aligned with ISO certifications and regulations, ensuring safe working conditions and the production of high-quality, compliant goods.

Other Industries

Compliance Managers in industries like pharmaceuticals, telecommunications, and energy focus on sector-specific regulations. They develop tailored compliance strategies, collaborate with regulatory bodies, and address unique challenges, such as clinical trial regulations, telecommunications data privacy, and energy sector requirements, ensuring operations align with evolving industry standards.

Equip yourself with our Effective Compliance Training for sustainable business success. Join today!

Conclusion

When exploring the dynamic world of compliance, you might wonder, “What Does a Compliance Manager Do?” They play a crucial role in ensuring that businesses not only meet regulatory requirements but also thrive within them. By transforming complex legal standards into actionable policies, they build a culture of integrity and transparency. Their expertise turns potential regulatory hurdles into opportunities for growth and success.

Enhance your compliance expertise with our industry-leading Compliance Training. Sign up now!

Frequently Asked Questions

Compliance Managers are in high demand and have lucrative careers in various industries, such as finance, healthcare, manufacturing, and technology. They can advance to senior positions, such as chief compliance officer, director of compliance, or vice president of compliance.

To become a Compliance Manager, one typically needs a bachelor’s degree in a related field, such as business, law, accounting, or finance. Some employers may prefer a master’s degree or a professional certification. One also needs several years of experience in compliance, risk management, or auditing.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Compliance Training, including Corporate Governance Course and Security Governance and Compliance Training. These courses cater to different skill levels, providing comprehensive insights into various Compliance Frameworks.

Our Compliance Training Blogs covers a range of topics related to ISO and Compliance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Compliance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming ISO & Compliance Resources Batches & Dates

Date

PCI DSS Implementer

PCI DSS Implementer

Thu 23rd Jan 2025

Thu 6th Feb 2025

Thu 3rd Apr 2025

Thu 5th Jun 2025

Thu 7th Aug 2025

Thu 2nd Oct 2025

Thu 4th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please