We may not have the course you’re looking for. If you enquire or give us a call on +43 720 115337 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Curious about How to Trade Ethereum effectively? Whether you’re a crypto rookie or looking to refine your trading skills, this blog will help you understand the dynamic Ethereum market. Explore how Ethereum's Blockchain revolutionises industries and offers diverse trading opportunities.

According to the latest data from Statista, the price of Ethereum reached £2,567.89 in May 2024. This significant increase underscores Ethereum's growing influence in Cryptocurrency, driven by its Blockchain technology and applications in DeFi and Smart Contracts. As Ethereum attracts traders and developers, understanding How to Trade Ethereum effectively is important for navigating this dynamic landscape. Let's explore the essentials of Ethereum trading in this blog!

Table of Contents

1) A brief overview of Ethereum

2) Importance of Ethereum to Traders

3) How can you trade on Ethereum?

4) Strategies to trade on Ethereum

5) Conclusion

A brief overview of Ethereum

Contrary to common belief, Ethereum is not merely a Cryptocurrency. It serves as a decentralised platform that empowers developers to create a wide range of applications on the Blockchain.

Unlike Bitcoin, which primarily focuses on financial transactions, Ethereum’s architecture supports a broader spectrum of decentralised services. These services operate within a secure and tamper-resistant environment.

The value often associated with Ethereum is tied to its native token, Ether. Similar to Bitcoin, Ether functions as a digital currency and represents the economic value of the entire Ethereum ecosystem. Conceived by Vitalik Buterin in 2013, Ethereum has attracted significant interest across various sectors, including finance, real estate, Software Development, and pharmaceuticals, thanks to its versatile and robust network.

Importance of Ethereum to traders

The following are the key factors that make Ethereum significantly important to traders in both the Cryptocurrency space and broader financial markets:

Ethereum stands out to traders as a groundbreaking platform that facilitates the creation and deployment of Decentralised Applications (dApps) akin to a programmable version of Bitcoin. It introduces smart contracts to the Blockchain, which are immutable and secure and provide a verifiable digital ledger, ensuring trust and reliability. These contracts operate without interruptions and are immune to censorship and fraud.

Smart Contracts are pivotal in the digitisation of traditional legal agreements. They can securely store records, facts, associations, balances, and other necessary data to execute the logic of real-world contracts.

The Ethereum Blockchain, coupled with Smart Contracts, essentially acts as a shared global supercomputer capable of transferring value, denoting ownership, managing tokenised assets, and facilitating complex financial operations digitally. This innovation allows for the creation of markets, shared ledgers, and digital organisations, all without intermediaries and with guaranteed permanence.

Ether, Ethereum’s native Cryptocurrency, is frequently associated with the platform itself. Ethereum tokens serve as utility tokens, providing holders with access to the platform’s services, particularly its decentralised Operating System.

The value of many Cryptocurrencies, including Ether, often depends on the utility and potential of the underlying projects, regardless of whether the native token is used by default.

Learn about Blockchain transactions by signing up for our Blockchain Training now!

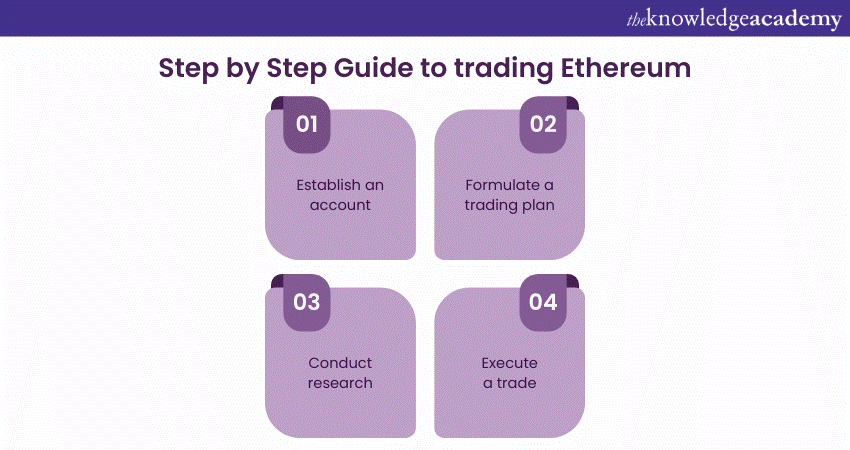

How do you Trade on Ethereum?

Trading Ethereum, the second-largest Cryptocurrency, requires strategic steps to navigate the dynamic and volatile crypto markets. Here's a brief overview of How to Trade on Ethereum:

To initiate Ethereum trading, setting up a live trading account is essential. Equipped with an account, a strategic plan, and a solid trading concept, you’re prepared to execute Ethereum trades. Follow these key steps:

Step 1: Establish an account

Begin your Ethereum trading journey by opening a live account with an online broker. For those speculating on short-term price fluctuations, CFDs are a popular choice, so we’ll focus on CFD providers.

Creating a CFD account is simple. Complete the registration and deposit funds, and upon approval, you’re set to trade.

Step 2: Formulate a trading plan

A comprehensive trading plan is crucial for Ethereum trading due to its potential volatility. Without a plan, emotional trading becomes a risk.

Your trading plan should cover strategy entry and exit criteria, trading times, markets, maximum loss per trade, desired risk-reward ratio, and other relevant metrics.

Step 3: Conduct research

With your trading plan ready, research is your next step. Analyse Ethereum’s price chart for viable trading prospects.

Consider support/resistance levels, chart patterns like wedges or triangles, and impactful news. Trading without prior market research is akin to gambling and can detrimentally affect your results.

Step 4: Execute a trade

Upon spotting a high-probability trading chance, proceed to trade. Buy Ethereum if you anticipate a price increase or short-sell if you expect a decrease.

Understand Cryptocurrency and its concepts by signing up for our Cryptocurrency Trading Training now!

Strategies to trade on Ethereum

Trading on Ethereum effectively requires well-thought-out strategies that accommodate its inherent volatility and unique market dynamics. Here are several strategies to consider when Trading on Ethereum:

a) Day trading CFDs: In day trading, you open and close a position within a single day, avoiding overnight market exposure. This strategy is ideal for those aiming to profit from Ether’s short-term price movements. Remember that not holding any positions at the cutoff time helps avoid overnight funding charges.

b) Swing trading: Swing traders take advantage of short-term price patterns, assuming that prices don’t move in just one direction. When swing trading Ether, you aim to profit from both upward and downward price movements within a narrow timeframe. Look for small reversals in Ether prices to execute this strategy.

c) Scalping: Scalping focuses on frequent, small profits by maintaining a high win rate. The idea is to build a large trading account by consistently making small profits through frequent trades. Scalping requires a strict exit strategy due to rapid market movements, especially in volatile markets like cryptocurrency.

d) Hedging strategy: Hedging aims to reduce risk by balancing your exposure to an existing position with an opposite one. For instance, if you hold Ether and worry about short-term depreciation, you’d open a short position. Profits from the second position would offset losses on the first. Keep in mind that hedging incurs fees on both positions.

Conclusion

Understanding How to Trade Ethereum is essential for navigating the dynamic world of Cryptocurrencies. Employ effective strategies and stay informed about market trends to maximise success. Choose a strategy that fits your risk tolerance and stay updated on Ethereum's innovations to enhance your trading decisions.

Learn about the concepts of blockchain technology by signing up for our Bitcoin and Cryptocurrency Course now!

Frequently Asked Questions

To trade Ethereum for money, use a Cryptocurrency exchange like Coinbase or Binance. Create an account, deposit your Ethereum, sell it for your desired currency, and withdraw the funds to your bank account.

Yes, you can make money trading Ethereum by buying low and selling high, participating in staking or engaging in margin trading. However, it involves significant risk and requires careful market analysis.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Blockchain Training, including Ethereum Developer Training, Bitcoin and Cryptocurrency Course and Blockchain Training. These courses cater to different skill levels, providing comprehensive insights into Interesting Blockchain Facts.

Our Advanced Technology Blogs cover a range of topics related to Blockchain, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Blockchain skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Ethereum Developer Training

Ethereum Developer Training

Fri 10th Jan 2025

Fri 14th Mar 2025

Fri 9th May 2025

Fri 11th Jul 2025

Fri 12th Sep 2025

Fri 14th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please