We may not have the course you’re looking for. If you enquire or give us a call on +43 720 115337 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Understanding "What is QuickBooks" is pivotal for those diving into the world of business finance. Developed by Intuit, QuickBooks is a renowned Accounting software tailored for small and medium-sized businesses. Offering features from invoicing to payroll, it streamlines financial tasks, enabling companies to operate more efficiently. Its intuitive interface ensures that individuals can effectively manage their finances regardless of their accounting background.

According to Datanyze, QuickBooks has a market share of over 30 per cent, making it one of the leading Accounting software companies. Read this blog to understand What is QuickBooks, its versions and features, how it works, its benefits and tips for using it effectively.

Table of Contents

1) What is QuickBooks?

a) Types of QuickBooks

b) Features of QuickBooks

2) How Does QuickBooks Work?

3) Benefits of Using QuickBooks

a) Tips for Optimal QuickBooks Usage

4) Conclusion

What is QuickBooks?

QuickBooks is one of the leading Accounting software that has revolutionised Financial Management for companies. It offers a comprehensive suite of tools and features designed to streamline accounting processes and provide valuable insights into a company's financial health.

With QuickBooks, businesses can efficiently track income and expenses, manage invoices, monitor inventory, and generate detailed financial reports. The software caters to freelancers, small business owners, and even large enterprises, making it a versatile solution for various financial needs.

QuickBooks' ability to streamline financial processes and save time is one of its most significant advantages. Automating tasks like invoicing, expense tracking, and payroll management frees up valuable resources that can be directed towards core business activities. This time efficiency translates into increased productivity and a more focused approach to achieving business goals.

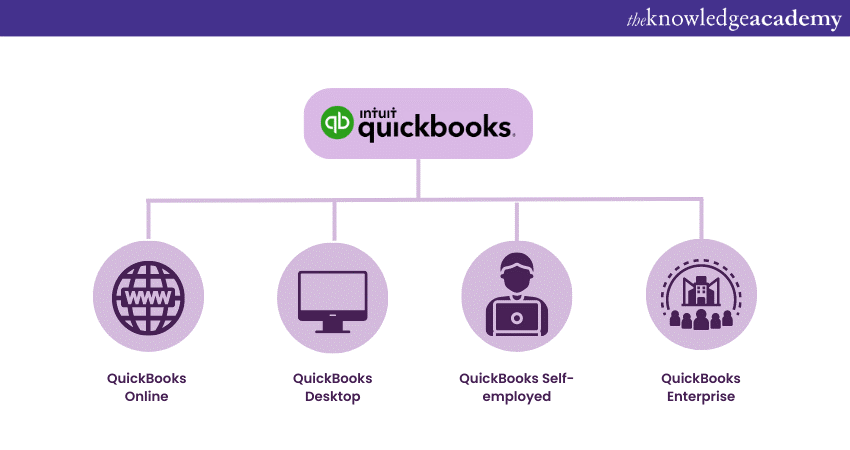

Types of QuickBooks

QuickBooks comes in different versions to meet the diverse requirements of various users. The most popular versions have been discussed below.

a) QuickBooks Online: This cloud-based version allows users to access their financial data anywhere with an internet connection. It is ideal for businesses with remote teams or those requiring flexibility in managing their finances.

b) QuickBooks Desktop: As a locally installed software, QuickBooks Desktop provides robust functionality and allows users to store their financial data securely on their computers. It is preferred by businesses that prioritise data control and extensive customisation options.

c) QuickBooks Self-employed: Tailored for freelancers and independent contractors, this version simplifies income and expense tracking, making it easier to manage finances for self-employed professionals.

d) QuickBooks Enterprise: Geared towards large businesses, QuickBooks Enterprise offers advanced features such as advanced reporting, customisable user permissions, and industry-specific tools. Regardless of the version chosen, QuickBooks ensures firms can efficiently manage their financial transactions and gain valuable insights to make informed decisions.

Unlock the secrets of effective Finance Management! Join our Book Keeping Training today.

Features of QuickBooks

Invoicing is the most important feature QuickBooks provides. It makes the process of creating and sending invoices seamless and professional. Users can customise invoices with their company's logo and branding, add payment links for easy transactions, and set up recurring invoices for their regular clients. Apart from invoicing, QuickBooks provides the following features:

a) Expense tracking: Tracking expenses can be time-consuming, but QuickBooks simplifies the process by allowing users to upload receipts directly into the system. It categorises expenses, making it easier to analyse spending patterns and plan budgets effectively.

b) Financial reporting: Generating accurate and insightful financial reports is crucial for business owners. QuickBooks offers a variety of pre-built reports, such as Profit and Loss and Cash Flow statements, Balance Sheets etc. which provide a comprehensive overview of the company's financial performance.

c) Payroll management: Managing payroll can be complex, especially for businesses with multiple employees. QuickBooks streamlines payroll by calculating salaries, taxes, and deductions, ensuring accurate and timely employee payments.

d) Inventory management: Businesses dealing with physical products find QuickBooks' inventory management feature invaluable. It helps monitor stock levels, track sales, and automate reordering processes, preventing stockouts and ensuring smooth operations.

e) Integration with third-party apps: QuickBooks integrates seamlessly with numerous third-party applications, allowing users to extend the software's functionality to suit their needs. These integrations, from project management tools to e-commerce platforms, enhance overall efficiency and productivity.

Elevate your financial skills! Join our Accounting Masterclass now!

How Does QuickBooks Work?

QuickBooks is an intuitive and powerful Accounting software that simplifies Financial Management for businesses. Understanding how QuickBooks works is essential for maximising its potential and efficiently managing financial transactions. Following are the step-by-step processes on How to use QuickBooks:

a) Setting Up QuickBooks: Getting started with QuickBooks is a straightforward process. Users can choose between QuickBooks Online or the locally installed QuickBooks Desktop version. After selecting the appropriate version, users need to create an account or install the software on their computer.

Users will be prompted to enter essential company information, such as business name, address, and contact details, during the setup. This information ensures the financial records are accurate and reflect the company's details.

b) Navigating the dashboard: The QuickBooks dashboard is the central hub that provides an overview of the company's financial health. It displays key financial metrics in a user-friendly format, such as income, expenses, and profit/loss. Users can easily access different features and reports from the dashboard with just a few clicks.

c) Adding company information: Entering accurate financial information, such as details of bank accounts, employees, vendors, and others, is essential. Users must enter information about bank accounts, vendors, customers, and employees. The software uses this data to facilitate various transactions and generate reports.

d) Chart of Accounts: The Chart of Accounts is a fundamental component of QuickBooks. It is a categorised list of all financial transactions related to the business. Each account represents a specific aspect of the company's finances, such as revenue, expenses, assets, liabilities, and equity. Users can easily track and report on different financial activities by organising transactions into these accounts.

e) Entering transactions: One of the primary functions of QuickBooks is recording financial transactions. Users can enter data related to sales, expenses, invoices, payments, and more. Each transaction is classified under the appropriate account, ensuring the financial data is well-organised and accurate.

f) Generating reports: QuickBooks offers an array of pre-built reports that provide valuable insights into the company's financial performance. Users can generate these reports anytime, giving them a clear picture of their business's financial status.

Moreover, QuickBooks allows users to customise reports based on specific date ranges, accounts, or other criteria. Customising reports helps in analysing financial trends and identifying areas for improvement.

g) Security and data backups: As a software dealing with sensitive financial information, security is a top priority. As a cloud-based solution, QuickBooks Online employs encryption protocols to protect data during transmission and storage. On the other hand, QuickBooks Desktop provides the advantage of storing data locally, reducing the risk of cloud-related breaches.

Dive deep into the world of finance! Master it with our Financial Modelling Training.

Benefits of Using QuickBooks

QuickBooks is not just Accounting software; it is a powerful tool with many other benefits. Whether you are a small startup, a growing enterprise, or a self-employed professional, embracing QuickBooks can significantly impact your Financial Management and overall business success. Here are some of the key benefits of using QuickBooks:

a) Time efficiency: One of the most significant advantages of QuickBooks is the time it saves in managing financial tasks. With automated invoicing, expense tracking, and payroll management processes, users can complete these tasks in a fraction of the time it would take manually. This time efficiency allows business owners and employees to focus on core operations.

b) Financial accuracy: Manual bookkeeping is prone to human errors, which can seriously affect a business's financial future. QuickBooks minimises the risk of errors by automating calculations and ensuring data accuracy. The software reconciles transactions and updates the accounts in real time, providing up-to-date and accurate financial information.

c) Business insights: Making informed decisions is crucial for the success of any business. QuickBooks generates various financial reports which offer deep insights into the company's financial performance. These reports help identify trends, strengths, weaknesses, and areas for improvement, empowering business owners to make data-driven decisions.

d) Tax compliance: Complying with tax regulations can be complex and time-consuming. QuickBooks simplifies tax management by providing accurate financial data that can be used for tax filing. The software also generates tax-related reports, making filing their taxes accurately and on time easier for businesses.

e) Payroll management: Managing payroll can be a challenging task, especially for businesses with multiple employees. QuickBooks streamlines payroll by calculating employee salaries, taxes, and deductions. It also generates pay stubs and assists with payroll tax filings, ensuring that employees are paid accurately and promptly.

f) Improved cash flow management: Effective cash flow management is vital for the financial stability of a business. QuickBooks helps track accounts receivable and accounts payable, allowing companies to stay on top of their cash flow. By monitoring incoming and outgoing funds, businesses can better plan for expenses, manage working capital, and maintain financial stability.

g) Easy invoicing and payments: QuickBooks simplifies invoicing, allowing businesses to create professional and customised invoices quickly. Users can send invoices directly through the software, and clients can make payments electronically, streamlining the payment collection process.

h) Remote access and collaboration: QuickBooks Online offers the advantage of remote access. Business owners and authorised team members can access financial data from anywhere with an internet connection, making it convenient for remote work scenarios and collaborations with accountants or financial advisors.

i) Integration with third-party apps: QuickBooks integrates seamlessly with various third-party applications. This integration expands the software's capabilities and allows users to connect with existing business tools. Whether integrating with a payment gateway, e-commerce platform, or CRM system, QuickBooks ensures a cohesive and efficient financial ecosystem.

Due to its several features, QuickBooks is a game-changer for businesses seeking efficient Financial Management and data-driven decision-making. From saving time to ensuring financial accuracy and providing valuable insights, QuickBooks empowers businesses to thrive in a competitive market. Whether you are a small business or a large enterprise, adopting QuickBooks can transform your financial processes and drive long-term success. For professionals preparing for roles in this field, reviewing QuickBooks Interview Questions can provide valuable knowledge and insights into its functionalities.

Shape the future of finance! Join our Financial Modelling And Forecasting Training today.

Tips for Optimal QuickBooks Usage

The following are some useful tips for optimal usage of QuickBooks which you must ensure:

a) Regular backups: Frequent backups of QuickBooks data are essential to avoid data loss in case of technical issues or hardware failures.

b) Keeping track of receivables and payables: Keeping a close eye on receivables and payables helps manage cash flow effectively and ensures timely payments.

c) Reconciling bank statements: Regularly reconciling bank statements with QuickBooks transactions helps identify discrepancies and errors.

d) Using categories and tags effectively: Organising transactions with categories and tags simplifies financial reporting and analysis.

Master the art of Money Management! Secure your spot in our Financial Management Training now!

Conclusion

QuickBooks is a user-friendly accounting software and a valuable resource that enables businesses to make data-driven decisions and optimise their financial processes. Be it a small business or a well-established corporation, knowing What is QuickBooks and how to use it can lead to improved Financial Management and contribute to the company's success and growth.

Unlock our Finance For Non Financial Managers Course and enhance your skills in the fields of Financial Management!

Upcoming Accounting and Finance Resources Batches & Dates

Date

Finance for Non Financial Managers

Finance for Non Financial Managers

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please