We may not have the course you’re looking for. If you enquire or give us a call on +61 272026926 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine steering a ship without knowing how much fuel is left or where the next port lies—risky, right? The same goes for businesses that overlook Cash Flow Management. It’s the lifeblood of any organisation, ensuring you have enough liquidity to cover daily operations, invest in growth, and weather unexpected financial storms.

But what exactly is Cash Flow Management, and why is it crucial? It’s more than just tracking money coming in and out; it’s about strategically managing funds to ensure your business stays afloat and thrives, even in turbulent markets. In this blog, we’ll dive into the core principles of Cash Flow Management, its importance, and the best practices to help your business maintain financial health.

Table of Contents

1) What is Cash Flow Management?

2) Why is Cash Flow Management Important?

3) How Does Cash Flow Management Work?

4) The Connection Between Accounts Payable and Cash Flow Management

5) Five Effective Strategies to Manage Cash Flow

6) Common Challenges in Cash Flow Management

7) Examples of Effective Cash Flow Management

8) Conclusion

What is Cash Flow Management?

Cash Flow Management is the method of planning, monitoring, and controlling the agencies to ensure monetary stability. It entails forecasting future cash needs, managing charges, optimising price timings, and providing enough finances to be available to fulfil responsibilities.

Moreover, they assist groups in avoiding financial challenges, including disasters, and support strategic selection-making by providing visibility into financial operations.

Why is Cash Flow Management Important?

Cash Flow Management is important for any business's financial health and success. Below described are the key reasons behind its relevancy:

1) Ensures Liquidity: Proper Cash Flow Management ensures that a business always has enough cash to cover its operational expenses, including payroll, rent, and utility bills.

2) Prevents Insolvency: By monitoring cash inflows and outflows closely, businesses can prevent running out of cash, a leading cause of insolvency and bankruptcy.

3) Supports Growth: Effective Cash Flow Management allows businesses to invest in growth opportunities, such as new product development, market expansion, and capital expenditures, without jeopardising their financial stability.

4) Facilitates Strategic Planning: Accurate cash flow forecasting allows businesses to make better decisions related to future investments, financing needs, and operational adjustments.

5) Improves Relationships with Suppliers and Creditors: Managing cash flow helps businesses to pay their suppliers and creditors on time, which helps in maintaining robust relationships and securing favourable terms.

6) Enhances Profitability: By optimising payment timings and managing expenses, businesses can reduce costs and boost their overall profitability.

7) Enables Crisis Management: A well-managed cash flow provides a buffer during economic downturns or unexpected challenges, allowing businesses to navigate tough times without severe financial strain.

How Does Cash Flow Management Work?

Cash Flow Management works by actively monitoring and controlling the cash in and out movements of a business. Managers track incoming cash from sales, loans, or investments and outgoing cash for expenses. Then, they forecast future cash needs by analysing past trends and projecting income and expenses.

Furthermore, in order to liquidity, they adjust the payments timings, delay expenditures, or accelerate collections whenever necessary. Maintaining a steady cash flow allows businesses to meet obligations, seize opportunities, and avoid financial shortfalls.

Optimise cash and investment strategies – sign up for Treasury Management Training!

The Connection Between Accounts Payable and Cash Flow Management

The connection between accounts payable and Cash Flow Management is critical for maintaining a business's financial fitness. Accounts payable represent the money an organisation owes to its suppliers, and how these bills are controlled at once affects coin float.

Efficiently dealing with money owed and payable—which includes strategically timing bills—can optimise cash flow, ensuring the company has enough liquidity to fulfil obligations while fending off needless interest or late costs.

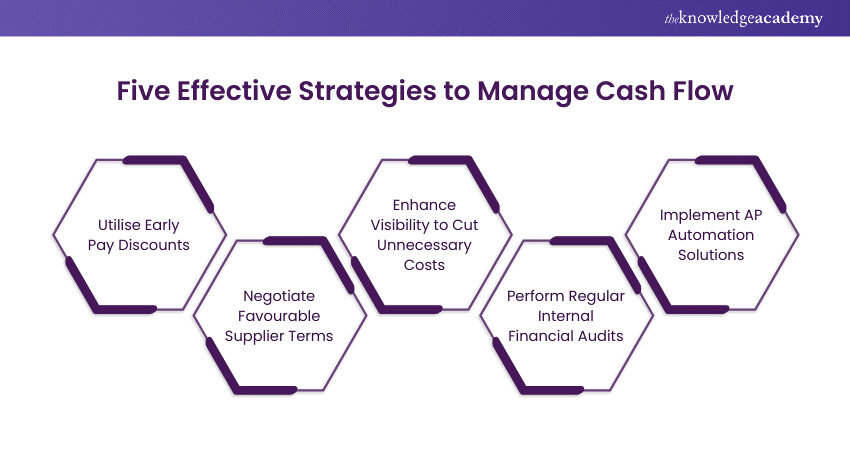

Five Effective Strategies to Manage Cash Flow

Effective Cash Flow Management is essential for sustaining a business's financial health. Here are five strategies to help you manage cash flow more effectively:

1) Utilise Early Pay Discounts

Leverage early-pay discounts is a smart way to save on costs. By settling invoices prior to their due dates, you can secure discounts from suppliers, directly enhancing your cash flow while fostering stronger supplier relationships.

2) Negotiate Favourable Supplier Terms

Negotiate better payment terms with suppliers, which can significantly simplify cash flow pressures. Moreover, extending payment periods or arranging flexible terms allows you to better align outgoing payments with your revenue cycles, ensuring smoother cash management.

3) Enhance Visibility to Cut Unnecessary Costs

Monitor expenditures closely through detailed reporting. This can help you make informed decisions that reduce waste and optimise your cash flow.

4) Perform Regular Internal Financial Audits

Regular financial audits are crucial for maintaining accuracy and efficiency in Cash Flow Management. These audits help detect discrepancies and ensure financial practices align with your goals, offering insights for more strategic financial planning.

5) Implement AP Automation Solutions

Automating accounts payable processes can greatly enhance Cash Flow Management. Additionally, it helps in reducing manual errors, speeds up processing, and improves tracking for a better overall financial stability.

Common Challenges in Cash Flow Management

Cash Flow Management is essential for maintaining the financial health of a business, but it comes with its own set of challenges. Understanding these challenges can help businesses better prepare and implement risk mitigation strategies. Below are some common challenges businesses face in Cash Flow Management:

1) Extending Credit

When businesses extend credit to customers, they often face delayed-related payments issues, which can disrupt cash flow. While extending credit can boost sales, it also ties up cash in receivables. This makes it challenging for businesses to cover immediate expenses and creating a gap between sales and actual cash inflows.

2) Forecasting Expenses

Accurately predicting future expenses is challenging, especially when dealing with variable costs. Inaccurate expense forecasting can lead to cash shortfalls, as unexpected costs may arise, leaving the business unable to meet its financial obligations. Consistent monitoring and adjusting forecasts can help mitigate this risk.

3) Rapid Business Growth

While rapid growth is a positive sign, it can strain cash flow if not managed properly. Increased demand for products or services often requires more inventory, staff, and resources, leading to higher upfront costs. This growth can quickly lead to liquidity issues without adequate cash reserves or financing.

4) Absence of Accounts Receivable System

Without an efficient accounts receivable system, businesses struggle to track outstanding invoices and ensure timely payments. This lack of oversight can lead to delayed collections, resulting in cash flow problems. A robust accounts receivable system can help streamline the collection process and improve cash flow predictability.

5) Industry Cyclicality

Industries with seasonal or cyclical demand face fluctuating cash flows, making maintaining consistent liquidity throughout the year difficult. During off-peak periods, businesses may experience reduced revenue, leading to cash shortages. Effective Cash Flow Management strategies, such as building reserves during peak times, are crucial for navigating these cycles.

6) Irregular Revenue Patterns

Businesses with irregular or unpredictable revenue patterns often struggle with maintaining steady cash flow. These fluctuations can result from variable customer demand, project-based work, or economic changes. To manage this challenge, businesses must implement strategies like creating cash buffers or diversifying revenue streams to smooth out inconsistencies.

Gain essential bookkeeping skills – sign up for our Book Keeping Course!

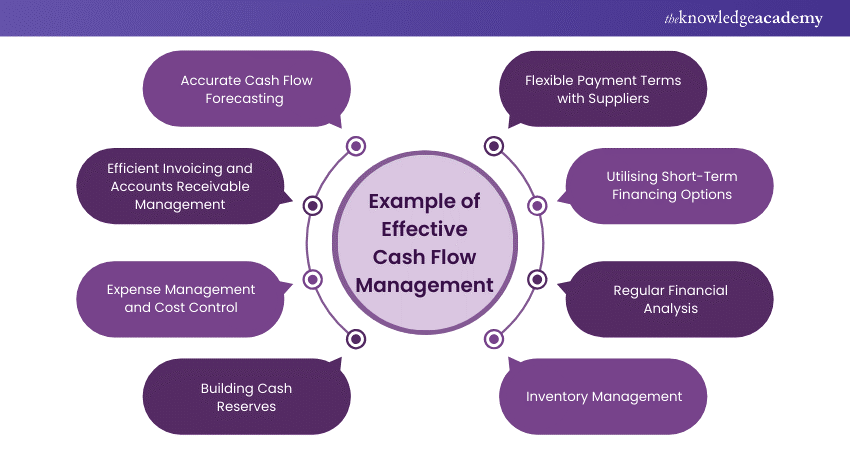

Examples of Effective Cash Flow Management

Effective Cash Flow Management is crucial for a business's financial stability and growth. Here are some examples of effective Cash Flow Management strategies that businesses can implement:

1) Accurate Cash Flow Forecasting

Accurate cash flow forecasting is one of the most effective Cash Flow Management practices. By regularly projecting cash inflows and outflows, businesses can anticipate their future cash needs. This preparation allows them to plan for potential shortfalls or surpluses, enabling better decision-making. For instance, a company that forecasts a seasonal dip in sales can plan accordingly by reducing expenses or securing short-term financing to cover operational costs during the downturn.

2) Efficient Invoicing and Accounts Receivable Management

Prompt invoicing and diligent accounts receivable management are vital for maintaining a healthy cash flow. Businesses that send invoices immediately after delivering goods or services and follow up on overdue payments ensure timely cash receipts. For example, implementing an automated invoicing system can help reduce billing delays and improve the speed of collections, ultimately enhancing cash flow.

3) Expense Management and Cost Control

Effective Cash Flow Management also involves careful expense management. By regularly reviewing and controlling expenses, businesses can reduce unnecessary costs and improve profitability. For instance, a company might negotiate better terms with suppliers, switch to more cost-effective vendors, or cut back on discretionary spending. These actions help retain more cash within the business, enhancing liquidity.

4) Building Cash Reserves

Building and maintaining cash reserves is a prudent Cash Flow Management practice. These reserves act as a financial buffer during periods of low revenue or unexpected expenses. For example, a business that sets aside a portion of its monthly profits into a reserve fund can weather economic downturns or cover emergency costs without disrupting operations.

5) Flexible Payment Terms with Suppliers

Negotiating flexible payment terms with suppliers can significantly improve cash flow. For instance, a company may arrange for extended payment terms, allowing it to hold onto cash longer while still fulfilling its obligations. This strategy frees up cash that can be used for other critical business activities, such as investing in growth opportunities or paying down debt.

6) Utilising Short-Term Financing Options

Businesses can use short-term financing options, such as lines of credit or invoice factoring, to manage cash flow more effectively. For example, a company facing a temporary cash shortfall might use a line of credit to cover immediate expenses and then repay it once cash flow stabilises. This approach helps maintain smooth operations even when cash flow is tight.

7) Regular Financial Analysis

Conducting regular financial analysis is key to effective Cash Flow Management. By consistently reviewing financial statements and cash flow reports, businesses can identify trends, spot potential issues early, and make informed decisions. For instance, a business that notices a gradual increase in overdue accounts receivable might take steps to tighten credit policies or improve collections processes.

8) Inventory Management

Proper inventory management is another example of effective Cash Flow Management. Holding excess inventory ties up cash that could be used elsewhere. By optimising inventory levels—keeping just enough to meet demand while minimising excess—a business can free up cash, reduce storage costs, and improve liquidity.

Manage project budgets with confidence – register for our Project Accounting Course!

Conclusion

Effective Cash Flow Management is the foundational stone of monetary stability and enterprise growth. It enables corporations to navigate demanding situations and seize opportunities through strategies that include accurate forecasting, green invoicing, and retaining cash reserves. Whether you're handling fast growth or managing enterprise cyclicality, accomplishing the Cash Flow Management talent guarantees your business remains resilient, agile, and geared up for lengthy-term fulfilment.

Gain control over receivables and payables – register for our Cash Cycle Management Course!

Frequently Asked Questions

The aim of Cash flow is to ensure that a business has enough liquid assets to meet its immediate and long-term obligations. This includes paying bills, salaries, and suppliers. By balancing inflows and outflows, cash flow allows a business to maintain financial stability, invest in growth opportunities, and avoid insolvency.

A company's cash flow can continue indefinitely if it consistently generates more inflows than outflows. Sustainability depends on steady revenue, effective expense management, and regular monitoring.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting Courses, including the Cash Flow Training, Project Accounting Course, and Cash Cycle Management Training. These courses cater to different skill levels, providing comprehensive insights into Financial Modelling Salary.

Our Accounting and Finance Blogs cover a range of topics related to Financial Management and Accounting Practices, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Analysis skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Cash Flow Training

Cash Flow Training

Fri 25th Oct 2024

Fri 22nd Nov 2024

Fri 20th Dec 2024

Fri 24th Jan 2025

Fri 21st Mar 2025

Fri 2nd May 2025

Fri 27th Jun 2025

Fri 29th Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please