We may not have the course you’re looking for. If you enquire or give us a call on +61 272026926 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine having the power to predict a company’s financial future, assess the viability of new projects, and make informed strategic decisions. This is the essence of Financial Modeling. Consequently, understanding What is Financial Modeling is a game-changer for businesses and professionals alike. This blog will unravel its complexities, highlight its importance, and the experts who create these models.

It will talk about how businesses forecast their earnings or evaluate investment opportunities. Be it as a finance veteran or a newcomer, mastering Financial Modeling can provide you with the insights to drive success. Ready to transform your approach to financial planning and analysis? Let’s dive in and explore the fundamentals of Finacial Modeling.

Table of Content

1) What is Financial Modeling?

2) Process of Financial Modeling

3) Elements of Financial Modeling

4) Who Builds Financial Models?

5) What Software is Best for Financial Modeling?

6) How to Learn Financial Modeling?

7) Benefits of Financial Modeling

8) Financial Modeling Best Practices

9) Conclusion

What is Financial Modeling?

Investment banking, corporate finance, private equity, venture capital, equity research, accounting, finance, and other fields all depend on the adaptable talent of Financial Modeling. Every industry can benefit greatly from knowing the financial implications of a decision made by a company. Let's explore the attributes of Financial Models in the following points:

a) Valuation: Calculate the fair worth of an enterprise, undertaking, or resource by considering anticipated growth, profits, cash flows, and risks. This aids in figuring out the appropriate price for deals such as acquisitions, divestitures, mergers, and Initial Public Offering (IPO).

b) Analysis: Look into the financial results of a project, investment, or business. Determine important drivers, trends, and ratios in addition to the Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis.

c) Planning: Planning is the process of determining the financial goals and objectives of a project, business, or investment and allocating the funds and resources needed to reach them. It can assist in developing the entity's budget, forecast, and strategic strategy.

d) Forecasting: Make predictions about future financial results using a range of situations and assumptions. Calculate probable results, profits, and hazards; assess the viability and impact of various options.

e) Decision-making: Weigh, compare, and assess several possibilities for a venture, undertaking, or financial commitment. Make well-informed choices to reduce risk and maximise profit.

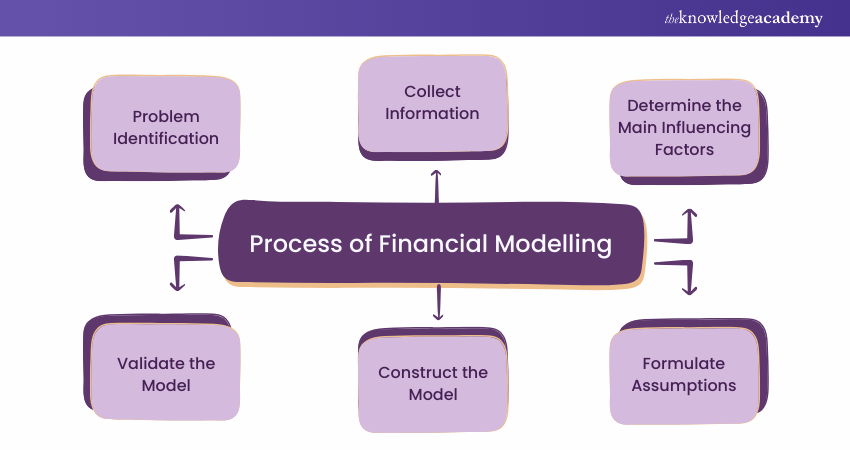

Process of Financial Modeling

Now that you know What is Financial Modeling and its purpose, let’s learn about its process. The process of Financial Modeling can vary depending on the purpose, complexity and scope of the model. However, a general framework that can be followed is as follows:

1) Problem Identification

The first stage is the formulation of the problem or the analysis of the question that the developed model seeks to solve or respond to. It can assist in defining the purpose, focus and environment of the model and defining its participants, information and assumption.

2) Collect Information

The second step is to collect the information and data needed to build the model. It can include the entity's financial statements, reports, and projections, as well as the market, industry, and economic data that affect its performance and position. The information and data should be reliable, accurate, and up-to-date and verified and validated before using them in the model.

3) Determine the Main Influencing Factors

The third process involves identifying the key factors that explain the financial performance and physical wealth status of the entity. These can include internal and external, numerical and non-numercial, and may differ with the nature and type of entity.

Some examples of influencing factors are revenue, cost, margin, growth, market share, competition, regulation, inflation, interest rate, exchange rate, and so on. These factors should be clearly defined, measured, and linked to the model.

4) Formulate Assumptions

The fourth step is to formulate the assumptions used to estimate the entity's future financial performance and position. These can be based on the historical trends, current conditions, and expected changes of the influencing factors, as well as the judgment and experience of the modeller. The assumptions should be realistic, logical, consistent, documented, and explained in the model.

5) Construct the Model

The fifth step is to construct the model using the information, data, factors, and assumptions collected and determined. The model should be structured clearly, logically, and organised, using appropriate tools and techniques, such as Excel, formulas, functions, charts, tables, and so on. The model should be easy to understand, follow, and modify, and it should have a user-friendly interface and layout.

6) Validate the Model

The sixth and final step is to validate the model to ensure accuracy, reliability, and robustness. It can involve checking the model for errors, inconsistencies, and anomalies and testing the model for sensitivity, scenario, and what-if analysis. The model should also be reviewed and verified by a third party, such as a supervisor, colleague, or client, to ensure that it meets the objective, scope, and context of the problem or question.

Take your Accounting and Finance skills to the next level - join our Accounting & Finance Trainings now!

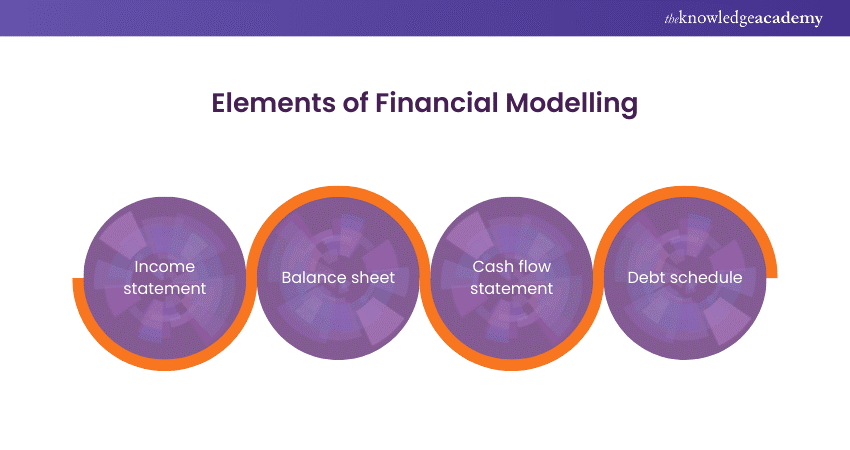

Elements of Financial Modeling

A Financial Model can have different elements depending on the purpose, scope, and complexity. However, some of the common elements that are found in most Financial Models include the following:

Income Statement

The income statement, often referred to the profit and loss statement, describes the revenues, expenses, and profits or losses of the entity over a period of time, such as a month, quarter, or year. It reflects the operating performance and profitability of the entity and is calculated as follows:

|

Income statement = Revenues - Expenses = Profits or Losses |

Balance Sheet

The balance sheet (statement of financial position) showcases the entity's assets, liabilities, and equity at a point in time, such as the end of a month, quarter, or year. It reflects the financial position and solvency of the entity and is calculated as follows:

|

Balance sheet = Assets = Liabilities + Equity |

Cash Flow Statement

The cash flow statement (statement of cash flows) showcases the inflows and outflows of cash and cash equivalents of the entity over a period of time, such as a month, quarter, or year. It reflects the liquidity and cash generation of the entity and is calculated as follows:

|

Cash flow statement = Cash flow from operating activities + Cash flow from investing activities + Cash flow from financing activities = Net change in cash and cash equivalents |

Take your financial expertise to the next level with our Financial Modeling Course – register now and make informed financial decisions!

Debt Schedule

The debt schedule (loan amortisation schedule) shows the details of the debt and interest payments of the entity over a period of time, such as a month, quarter, or year. It reflects the debt structure and servicing of the entity and is calculated as follows:

|

Debt schedule = Beginning debt balance + New debt issued - Debt repaid + Interest expense = Ending debt balance. |

Who Builds Financial Models?

Financial models are crafted by a variety of professionals across the finance industry, each bringing their unique expertise to the table:

1) Investment Bankers: Evaluate mergers, acquisitions, capital raising, and strategic decisions using complex scenarios and sensitivity analyses.

2) Equity Researchers: Forecast future earnings and determine stock valuation to make, buy, hold, or sell recommendations.

3) Corporate Development Analysts: Explore growth opportunities like acquisitions and partnerships, supporting strategic planning.

4) FP&A Specialists: Forecast budgets, analyse financial performance, and support internal decision-making.

5) Accountants: Assess financial health and value for due diligence, transaction advisory, and valuations.

6) Private Equity Professionals: Evaluate investment opportunities, perform due diligence, and manage portfolio companies with detailed cash flow projections.

7) Consultants: Advise on restructuring, performance improvement, and strategic planning to help clients make informed decisions.

What Software is Best for Financial Modeling?

Since every organisation has a different set of assumptions and computations to make, projecting a company's future operations can be very difficult. Because of its adaptability and customisation, Excel is the recommended tool for this activity.

Excel is a widely used and widely understood software that is perfect for financial modeling, in contrast to other tools that could be overly specialised or rigid.

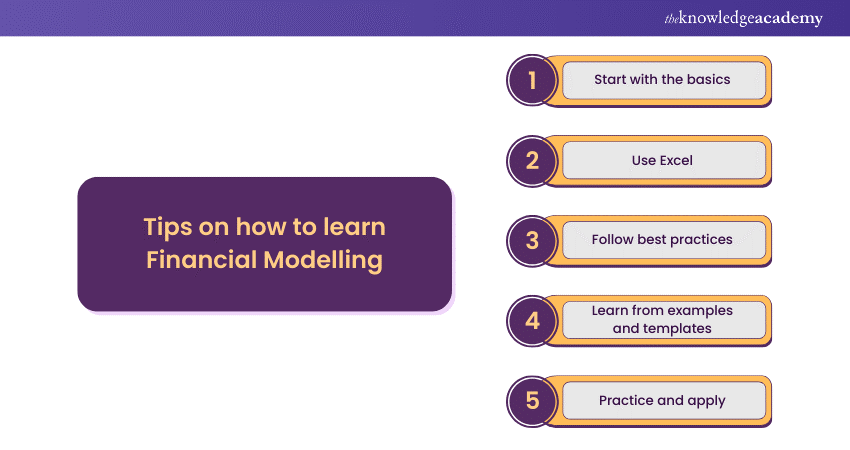

How to Learn Financial Modelling?

Financial Modelling is an important skill that can help you advance your career in finance, accounting, investment, and other related fields. However, learning Financial Modelling can be challenging, as it requires a combination of practical application and theoretical knowledge. Here are some tips on how to learn Financial Modelling effectively:

a) Start With the Basics

Before diving into complex and advanced models, you should master the basics of Financial Modeling, such as the three-statement model, the Discounted Cash Flow (DCF) model, the Comparable Company Analysis (CCA) model, and the Leveraged Buyout (LBO) model. You should also familiarise yourself with the concepts, principles, and standards of finance and accounting, such as financial statements, ratios, valuation, capital structure, cost of capital, and so on.

b) Use MS Excel

Excel is the most used tool for Financial Modeling, and you should learn how to use it proficiently. You should learn how to use Excel’s features, such as formulas, functions, charts, tables, pivot tables, data validation, conditional formatting, and so on. You should also learn how to use Excel’s shortcuts, macros, and Visual Basic for Application (VBA) to speed up and automate your modeling process.

c) Follow Best Practices

To ensure that your Financial Model is precise, reliable, and robust, you should follow some best practices, such as planning ahead, using consistent and clear conventions, separating inputs, calculations, and outputs, using formulas and functions wisely, building error checks and controls, and testing and validating the model.

d) Learn From Examples and Templates

One of the finest ways to learn Financial Modelling is to learn from examples and templates of real-world Financial Models. You can find many examples and templates of Financial Models online.

e) Practice and Apply

The best way to improve your Financial Modelling Skills is to practice and apply them to real-world problems and scenarios. You can use your own data or data from public sources, such as financial statements, reports, and projections of companies, industries, and markets.

Take control of your finances with our Financial Management Course - secure your spot today!

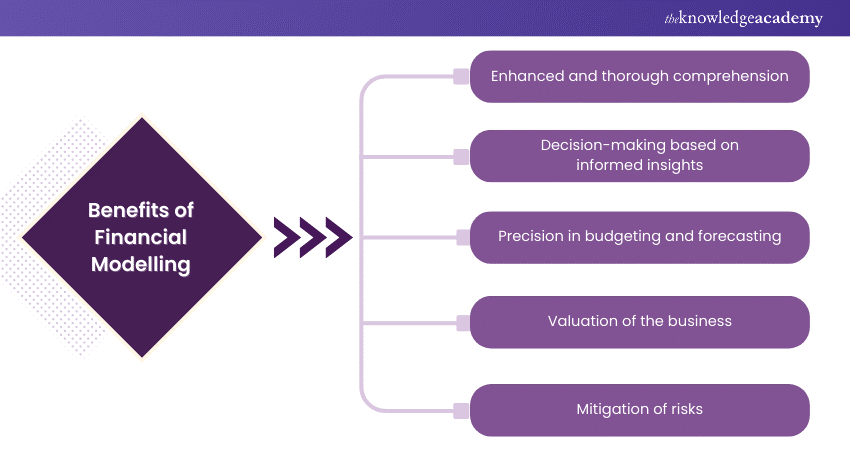

Benefits of Financial Modelling

Financial Modelling can provide various benefits to the users and stakeholders of the model, such as:

Enhanced and Thorough Comprehension

Financial Modelling can help enhance and improve the understanding and knowledge of the financial performance and position of the entity, as well as the factors and assumptions that affect it. It can also help identify and quantify the opportunities and challenges that the entity faces, as well as the risks and uncertainties that it entails.

Enhance your career and make informed financial decisions with our Financial Modeling Course – register now and learn from industry experts!

Decision-making Based on Informed Insights

Financial Modelling can help make decisions based on informed insights and analysis rather than on intuition or guesswork. It can help in comparing and evaluating different options and alternatives and selecting the best one that maximises the value and minimises the entity's risk. It can also help in communicating and presenting the results and recommendations of the model to the relevant stakeholders, such as Managers, Investors, lenders, regulators, and so on.

Precision in Budgeting and Forecasting

Financial Modelling can help achieve precision and accuracy in budgeting and forecasting the entity's future financial performance and position. It can help set realistic and attainable goals and objectives and allocate the resources and capital required to achieve them. It can also help monitor and track the actual results and performance of the entity and adjust the model and the plan accordingly.

Valuation of the Business

Financial Modelling can help estimate the fair value of the business, project, or investment based on its expected cash flows, earnings, growth, and risk profile. It can help determine the appropriate price to pay or receive in a transaction, such as a merger, acquisition, divestiture, or IPO. It can also help assess the impact of the transaction on the value and performance of the entity and the synergies and benefits it can create.

Join our comprehensive Financial Analyst Training and master the required skills to analyse and interpret financial data.

Mitigation of Risks

Financial Modelling can help mitigate and manage the risks and uncertainties that the entity faces, such as market, operational, financial, and strategic risks. It can help test the sensitivity and feasibility of the model and the entity and analyse the different scenarios and outcomes that can occur. It can also help in developing and implementing contingency plans and strategies to cope with the potential threats and challenges that the entity may encounter.

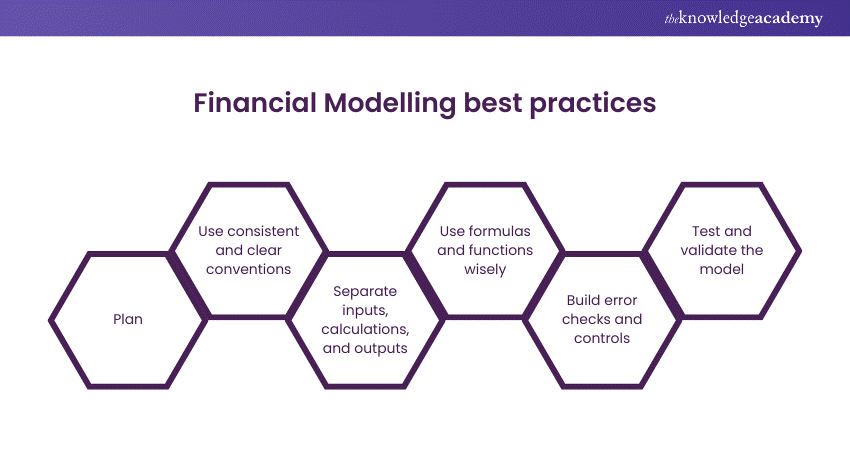

Financial Modelling Best Practices

Financial Modelling is both an art and a science and requires a combination of skills, knowledge, and creativity. To guarantee the accuracy, reliability, and robustness of the Financial Model, it is essential to adhere to the following best practices:

a) Plan: Before building the model, plan the objective, scope, and context of the model, as well as the structure, layout, and format of the model. It can help create a clear and logical framework for the model and avoid unnecessary complications and errors.

b) Use consistent and clear conventions: Use consistent and clear conventions for naming, formatting, and documenting the model, such as cells, ranges, sheets, formulas, functions, charts, tables, and so on. It can help enhance the readability, understandability, and modifiability of the model and avoid confusion and ambiguity.

c) Separate inputs, calculations, and outputs: Separate the inputs, calculations, and outputs of the model into different sections, sheets, or modules, and use different colours or fonts to distinguish them. It can help organise and simplify the model and facilitate the model's data entry, analysis, and presentation.

d) Use formulas and functions wisely: Use formulas and functions that are simple, accurate, and consistent, and avoid hard coding, circular references, and volatile functions. This approach aids in ensuring the model's validity, reliability, and efficiency while minimising the likelihood of errors and inconsistencies.

e) Build error checks and controls: Build error checks and controls into the model, such as balance checks, reasonableness checks, cross-checks, and flags. It can help detect and correct any errors, anomalies, or deviations in the model and ensure its quality and integrity.

f) Test and validate the model: Test and validate the model using various methods, such as debugging, auditing, reviewing, verifying, and analysing. It can help ensure that the model is accurate, reliable, and robust and meets the objective, scope, and context of the problem or question.

Unlock your financial expertise – join our comprehensive Financial Modelling Course today!

Conclusion

As we conclude our blog on What is Financial Modeling, we hope you now see it as more than just numbers and spreadsheets. It’s a powerful tool for unlocking strategic insights. So, embrace Financial Modeling, and watch your business thrive with newfound clarity and confidence.

Master the business language with our Accounting Course register now and navigate the financial reporting complexities!

Frequently Asked Questions

Financial Modeling in Excel involves creating a detailed representation of a company’s financial performance. It uses Excel to forecast future financial outcomes based on historical data and assumptions.

The P&L (Profit and Loss) Financial Model outlines a company’s revenues, costs, and expenses over a specific period, helping to assess profitability and financial health.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Courses, including Financial Modelling, Payroll and Financial Management. These courses cater to different skill levels, providing comprehensive insights into Financial Management.

Our Business Skills covers a range of topics related to Financial Modeling, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Management skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Financial Modelling Course

Financial Modelling Course

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please