We may not have the course you’re looking for. If you enquire or give us a call on +32 35001305 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine you’re planning for your future and aiming for financial security, but you’re unsure whether to diversify across different asset classes or concentrate on a single investment. This is where Portfolio Management comes into play. It’s the art of making strategic investment decisions to maximise returns while minimising risk. By grasping the concepts of diversification, risk tolerance, and asset allocation, even beginners can start crafting a strong investment portfolio.

In this blog, we’ll explore the fundamentals of Portfolio Management, providing you with the knowledge and tools to make informed investment choices. Let’s dive in and discover how you can make your money work for you.

Table of Contents

1) Understanding “What is Portfolio Management?”

2) Components of a Portfolio

3) Portfolio Management Strategies

4) Benefits of Implementing Portfolio Management

5) Challenges of Portfolio Management

6) Conclusion

Understanding What is Portfolio Management?

Licensed professional Portfolio Managers operate on behalf of clients, whereas individuals have the option to construct and manage their own portfolios. Regardless of the strategy, the primary objective of a Portfolio Manager is to maximise the expected Return on Investments (ROI) while maintaining an appropriate level of risk exposure.

Effective Portfolio Management Software necessitates the ability to assess the strengths and weaknesses, opportunities and threats across a range of investments. The decisions involve various trade-offs, such as choosing between debt and equity, domestic and international investments, and prioritising growth versus safety.

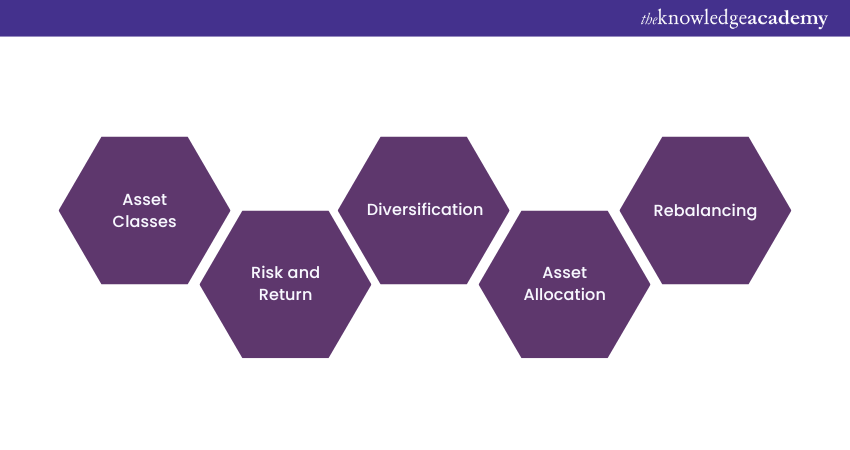

Components of a Portfolio

A portfolio consists of various components that work together to form a comprehensive investment strategy. These components help investors diversify their holdings, manage risk, and align their investments with their financial goals. The key components of a portfolio include:

1) Risk and Return

When constructing a portfolio, buyers should keep in mind the relationship between Risk Management. Generally, investments with better capability returns include higher degrees of risk. It is vital to balance searching for higher returns and coping with the associated risks. Investors ought to check their risk tolerance and economic goals to determine the right allocation of assets within their portfolio.

2) Diversification

Diversification is a crucial precept in Portfolio Management. It includes spreading investments across various asset instructions, industries, and geographic areas. By diversifying, buyers aim to reduce the impact of any investment's terrible performance on the entire portfolio. The system allows mitigate hazard and may enhance the portfolio's ability for long-time period growth.

3) Asset Allocation

Asset allocation refers back to the strategic distribution of investments across exclusive asset instructions. The allocation relies upon the investor's risk tolerance, investment horizon, and monetary targets. A well-designed asset allocation approach considers elements including age, financial desires, and time horizon. It allows to create a balanced portfolio that aligns with the investor's risk urge and maximises the ability for returns.

4) Rebalancing

Over time, the performance of various investments within a portfolio may additionally deviate from the preferred asset allocation. Rebalancing involves periodically reviewing and adjusting the portfolio to hold the favoured allocation. This method guarantees the portfolio stays aligned with the investor's dreams and risk tolerance. Rebalancing may additionally contain promoting overperforming assets and buying underperforming ones, returning the portfolio to its goal allocation.

Acquire the expertise to manage and optimise your organisation’s portfolio – join our Management Of Portfolios (MoP®) Foundation Course

Portfolio Management Strategies

Portfolio Management strategies involve implementing specific approaches to guide investment decisions and optimise the performance of a portfolio. These strategies consider various factors, such as the investor's risk tolerance, investment goals, and market conditions. Here are some commonly used strategies:

1) Active vs Passive Management

Active management entails actively selecting and coping with individual investments to outperform the market. Portfolio Managers accomplishing energetic control frequently have interaction in widespread studies, analysis, and frequent selling and promoting of assets. In evaluation, passive control entails investing in index finances or Exchange-traded Funds (ETFs) that look to copy the overall performance of a selected marketplace index. Passive strategies normally require much less frequent buying and selling and consciousness on long-time period investment objectives.

2) Growth vs Value Investing

Growth investing specialises in figuring out businesses with excessive growth ability. These companies frequently reinvest their profits lower back into the enterprise to gas growth. Growth traders mostly search for organisations with sturdy revenue and profits' growth, normally in technology, healthcare, and other revolutionary sectors. Value investment, on the other hand, involves looking for undervalued companies whose stock prices may not replicate their intrinsic price. Value traders search for companies that can be briefly out of favour or undervalued by the marketplace.

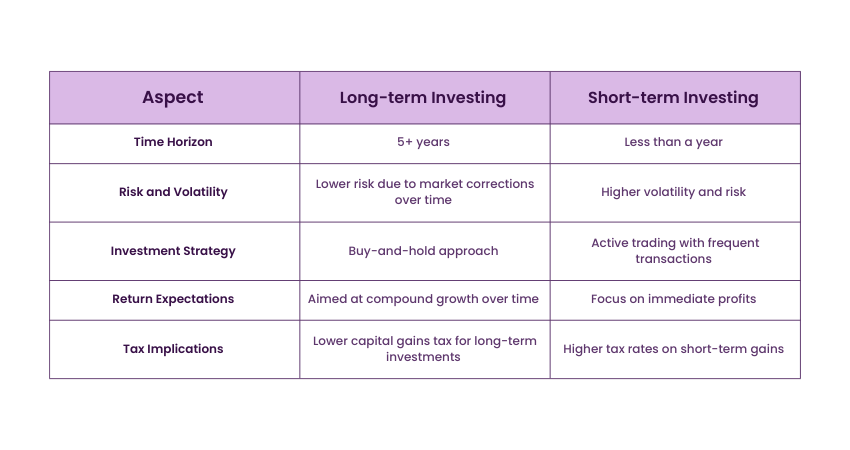

3) Long-term vs Short-term Investing

Long-term investing involves holding investments for an extended period, often years or even decades. Long-term investors aim to capitalise on compounding returns and the potential for growth over time. They generally take a more patient and less reactive approach to market fluctuations.

In contrast, short-term investing takes advantage of short-term market trends and price movements. Short-term investors may engage in more frequent trading and try to profit from market volatility.

4) Tactical vs Strategic Asset Allocation

Tactical asset allocation involves making short-term adjustments to the portfolio's asset allocation as per the current market conditions and economic outlook. Portfolio Managers employing this strategy may increase or decrease exposure to specific asset classes to take advantage of perceived opportunities or manage risk. Strategic asset allocation, on the other hand, focuses on long-term objectives and adheres to a predetermined asset allocation strategy. Strategic allocation decisions are typically based on an investor's risk profile and long-term goals.

5) Risk Management Strategies

Risk management strategies aim to minimise potential losses and protect the portfolio during adverse market conditions. These strategies may include diversification, hedging, or employing defensive investment approaches. Portfolio Managers may use derivatives, options, or other risk management tools to mitigate specific risks associated with certain investments or market events.

Benefits of Implementing Portfolio Management

Implementing Portfolio Management offers numerous benefits to traders. By adopting its powerful practices, individuals and corporations can maximise the ability for returns even as minimising risks. Here are some of their important benefits:

1) Risk-return Optimisation

Portfolio Management allows traders to optimise the risk-return trade-off. By cautiously choosing investments and balancing the portfolio's asset allocation, buyers can tailor the threat exposure to their consolation stage at the same time as seeking better ability returns. This technique involves assessing an investor's risk tolerance, economic desires, and investment horizon to decide the most reliable blend of belongings that align with their goals. Through diversification and risk management techniques, it aims to achieve a most reliable balance between risk and return.

2) Active Monitoring and Adjustments

Effective Portfolio Management involves continuous monitoring of investments and making informed adjustments when necessary. Regularly reviewing the portfolio's performance and comparing it to established benchmarks allows investors to identify underperforming assets or sectors. By appropriately managing the portfolio, investors can take advantage of emerging opportunities, respond to market trends, and mitigate potential risks. This proactive approach helps investors to stay on track towards their financial objectives and adapt to changing market conditions.

3) Long-term Financial Discipline

Portfolio Management promotes long-term financial discipline. It encourages investors to focus on their overarching investment objectives rather than getting swayed by short-term market fluctuations or impulsive investment decisions. By setting clear investment goals and aligning their portfolio accordingly, investors are more likely to stay committed to their long-term plans and resist emotional reactions to market volatility. This disciplined strategy can lead to better investment outcomes and a greater likelihood of achieving financial objectives.

4) Professional Expertise and Guidance

Implementing Portfolio Management often involves seeking professional expertise and advice. Financial Advisors or Portfolio Managers bring their knowledge and experience to the table, providing valuable insights and recommendations. They can assist investors in constructing a well-balanced portfolio, selecting suitable investments, and managing risk effectively. By working with professionals, investors can benefit from their expertise and access to sophisticated tools and resources, enhancing their capabilities.

5) Performance Evaluation and Transparency

Portfolio Management facilitates thorough performance evaluation and transparency. By monitoring the portfolio's performance, investors can assess the progress towards their investment goals and evaluate the effectiveness of their investment strategy. This evaluation allows for informed decision-making and adjustments as needed. Additionally, implementing such practices provides transparency, enabling investors to clearly understand their investments, associated risks, and the factors influencing their portfolio's performance.

Sign-up for our Management Of Portfolios (MoP®) Foundation & Practitioner Course and become a certified Portfolio Management professional

Challenges of Portfolio Management

Managing a portfolio effectively requires a blend of strategic planning, market knowledge, and adaptability. Here are some key challenges of Portfolio Management:

a) Market Volatility: The constant fluctuations in the market can greatly affect investment values, necessitating ongoing vigilance and timely portfolio adjustments.

b) Diversification: Achieving the right balance between spreading risk across various assets and maximising returns can be intricate and challenging.

c) Regulatory Changes: Staying updated with the ever-changing financial regulations and ensuring compliance can be both demanding and time-consuming.

d) Economic and Geopolitical Factors: Unpredictable global events and economic shifts can impact market conditions, requiring a flexible and well-informed approach.

e) Client Expectations: Meeting the specific goals and risk tolerance of clients adds complexity and pressure to Portfolio Management strategies.

Technological Advancements: Adapting to new tools and platforms necessitates continuous learning to maintain a competitive edge in the industry.

Conclusion

Mastering Portfolio Management is your gateway to financial stability and growth. By understanding the basics and staying informed, you can make smarter investment decisions. Remember, it’s not just about picking the right assets, but also about balancing risk and reward to meet your financial goals.

Take your Portfolio Management capabilities to the next level – register for our Management Of Portfolios (MoP®) Practitioner Upgrade Training

Frequently Asked Questions

Portfolio Management is a valuable skill that can help you achieve your career goals. By learning how to select, prioritise, and execute the right projects, you can demonstrate your strategic thinking, leadership, and problem-solving abilities. It can also open up opportunities for advancement, as it is a key function in many organisations.

Evaluating your risk tolerance involves gauging your ability to handle market volatility and potential losses. Factors include your financial goals, investment horizon, income, and comfort with risk. Tools like questionnaires and past investment experiences, along with advice from a financial advisor, can help clarify your risk profile.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various MoP® Management of Portfolios courses, including MoP® Foundation and Practitioner Courses. These courses cater to different skill levels, providing comprehensive insights into Portfolio Management Methodologies.

Our Business Skills Blogs covers a range of topics related to Portfolio Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Management of Portfolios (MoP®) Foundation & Practitioner

Management of Portfolios (MoP®) Foundation & Practitioner

Mon 13th Jan 2025

Mon 10th Feb 2025

Mon 10th Mar 2025

Mon 14th Apr 2025

Mon 12th May 2025

Mon 9th Jun 2025

Mon 14th Jul 2025

Mon 11th Aug 2025

Mon 8th Sep 2025

Mon 13th Oct 2025

Mon 10th Nov 2025

Mon 8th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please