We may not have the course you’re looking for. If you enquire or give us a call on +32 35001305 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The financial industry has drastically changed in the past couple of years. To help families, individuals, and organisations maintain their financial goals and manage them, the concept of Wealth Management was introduced. But people are still aware of What is Wealth Management.

Wealth Management is a robust approach which helps individuals, families, and businesses to create correct Financial Planning and Investment Management, which is tailored to meet specific needs and goals. Thus, it’s crucial to learn about this approach and let your finances be in a safe place. So, read this blog to get an in-depth knowledge of What is Wealth Management, its approaches, how you can choose a Wealth Manager and more!

Table of Contents

1) Understanding What is Wealth Management

2) Effective Wealth Management approaches

3) Minimum funds required for Wealth Management services

4) Benefits of Wealth Management

5) Alternatives to Wealth Management

6) Conclusion

Understanding What is Wealth Management

Wealth Management is a sophisticated Financial Advisory service that encompasses multiple Wealth Management Strategies and techniques aimed at helping individuals and organizations grow, protect, and distribute their wealth. It goes beyond simple investment advice, offering a comprehensive analysis of an individual's or entity's financial situation. Wealth Managers are experts in various financial disciplines who work closely with clients to understand their financial goals, risk tolerance, and unique circumstances.

One of the primary objectives of Wealth Management is to generate long-term wealth while mitigating risks. Wealth Managers assess diverse investment options, considering market trends, economic indicators, and individual client preferences. They formulate personalised investment portfolios, incorporating a mix of assets like stocks, bonds, Real Estate, and alternative investments, to optimise returns within the defined risk parameters. Through Wealth Management they also address critical aspects like Tax Planning, Estate Planning, and retirement strategies. Professionals in this field also provide the following services:

a) Invaluable guidance on minimising tax liabilities.

b) Preserving assets for future generations.

c) Ensuring a comfortable retirement.

Moreover, they adapt strategies as clients' circumstances change, ensuring their financial plans remain relevant and practical.

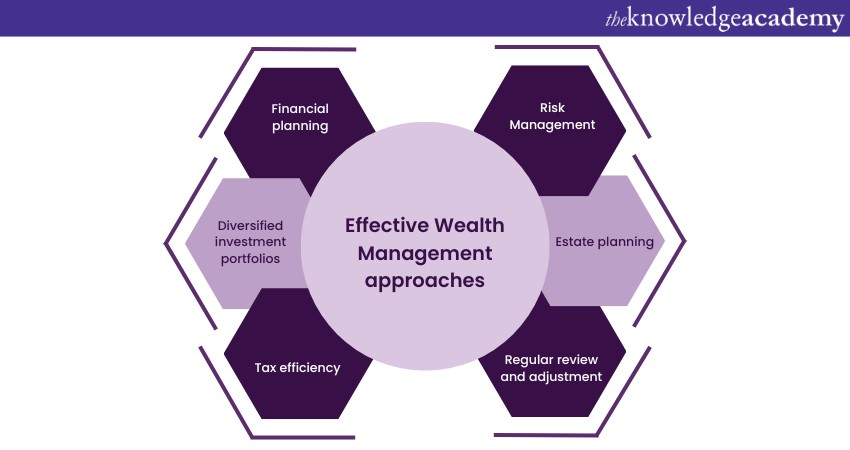

Effective Wealth Management approaches

Effective Wealth Management approaches are multifaceted strategies that go beyond traditional Financial Planning. They are tailored to meet the needs and goals of individuals, families, or organisations, ensuring optimal growth, protection, and distribution of wealth. Let us see how:

1) Financial Planning: Effective Wealth Management begins with a thorough understanding of a client’s financial landscape. Wealth Managers conduct in-depth analyses of income, expenses, assets, and liabilities. They ask clients about their short-term and long-term financial goals, such as home buying, funding education, or retiring comfortably. This approach forms the foundation for all subsequent strategies.

2) Diversified investment portfolios: Wealth Managers design diversified investment portfolios that balance risk and return. They invest across various asset classes, such as stocks, bonds, real estate, and commodities. Diversification minimises the impact of market volatility on overall portfolio performance, ensuring stable, long-term growth.

3) Tax efficiency: Wealth Managers employ tax-efficient strategies to minimise clients’ tax liabilities. This involves utilising tax-sheltered accounts, optimising capital gains, and exploring tax-free investment options. By maximising after-tax returns, individuals can retain more wealth, enhancing overall financial growth.

4) Risk management: Effective Wealth Management includes robust Risk Management strategies. Wealth Managers assess clients’ risk tolerance and design portfolios that align with their comfort levels. They also employ insurance products like life, health, and property insurance to protect assets against unforeseen events, ensuring financial security even in challenging times.

5) Estate Planning: Wealth Managers assist clients in structuring their estates efficiently. This involves creating wills, establishing trusts, and implementing gifting strategies to minimise estate taxes and facilitate seamless wealth transfer to future generations.

6) Regular review and adjustment: Wealth Managers regularly review clients’ portfolios and financial plans, making necessary changes to adapt to market fluctuations, changes in clients’ lives, or alterations in financial goals.

Learn how to transform your financial skills with our Accounting & Finance Training - join now!

Minimum funds required for Wealth Management services

The minimum funds required for Wealth Management services can vary significantly based on the financial institution, the complexity of the individual's or organisation's economic situation, and the specific benefits offered. Generally, Private Wealth Management services are designed for individuals with substantial assets, often well above what is needed for essential financial planning.

The minimum threshold for Wealth Management typically starts at several hundred thousand dollars, although this can vary widely. However, if an individual possesses the required amount of funds for the services, these are some of the services that can be expected:

a) Tailored services: Wealth Management services are highly personalised. Clients with significant funds benefit from tailor-made investment strategies, tax planning, estate planning, and risk management. These services often come with a higher price tag due to the individualised attention and expertise provided by Wealth Managers.

b) Diverse investment opportunities: Clients gain access to many investment opportunities, like private equity, hedge funds, and many other opportunities. These options often require substantial minimum investments. Wealth Managers use these alternatives to diversify portfolios and potentially enhance returns, catering to high-net-worth individuals who can afford these investments.

c) Cost of expertise: Wealth Management services encompass a team of experts, including financial analysts, tax specialists, estate planners, and legal advisors. The cost of hiring these professionals adds to the overall fee structure. The expertise provided ensures clients receive comprehensive financial advice, enabling them to navigate complex financial situations effectively.

d) Advanced technology: Wealth Management services often utilise cutting-edge technology, including sophisticated financial software and analytics tools. These technologies help in analysing vast amounts of data, making informed investment decisions, and optimising portfolios. The cost of implementing and maintaining these technologies is reflected in the fees charged to clients.

e) Customised financial plans: Wealth Managers create intricate financial plans tailored to client’s unique goals. These plans require detailed analysis and constant adjustments based on market and client circumstances. Wealth Managers continuously monitor portfolios and make real-time decisions, ensuring clients’ financial objectives are met. This high level of customisation and ongoing management justifies the higher fees associated with Wealth Management services.

f) Comprehensive support: Wealth Management services offer complete support, including regular financial reviews, tax planning, estate planning, and retirement strategies. Clients receive proactive advice and assistance in every aspect of their financial lives. The level of support provided, along with the expertise offered, contributes to the higher cost of Wealth Management services.

Enhance your financial and managerial skills with our Financial Management Training - register now!

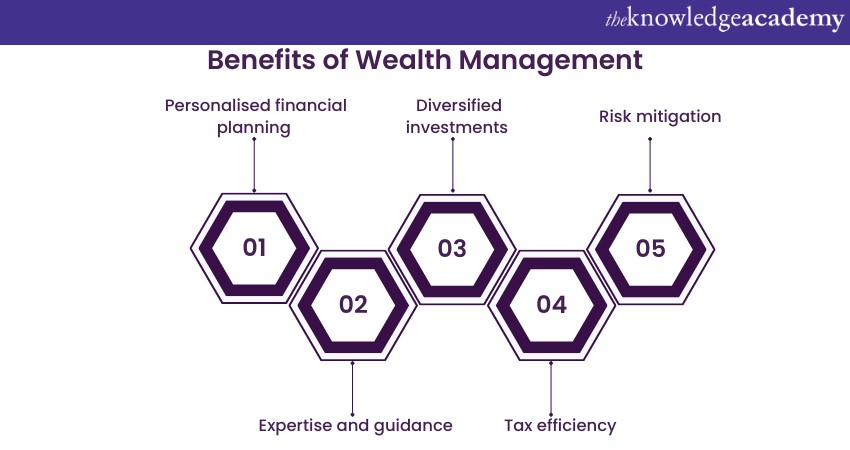

Benefits of Wealth Management

Wealth Management offers several benefits beyond simple Financial Management, making it a valuable service for individuals and organisations seeking long-term economic prosperity and security. Some of these benefits are as follows:

a) Personalised financial planning: Wealth Managers provide tailored financial plans, aligning investments, savings, and expenditures with specific goals, ensuring a clear roadmap for financial success.

b) Diversified investments: Wealth Management experts design diversified portfolios, spreading investments across various asset classes, minimising risks and maximising returns, thereby safeguarding wealth in volatile markets.

c) Expertise and guidance: Clients benefit from the expertise of financial professionals who stay updated on market trends and regulatory changes, offering informed advice on investment opportunities and financial strategies.

d) Tax efficiency: Wealth Managers employ tax-efficient strategies, optimising clients’ tax liabilities by utilising legal deductions and exemptions, preserving wealth and maximising after-tax returns.

e) Risk mitigation: Wealth Managers assess risk tolerance and design portfolios that align with clients' comfort levels, ensuring investments align with their financial objectives and reducing the likelihood of significant losses.

f) Estate planning: Wealth Management services include comprehensive estate planning, ensuring smooth wealth transfer to future generations, minimising estate taxes, and safeguarding family legacies.

g) Continuous monitoring: Wealth Managers continuously monitor portfolios, adapting strategies to changing market conditions and clients' evolving needs, ensuring financial plans remain robust and effective over time.

Learn how to navigate complexities and optimise investments – sign up now for our Capital Market Training!

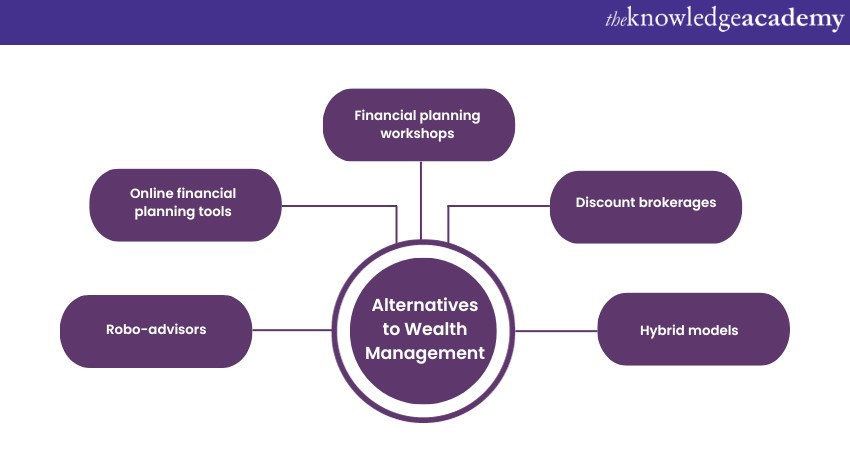

Alternatives to Wealth Management

Alternatives to traditional Wealth Management services exist for individuals or organisations seeking financial guidance without the extensive costs associated with specialised Wealth Managers. These alternatives are as follows:

a) Robo-advisors: Robo-advisors are digital platforms, offering automated, algorithm-driven financial planning services. They provide tailored investment strategies based on the client's risk tolerance, financial goals, and time horizon. These services are particularly more affordable than traditional Wealth Management, making them accessible to a broader range of investors.

b) Online financial planning tools: Various online tools and software platforms assist individuals in creating financial plans, budgeting, and tracking investments. These tools often come with educational resources and calculators, empowering users to manage their finances independently.

c) Financial planning workshops: Attending Financial Planning workshops and seminars conducted by certified financial planners can provide valuable insights into managing finances, investing, and retirement planning. These events are often more cost-effective and offer opportunities for personalised advice.

d) Discount brokerages: Discount brokerages provide a platform for individuals to invest in stocks, bonds, mutual funds, and other securities at a lower cost per trade. While they do not offer personalised financial advice, they are suitable for self-directed investors who want to manage their portfolios independently.

e) Hybrid models: Some financial advisory firms offer hybrid models that combine automated robo-advisory services with access to human advisors. This approach balances cost-effectiveness and personalised guidance, catering to clients who prefer a middle-ground solution. Understanding hybrid models is essential for Becoming a Financial Advisor as they represent a growing trend in the industry.

Boost your analytical skills and shape data into strategic insights with our Financial Modelling Training!

Conclusion

We hope that this blog provides you with insights into what Wealth Management is and how to choose a Wealth Manager if you want good financial planning. Whether it be your short-term or long-term goals, Wealth Managers will help you properly plan your assets, which can also be a focus in Wealth Management Interview Questions.

Want to learn how to optimise Credit Management and drive financial stability for your business? Then sign up now for our Introduction to Credit Control Course!

Frequently Asked Questions

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please