We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Payroll Management refers to the systematic administration of employee wages, benefits, and taxes. Effective management of Payroll ensures accurate and timely payment to employees, fostering employee satisfaction and organisational success.

According to a Deloitte Global Payroll Benchmarking Survey, on average, a Payroll staff spends 27 per cent of their time doing manual tasks. This could be reduced by implementing an effective Payroll system. In this blog, you will learn about Payroll Management, how to manage it effectively, and how to implement a well-organised Payroll administration system.

Table of Contents

1) What is Payroll Management?

2) Payroll Management system and its features

3) Benefits of an effective Payroll Management system

4) Choosing the right Payroll Management software

5) How to implement a Payroll administration system?

6) Tips for managing Payroll effectively

7) Conclusion

What is Payroll Management?

Payroll Management is the process of handling employee compensation, including salaries, wages, deductions, and taxes. It involves various tasks such as calculating Payroll, generating paychecks, and maintaining accurate records. Efficient Payroll Management ensures that employees are paid accurately and on time while adhering to legal and regulatory requirements.

Payroll Management system and its features

A Payroll Management system is a software application or tool that automates and streamlines calculating and disbursing employee salaries. Moreover, it helps manage tax deductions and handle other aspects of employee compensation. It is a centralised platform for HR and finance teams to manage Payroll Processes efficiently and accurately. Let's look at some of its prominent features.

Features of Payroll Management system

A comprehensive Payroll Management system offers a range of features designed to streamline and simplify organisational processes. These features contribute to accurate and efficient management of Payroll, ensuring compliance with labour laws and enhancing employee satisfaction. The following are some of its key features:

a) Automated Salary Calculation: Calculate employee salaries accurately based on factors like hours worked, pay rates, and bonuses.

b) Tax management: Handle tax calculations, generate tax forms, and facilitate tax filing processes.

c) Deductions and benefits: Manage deductions (e.g., insurance premiums, loan repayments) and employee benefits.

d) Direct deposit: Offer direct deposit functionality for convenient salary payments to employee bank accounts.

e) Employee self-service: Provide self-service portals for employees to access pay stubs, update personal details, and submit time-off requests.

f) Compliance and Reporting: Ensure compliance with legal and tax regulations, generate Payroll reports, and facilitate tax filings.

g) Integration with time and attendance systems: Integrate with time and attendance tracking systems to streamline data transfer.

h) Data security: Implement robust data security measures to protect sensitive employee information.

i) Analytics and insights: Provide analytics and reporting capabilities to gain insights into labour costs and key Payroll metrics.

j) Scalability and customisation: Accommodate organisations of different sizes and offer customisation options to align with specific needs.

Master the art of Payroll Management with our dynamic Introduction to Payroll Course – Sign up now!

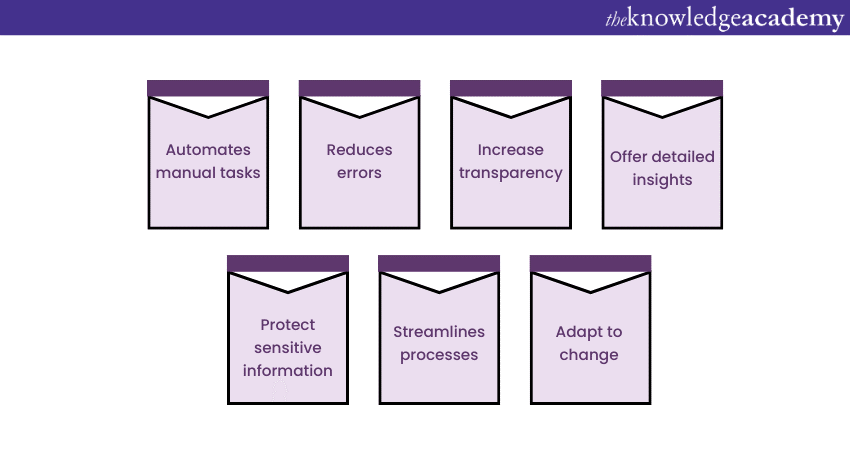

Benefits of an effective Payroll Management System

Implementing an effective Payroll Management system offers numerous advantages for organisations. By leveraging automation, accuracy, and streamlined processes, businesses can experience the following benefits:

a) Time and cost savings: An efficient Payroll system automates manual tasks, saving time for HR and finance teams. This reduces administrative workload and minimises costs associated with Payroll processing.

b) Improved accuracy and compliance: By automating Payroll calculations and tax withholdings, a reliable system significantly reduces errors and ensures compliance with tax laws and regulations. This helps avoid potential penalties and legal issues.

c) Enhanced employee satisfaction: Timely and accurate salary payments improve employee experiences. A Payroll system enables employees to access their pay information conveniently, enhancing transparency and engagement.

d) Streamlined reporting and analytics: Effective Payroll systems provide comprehensive reporting and analytics features, offering insights into Payroll expenses, tax summaries, and labour cost analysis. This data helps organisations make informed decisions and optimise their Payroll processes.

e) Data security and confidentiality: Payroll systems prioritise data security, protecting sensitive employee information through encryption, access controls, and backups. This ensures privacy and safeguards against data breaches.

f) Efficient benefits administration: Integrated benefits management within a Payroll system simplifies the administration of employee benefits, such as health insurance and retirement plans. This streamlines HR processes and ensures accurate benefits calculations.

g) Scalability and adaptability: A flexible Payroll system can accommodate organisational growth, handle increased employee numbers, and adapt to changing Payroll requirements.

By harnessing the benefits of an effective Payroll system, you can save time and costs, improve accuracy and compliance, and enhance employee satisfaction. Additionally, you can gain valuable insights, maintain data security, streamline benefits administration, and scale effectively.

Harness the full potential of this cutting-edge software and streamline your Payroll processes with our Xero Payroll Training - Sign up now!

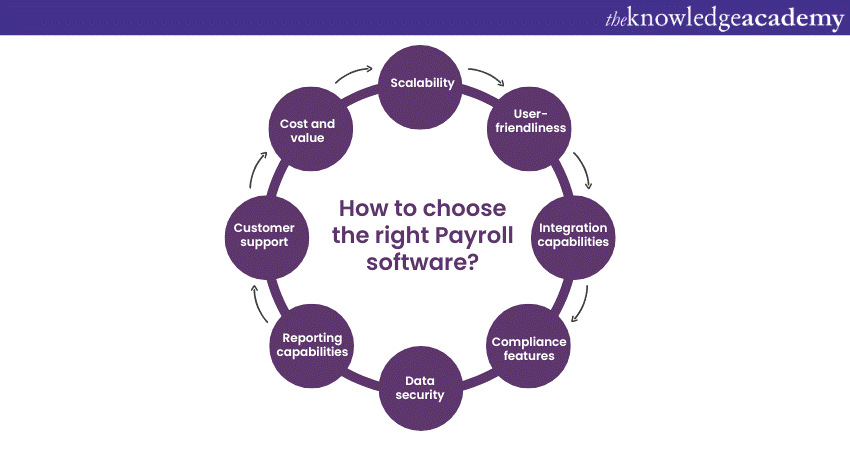

Choosing the right Payroll Management software

Selecting the appropriate Payroll Management software is crucial for efficient Payroll processing. When choosing the right software, consider the following factors:

a) Scalability: Choose Payroll Management software that can scale as your organisation grows. It should accommodate increasing employees and handle complex Payroll structures, such as multiple pay rates, deductions, and benefits.

b) User-friendliness: Opt for software with a user-friendly interface and intuitive navigation. The software should be easy to understand and operate, reducing the learning curve for your HR and finance teams.

c) Integration capabilities: Consider the software's integration capabilities with other systems, such as time and attendance tracking, HR management, and accounting software. Seamless integration eliminates data duplication, streamlines processes, and improves overall efficiency.

d) Compliance features: Ensure that the software has built-in compliance features to handle legal and tax regulations specific to your jurisdiction. It should automatically calculate taxes, manage tax forms, and generate accurate reports for tax filing purposes.

e) Data security: Payroll data contains sensitive employee information, so prioritise software that provides robust data security measures. Look for data encryption, secure access controls, and regular data backup features to protect against data breaches and ensure privacy.

f) Reporting capabilities: Choose software that offers comprehensive reporting capabilities. It should generate detailed reports on Payroll expenses, tax deductions, employee earnings, and other relevant metrics. Customisable reports allow you to extract specific data for analysis and decision-making.

g) Customer support: Consider the level of customer support the software vendor provides. Ensure they offer responsive customer service, including technical support and software implementation and troubleshooting assistance.

h) Cost and value: Evaluate the cost of the Payroll Software in relation to its features and value. Consider factors such as licensing fees, implementation costs, ongoing maintenance, and support. Assess the return on investment (ROI) and long-term benefits the software can provide to your organisation.

By carefully considering these factors, you can choose the right Payroll Management software that aligns with your organisation's needs. Such software streamlines Payroll processes, ensures compliance and enhances overall efficiency.

Discover the power of financial knowledge! Join our Finance for Non-Financial Managers course and gain the skills you need to make informed business decisions.

How to implement a Payroll administration system?

Implementing a well-organised Payroll administration system requires careful planning and execution. Follow the below steps to establish an efficient Payroll administration system in your organisation:

a) Document Payroll policies and procedures: Start by documenting clear and comprehensive Payroll policies and procedures. This includes pay structures, deductions, tax withholding rules, overtime calculations, and other relevant guidelines. Ensure that these policies comply with legal and tax regulations specific to your jurisdiction.

b) Centralise employee data: Set up a centralised system to collect and maintain employee data. This system should include personal information, tax forms, employment contracts, and other relevant documents. Centralising employee data streamlines Payroll processing and ensures accuracy.

c) Establish clear communication channels: Implement clear communication channels for employees to address Payroll-related inquiries. Provide a dedicated email address or online portal where employees can submit their queries, request changes, or report discrepancies. Ensure that responses are prompt and informative.

d) Automate payroll processes: Utilise Payroll software or tools to automate Payroll processes. These tools can handle tasks like salary calculations, tax deductions, benefits administration, and direct deposit. Automation reduces manual effort, minimises errors, and saves time for HR and finance teams.

e) Regularly update employee records: Keep employee records updated by updating information related to employee status, salary changes, benefits, and tax exemptions. This ensures accuracy in Payroll calculations and prevents any discrepancies.

f) Ensure compliance with legal requirements: Stay informed about legal and tax regulations that govern Payroll administration. Regularly review and update Payroll processes to comply with changing laws. Be aware of deadlines for tax filings, reporting requirements, and minimum wage laws, and adhere to them accordingly.

g) Perform periodic Payroll audits: Conduct periodic audits of your Payroll records to ensure accuracy and identify any discrepancies. Compare Payroll data with financial records to ensure that expenses align and there are no irregularities. Perform reconciliations to address any inconsistencies promptly.

h) Educate employees on Payroll processes: Provide training and resources to employees regarding Payroll processes and procedures. Educate them on accessing their pay stubs, understanding tax withholdings, and updating their personal information. Empowering employees with knowledge enhances their understanding and reduces unnecessary inquiries.

Following these steps, you can implement a well-organised Payroll administration system that ensures accuracy, compliance, and efficiency in managing employee compensation.

Ready to take your financial management skills to the next level? Join our comprehensive Financial Management Training course and gain the expertise needed to excel in today's complex business environment.

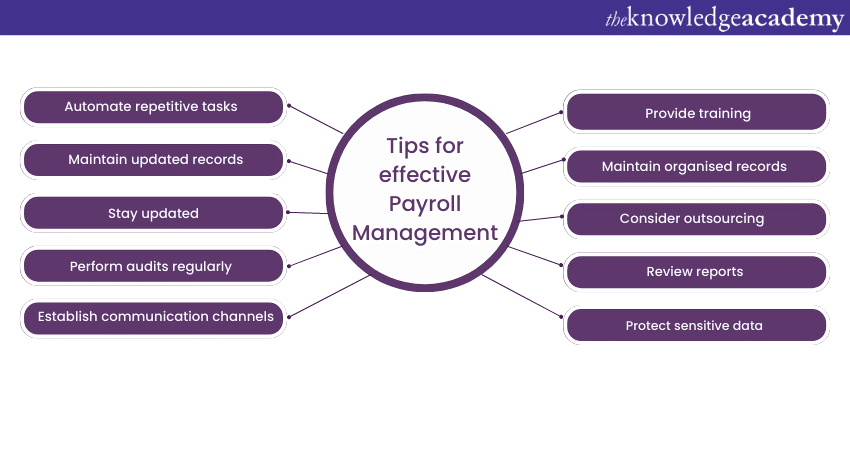

Tips for Managing Payroll Effectively

Managing Payroll effectively is crucial for the smooth operation of any organisation. By implementing efficient practices and utilising the right tools, you can streamline Payroll processes, ensure accuracy, and enhance employee satisfaction. Consider the following tips to effectively manage your Payroll:

Managing Payroll effectively is crucial for the smooth operation of any organisation. By implementing efficient practices and the right tools, you can streamline Payroll processes, ensure accuracy, and enhance employee satisfaction. Consider the following tips to manage your Payroll effectively:

a) Automate Payroll processes: Utilise Payroll software or tools to automate repetitive tasks, such as calculating salaries, tax deductions, and benefits administration. Automation reduces the likelihood of errors and saves time for your HR and finance teams.

b) Regularly update employee records: Keep employee records accurate and up to date. Update information related to employee status, salary changes, benefits, and tax exemptions. Regularly review and validate the data to ensure Payroll accuracy.

c) Stay informed about legal and tax regulations: Keep updated with the latest tax laws, labour regulations, and reporting requirements relevant to your jurisdiction. Comply with these regulations to prevent penalties and legal issues.

d) Conduct Payroll audits: Perform regular audits of your Payroll records to ensure accuracy and identify any discrepancies. Reconcile Payroll expenses with financial records to verify that they align. Address any inconsistencies promptly.

e) Provide clear Payroll-related communication: Establish transparent communication channels to address employee inquiries, concerns, and changes in Payroll policies or procedures. Ensure employees understand their pay stubs, tax withholdings, and other Payroll-related information.

f) Train employees on Payroll processes: Provide training and resources regarding Payroll processes, self-service portals, and tax-related information. Educate them on accessing their Payroll information, updating personal details, and resolving minor queries independently.

g) Stay organised: Maintain well-organised Payroll records and documentation. Establish a system for storing and retrieving Payroll-related documents, such as tax forms, employment contracts, and time sheets. This ensures easy access and smooth processing.

h) Outsource Payroll processing: If internal managing Payroll becomes overwhelming or complex, consider outsourcing Payroll processing to a professional service provider. They can handle Payroll calculations, tax filings, and compliance on your behalf.

i) Review Payroll reports: Regularly review Payroll reports to gain insights into labour costs, Payroll expenses, and other relevant metrics. Analyse the data to identify trends, make informed decisions, and ensure the efficient allocation of resources.

j) Maintain data security: Payroll data contains sensitive employee information. Apply robust data security measures, such as encryption, access controls, and regular data backups, to protect employee data and prevent unauthorised access.

By implementing these tips, you can streamline your Payroll Management processes, minimise errors, ensure compliance, and foster a positive employee experience.

Ready to master the art of credit control? Join our Introduction to Credit Control course and gain the knowledge and skills to effectively manage credit risks and maintain healthy cash flow.

Conclusion

We hope you read and understood everything about Payroll Management. Implementing an effective Payroll Management system is crucial for organisations to streamline their processes, ensure accuracy, and enhance efficiency. By leveraging automation, organisations can save time and costs while improving accuracy and compliance. Additionally, employees benefit from timely and accurate salary payments, increasing satisfaction and engagement.

Unleash your potential in accounting and finance through our transformative Accounting & Finance Training Courses – Sign up now!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Payroll Course

Payroll Course

Fri 24th Jan 2025

Fri 28th Feb 2025

Fri 30th May 2025

Fri 15th Aug 2025

Fri 26th Sep 2025

Fri 31st Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please