We may not have the course you’re looking for. If you enquire or give us a call on +971 8000311193 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In today’s dynamic financial landscape, Portfolio Manager Skills have become as crucial as ever. They are the backbone of successful investment strategies and client relations. Just as cloud computing has transformed data management, Portfolio Manager Skills revolutionise how investments are handled, offering a competitive edge in the bustling market.

This blog provides a concise overview of the top 10 Portfolio Manager Skills required to excel in the domain. From analytical prowess to effective communication, we delve into the essentials that define industry leaders. If you’re keen to understand what sets top portfolio managers apart, join us as we explore these pivotal attributes. Let’s dive in!

Table of Contents

1) List of Portfolio Manager Skills

a) Strong emotional regulation

b) Drive for competitiveness

c) Quick decision-making

d) Analytical prowess

e) Persistence

f) Forward-thinking

g) Seasoned expertise

h) Creative thinking

i) Modesty

j) Effective communication

2) Conclusion

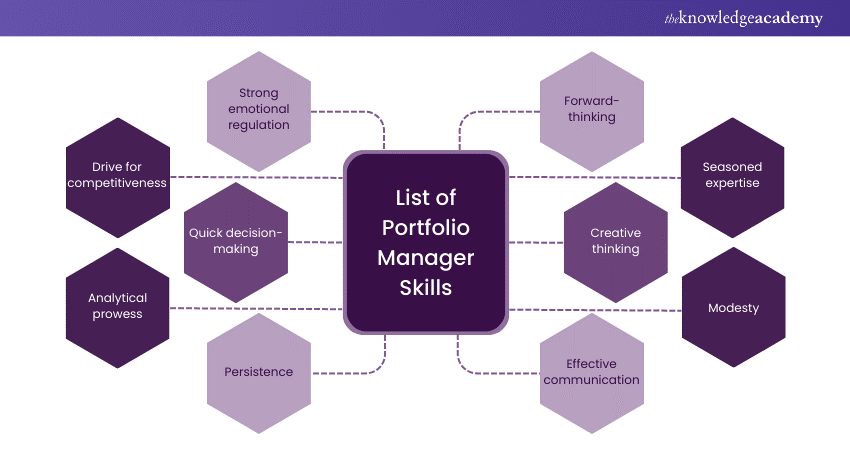

List of Portfolio Manager Skills

Portfolio management encompasses a multifaceted role that demands a diverse array of skills to navigate the complexities of the financial markets and optimise investment outcomes. Let's delve deeper into each of the listed skills:

1) Strong emotional regulation

Portfolio Managers need to maintain their composure, exhibit control, and continue making decisions logically, even in highly pressurised conditions characterised by market volatility or unforeseen developments. You must be able to control your emotions—fear, greed, or even panic will likely cloud your judgment and have you making some very impulsive or unwise decisions in the investment process. Such disciplined adherence to pre-defined investment strategies helps the portfolio manager not get caught into emotional trading and remains focused on the long-term objectives, with the net result that improvement accrues to the investment portfolios in resilience and stability.

2) Drive for competitiveness

In the fast-paced world of financial markets, prompt and informed decision-making is essential. Portfolio managers must, therefore, have the ability to process huge volumes of data, constantly measure the state of the market, and evaluate the state of underlying investment opportunities relatively quickly for either moving with emerging trends or hedging against possible risks. Those are actually the decisions of very dynamic nature, which create, in a very fast-changing market environment, windows of opportunities and are enabled via technologies and analytical tools.

3) Quick decision-making

In the swiftly evolving financial markets, the ability to make quick, well-informed decisions is critical. Portfolio managers are required to sift through vast amounts of data, gauge the market's current status, and quickly appraise potential investment opportunities. This rapid evaluation is necessary to align with new market trends or protect against potential risks effectively. The decisions made by portfolio managers are inherently dynamic, opening up opportunities within the rapidly shifting market landscape. This agility is made possible through the application of advanced technologies and analytical tools, which assist in navigating and capitalising on the fluid nature of financial markets.

4) Analytical prowess

Much higher analytical acumen is required from the Portfolio Manager in respect of interpreting financial data, appraising opportunities, and overseeing performance, where they have to carry out a quantitative analysis of such factors as relates to asset valuation, risk metrics, and market trends that shall be used in making investment decisions and optimisation of the portfolio. Equally, it develops an understanding of dynamics, patterns, or anomalies in the markets, leading to managers being provided with enhanced and quality effectiveness in the data-driven decisions that have been put in place in the management of portfolios.

Learn the basics of Project Management, sign up for our Introduction To Project Management Certification Course - Register now!

5) Persistence

The journey of portfolio management is fraught with constant challenges, setbacks, and sometimes volatile market behaviour. Persistence becomes invaluable, helping portfolio managers commit to their plans and stay true to their investment strategies and objectives. Maintaining discipline, a long-term view, and patience helps portfolio managers navigate through short-term fluctuations and uncertain times with determination, aiming for long-term success and consistent returns for clients or stakeholders.

6) Forward-thinking

Effective portfolio management involves forecasting future market trends, economic developments, and regulatory changes. Portfolio managers must adopt a future-focused mindset, continuously scanning for emerging opportunities or potential threats to their investment portfolios. This capability enables them to adapt investment strategies dynamically, proactively optimise portfolio allocations, and position their portfolios to take advantage of changing market conditions. Consequently, this approach not only enhances long-term performance but also helps in mitigating potential downside risks.

7) Seasoned expertise

Experience is a treasure trove in Portfolio Management, endowing managers with enriched insights, wisdom, and judgment gleaned from extensive, hands-on experience in the financial markets. Those seasoned in the field boast a profound grasp of market dynamics, asset classes, and investment strategies, equipping them to make astute decisions, forecast market shifts, and adeptly navigate through various market cycles. Their expertise and past experiences empower seasoned portfolio managers to adeptly manage risks, unearth opportunities, and achieve superior investment outcomes for their clients or organisations.

Preparing for your PMP exam? Sign up for our PMP® Exam Prep Boot Camp - Register now!

8) Creative thinking

Innovation and creativity are pivotal in portfolio management, enabling managers to forge unique investment paths, delve into unconventional opportunities, and tackle complex challenges. Creative thinking, which ventures beyond conventional wisdom, employs novel ideas or approaches towards portfolio construction and management. This capacity to think outside the box uncovers hidden opportunities, propelled by a culture that champions innovation, driving performance enhancements and adept adaptation to changing market conditions.

9) Modesty

Modesty is immensely important in the uncertain world of financial markets. Recognising that nobody has all the answers encourages portfolio managers to remain open, value feedback, and be willing to learn from mistakes. This approach fosters a culture of continuous learning and self-improvement, as input from both colleagues and experts is encouraged, and success is met with humility.

Modesty enhances transparency and authenticity in communications, allowing portfolio managers to openly discuss their strengths and limitations with clients, stakeholders, and team members. By demonstrating humility and modesty, they cultivate an environment of collaboration, honesty, and respect, contributing to the enduring success of their strategies and portfolios.

10) Effective communication

Effective Communication is crucial for portfolio managers to effectively convey investment strategies, provide updates on performance, and ensure that stakeholders' expectations are aligned. This process includes adapting messages for various audiences, breaking down complex financial concepts into understandable terms, and actively listening to stakeholders' feedback. By establishing open and transparent communication channels, trust is built, collaboration is fostered, and everyone involved is aligned, which results in better decision-making and superior investment outcomes.

Accelerate your career and become a certified project management professional! Join our PMP Certification Training today and gain the skills to lead successful projects.

Conclusion

Mastering Portfolio Manager Skills is essential for success in overseeing complex projects and aligning them with organisational goals. These skills empower professionals to navigate uncertainty, communicate effectively, and drive strategic decision-making. Whether it’s risk management, stakeholder engagement, or financial acumen, honing these competencies ensures effective portfolio management.

Frequently Asked Questions

A good portfolio manager should be analytical, possess good decision-making skills, resilience in markets with ups and downs, and be equipped with excellent communication skills. They should adapt strategies according to market conditions quickly and see to it that the best of results is derived in terms of meeting the client's objectives and managing risks efficiently

To become a portfolio manager, one typically needs a bachelor's degree in finance, economics, or a related field, along with relevant work experience in investment management. Advanced certifications such as Chartered Financial Analyst (CFA or MBA may enhance qualifications and career prospects.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various PMP Training , including CAPM Certification Training, PMI-ACP, and PMP exam prep. These courses cater to different skill levels, providing comprehensive insights into Digital Project Management methodologies.

Our Project Management blogs covers a range of topics related to Project Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Project Management skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please