We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The ACCA qualification opens doors to a thriving career in finance. It covers 13 essential ACCA papers and crucial areas like financial accounting, management accounting, taxation, and auditing. This comprehensive programme equips you with the expertise needed to excel in the ever-evolving finance industry.

Understanding potential exemptions can fast-track your journey to becoming a qualified professional. Join us as we explore the 13 ACCA Papers that will pave your way to success in the finance world. Let’s get started!

Table of Contents

1) The Importance of ACCA Papers

2) ACCA Exams Structure

a) Applied Knowledge Papers

b) Applied Skills Papers

c) Strategic Professional Papers

3) Conclusion

The Importance of ACCA Papers

The ACCA qualification is a highly regarded credential in the Accounting and Finance industry. It consists of 13 papers covering a wide range of topics, offering a strong foundation for aspiring accountants to develop their skills. Candidates may be eligible for exemptions from specific exams based on their academic background, which is an aspect that often comes up in discussions of ACCA vs CPA when comparing the requirements and flexibility of both qualifications.

The ACCA Qualification equips individuals with the expertise needed to excel in their careers, and ACCA Books serve as essential resources for mastering key concepts. One of the key ACCA benefits is the chance to join a network of like-minded professionals worldwide. The ACCA qualification is a gateway to a successful career in accounting and finance, offering a detailed framework for professional growth and a chance to connect with a global community of professionals.

ACCA Exams Structure

The ACCA exams are divided into three primary levels: Applied Knowledge, Applied Skills, and Strategic Professional. As you progress through these levels, the exams become increasingly challenging, and pass rates tend to decrease. So, be prepared for a tougher journey as you advance.

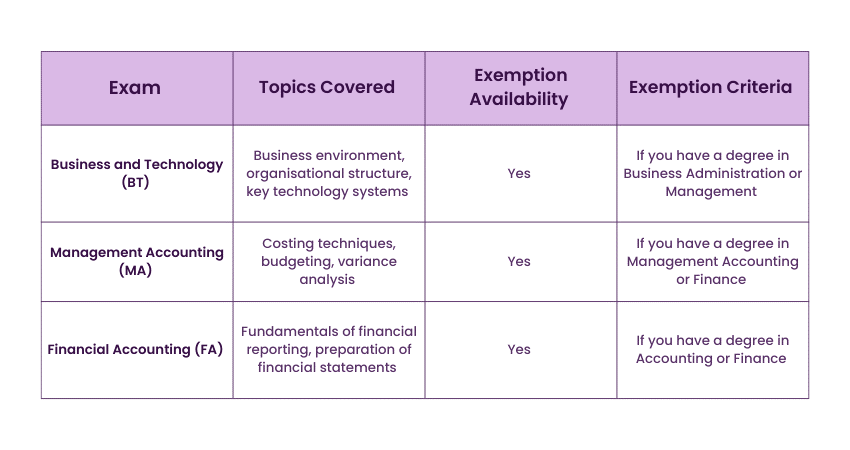

Applied Knowledge Papers

The Applied Knowledge exams offer students a comprehensive introduction to finance, helping them build a solid foundation in accounting principles and techniques. These exams are designed to develop your essential understanding and skills in accounting.

Exemptions

Business and Technology (BT)

This paper focuses on understanding the business environment, the role of accounting in business, and the influence of technology on business operations.

Management Accounting (MA)

This paper covers management accounting principles, including budgeting, costing, and performance measurement, which are crucial for internal business decision-making.

Financial Accounting (FA)

This paper deals with the fundamentals of financial accounting, including preparing financial statements and financial reporting principles.

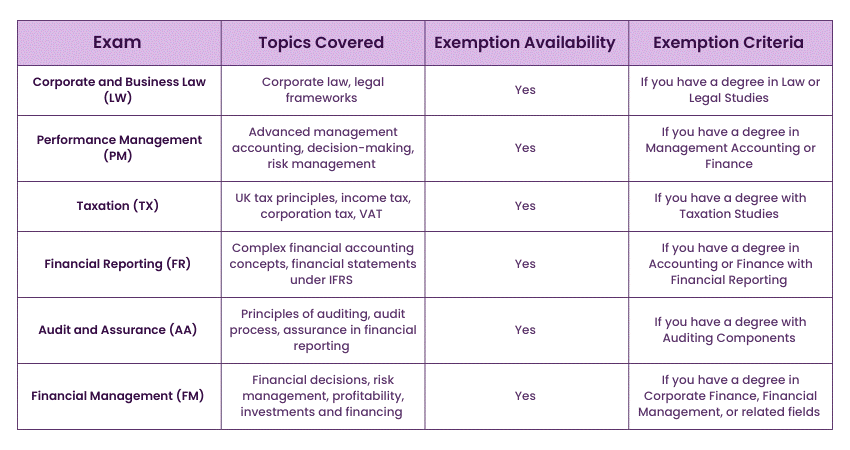

Applied Skills Papers

The Applied Skills exams enhance your knowledge and understanding, equipping you with robust, comprehensive, practical finance skills essential for a future strategic professional accountant in any sector or industry.

Exemptions:

Corporate and Business Law (LW)

This paper focuses on businesses' legal framework, covering contracts, employment, and company law.

Performance Management (PM)

It Covers Management Accounting techniques to help businesses plan, control, and make decisions, including budgeting and performance evaluation.

Taxation (TX)

It deals with the principles of taxation and its application to individuals and businesses, including Income Tax, Corporation Tax, and VAT.

Financial Reporting (FR)

This paper focuses on preparing and interpreting Financial Statements according to International Accounting Standards.

Audit and Assurance (AA)

This paper Covers the principles and practices of Auditing, including the Audit Process, Internal Controls, and Audit Reports.

Financial Management (FM)

It Deals with Financial Management Principles, including Investment, Financing, and Dividend Decisions.

Strategic Professional

The Strategic Professional exams are designed to prepare students for future leadership roles. They help develop a strategic vision by combining technical, ethical, and professional skills. Students can also specialise in areas that align with their career goals. To complete this level, students must pass both Essentials exams and select two from the Optional exams. These exams include:

Strategic Business Leader (SBL)

This paper Integrates leadership, strategy, and risk management to develop a strategic vision and lead organisations effectively.

Strategic Business Reporting (SBR)

It focuses on Advanced Financial Reporting, including interpreting and applying International Accounting Standards.

Optional or Elective Papers:

Advanced Financial Management (AFM)

It covers Advanced Investment, Financing, and Risk Management Strategies to support long-term Financial Decision-making.

Advanced Performance Management (APM)

This paper focuses on strategic performance measurement and management, including Advanced Management Accounting techniques.

Advanced Taxation (ATX)

It Deals with complex tax issues and planning, including International Taxation and Tax Strategy.

Conclusion

Securing the right qualifications is extremely important in the fast-paced world of Finance. The ACCA qualification will equip you with the knowledge and skills to flourish in this field. These 13 ACCA Papers cover various Finance areas, including Financial Accounting, Management Accounting, Taxation, and Auditing. Studying these papers will help you to build a robust foundation in essential regions, paving the way for a successful career in Finance.

Frequently Asked Questions

Is ACCA More Difficult Than CA?

Both are challenging. The difficulty of ACCA vs CA depends on individual strengths and preferences. ACCA is globally recognised and focuses on international standards, while CA is country-specific and focuses more on local laws and regulations.

Can I Finish ACCA in 1 Year?

Completing ACCA in 1 year is highly challenging due to the number of exams and the depth of content. Most students take 2-3 years, depending on prior qualifications, study time, and exam success.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please