We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine a company tracking employee salaries daily, even though payments are made at the end of the month. The cost is recorded as it’s incurred rather than when the cash is actually spent. That is Accrued Expenses—ensuring expenses align with the period they belong to, not just when they’re paid. This approach enhances financial accuracy, improves Cash Flow Management, and offers a clearer view of a company’s true financial standing.

But is Accrued Expenses Accounting the right fit for your business? Recordkeeping must be exact with deliberate planning as well as proper Accounting Principle compliance. In this blog, we’ll break down how such expenses work, explore real-life examples, and uncover their impact on financial reporting. Let’s get started!

Table of Contents

1) What are Accrued Expenses?

2) Examples of Accrued Expenses

3) Accrual vs Cash Basis Accounting

4) Benefits of Accrued Expenses

5) Drawbacks of Accrued Expenses

6) Difference Between Accrued Expenses and Prepaid Expenses

7) Conclusion

What are Accrued Expenses?

Suppose you are running a business where you receive services today but pay for them later. The concept of Accrued Expenses functions in this manner. A company's financial records include the amounts it spent before actually making payments to suppliers, wage earners, and utility providers.

Business financial records need to display accurate expenses by using Accrued Expenses to hold temporary records of costs that haven't flowed out from the business account.

For example, if a company’s employees work in December but receive their salaries in January, those wages are an accrued expense for December. This helps businesses maintain accurate financial statements and avoid overstating profits.

By recording expenses as they happen rather than when they’re paid, companies get a realistic view of their financial health—making Accrued Expenses an essential part of smart accounting!

Examples of Accrued Expenses

Here are some common examples of Accrued Expenses you might encounter when running a business:

a) Workers put in their hours throughout December while their paycheck arrives in the following month of January.

b) A business incurs interest expense on loans during the quarter though it pays the interest expense exclusively at the quarterly conclusion.

c) Customers receive their electricity bills during the next month although they used electricity during the active month.

d) A firm determines tax obligations, yet it delays payment until later times. Payable rent exists until the next month starts although lease payments are due at the month's end.

e) Vendor Invoices represent purchases of received goods or services that payment occurs after the delivery date.

f) Employee bonuses earned as part of salary which becomes payable in the upcoming financial period.

Understand Accrued Expenses better with our expert-led Financial Management Course -Register Now!

Accrual vs Cash Basis Accounting

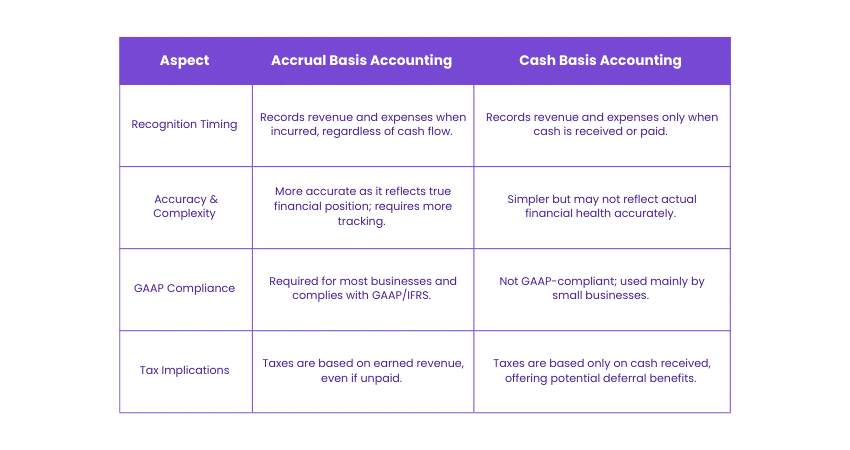

Accrual Accounting: An organisation records both income and expenses during their date of generation or spend regardless of payment methods. The method better represents financial realities and works best when dealing with big business organisations.

Cash Basis Accounting: The system only reports income and expenses after cash payments or receptions. Simpler to manage and commonly used by small businesses with straightforward transactions.

Refer to the table below to understand the difference between Accrual vs Cash Basis Accounting

Accrual Accounting presents complete financial data by following business activity patterns yet cash accounting delivers instant cash flow information.

Boost Your Accounting Expertise with our Financial Modelling Course – Join Today!

Benefits of Accrued Expenses

Think of a business where employees have already worked for the month, but their salaries will be paid next week. Should those wages be recorded now or later?

Accrued Expenses ensure businesses track costs when they happen, not just when cash changes hands, leading to better financial management.

1) Financial Accuracy

Accrued Expenses align costs with revenues, giving businesses a clearer financial picture. Instead of waiting for payments, they record expenses as they occur, improving reporting and Decision-Making.

2) Better Budgeting & Planning

Knowing upcoming liabilities helps businesses allocate funds wisely, avoiding financial surprises. This ensures smoother operations and prevents cash flow disruptions.

3) Compliance & Transparency

Most businesses follow accrual accounting to meet Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) standards, ensuring credibility with investors, regulators, and lenders.

4) Stronger Vendor Relationships

Tracking expenses properly ensures timely payments to suppliers and employees, fostering trust and preventing service disruptions.

Strengthen your accounting skills with our Financial Accounting Course – Start Learning Today!

Drawback of Accrued Expenses

While Accrued Expenses improve financial accuracy, they can pose challenges in maintaining Cash Flow Analysis and bookkeeping.

1) Increased Complexity: Tracking unpaid expenses requires detailed record-keeping, adding to the accounting workload and risk of errors.

2) Cash Flow Mismatch: Expenses are recorded before payment, which can make a business appear profitable on paper while cash reserves remain tight.

3) Risk of Misstatements: Incorrectly recorded Accruals may distort financial reports, leading to poor business decisions.

4) Compliance Challenges: Accrual Accounting demands strict adherence to financial standards, increasing audit and regulatory requirements.

Gain financial expertise with our Quantitative Finance Course – start learning today!

Difference Between Accrued Expenses and Prepaid Expenses

Accounting has two core principles: Accrued Expenses represent expenditures waiting to be paid yet prepaid expenses are future payments made before their due date.

Accurate financial reporting requires knowledge of how Accrued Expenses and prepaid expenses differentiate from each other.

1) Timing of Payment

Accrued Expenses: Businesses record costs of expenses which remain unpaid prior to payment (such as workers' salaries from December).

Prepaid Expenses: People pay money in advance to secure future benefits such as annual insurance premiums that they purchase ahead of time.

2) Accounting Treatment

Accrued Expenses: Financial records show these liabilities because the payment obligation extends into the future.

Prepaid Expenses: The future economic benefits they confer make payable expenses qualify as assets.

3) Impact on Financial Statements

Accrued Expenses: Organisations increase liabilities on their balance sheet while simultaneously decreasing their reported net income levels.

Prepaid Expenses: Organisations add assets in advance before starting to decrement these balances through expenditure-related expense categories as the benefit unfolds.

4) Common Examples

Accrued Expenses: Unpaid expenses for utilities and interest charges and wages due to employees.

Prepaid Expenses: Businesses pay insurance and rent for future periods along with annual subscriptions for software.

Companies must monitor their financial statements accurately through careful tracking because untracked expenses create both reporting challenges and unexpected flow issues.

Conclusion

To wrap things up, Accrued Expenses play a vital role in keeping your financials in check and your business running smoothly. By recognising expenses before payment, you can avoid surprises and ensure your accounts truly reflect the reality of your operations. With such expenses, you are always one step ahead!

Transform Your Accounting Game with Accrual Expertise with our Financial Risk Management Certification – Sign Up Now!

Frequently Asked Questions

What are the two Types of Accruals?

Accruals fall into two categories: Accrued Expenses and Accrued Revenues. Accrued Expenses are costs incurred but not yet paid, such as wages or interest. Accrued Revenues refer to earnings recognised before payment is received, ensuring accurate financial reporting.

What is the Double Entry for Accruals?

The double entry for accruals involves recording expenses or revenues before cash transactions occur. For Accrued Expenses, a debit is made to the expense account and a credit to accrued liabilities. For Accrued Revenues, a debit is made to accounts receivable and a credit to revenue. These entries reflect real-time transactions, not cash exchanges.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse online course catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Finance Courses including the Financial Accounting Training Course, and the International Financial Reporting Standards Training. These courses cater to different skill levels, providing comprehensive insights into Financial Literacy.

Our Accounting and Finance Blogs cover a range of topics related to Accounting and Finance Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting and Finance Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Certified Artificial Intelligence (AI) for Accountants Training

Certified Artificial Intelligence (AI) for Accountants Training

Fri 25th Apr 2025

Fri 22nd Aug 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please