We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine running a small business and feeling your expenses going out of control. You start thinking, "Where is my money going?" This is where Activity-Based Costing (ABC) comes into play. ABC is not just another accounting method, it's like having a magnifying glass that lets you see exactly where your resources are being spent, helping you gain control and make smarter decisions.

Table of Contents

1) What is Activity-Based Costing (ABC)?

2) Importance of Activity-Based Costing

3) Key Features of Activity-Based Costing

4) Formula of Activity-Based Costing

5) Example of Activity-Based Costing

6) How Does Activity-Based Costing Work?

7) Implementing Activity-Based Costing (ABC)

8) Benefits of Activity-Based Costing

9) Limitations of Activity-Based Costing

10) Conclusion

What is Activity-Based Costing (ABC)?

Activity-Based Costing (ABC) is a approach that assigns indirect and overhead costs to related products and services. This approach recognises the relationship between costs, overhead activities, and manufactured products, making the assignment of indirect costs to products less arbitrary compared to traditional methods.

However, some indirect costs, such as management and office staff salaries, remain challenging to allocate to specific products.

Key Points:

a) ABC Assigns Overhead and Indirect Costs: (e.g., salaries and utilities) to products and services.

b) Based on Activities: An activity is any unit of work, event, or task with a specific goal.

c) Activities are Cost Drivers: Examples include purchase orders and machine setups.

d) Cost Driver Rate: Calculated by dividing the cost pool total by the cost driver total, this rate helps determine the overhead and indirect costs associated with a particular activity.

e) Purpose: ABC helps companies better understand costs, enabling them to develop more appropriate pricing strategies.

The Importance of Activity-Based Costing

Understanding where your money goes is not just about cutting costs, it's about allowing your business to grow brighter. ABC plays a crucial role in this by clarifying how resources are utilised. It allows businesses to identify high-cost activities, helping them focus on efficiency and profitability.

For example, a manufacturing company might find out that a particular production process consumes more resources than anticipated. With ABC, they can make informed decisions, like improving that process or reallocating resources, which ultimately leads to better financial health.

Key Features of Activity-Based Costing

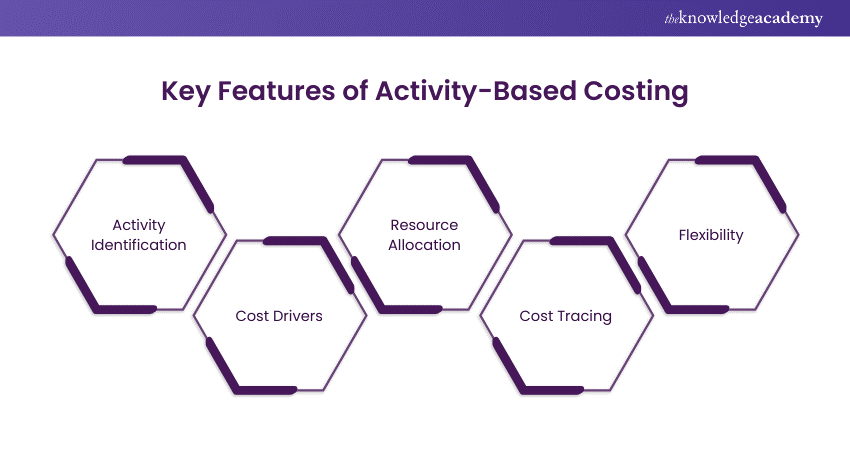

ABC is distinct due to its focus on specific activities and the costs they generate. Here are some key features:

1) Activity Identification: ABC starts by identifying vital organisational activities that consume resources.

2) Cost Drivers: It then determines cost drivers—factors that cause costs to increase or decrease—related to each activity.

3) Resource Allocation: Resources are assigned to activities based on usage, ensuring accurate cost distribution.

4) Cost Tracing: ABC traces costs to products or services based on the activities involved in their production or delivery.

5) Flexibility: ABC can be applied across various industries, making it a versatile tool for business models.

Formula of Activity-Based Costing

The basic formula for ABC involves assigning costs to products or services considering the activities that drive those costs:

ABC Cost = Total Overhead Costs / Total Cost Driver Units

To break it down, you first calculate the cost per unit of each activity by dividing the total overhead costs by the total cost of driver units. Then, this rate can be applied to the units consumed by a specific product or service.

Example of Activity-Based Costing

Let’s put ABC into action with a simple example. Imagine a company that manufactures two products: A and B. Traditionally, it would allocate its £100,000 overhead costs evenly, £50,000 each. But what if Product A is more complex and requires more resources?

Using ABC, we found that Product A uses 60% of the activities, while Product B only uses 40%. Instead of splitting costs evenly, we allocated £60,000 to Product A and £40,000 to Product B. This more accurate costing could show that Product A might be less profitable despite bringing in more revenue than Product B because it uses more resources.

Step into leadership with confidence—start your journey with our Introduction to Management Course!

How Does Activity-Based Costing Work?

ABC identifies all the activities involved in producing a product or delivering a service. Next, it assigns a cost to each activity based on how much it contributes to the overall process. Finally, it allocates these costs to products or services depending on their consumption of these activities.

This process might sound complex, but the result is a far more accurate picture of where your money is going and why.

Implementing Activity-Based Costing (ABC)

Implementing ABC requires careful planning and a deep understanding of your business processes. Start by identifying key activities that consume resources. Next, determine the cost drivers—these factors influence the cost of an activity. Once you’ve mapped out these elements, allocate your overhead costs based on actual usage rather than arbitrary allocations.

This approach may require investment in specialized software or training, but the benefits in cost accuracy and decision-making can be significant.

Master the art of leading from afar—join our Managing Remote Teams Training today!

Benefits of Activity-Based Costing

ABC is excellent for businesses because it helps in a bunch of ways:

a) Better Accuracy: ABC gives a more accurate view of costs by focusing on specific activities, so businesses don't waste resources.

b) Smarter Decision-Making: With better cost data, companies can make smarter decisions about prices and products and save money.

c) Using Resources Better: ABC shows which activities are a waste of time or money so businesses can work smarter and reduce waste.

d) More Control Over Costs: ABC details costs, so managers have more say in how money is spent.

e) Being Competitive: Understanding costs helps businesses price products and services competitively while making a profit.

Limitations of Activity-Based Costing

While ABC has many benefits, it’s not without its challenges. Some of these challenges include:

a) Complexity: Implementing ABC can be a hassle, especially for big companies with many different operations.

b) Cost: Obtaining and analysing all that data can be costly. You'll need to invest in software and training.

c) Resistance to Change: Employees may be more open to switching to ABC, especially if it means role changes.

d) Overemphasis on detail: It can lead to analysis paralysis, hindering the ability to see the bigger picture.

e) Not for Everyone: ABC might only work for certain businesses, especially those with simple, similar processes.

Get ready for your next role with top Management Interview Questions and Answers. Explore expert insights and ace your interview with confidence!

Conclusion

ABC provides a fresh perspective on your business by focusing on the essential costs. Activity-Based Costing allows you to seize control of your financial future by revealing unseen inefficiencies and recognising growth opportunities. Knowing your expenses accurately is more crucial than ever in a world where every cent matters.

Elevate your leadership skills—join our Management Training for New Managers and lead with confidence!

Frequently Asked Questions

How Does Activity-Based Costing Differ from Traditional Costing?

Activity-Based Costing (ABC) differs from traditional costing by focusing on activities as the primary cost drivers rather than allocating overhead costs broadly. ABC provides a more accurate and detailed view of resource consumption, leading to better decision-making and cost control.

How Does Activity-Based Costing Differ from Traditional Costing?

Industries with complex processes, such as manufacturing, healthcare, and logistics, benefit the most from Activity-Based Costing. ABC helps these industries accurately track costs associated with specific activities, leading to more efficient resource allocation and improved profitability.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Management Courses, including the Costing and Pricing Training, Management Training for New Managers and the Introduction to Managing People Course. These courses cater to different skill levels, providing comprehensive insights into Cost Accounting and Management Accounting.

Our Business Skills Blogs cover a range of topics related to Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Management Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Costing and Pricing Training

Costing and Pricing Training

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please