We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In international trade, where transactions span borders and continents, buyers and sellers must ensure secure and efficient payment methods. One such financial instrument that plays a pivotal role in facilitating international trade is the Letter of Credit (LC).

In this blog, we will explore the Advantages and Disadvantages of Letters of Credit in international trade finance, highlighting their potential for secure transactions. We will delve into the intricacies of a Letter of Credit, exploring the Advantages and Disadvantages of a Letter of Credit to help businesses make informed decisions in their global ventures. Read more to learn more!

Table of Contents

1) What is a Letter of Credit?

2) Advantages of Letter of Credit

a) Safely grow your business worldwide

b) Highly customisable

c) The seller gets paid when terms are met

d) Acts as a buyer's credit certificate

e) No credit risk for the seller

f) Rapid execution for parties with good credit

g) Assurance of payment in contested transactions

h) Timely payments enhance cash flow management

i) Disadvantages of Letter of Credit

3) Conclusion

What is a Letter of Credit?

A Letter of Credit is a financial document issued by a bank on behalf of a buyer, guaranteeing payment to the seller upon the fulfilment of specified conditions. It acts as a contractual agreement between the buyer, the seller, and the issuing bank, mitigating the risks associated with cross-border transactions.

It stands out as a widely employed trade finance service in cross-border trade dealings, relied upon by sellers and buyers to prevent payment mishaps in the import and export processes. This highly adaptable and efficient form is valuable in mitigating credit risks.

Advantages of Letter of Credit

The following are the Advantages of a Letter of Credit:

1) Safely grow your business worldwide

One of the primary advantages of using a Letter of Credit is its ability to foster international business growth securely. Providing a reliable payment mechanism instils confidence in both parties, encouraging them to explore new markets without fearing payment uncertainties.

2) Highly customisable

Letter of Credit offers a high degree of customisation, allowing parties to tailor the terms and conditions according to the unique requirements of their transaction. This flexibility makes LCs adaptable to various business scenarios, contributing to their widespread use in diverse industries.

3) The seller gets paid when terms are met

For sellers, the assurance that they will receive payment once they fulfil the terms and conditions stipulated in the Letter of Credit is a significant advantage. This mitigates non-payment risk, providing financial security particularly valuable in international trade.

4) Acts as a buyer's credit certificate

Buyers benefit from the Letter of Credit by using it as a credit certificate. This allows them to negotiate favourable payment terms with the seller while ensuring that the seller is paid promptly upon meeting the specified criteria. It acts as a win-win situation, fostering healthy buyer-seller relationships.

5) No credit risk for the seller

Unlike open account transactions where the seller may face credit risks, a Letter of Credit eliminates this concern. The bank's commitment to payment provides sellers a risk-free payment method, making it an attractive option for businesses involved in high-value or long-distance transactions.

6) Rapid execution for parties with good credit

Parties with a good credit history can benefit from the expeditious execution of a Letter of Credit. Banks are more willing to issue LCs promptly to businesses with proven financial stability, facilitating quicker and smoother transactions.

7) Assurance of payment in contested transactions

When disputes arise between the buyer and the seller, the funds in a Letter of Credit remain secure until the issue is resolved. This assurance of payment adds an extra layer of protection, reducing the potential financial impact of contested transactions.

8) Timely payments enhance cash flow management

The structured nature of a Letter of Credit ensures that payments are made promptly upon fulfilling conditions. This punctuality enhances cash flow management for buyers and sellers, allowing them to plan and allocate resources more effectively.

Unlock the intricacies of Letters of Credit with our The Letters Of Credit Training Course for enhanced proficiency in accounting and finance!

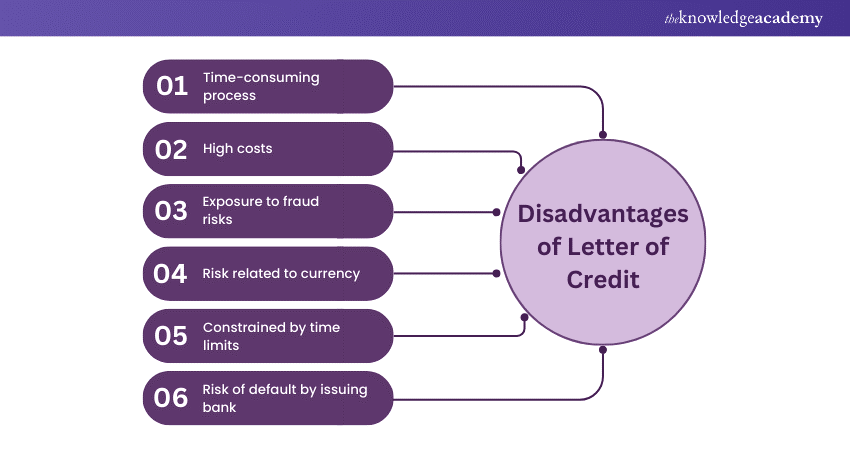

Disadvantages of Letter of Credit

The following are the Disadvantages of Letter of Credit:

1) Time-consuming process

Letter of Credit involves a multifaceted and time-consuming process. From the initial application to the thorough examination of documents, each stage demands meticulous attention. This intricacy may lead to delays, particularly in industries where swift and agile transactions are imperative. The extensive documentation process can hinder the efficiency of transactions, potentially affecting the competitiveness of businesses in fast-paced markets.

2) High costs

An undeniable drawback of a Letter of Credit is the financial burden imposed on businesses. Banks charge various service fees, including issuance, amendment, and confirmation fees. Additionally, additional costs are tied to complying with the specific terms outlined in the Letter of Credit. These cumulative expenses can significantly impact the cost-effectiveness of employing a Letter of Credit in international trade, making it crucial for businesses to assess the economic viability of such transactions carefully.

3) Exposure to fraud risks

Despite the security measures, Letters of Credit are susceptible to fraudulent activities. Unscrupulous parties may attempt to exploit vulnerabilities within the intricate process, leading to financial losses for the involved entities. The risk of fraudulent attempts necessitates constant vigilance, rigorous due diligence, and the implementation of robust verification processes throughout the transaction lifecycle to safeguard against potential financial and reputational damages.

4) Risk related to currency

The global nature of trade exposes transactions to currency fluctuations, and Letters of Credit are not immune to this risk. Changes in exchange rates can have substantial implications on the value of transactions, introducing an additional layer of complexity. Businesses engaged in international trade must actively manage the risk associated with currency fluctuations, employing hedging strategies or negotiating terms that account for potential currency volatility to safeguard against unforeseen financial consequences.

5) Constrained by time limits

Time constraints in Letter of Credit transactions add a layer of complexity to the process. Strict timelines for the presentation and verification of documents necessitate meticulous planning and coordination among all parties involved. Adherence to these prescribed time limits can result in non-payment or delays in payment processing, underscoring the critical importance of timely execution in the success of international trade transactions.

6) Risk of default by issuing bank

While Letters of Credit is designed to enhance transaction security, there is an inherent risk of the issuing bank defaulting. Economic instability, financial crises, or unforeseen events can impact the stability of banks, introducing an element of uncertainty into the transaction process. To mitigate this risk, businesses must thoroughly assess the issuing bank's financial standing, reliability, and regulatory compliance before engaging in a Letter of Credit transaction. This due diligence is crucial for maintaining the financial integrity and stability of the overall trade transaction.

Supercharge your financial expertise with our Accounting Masterclass for a confident stride in your financial journey. Sign up now!

Conclusion

A Letter of Credit is a sophisticated trade finance tool designed to safeguard importers and exporters against potential payment failures and various risks associated with cross-border trade, including currency fluctuations and political instability. It is, therefore, important to gain a comprehensive understanding of the Advantages and Disadvantages of a Letter of Credit before incorporating them into international trade transactions. We hope you have understood the Advantages and Disadvantages of a Letter of Credit through our blog!

Enhance your financial acumen with our Accounting and Finance Courses for a brighter career ahead!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Accounting Course

Accounting Course

Fri 17th Jan 2025

Fri 21st Mar 2025

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please