We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Today, having Basic Accounting Skills is like having an essential tool in your career toolkit. Whether you are running a business, managing things, or dreaming of a career in finance, knowing these skills can bring you growth.

Develop essential Basic Accounting Skills for accurate financial management. Continue reading to learn bookkeeping, analysis, and more. Start your journey today.

Table of Contents

1) Accounting- an overview

2) Essential Basic Accounting Skills

3) The significance of Basic Accounting Skills

4) How to develop and enhance your Accounting Skills

5) Conclusion

Accounting- an overview

Accounting is the process of recording and tracking financial transactions. It involves keeping a detailed record of money coming in (income) and going out (expenses). This information helps individuals and businesses understand their financial health, make informed decisions, and ensure everything adds up correctly. It's like a financial "language" that helps everyone understand where the money is flowing and how it's being used.

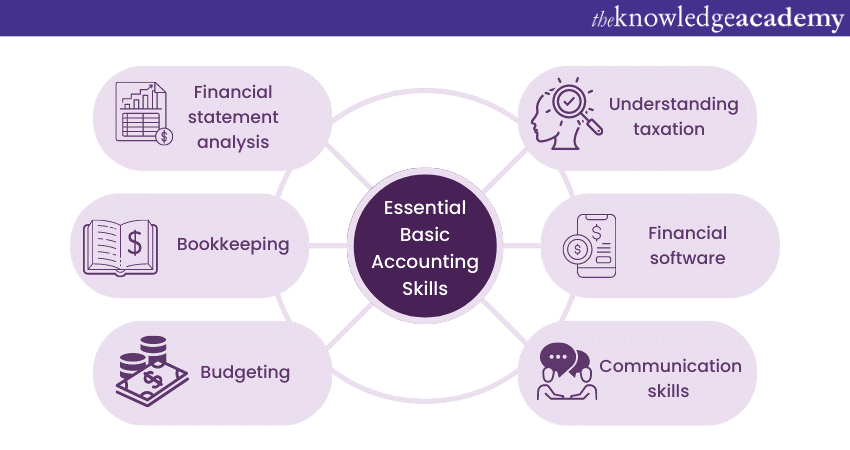

Essential Basic Accounting Skills

There are various Accounting skills that are essential to strive in the field. Given below are some of the few basic skills one should have in their arsenal.

Financial statement analysis

Understanding financial statements – the balance sheet, income statement, and cash flow statement – is fundamental. It helps you interpret these documents to assess an organisation's financial health, performance, and liquidity.

This skill isn't limited to financial professionals; it's essential for business owners, managers, investors, and creditors alike. It empowers individuals to understand the company's financial story, allowing for informed decisions that impact long-term success.

Bookkeeping

Basic bookkeeping skills involve accurately recording financial transactions. This includes maintaining journals, ledgers, and reconciling accounts. Bookkeeping ensures financial data is organised for analysis and decision-making.

It involves maintaining ledgers, journals, and other financial records. These play a crucial role in producing key financial statements such as the balance sheet, income statement, and cash flow statement. By keeping an updated book, organisations can track their financial performance, identify areas for cost control or revenue enhancement, and meet regulatory compliance requirements.

Budgeting

Learn the art of creating and managing budgets. Budgets help organisations plan expenses, allocate resources efficiently, and achieve financial goals. Proficiency in budgeting is invaluable for any business-minded individual.

A well-planned budget helps you control your finances and make informed decisions. It allows you to allocate funds to various categories, such as housing, transportation, groceries, entertainment, and savings. By setting limits for each category, you can prevent overspending and ensure that you have enough money to cover all essential expenses.

Basic knowledge of taxation

Basic knowledge of taxation is essential, whether for personal finance or business operations. Taxes are compulsory contributions individuals and businesses make, and understanding taxation is essential for both personal financial management and business operations.

For businesses, it involves understanding the tax implications of various activities, structuring transactions in a tax-efficient manner, and ensuring compliance with tax regulations. A solid understanding of taxation is invaluable for individuals and businesses alike. It helps individuals manage their finances, maximise their income, and remain compliant with the law.

Financial software

Familiarise yourself with common accounting software packages. Proficiency in tools like QuickBooks, Excel, or cloud-based platforms is highly beneficial in the modern workplace.

More advanced financial software includes enterprise resource planning (ERP) systems, which integrate various aspects of business operations, including finance, supply chain management, human resources, and more. It allows individuals and financial professionals to monitor investments, track performance, and make informed decisions based on market trends.

Communication skills

Being able to communicate financial information clearly is vital. Whether it's presenting financial reports to colleagues or explaining financial concepts to non-financial stakeholders, strong communication skills are essential for any professional with basic accounting knowledge.

Furthermore, strong communication skills extend beyond the workplace, positively impacting personal relationships and daily interactions. Clear communication helps prevent misunderstandings, encourages empathy, and promotes healthy connections with family, friends, and the community.

Enhance your career with our Bookkeeping Training Course. Join today!

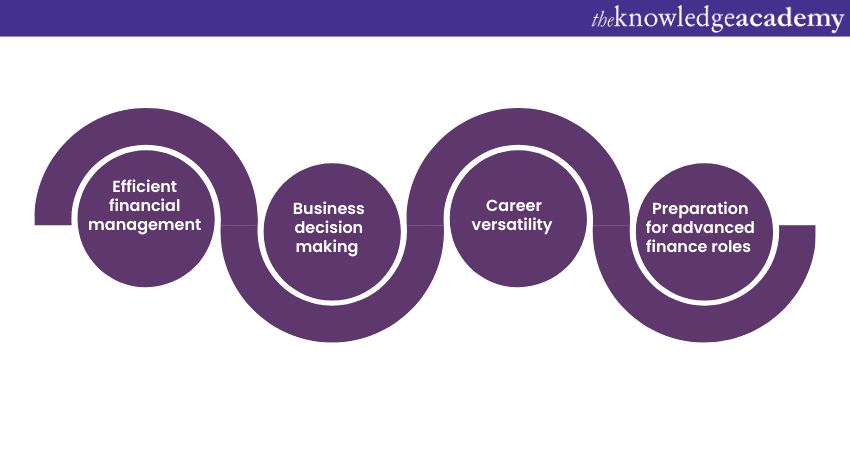

The significance of Basic Accounting Skills

From efficiently managing finance in business to having a hand in latest technological tools, the significances are many. In this section, we will discuss it in detail.

Efficient financial management

It is the practice of optimally utilising financial resources to achieve goals, maximise profitability, and ensure long-term sustainability. It involves a strategic approach to handling finances. It empowers individuals to take control of their financial well-being and helps businesses maintain financial health in a competitive marketplace.

For businesses, efficient financial management is a critical component of success. It involves creating and adhering to budgets, monitoring cash flow, and optimising resource allocation. Financial management helps businesses identify cost-saving opportunities and make informed decisions based on financial data.

Business decision making

It is a complex yet essential process that involves evaluating various factors to make informed choices that impact an organisation's present and future. These decisions span a wide range of areas, including strategic planning, resource allocation, risk management, and innovation.

Strategic decision-making is at the heart of business success. Leaders must analyse market trends, competitive forces, and internal capabilities to set the direction for the company. These decisions often shape the company's growth, market positioning, and long-term goals.

Resource allocation is another crucial aspect of business decision-making. Whether it's allocating funds, personnel, or time, businesses need to ensure that resources are optimally utilised to achieve the desired outcomes.

Career versatility

It refers to the ability of an individual to adapt, thrive, and excel in various roles, industries, or job environments throughout their professional journey. Career versatility allows individuals to remain competitive, resilient, and valuable contributors in the ever-evolving job market.

Career versatility also improves job security. Professionals with the ability to excel in different roles are less in danger of economic downturns. They can transfer their skills across sectors, stepping into roles that are in demand even during changing circumstances.

It also expands professional networks and opens doors to diverse experiences. By engaging with different industries, roles, and work environments, individuals gain a broader perspective and a wider range of connections.

Preparation for advanced finance roles

It involves a comprehensive and strategic approach to developing the necessary skills, knowledge, and experience required for high-level positions within the finance industry. A thorough and strategic approach is crucial for those aiming for top finance roles, requiring the development of essential skills, knowledge, and experience. This is vital for positions like finance managers, CFOs, investment analysts, or other senior roles that demand a deep understanding of complex financial concepts and a strategic mindset.

A solid educational foundation is essential for aspiring finance leaders. Advanced degrees like Master's in Finance, Accounting, or MBA provide deep insights into financial theory, risk management, reporting, and decision-making. These programmes offer real-world exposure, industry trends, and networking.

Relevant professional certifications, such as CFA, CPA, or FRM, showcase expertise and commitment, enhancing credibility. Practical experience, especially in roles with increasing responsibilities, is crucial. It builds a track record of success, sharpens financial management skills, and prepares individuals for advanced roles in the finance industry.

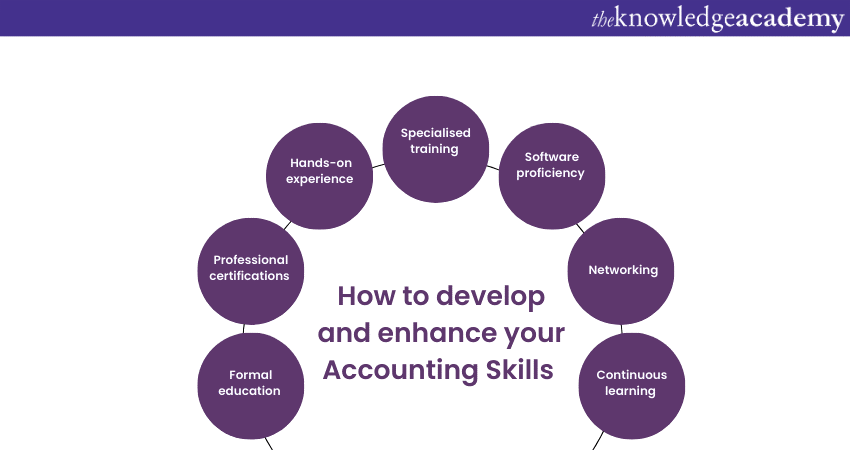

How to develop and enhance your Accounting Skills

This involves a combination of education, hands-on experience, continuous learning, and practical application. These steps are essential for individuals looking to excel in accounting roles, whether as professionals in the field or individuals managing their personal finances.

Formal education

It refers to structured learning that happens in schools, colleges, or other official educational institutions. It's the kind of learning where you attend classes, have teachers or instructors guiding you, and follow a planned curriculum. This type of education usually leads to degrees or qualifications that are recognised by employers and society.

It provides a solid foundation of knowledge and skills in a particular subject, setting you up for future opportunities and a better understanding of the world around you. Whether it's getting a degree, taking courses, or attending workshops, formal education helps you gain important knowledge and opens doors to various career paths.

Sign up for our Accounting Masterclass Course to explore advanced financial skills and excel in your professional journey.

Professional certifications

These are official qualifications that demonstrate your expertise and knowledge in a particular field or industry. They are often awarded by recognised organisations or governing bodies and serve as a validation of your skills. These certifications are valuable because they show employers and clients that you've achieved a certain level of competence.

It's a way to stand out in a competitive job market and gain the trust of those you work with. Certifications can cover a wide range of subjects, from accounting and IT to healthcare and project management. They're an investment in your career that can lead to better job opportunities, higher salaries, and increased respect from peers and employers.

Hands-on experience

It is the practical, real-world learning you gain by actively doing tasks, trying out skills, and being directly involved in activities. It's like learning to ride a bike by getting on the bike and pedalling rather than just reading about it. This kind of experience is essential for gaining a deeper understanding and honing your abilities in various fields, whether it's in a professional job or in everyday life.

Employers highly value hands-on experience. It shows that you've not only studied the subject but have also demonstrated the ability to use that knowledge effectively. It's the difference between understanding the theory of driving a car and actually driving one. Whether you're aiming for career advancement or simply want to master a new skill, hands-on experience is the crucial step.

Specialised training

It refers to focused, targeted learning that goes deeply into a specific area or skill. It's like receiving advanced instruction in a particular subject, allowing you to become an expert in that field. This type of training goes beyond general knowledge, providing in-depth insights and practical expertise that can be applied to specific tasks or industries.

Specialised training helps professionals looking to enhance their abilities, gain a competitive edge, or enter a specialised field. It's a way to stay ahead in rapidly evolving industries where in-depth knowledge is a must.

Software proficiency

It is the level of skill and expertise an individual has in using specific software applications effectively. Today, many tasks in various industries are performed using software tools. Being proficient in these tools means you can control them confidently and utilise their features to their fullest potential. This helps you to produce high-quality results.

It's an essential skill listed in many job descriptions, indicating the software you'll need to use on the job. Being proficient in these tools not only makes you more employable but also more adaptable to the digital world. You can gain software proficiency through training, practice, and continuous learning.

Expand your financial expertise with our focused Financial Management Training Course for a successful and impactful career.

Networking

It is the intentional act of building and maintaining relationships with individuals in both professional and personal contexts. It involves connecting with people, sharing information, and cultivating a network of contacts. This can provide support, knowledge, and opportunities. Effective networking is a valuable skill that can impact your personal and professional growth.

In a professional context, networking is a powerful tool for career development. It can lead to job opportunities, mentorship, collaborations, and industry insights. By attending networking events, joining professional organisations, or simply reaching out to colleagues and peers, you expand your circle of contacts. It increases the chances of finding new opportunities for growth.

Continuous learning

It is the continuous process of acquiring knowledge, developing skills, and expanding your understanding throughout your life. In accounting, continuous learning is not limited just to formal education but extends to professional development and personal growth.

Technologies, regulations, and industry best practices constantly change, and those who invest in learning and professional development succeed. Whether it's attending workshops, taking online courses, or reading industry publications, continuous learning ensures you're equipped to tackle new challenges.

Conclusion

Basic Accounting Skills are essential in the highly competitive business market. They help individuals to take care of their finances, make strategic plans and pursue different careers. By developing a strong base in these skills, you will improve your value as an employee.

Explore our comprehensive Accounting and Finance Training Courses to enhance your financial skills and boost your career!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Accounting Course

Accounting Course

Fri 17th Jan 2025

Fri 21st Mar 2025

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please