We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Commerce is a vast and diverse field that includes various disciplines, such as accounting, finance, marketing, economics, and business management. As a commerce graduate, you already possess a solid foundation in these areas. However, to stay ahead in today's competitive job market, it is very important to constantly upgrade your skills and knowledge. So, you must be wondering what are the Best Courses After Graduation in Commerce. Do not worry because we have got you covered.

Table of Contents

1) What is Bcom?

2) List of Best Courses After Graduation in Commerce

3) Best career options after Bcom

4) Career options in top sectors after graduation in commerce

5) Government jobs after Bcom

6) Conclusion

What is Bcom?

A Bachelor of Commerce (BCom) is an undergraduate degree in commerce and business studies. It majorly highlights varied aspects pertaining to commerce, business, finance, and economics. The curriculum has been designed to preface the learner with a complete insights into the fundamentals and practices in the world of commerce.

Bcom programs aim to endow the student with broad-based knowledge, as well as the analytical ability necessary to function successfully in the world of business. Theoretical concepts and practical applications are brought to students through case studies, projects, and internship environments to bring a broad understanding of the different domains of commerce. It typically includes accounting, economics, business management, financing, marketing, taxation, and business law.

A graduate with a Bcom degree is free to apply to any field or sector after completion. They can pursue careers in banks, finance, accounting, marketing, human resource management, consulting, or any business enterprise. Others use it as a stepping stone to pursue further studies to give them a cutting-edge industry in their field of specialisation.

List of Best Courses After Graduation in Commerce

We have compiled a list of courses for your perfect headstart after getting a degree in commerce. These are just a few options among many versatile courses available for commerce graduates!

While each course offers unique benefits and career prospects, consider your interests, career goals, and industry trends while selecting the course! Here is a list of some of the best courses you can consider pursuing after graduation in commerce:

1) Master of Commerce (MCom)

MCom is a postgraduate degree that takes one further into some of the basics learned in relation to commerce: accounting, finance, economics, and business management. It has advanced knowledge and skills in the mentioned areas, making someone a specialist in the field of commerce. Such a degree should set your career at a higher level for greater opportunities and qualify you for a higher position in finance, banking, consulting, and academia.

2) Company Secretary (CS)

The Company Secretary program is designed to inculcate in-depth knowledge of corporate governance, company law, and compliance and secretarial practices. One acts as a Company Secretary, ensuring that all matters within the company are run in accordance with legal and regulatory compliance; with this, one compiles and maintains company records and therefore enables the effective communication protocol between the board of directors, management, and shareholders. This presents roles within the corporate sphere in management, consulting regarding legal matters, and undertakings of compliance.

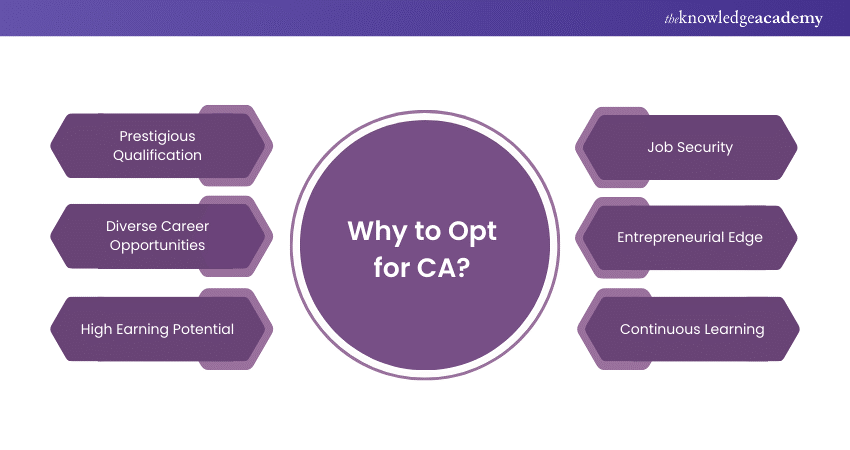

3) Chartered Accountancy (CA)

Chartered Accountancy is another prestigious professional qualification with a specialisation in accounting, auditing, taxation, and financial management. The course in CA would develop and prepare a professional with expertise in financial reporting, analysis, and strategic decision-making.

A chartered accountant can be employed at auditing firms, in corporations, or even at an independent accounting firm. It proves to be quite a hard yet lucrative deal for those opting to work in the finance sector.

4) Certified Management Accountant (CMA)

The CMA qualification is appropriate for interest in areas such as management accounting and financial management. In this curriculum, they teach cost accounting, budgeting, financial analysis, and strategic planning. With a CMA qualification, you can get different jobs, such as management accounting, financial, and business analysis.

5) Chartered Financial Analyst (CFA)

The Chartered Financial Analyst is recognised globally and is also reserved for practitioners who work either in finance or in the administration of investments. Some of the areas of operations the program addresses include investment analysis, portfolio management, and professional and ethical standards in the finance industry. The CFA designation boosts knowledge and credibility in various job positions at investment firms, banks, and asset management companies.

6) Master of Business Administration (MBA)

MBA remains the most popular choice for commerce graduates who want a wider exposure to business management, covering marketing and finance, operations and human resource management, strategic planning, and, along with leadership skills, a business view in totality toward the commitment of one preparing for a manager's position, entrepreneurship, or a consulting career.

7) Certificate in Investment Banking (CIB)

Focus more on the subtleties of investment banking: Mergers and acquisitions, capital markets, and financial modelling that the course delves into. It empowers you with the knowledge and skills required to work with investment banks, private equity firms, or corporate finance departments.

8) Association of Chartered Certified Accountants (ACCA)

The Association of Chartered Certified Accountants (ACCA) is a globally recognised professional accounting body offering the Chartered Certified Accountant qualification. ACCA is one of the largest and fastest-growing international accountancy bodies, with members and students in over 180 countries. Its qualification structure includes three levels of exams—Applied Knowledge, Applied Skills, and Strategic Professional—covering subjects like financial accounting, management accounting, taxation, audit and assurance, and financial management. It provides you with both international opportunities and a demonstration of your ability to be professional.

9) Data science certification

Data science certifications walk you through the operations of data analysis, machine learning (ML), and decision-making that employ the use of data. These programs are designed to equip individuals with the knowledge and skills needed for a career in data science, focusing on extracting insights from data through various analytical, statistical, and computational techniques. These programs typically cover a wide range of topics, including statistics, machine learning, data visualisation, data manipulation, big data technologies, and programming languages like Python and R. There is a huge demand for these skills, and no wonder, in a cross-section of the industry, ranging from finance through marketing to consulting.

10) Bachelor of Education (B.Ed.)

B.Ed. is an authentic career option for any commerce graduate who wishes to indulge in teaching or education, which provides further persons with the necessary information and skills required to qualify as a teacher in schools or educational institutions gearing toward the commerce area.

11) U.S. Certified Public Accounting (CPA)

The U.S. Certified Public Accountant (CPA) designation is a prestigious professional credential awarded to accountants who meet stringent education, examination, and experience requirements set by state boards of accountancy. To become a CPA, candidates must typically complete 150 semester hours of college education, often including coursework in accounting, auditing, taxation, and business law. They must also pass the Uniform CPA Examination, a comprehensive four-part exam administered by the American Institute of Certified Public Accountants (AICPA), covering Auditing and Attestation (AUD), Business Environment and Concepts (BE

Learn the importance of Time Management with our Time Management Training – join now!

12) Business Accounting and Taxation (BAT)

BAT courses provide specialised training in accounting and taxation, focusing on practical skills required for careers in accounting, taxation, and compliance. These courses equip you with the knowledge and expertise needed to handle accounting and tax-related responsibilities in organisations.

13) Cost Accountancy (ICWA)

Cost Accountancy, also known as the Institute of Cost and Works Accountants (ICWA), is a professional course that emphasises cost accounting, management accounting, and financial planning. It prepares you for careers in cost management, budgeting, and financial decision-making.

14) Certified Financial Planner (CFP)

CFP certification equips individuals with skills in personal financial planning, investment management, and retirement planning. As a Certified Financial Planner, you can provide comprehensive financial planning services to individuals and families, helping them achieve their financial goals.

Best career options after Bcom

Here is a list of career options after Bcom. You can select the pathway that aligns with your interests. Consider your career goals and industry trends to choose the course that pairs up best with your aspirations. Continuous learning, acquiring practical experience through internships or entry-level positions, and networking can further enhance your career growth.

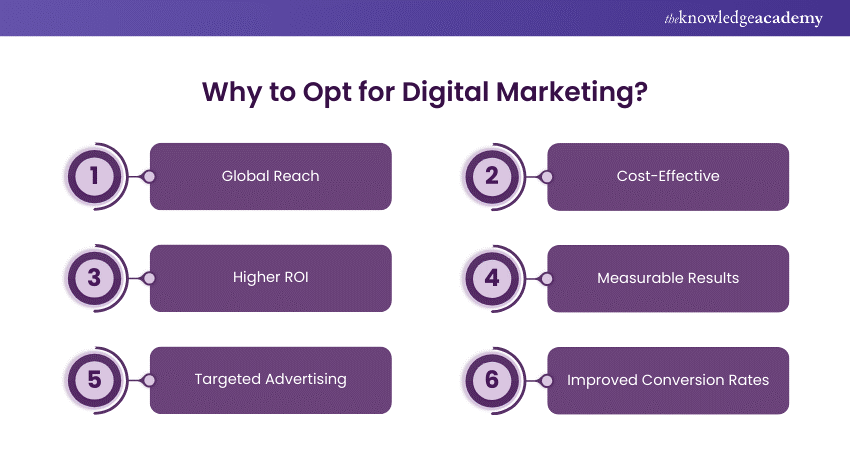

Digital marketing

Digital marketing is the process of promoting one's products or services through digital channels, such as search engines, social media, e-mails, and websites. A number of fields converge under digital marketing: Search Engine Optimisation (SEO), social media marketing, content marketing, and internet advertising. Today, internet marketing skills have become in high demand because businesses have learned of the vitality of an internet presence. Effectively, this course will train you for a possible position in any marketing, advertising, or digital agency.

Graphics designing

Learning the subject of graphic design implies learning how to combine visual content by utilising numerous tools and applications. That is why this subject teaches typography, colour theory, design layout, and image editing. This course helps you specialise in graphic design by creating visual assets for websites and other branding materials, advertisements, and so forth. It is a very creative field that demands an activator's eyes on things that are aesthetic and can communicate.

Stock broking

Stock broking refers to the buying and selling of stocks and other securities on behalf of clients. A course in stock broking equips you with knowledge of financial markets, investment instruments, trading strategies, and regulatory frameworks. With this course, you can work as a stockbroker, managing investment portfolios, providing investment advice, and executing trades on behalf of clients.

Financial Risk Manager (FRM)

The Financial Risk Manager (FRM) course focuses on the identification, assessment, and management of financial risks faced by organisations. It covers topics such as credit risk, market risk, operational risk, and risk modelling. This course prepares you for careers in risk management, working in banks, insurance companies, consulting firms, or other financial institutions.

Certified Financial Planner (CFP)

The Certified Financial Planner (CFP) course trains individuals in personal financial planning, investment management, and retirement planning. It equips you with the knowledge and skills to provide comprehensive financial planning services to individuals and families. As a Certified Financial Planner, you can offer advice on budgeting, investment strategies, insurance, tax planning, and estate planning.

Insurance

A course in insurance provides an in-depth understanding of insurance principles, products, underwriting, and risk management. It prepares you for careers in the insurance industry, working as an insurance agent, underwriter, claims adjuster, or risk analyst. This course covers different types of insurance, such as life insurance, health insurance, property insurance, and liability insurance.

Wealth management

Wealth management is a course that focuses on managing the financial affairs of high-net-worth individuals and families. It covers areas such as investment management, tax planning, estate planning, and wealth preservation. With this course, you can work as a wealth manager, providing personalised financial advice and services to affluent clients.

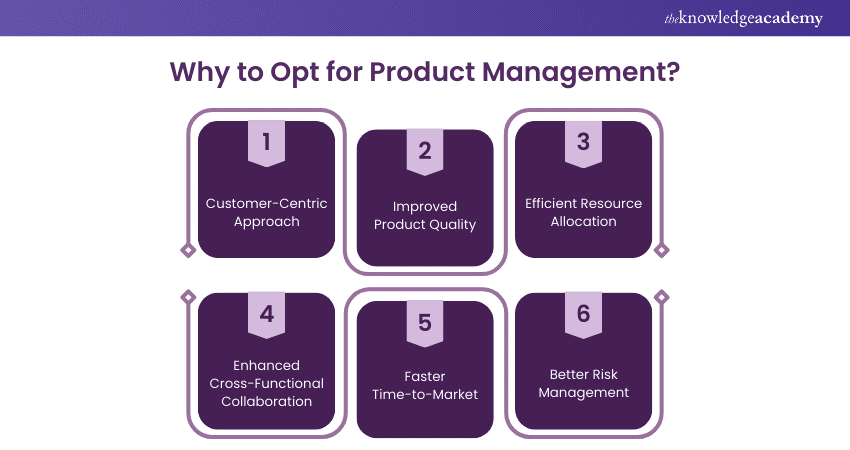

Product management

Product management is a course that trains individuals in the process of developing and managing products or services throughout their lifecycle. It covers areas such as market research, product development, pricing, marketing, and product strategy. With this course, you can work as a product manager, responsible for identifying customer needs, defining product features, and overseeing the product's success in the market.

Are you interested in learning more about Personality Development? Then sign up now for our Personal Development Course!

Entrepreneurship

Entrepreneurship courses focus on developing the skills and mindset required to start and manage a successful business venture. They cover areas such as business planning, opportunity identification, marketing, finance, and leadership. With this course, you can gain the knowledge and confidence to start your own business, become a self-employed professional, or contribute to the growth of existing enterprises.

Supply chain management

Supply chain management involves the coordination and management of the flow of goods, services, and information from suppliers to customers. A course in supply chain management covers topics such as procurement, logistics, inventory management, and demand forecasting. With this course, you can pursue careers in supply chain or operations management, working in industries such as manufacturing, retail, logistics, or e-commerce.

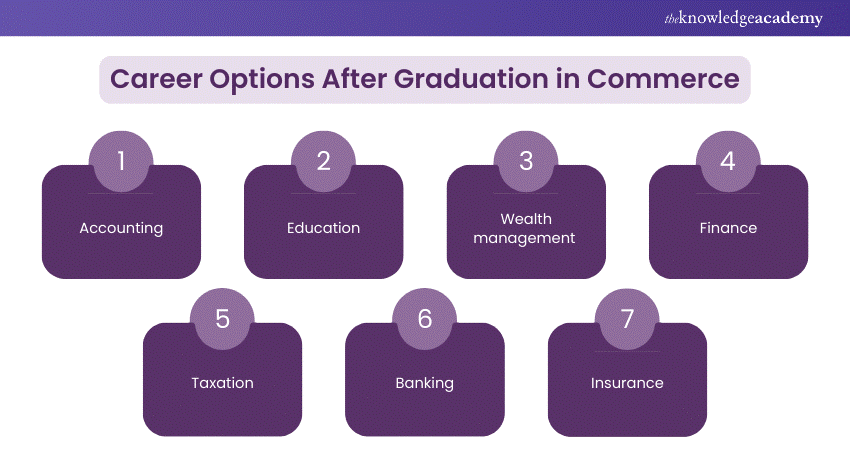

Career options in top sectors After Graduation in Commerce

These sectors offer a wide range of career opportunities for commerce graduates. Consider your interests, skills, and long-term goals to choose the sector and role that aligns best with your aspirations. Continuous learning, certifications, and practical experience through internships or entry-level positions can further enhance your career prospects in these sectors.

1) Accounting

Accounting is actually a discipline that is meant to record and analyse business and other financial information and report the data. Career opportunities after this career include being an accountant, auditor, tax consultant, or financial analyst. They prepare financial records and reports and advise enterprises concerning their financial position. They play an essential role in a decision-making process and also are entrusted with ensuring that finance regulations are adhered to.

2) Education

Teaching is another area that commerce graduates can venture into as a profession. Graduates impart knowledge as teachers or professors in commerce education that includes accounting, finance, economics, business studies, amongst others. Having the right prowess for the field and interest in it, one gets a chance to enhance education by pouring in the knowledge to the minds of the tutees for shaping the future of many.

3) Wealth management & more

Career paths within the wealth management sector, particularly for commerce graduates, pertain mainly to interest in financial planning and investment management. Wealth managers interact with high-net-worth individuals or families and work to help them build and manage their wealth. Some other such careers are that of a financial advisor, an investment analyst, or a portfolio manager. Such careers pertain to the financial goals of the clients, investment advice, and management of investment portfolios.

4) Finance

The finance area provides career-oriented disciplines to commerce students in financial markets, investment and financial decision-making. The designations in finance include financial analysts, investment bankers, risk managers, and financial controllers. They analyse financial information, estimate investment opportunities, manage financial risks, and ensure financial well-being.

5) Taxation

It is one of the specialised areas, and he has to be informed about the laws and rules regarding taxes. A commerce graduate does have a career as a taxation consultant or analyst. They guide individuals and businesses on their tax obligations and the formulation of tax strategies for optimising compliance with the law. Tax professionals help their clients in tax planning, preparation of tax returns, and representation in tax matters.

6) Banking

Careers in the banking sector for commerce graduates are diverse and can include work in commercial banks, investment banks, and private banks. Entry-level work will be that of a bank teller, a customer relationship manager, or even a loan officer. With experience and higher qualifications, one can become a branch manager, credit analyst, investment advisor, or financial analyst. Besides, the banking sector offers an opportunity for somebody to work with individual and corporate clients while getting exposed to different financial products and services.

7) Insurance

Career paths in the insurance industry for commerce graduates inclined towards the aspect of risk management and financial protection include: insurance agents, underwriters, claims adjusters, and risk analysts. A group of professionals in insurance take the role of assessing risks and establishing the level of vulnerability - settling insurance claims and offering risk management services to individuals or organisations. Job opportunities in the insurance industry range in the career fields of life, health, property insurance, and many others.

Government jobs after B.Com

These government job opportunities offer B.Com graduates the opportunity to work in esteemed positions in a number of fields. Each of these examinations has its own selection process, and one needs to prepare accordingly through the syllabus covering old question papers for practice and current affairs. Another requirement for the job is in-service training and passing the probationary period. One should be very dedicated, patient, and a good learner to succeed because the competition in all these positions is very high.

1) SSC - CGL (Combined Graduate Level)

The Staff Selection Commission (SSC) conducts the Combined Graduate Level (CGL) examination for various posts in different government departments and organisations. B.Com graduates can apply for positions such as Assistant Audit Officer, Assistant Accounts Officer, Tax Assistant, and Assistant Section Officer through this exam. The selection process includes multiple stages, such as Tier-I and Tier-II exams, followed by a skill test or interview.

2) IBPS PO Bank Probationary Officer

The Institute of Banking Personnel Selection (IBPS) conducts the Probationary Officer (PO) examination for recruitment in public sector banks. B.Com graduates can apply for the PO position, which involves training and the probationary period before assuming the role of an Assistant Manager. The selection process includes a preliminary exam, a main exam, and an interview.

3) RBI Grade B Officer

The Reserve Bank of India (RBI) conducts the Grade B Officer examination to recruit officers for various roles in RBI and its associated institutions. B.Com graduates can apply for this prestigious position, which involves monetary policy formulation, financial supervision, and regulation. The selection process includes a preliminary exam, a main exam, and an interview.

4) LIC Assistant Administrative Officer (AAO)

The Life Insurance Corporation of India (LIC) conducts the Assistant Administrative Officer (AAO) examination to recruit candidates in various specialised roles such as Generalist, IT, Chartered Accountant, and Actuarial. B.Com graduates can apply for the AAO position in the Generalist or Chartered Accountant category. The selection process includes a preliminary exam, a main exam, and an interview.

5) UPSC CSE / IAS

The Union Public Service Commission conducts the Civil Services Examination (CSE) to recruit candidates for prestigious such as the Indian Administrative Service (IAS), Indian Foreign Service (IFS), and Indian Revenue Service (IRS). B.Com graduates can apply for the CSE and, if successful, can choose the desired administrative path. The selection process includes multiple stages, such as a preliminary exam, a main exam, and an interview.

Are you interested in learning more about Personal Development Skills? Then sign up now for our Active Listening Training!

Conclusion

The blog has outlined Best Courses After Graduation in Commerce including various career paths across sectors. From traditional finance and accounting roles to emerging fields like digital marketing, data science, and entrepreneurship. The journey for commerce graduates extends far beyond their B.Com degree, with a multitude of exciting and rewarding courses available to push their careers to new heights!

Frequently Asked Questions

Whenever you are selecting a course, identify your interests to find your passion. Check that the courses and syllabus suit your academic interests and professional aspirations. Check the colleges, fees, and salaries associated with your aligned course.

Yes, there are plenty of short-term courses for commerce graduates in digital marketing, banking, financial services, business, and accountancy. These short-term courses have a wide scope for commerce graduates.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Personal Development Courses, including Attention Management Training, Active Listening Skills Course, and Organisational Skills Training Course. These courses cater to different skill levels, providing comprehensive insights into Leadership Interview Questions.

Our Business Skills blogs covers a range of topics related to courses after graduation, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Leadership Skills Training

Leadership Skills Training

Fri 26th Jul 2024

Fri 30th Aug 2024

Fri 27th Sep 2024

Fri 25th Oct 2024

Fri 29th Nov 2024

Fri 27th Dec 2024

Fri 28th Feb 2025

Fri 11th Apr 2025

Fri 27th Jun 2025

Fri 22nd Aug 2025

Fri 24th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please