We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

If you are about to take your first step into the fast-paced world of day trading, choosing the right trading platform might feel like an uphill battle. After all, day trading is a skill, and a trading platform is the sole driving force that will enhance your strategies and speed up your profits.

The top day trading platforms are characterised by outstanding apps for analysing indicators and executing trades across stocks, Cryptocurrency, forex, futures and more. If done right, day trading has the potential to become a lucrative career. This blog will guide you in selecting the right trading platform for you.

Table of Contents

1) What is day trading?

2.) Best Day Trading Platform

a) Interactive Brokers (IKBR)

b) Webull

c) E*TRADE

d) Tastytrade

e) Trading 212

f) Interactive Investor

g) Fidelity Investments

h) Firstrade Securities

i) Moomoo

3) Conclusion

What is day trading?

Day trading involves buying and selling stocks across a very short time frame. The holding period for day traders typically range from a few minutes to even a few seconds. The idea behind day trading is to make small profits quickly without risking large amounts of capital.

Day traders predict how prices for their investments fluctuate over short periods of time to potentially make money off these swings. This form of trading involves combining strategies and forms of analyses such as technical analysis and momentum trading.

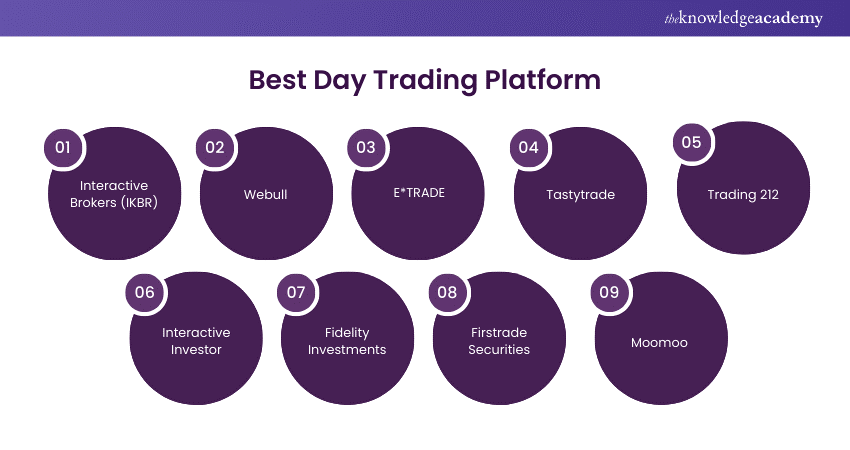

Best Day Trading Platform

Here's list of the most powerful day trading platforms for you to choose from:

Ready to expand your trading strategy? Sign up for our Day Trading Course

a) Interactive Brokers (IKBR)

Interactive Brokers (IKBR) meets the needs of a wide variety of traders and the strategies they trade. The extensive options for customising charts, layouts and user-defined buttons allow for a multitude of unique charting setups tailored to every trader.

Experienced day traders can refine their trade selection and execution skills by using the high-powered tools available in the IBKR Traders Workstation (TWS) platform. Additionally, they can choose the IBKR PRO pricing plan to lower costs associated with their specific strategies and enhance execution quality.

But all that power and flexibility doesn’t stop IBKR’s platform to remain user-friendly and enables new users to learn quickly.

Here are the pros and cons of IKBR:

|

PROS |

CONS |

|

Highly customisable |

Each platform is different |

|

Excellent customisation features for day trading strategies |

Learning curve for advanced TWS platform |

|

Powerful screeners, charting and analysis tools |

API is dated and tool integration can be complicated |

b) Webull

Day traders who prefer mobile apps will find Webull an excellent low-cost option for trading stock shares. With no account minimums or commissions, and the ability to trade fractional shares, this platform is ideal for novice day traders with small account sizes.

Webull operates in 10 major markets and 15 regions worldwide and its mobile-first approach caters primarily to its key target market: Millennials. This has strategically positioned Webull to attract younger active traders through comprehensive range of services at no cost.

|

PROS |

CONS |

|

Easy setup with simple and intuitive interface |

PFOF reduces execution performance for options

|

|

No account minimums Fractional shares available |

Mobile app doesn’t access the stock screener

|

|

Updated mobile interface includes better educational resources |

No access to bonds |

c) E*TRADE

The E*TRADE mobile apps are highly customisable, enabling users to tailor them to their individual trading strategies. The apps’ optimised content and intuitive interface sets E*TRADE apart.

Designed with new investors in mind, the apps prioritises essential features such as market research, watchlists, portfolio management, quotes and more. E*TRADE provides a wealth of proprietary and third-party research through the apps, empowering users with comprehensive insights.

|

PROS |

CONS |

|

Easy-to-learn, easy-to-use interface |

Low interest rate for uninvested cash

|

|

Highly customisable Two versions of the mobile app to meet different trader needs |

No cryptocurrency purchases

|

|

Excellent news and educational material Level II information also available |

No fractional share purchases |

d) Tastytrade

Tastytrade is a technology-driven broker and uses a proprietary order routing system. The platform’s algorithms focus on price improvement and order fill quality. For the day trader who frequently uses options in their strategies, Tastytrade is a good choice.

Despite its Do-it-yourself (DIY) vibe, Tastytrade brings industrial-level tools and execution to a retail crowd.

Check out these Pros and Cons:

|

PROS |

CONS |

|

Excellent options tools for both trading and analysis |

Learning curve for the interface

|

|

Great execution with frequent price improvement and Strong and current options education |

Education favours advanced option spreads

|

|

Fractional share trading available and Industry-leading options-based content |

Fee structure favours position larger than 10 contracts

|

e) Trading 212

Trading 212 offers commission-free trading, charges no trading or custody fees, and has more than 2 million clients. The easy-to-use app and website provide excellent technical information and advanced trading tools for day traders.

Additionally, it provides a decent research offering, including the “212 Hotlist” of most popular shares, a community trading forum and video guides to investing. While Trading 212 doesn’t offer a telephone service, it responds quickly and comprehensively via its messaging facility.

|

PROS |

CONS |

|

Simple-to-use app and No trading fees or platform charges |

Less comprehensive research than other platforms |

|

Can hold account in multiple currencies |

No telephone trading |

|

Offers stop and limit orders and virtual trading account |

No telephone support available |

|

Low foreign exchange fees of 0.15% |

No trailing stop orders for shares |

f) Interactive Investor

One of the larger platforms, Interactive Investor (II) provides one of the broadest range of investments for day traders. II provides a comprehensive company research and share tips. Investors can trade through app or via the website, although its app is not as slick as others.

Interactive investor is overall a good choice for investors with higher-value portfolios due to the flat platform fee.

|

PROS |

CONS |

|

Low dealing fee |

High trading charge for funds |

|

Option of free trades

|

Highest foreign exchange fee of 1.5% (up to £25,000) |

|

Flat platform fee and large range of investments |

Website looks quite dated |

g) Fidelity Investments

From the desktop platform Active Trader Pro to their mobile app, Fidelity provides a range of trading platforms to meet diverse needs. These platforms offer advanced charting tools, real-time quotes and various order types, which are crucial for day traders.

Fidelity is renowned for its research and educational resources, offering articles, webinars, and courses to enhance traders’ skills. Additionally, Fidelity provides a practice account, enabling traders to test their strategies without risk.

|

PROS |

CONS |

|

Complete range of independent and managed services available at exceptionally affordable prices |

Higher margin rates higher than many other competing brokerages |

|

Offers access to domestic markets and 25 foreign markets, as well as a wide range of options contracts and over 10,000 mutual funds |

No access to futures trading

|

|

Well-integrated mobile app that works just as well as the desktop platform. Vast selection of education tools and resources available free of charge |

High fees to buy a non-Fidelity mutual fund |

h) Firstrade Securities

Firstrade Securities offers thousands of trading products including stocks, options, cryptos and mutual funds. Proprietary trading apps, commission-free investing and an instant execution model have made this online brokerage quite popular among day traders

|

PROS |

CONS |

|

Low OTC fees |

No copy trading

|

|

Crypto trading |

Some withdrawal fees

|

|

No minimum deposit |

No 24/7 customer support

|

|

Commission-free investing |

No forex or futures trading

|

|

Multiple customer support options Mobile app with advanced features and analysis |

No demo/paper trading account

|

|

Access to education, research, and tools. Stop limit and trailing stop orders supported |

Visa Credit/debit card withdrawals and deposits not accepted |

i) Moomoo

Moomoo is an excellent choice for new and intermediate day traders looking to build a diverse investment portfolio. The user-friendly app, low trading fees, zero commissions, no account minimum and free level 2 data are the standout features of Moomoo.

|

PROS |

CONS |

|

As a Member of FINRA and the Securities Investor Protection Corporation (SIPC), Moomoo adds another level of security for prospective clients

|

There is no negative balance protection (a common safety feature at top-tier-regulated brokers)

|

|

Dynamic passwords generated by the ‘Moomoo Token’ for transaction security. Detailed analytics and insights |

There is no 2-factor authentication (2FAT |

|

No minimum deposit requirement makes the broker accessible for beginners Access to extended pre-market trading hours and Reduced options contract fees |

There is no phone or live chat support |

Conclusion

Day trading is a risky game defined by big profits and steep losses. Despite benefits such as easy access, no overnight risk and professional prospects, day trading can be a stressful endeavour with high probability of losses. Do your market research and devise a strong strategy before you take the first step. We hope this blog helps you pick the right trading platform.

Want to improve your investment game? Investment Management will guide you! Sign up today

Frequently Asked Questions

Day trading is neither illegal or unethical. But it is extremely complicated and risky, and it’s a technique that is best employed by a professional day trader.

The Pattern Day Trader Rule mandates that day traders must maintain a minimum balance of 19,635£ in their margin accounts at all times. If the margin account goes below the 19,635£ entity, the trader cannot purchase or sell assets until the account has the minimum necessary amount.

The Rule of 3 suggests that after a significant price move, a retracement typically occurs, lasting for 1/3 of the initial move. The Rule of 5 states that after the retracement, the price continues in the direction of the initial move for 1/5 of the initial move. Additionally, the Rule of 7 suggests a second retracement occurs after the initial move, lasting for 1/7 of the initial move.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers Day Trading Course alongside stock trading. These courses cater to different skill levels, providing comprehensive insights into Investment Management.

Our Investment Training Blogs cover a range of topics related to Investment and trading, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your trading skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Day Trading Course

Day Trading Course

Fri 15th Nov 2024

Fri 21st Feb 2025

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please