We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine a bustling marketplace, filled with merchants exchanging goods and services. The speed at which these transactions occur is crucial to the market's overall efficiency. In the world of business, this efficiency is measured by the Cash Conversion Cycle. This metric reflects the time it takes for a company to convert its investments in inventory and other resources into cash flow from sales.

A shorter Cash Conversion Cycle is a sign of a healthy business, as it indicates that the company is efficiently managing its resources and generating cash quickly. Conversely, a longer cycle can strain cash flow and hinder growth. Let's delve into the intricacies of the Cash Conversion Cycle, exploring its components, best practices for optimisation, and its impact on overall business performance.

Table of Contents

1) What is the Cash Conversion Cycle (CCC)?

2) Stages of the Cash Conversion Cycle

3) Example of the Cash Conversion Cycle

4) What Affects the Cash Conversion Cycle?

5) How to Improve the Cash Conversion Cycle?

6) Conclusion

What Is the Cash Conversion Cycle (CCC)?

The Cash Conversion Cycle (CCC) is a financial metric that assesses how efficiently a company manages its working capital. It calculates the time it takes for a company to convert its investments in inventory and accounts receivable into cash flows from sales. The CCC is particularly useful for understanding the liquidity and operational efficiency of a business.

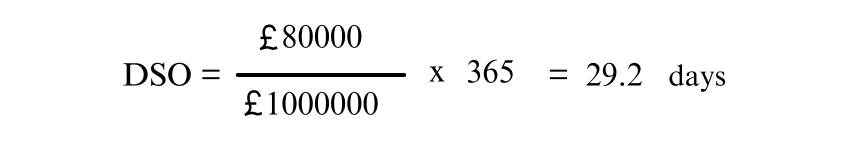

The formula for the CCC is:

Where:

a) DIO stands for Days Inventory Outstanding.

b) DSO stands for Days Sales Outstanding.

c) DPO stands for Days Payable Outstanding.

The CCC indicates the number of days it takes for a company to turn its inventory and receivables into cash after accounting for the time it takes to pay its suppliers.

Stages of the Cash Conversion Cycle

Let’s explore the various stages of the Cash Conversion Cycle:

Days Inventory Outstanding (DIO)

Days Inventory Outstanding (DIO) measures the average number of days a company holds inventory before selling it. It reflects how efficiently a company manages its inventory. A lower DIO indicates that a company sells its inventory more quickly, which is generally positive as it implies faster cash flow.

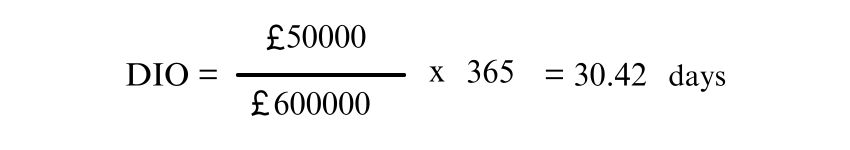

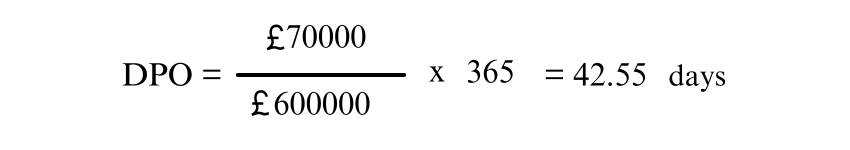

The formula to calculate DIO is:

For example, if a company has an average inventory of £50,000 and a cost of goods sold (COGS) of £600,000, the DIO would be:

Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) measures the average number of days it takes for a company to collect payments from its customers after a sale. It highlights the efficiency of a company's credit and collection policies. A lower DSO signifies that a company collects its receivables more swiftly.

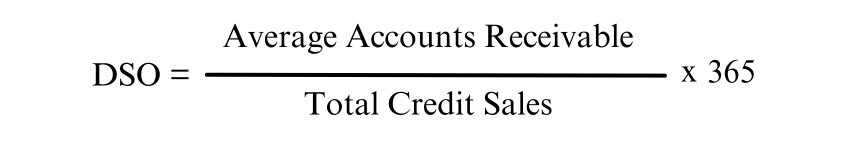

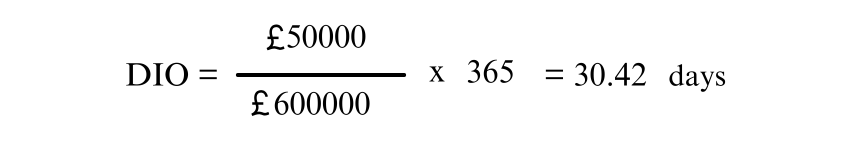

The formula to calculate DSO is:

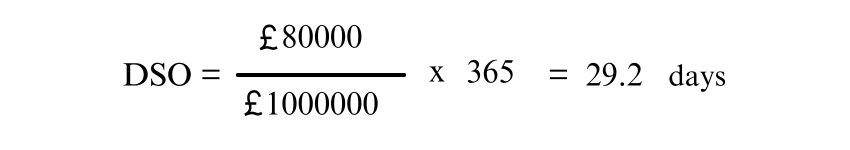

For instance, if a company has average accounts receivable of £80,000 and total credit sales of £1,000,000, the DSO would be:

Days Payable Outstanding (DPO)

Days Payable Outstanding (DPO) measures the average number of days a company takes to pay its suppliers. It reflects how long a company can defer payments without incurring penalties. A higher DPO indicates that a company is taking longer to pay its suppliers, which can be advantageous if managed properly, as it can help preserve cash.

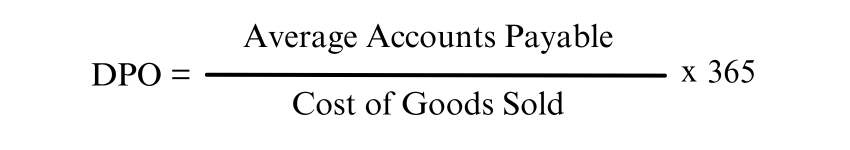

The formula to calculate DPO is:

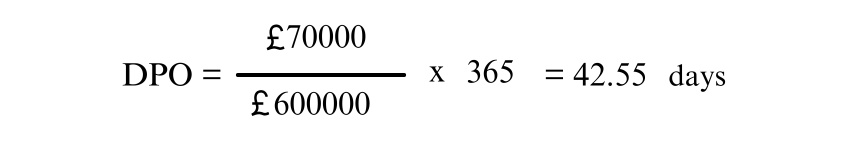

For example, if a company has average accounts payable of £70,000 and a COGS of £600,000, the DPO would be:

Unlock your Financial Potential—Join in our Capital Market Course today!

Example of the Cash Conversion Cycle

Let’s consider a hypothetical company to illustrate how the Cash Conversion Cycle is calculated:

1) Days Inventory Outstanding (DIO):

Average Inventory: £50,000

Cost of Goods Sold: £600,000

2) Days Sales Outstanding (DSO):

Average Accounts Receivable: £80,000

Total Credit Sales: £1,000,000

3) Days Payable Outstanding (DPO):

Average Accounts Payable: £70,000

Cost of Goods Sold: £600,000

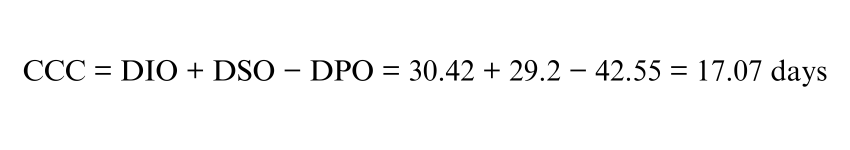

Now, applying these values to the Cash Conversion Cycle formula:

This means the company takes approximately 17 days to convert its investments in inventory and receivables into cash after accounting for the time it takes to pay its suppliers.

What Affects the Cash Conversion Cycle?

Several factors can impact the Cash Conversion Cycle, including:

a) Inventory Management: Efficient inventory management reduces DIO by ensuring products are sold quickly and excess stock is minimised.

b) Credit Policies: Stricter credit policies can reduce DSO by shortening the period it takes to collect receivables.

c) Supplier Terms: Negotiating better payment terms with suppliers can extend DPO, thereby improving cash flow.

Economic conditions, industry standards, and company-specific practices also play significant roles in influencing the CCC.

Optimise your Cash Flow and boost efficiency with our Cash Cycle Management Training. Join today!

How to Improve the Cash Conversion Cycle?

Improving the Cash Conversion Cycle involves optimising each stage of the cycle:

a) Enhance Inventory Management: Implement inventory management practices like Just-In-Time (JIT) to reduce excess stock and shorten DIO. Use inventory management software to track and forecast inventory levels accurately.

b) Streamline Collections: Improve credit policies and collection processes to shorten DSO. Consider offering discounts for early payments, implementing stricter credit terms, and using automated invoicing and payment systems.

c) Negotiate Supplier Terms: Extend DPO by negotiating longer payment terms with suppliers. Strengthening supplier relationships and managing supplier payments strategically can help maintain cash flow.

d) Implement Technology: Leverage financial and supply chain management software to automate and integrate processes, enhancing overall efficiency and visibility across the Cash Conversion Cycle.

Unlock the power of secure transactions—Join our Letters of Credit Training Course now!

Conclusion

The Cash Conversion Cycle is a vital metric for assessing how effectively a business manages its working capital and liquidity. By understanding and optimising the CCC, companies can enhance their cash flow, improve operational efficiency, and strengthen their financial position. Monitoring and managing each stage—Days Inventory Outstanding, Days Sales Outstanding, and Days Payable Outstanding—can lead to more informed decision-making and better financial health.

Take control of your finances—join our Introduction to Credit Control course today!

Frequently Asked Questions

Yes, the Cash Conversion Cycle (CCC) can be negative if a company receives cash from sales before paying its suppliers and before needing to replenish inventory. This typically indicates efficient working capital management.

Retail and fast-moving consumer goods (FMCG) industries often have shorter CCCs due to quick inventory turnover and fast receivables. Their business models focus on rapid sales and frequent inventory restocking, reducing the cycle time.

No, a higher Cash Conversion Cycle (CCC) is not better. It indicates longer periods for converting investments in inventory and receivables into cash, which can strain liquidity. Shorter CCCs are generally preferred for better cash flow management.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting Courses. including the Cash Flow Training, Capital Market Training Course and Cash Cycle Management Training Course. These courses cater to different skill levels and provide comprehensive insights into Council Tax Bands.

Our Accounting and Finance Blogs cover a range of topics related to Cash Flow Training, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Cash Flow Training

Cash Flow Training

Fri 13th Dec 2024

Fri 21st Feb 2025

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Halloween sale! Upto 40% off - 95 Vouchers Left

Halloween sale! Upto 40% off - 95 Vouchers Left

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please