We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine you’re a captain leading your team in the final over of a nail-biting cricket thriller. Every run, every ball is like the heartbeat of your game plan—each decision can make or break the match. Just as those final deliveries can determine victory, understanding and managing your cash flow is what keeps your business in the game.

Cash Flow Analysis is your strategy guide, helping you make winning moves that keep your business thriving and ahead of the competition. Ready to hit your financial goals out of the park? Let’s cheer!

Table of Contents

1) What is Cash Flow Analysis?

2) The Importance of Cash Flow Analysis

3) Key Components of Cash Flow Analysis

4) Steps to Prepare Your Cash Flow Analysis

5) Insights Gained From Cash Flow Analysis

6) Example of Cash Flow Analysis

7) Conclusion

What is Cash Flow Analysis?

Cash Flow Analysis is the process of examining the movement of cash in and out of a business over a specific period. It plays a crucial role in Cash Flow management, helping businesses determine how effectively they generate cash to cover debts, expenses, and investments. By analysing cash flow, companies can assess their financial health, make informed decisions, and ensure they have sufficient liquidity to sustain operations and seize growth opportunities.

The Importance of Cash Flow Analysis

Cash Flow Analysis is a vital tool for businesses to ensure they remain financially healthy and sustainable. By regularly reviewing cash flow, businesses can gain crucial insights that support strategic decision-making and long-term growth. Here is the key importance of Cash Flow Analysis:

1) Maintaining Liquidity: Cash Flow Analysis helps businesses monitor their liquidity levels, ensuring they have enough cash to meet short-term obligations and avoid financial distress.

2) Supports Strategic Planning: By understanding cash flow patterns, businesses can confidently plan for future investments, expansions, and other strategic initiatives, knowing they have the financial resources to back them up.

3) Identifies Financial Trends: Regular analysis allows businesses to identify trends in cash inflows and outflows. This enables them to anticipate potential cash shortages or surpluses and adjust their strategies accordingly.

4) Enhances Decision-making: Cash Flow Analysis provides valuable data that aids in making informed decisions regarding budgeting, cost-cutting, and capital allocation, leading to better overall financial management. Integrating a well-structured Cash Flow Budget ensures better control over expenses and helps maintain financial stability.

5) Assesses Business Performance: By evaluating cash flow, businesses can gauge their operational efficiency and financial performance, helping them gauge areas for improvement and optimise their cash management practices.

Optimise liquidity and risk with Treasury Management Training- join now!

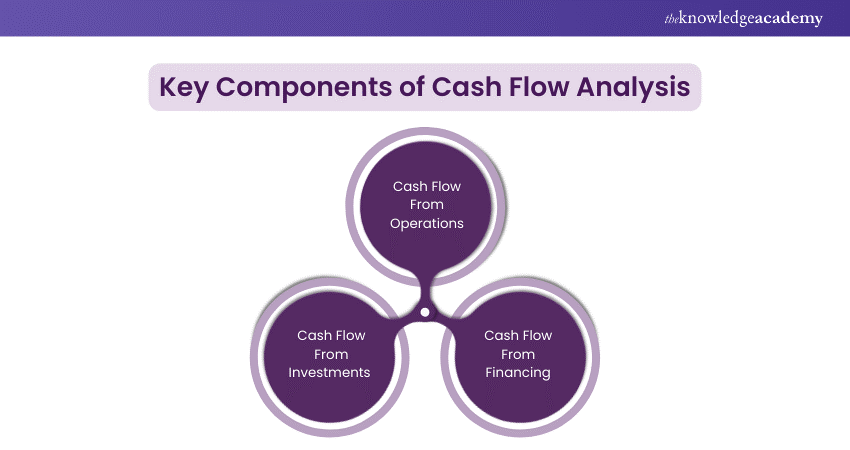

Key Components of Cash Flow Analysis

Understanding the critical components of Cash Flow Analysis is essential for understanding a company’s financial health. Each component reflects a different aspect of the business’s cash flow, providing insights into how it generates, invests, and finances its cash.

1) Cash Flow From Operations

Cash flow from operations reflects the cash generated or used by core business activities, such as product or service sales. It shows whether the company can generate sufficient cash flow to maintain and grow its operations. Positive cash flow from operations indicates a healthy, sustainable business, while negative cash flow might signal operational inefficiencies or challenges.

2) Cash Flow From Investments

Cash Flow from Investments tracks the cash used for investing in assets, such as property, equipment, or securities, and cash received from selling such assets. This component helps assess how much the business spends on growth and long-term assets. A negative cash flow from investments often indicates that a company is actively investing in its future, while a positive figure might suggest asset sales or a slowdown in investment.

3) Cash Flow From Financing

Cash Flow from Financing represents the cash flow related to borrowing, repaying debt, issuing equity, or paying dividends. This component demonstrates how a company finances its operations and growth through external capital sources. Positive cash flow from financing might indicate new borrowing or capital raising, while negative cash flow could signal debt repayment or dividend payments to shareholders.

Streamline your financial records—sign up for our expert Book Keeping Training!

Steps to Prepare Your Cash Flow Analysis

Preparing a thorough Cash Flow Analysis involves a series of systematic steps to ensure that you accurately track and manage your business’s financial health. By following these steps, you can clearly understand your cash position and make informed decisions to support your business’s success.

1) List All Income Sources

Begin by listing all your business's income sources, including sales revenue, interest income, and any other cash inflows. This step ensures your account for every pound entering your business, providing a clear picture of your overall cash generation.

2) List All Business Expenses

Following that, make a detailed list of all your business expenses, such as rent, utilities, payroll, and inventory costs. By accurately listing these outflows, you can assess where your money is going and identify potential areas for cost-saving or optimisation.

3) Develop Your Cash Flow Statement

With your income and expenses listed, develop your cash flow statement by organising these figures into operating, investing, and financing activities. This statement gives you a comprehensive perspective of your cash inflows and outflows, categorised according to the transactional type.

4) Review and Analyse Your Cash Flow Statement

Finally, review and analyse your cash flow statement to identify trends, identify any cash shortages, and assess your business’s financial health. This step allows you to make data-driven decisions, adjust your Cash Flow Strategies as needed, and ensure your business remains financially stable.

Navigate Market Changes with Confidence! Explore Top Trends in Treasury Management Today.

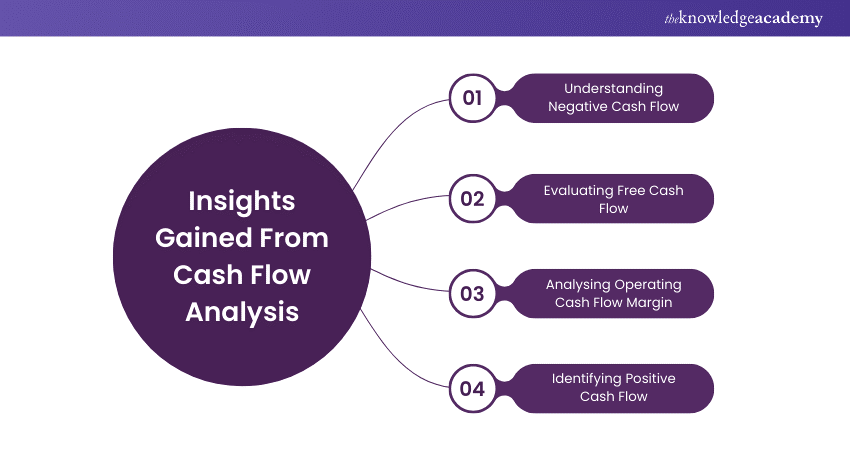

Insights Gained From Cash Flow Analysis

Cash Flow Analysis offers valuable insights to help businesses gain a better understanding of their financial dynamics and make smarter decisions. Furthermore, by carefully examining different aspects of cash flow, businesses can identify significant trends and potential issues that may impact their financial health.

1) Understanding Negative Cash Flow

When analysing cash flow, it’s crucial to understand the implications of negative cash flow. Negative cash flow occurs when a business spends more money than it obtains during a specific period. While this may indicate financial challenges, it’s not always a flawed sign; for instance, it could result from significant investments in growth. However, consistently negative cash flow needs attention to avoid long-term financial problems.

2) Evaluating Free Cash Flow

Free cash flow is a key metric that represents the cash available after a business has covered its operating expenses and capital expenditures. Evaluating free cash flow helps businesses determine how much money they have to invest in new opportunities, pay down debt, or return to shareholders. A robust free cash flow indicates a healthy, financially flexible company.

3) Analysing Operating Cash Flow Margin

The operating cash flow margin measures the proportion of cash generated from a company’s core operations relative to its revenue. By analysing this margin, businesses can assess their operational efficiency and ability to convert sales into cash. A higher operating cash flow margin suggests a more efficient and profitable business, while a lower margin might demonstrate operational inefficiencies or cost management issues.

4) Identifying Positive Cash Flow

Positive cash flow is a vital indicator of a company’s financial health, demonstrating that the business generates more cash than its expenditure. Identifying positive cash flow allows businesses to reinvest in growth, build reserves, and strengthen their financial stability. Consistent positive cash flow is essential to achieving long-term success and provides the flexibility to navigate challenges and capture opportunities.

Streamline WIP and revenue recognition—start your specialised Project Accounting Course today!

Example of Cash Flow Analysis

To better understand how Cash Flow Analysis works, let’s walk through an example highlighting the key steps and insights gained. This example will demonstrate how a business can employ Cash Flow Analysis to assess its financial health and make informed decisions.

1) Calculate Cash Flow from Operations

Start by calculating the cash flow from operations by examining all the cash generated from the company’s core activities. For instance, if a retail store generates £300,000 in sales and spends £200,000 on operating expenses, the cash flow from operations would be £100,000. This figure indicates the company’s ability to generate cash from its regular business activities.

2) Evaluate Cash Flow from Investments

Following that, evaluate the cash flow from investments by looking at cash spent on purchasing new assets or received from selling old ones. If the company invests £100,000 in new equipment and sells unused machinery for £50,000, the cash flow from investments would be -£50,000. Unlike the expenditures, this negative figure indicates an investment in the company’s future growth.

3) Analyse Cash Flow from Financing

Then, analyse the cash flow from financing by considering activities like borrowing, repaying debt, or issuing equity. For example, if the company takes out a loan of £150,000 and repays £50,000 in debt, the cash flow from financing would be £100,000. This positive cash flow suggests the company is raising capital to support its operations or expansion.

4) Review the Overall Cash Flow

Finally, review the overall cash flow by combining operations, investments, and financing figures. In this example, the company’s total cash flow would be £250,000 (£200,000 from operations, -£50,000 from investments, and £100,000 from financing). This positive overall cash flow indicates a solid financial position, enabling the business to continue operating, invest in growth, and manage its debts effectively.

Conclusion

In conclusion, Cash Flow Analysis is an indispensable tool for any business striving for long-term success. By carefully tracking and analysing cash flow, you gain the insights needed to optimise operations, make strategic investments, and ensure financial stability. Whether you’re navigating challenges or seizing new opportunities, mastering Cash Flow Analysis will empower you to make smarter decisions and propel your business forward. Ready to take control of your financial future?

Enhance working capital efficiency—join our Cash Cycle Management Course now!

Frequently Asked Questions

Which Technique is Used for Cash Flow Analysis?

The Direct Method and Indirect Method are commonly used for Cash Flow Analysis. The Direct Method lists actual cash inflows and outflows, offering a clear view of cash transactions. While, the Indirect Method starts with net income and adjusts for non-cash transactions, making it widely used owing to its simplicity and accrual accounting.

What Makes Cash Flows Difficult to Predict?

Cash flows are difficult to predict due to factors such as fluctuating sales, unexpected expenses, seasonal variations, and markets changes. Elements such as economic downturns, regulatory changes, and shifts in consumer behaviour also contribute to the uncertainty, making sure the forecasting is accurate.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Accounting Courses, including the Cash Flow Training, Project Accounting Course, and Cash Cycle Management Training. These courses cater to different skill levels, providing comprehensive insights into Wealth Management.

Our Accounting and Finance Blogs cover a range of topics related to Financial Management and Accounting Practices, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Analysis skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Cash Flow Training

Cash Flow Training

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please