We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The Cash Flow Statement is a crucial financial document that tracks the movement of cash within a business over a specified period. Unlike other financial statements that may focus on profitability or financial position, the Cash Flow Statement provides a clear view of how cash is generated and used in the business's day-to-day operations, investments, and financing activities. By detailing the actual inflows and outflows of cash, this statement helps stakeholders understand the company’s liquidity and overall financial health, ensuring that the business can meet its short-term obligations and make informed decisions about future investments and growth strategies.

Table of Contents

1) What is a Cash Flow Statement?

2) Structure of a Cash Flow Statement

3) How Cash Flow Statements Work

4) Steps to Prepare a Cash Flow Statement

5) Example of Cash Flow Statement

6) Difference Between Balance Sheet and Cash Flow Statement

7) Conclusion

What is a Cash Flow Statement?

A Cash Flow Statement is an essential financial report that provides insights into a company's Cash inflows and outflows over a specific period. Unlike the income statement, which focuses on profitability, the Cash Flow Statement highlights the actual Cash generated and used in operations, investing, and financing activities.

This statement helps stakeholders understand how a company manages its Cash position and whether it has enough cash to meet its obligations and fund its growth.

Structure of a Cash Flow Statement

The Cash Flow Statement is divided into three main sections that outline how Cash is generated and utilised:

Cash Flows from Operations

This section details the Cash generated or spent from core business activities. It includes receipts from customers and payments to suppliers and employees, providing a clear picture of the Cash impact of the company’s primary operating activities.

Cash Flows from Investing

Here, you'll find information about Cash Flows for acquiring or selling physical assets, investments, or other long-term assets. This section highlights expenditures on capital projects, acquisitions, or asset sales, offering insights into how the company invests in its future.

Cash Flows from Financing

This part covers Cash Movements related to financing activities, such as issuing or repurchasing stock, borrowing, and repaying loans. It shows how the company finances its operations and growth through various sources of capital. Maintaining a structured Cash Flow Budget ensures better financial planning and stability in managing these activities.

Unlock your Financial Potential—Join in our Capital Market Course today!

How Cash Flow Statements Work?

A Cash Flow Statement captures the cash and cash equivalents changes over a specific reporting period. It begins with the cash balance at the start of the period and then adjusts this figure by adding cash inflows from operations, investing, and financing activities.

Cash outflows, including payments and expenditures, are subtracted. The resulting figure is the ending cash balance for the period. This method clearly shows how effectively a company generates and uses cash. By analysing these changes, stakeholders can assess the company’s liquidity, solvency, and overall financial flexibility.

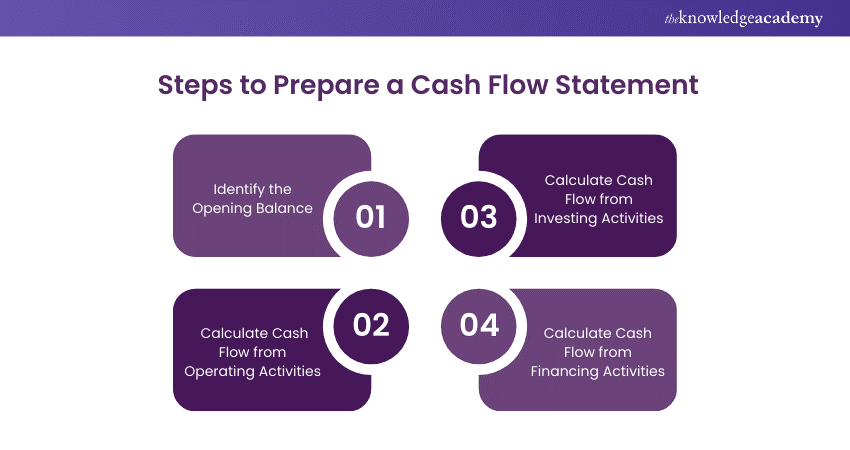

Steps to Prepare a Cash Flow Statement

Creating a Cash Flow Statement involves several key steps to ensure accuracy and completeness:

1) Identify the Opening Balance

Start with the Cash Balance from the end of the previous period. This amount will be the starting point for the current period’s Cash Flow Statement.

2) Calculate Cash Flow from Operating Activities

Determine Cash Flows from operating activities by adjusting net Income for non-cash items and changes in working capital. This includes depreciation, changes in accounts receivable, and inventory.

3) Calculate Cash Flow from Investing Activities

Add or subtract Cash Flows from investing activities by accounting for purchases or sales of property, plant, equipment, and investments. This reflects the company's strategic investments in its growth.

4) Calculate Cash Flow from Financing Activities

Sum up Cash Flows from financing activities, including new borrowings, debt repayments, and shareholder transactions. This shows how the company raises and repays capital.

Optimise your Cash Flow and boost efficiency with our Cash Cycle Management Training. Join today!

Example of Cash Flow Statement

To illustrate, let’s consider a simplified Cash Flow Statement for a fictional company:

Cash Flow Statement for XYZ Corp.

Operating Activities:

a) Net Income: £50,000

b) Adjustments:

c) Depreciation: £5,000

d) Increase in Accounts Receivable: - £10,000

e) Net Cash Provided by Operating Activities: £45,000

Investing Activities:

a) Purchase of Equipment: - £20,000

b) Proceeds from Sale of Investments: £10,000

c) Net Cash Used in Investing Activities: - £10,000

Financing Activities:

a) Issuance of Shares: £15,000

b) Repayment of Long-Term Debt: - £5,000

c) Net Cash Provided by Financing Activities: £10,000

Net Increase in Cash: £45,000 - £10,000 + £10,000 = £45,000

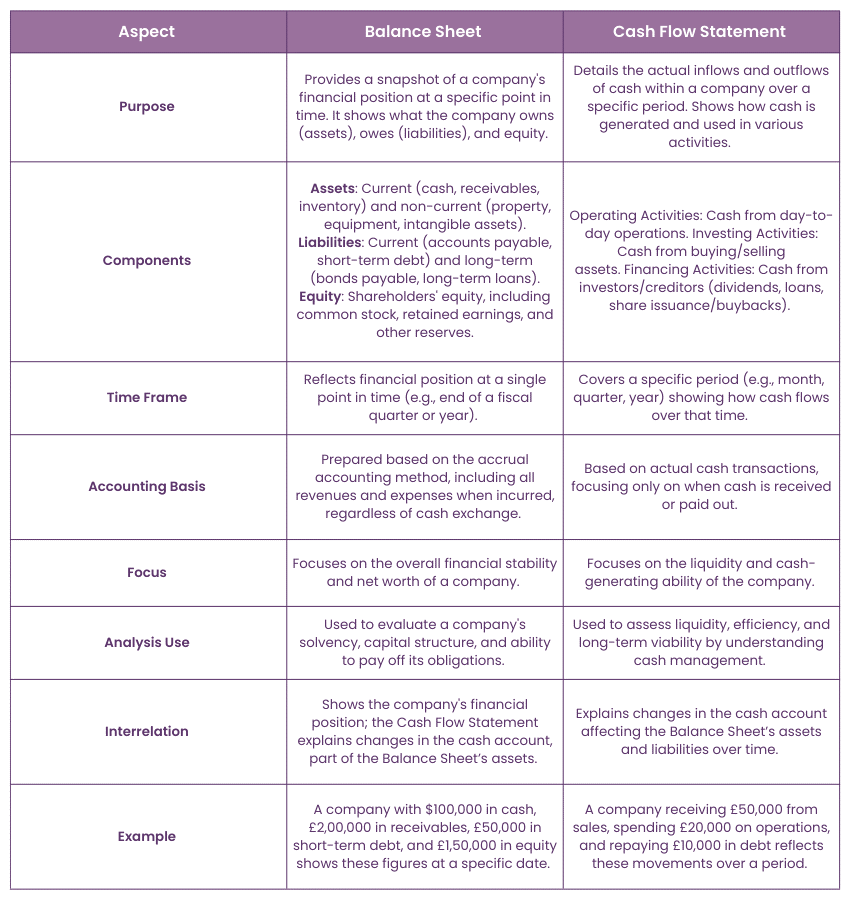

Differences Between Balance Sheet and Cash Flow Statement

The Balance Sheet and the Cash Flow Statement are two of the most critical financial statements used to assess a company's financial health. Here’s a breakdown of the differences between them:

Conclusion

A Cash Flow Statement is more than just numbers on a page; it’s a vital tool for understanding how Cash Flows through a business. Coupled with a reliable Cash Flow Forecast, it provides a comprehensive view of future financial health. Mastering the Cash Flow Statement can give you insights into operational efficiency, investment strategies, and financial health. Embrace the Cash Flow Statement to navigate the economic landscape with confidence!

Unlock the power of secure transactions—Join our Letters of Credit Training Course now!

Frequently Asked Questions

What is the Main Purpose of a Cash Flow Statement?

The main purpose of a Cash Flow Statement is to provide insights into how Cash is generated and used in a business. It helps assess the company’s liquidity and financial flexibility.

How Often Should a Cash Flow Statement Be Prepared?

A Cash Flow Statement is typically prepared monthly or quarterly, aligning with the company’s reporting cycle to ensure timely financial analysis and decision-making.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Accounting Courses. including the Cash Flow Training, Capital Market Training Course and Cash Cycle Management Training Course. These courses cater to different skill levels and provide comprehensive insights into Council Tax Bands.

Our Accounting and Finance Blogs cover a range of topics related to Cash Flow Training, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Cash Flow Training

Cash Flow Training

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please