We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you thinking about a career in Mortgage Advice? CeMAP is your gateway to a range of job opportunities in the financial services sector. Recognised throughout the UK, CeMAP provides the essential knowledge needed to navigate financial regulations, mortgage products, and the home-buying process. This blog explores various job roles you can pursue after earning your CeMAP Certification. We'll also look at the factors that affect your potential CeMAP Salary, offering insights into this rewarding career path.

Table of Contents

1) What is CeMAP?

2) Job Opportunities After Completing CeMAP

3) CeMAP Salary Based on Location

4) CeMAP Salary Based on Experience

5) CeMAP Salary Based on Job Roles

6) Factors Affecting CeMAP Salary

7) Conclusion

What is CeMAP?

The Certificate in Mortgage Advice and Practice (CeMAP) is a well-known qualification in the UK for people who want to become Mortgage Advisors. Awarded by the London Institute of Banking & Finance (LIBF), it is a key Certification in the financial services industry. CeMAP ensures that Advisors understand UK financial regulations, mortgage products, and the home-buying process. The Certification is divided into three modules:

a) CeMAP 1: UK Financial Regulation

b) CeMAP 2: Mortgages

c) CeMAP 3: Assessment of Mortgage Advice Knowledge

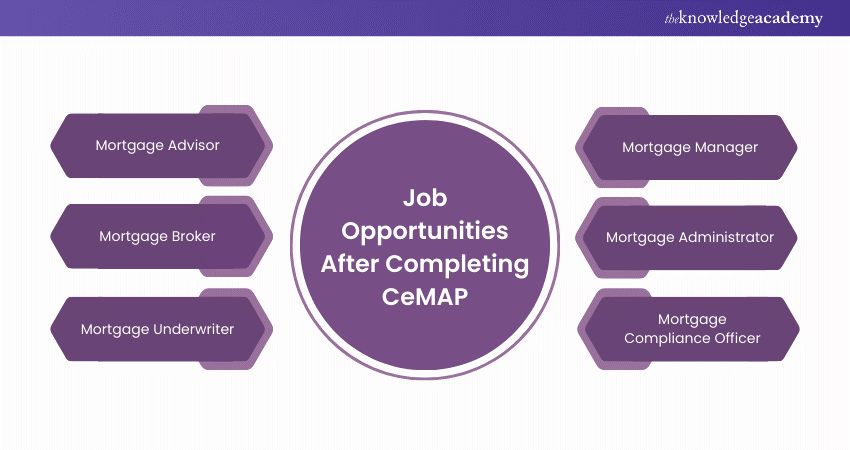

Job Opportunities After Completing CeMAP

With the growing demand for mortgage products, the need for financial professionals is expected to rise, creating a favourable job market. The Worth of CeMAP is evident as it opens many job opportunities in the mortgage and finance industry. Listed below are some of the key opportunities:

Mortgage Advisor

Mortgage Advisors provide clients with advice on mortgage products, helping them choose the most suitable options based on their financial situation. They assess clients' needs, explain different mortgage options, and guide them through the application process. They work in Banks, building societies, and independent mortgage broker firms.

Mortgage Broker

Mortgage Brokers work independently or for brokerage firms, offering advice to clients on various mortgage products from multiple lenders. They compare different mortgage deals and help clients find the best mortgage to meet their needs. They also assist with the application process, making it easier for clients to secure a mortgage.

Mortgage Underwriter

Mortgage Underwriters assess and evaluate mortgage applications to determine the creditworthiness and risk of potential borrowers. They review financial information, credit reports, and property valuations to make informed lending decisions. They work in Banks, mortgage lenders, and building societies.

Mortgage Manager

Mortgage Managers oversee a team of Mortgage Advisors and Underwriters. They ensure that mortgage applications are processed efficiently and in compliance with regulatory standards. Professionals with CeMAP or CII certification also manage relationships with lenders and other financial institutions. They play a key role in maintaining smooth operations and meeting business goals.

Mortgage Administrator

Mortgage Administrators provide administrative support to Mortgage Advisors and Brokers. They handle paperwork, process applications, liaise with clients and lenders, and ensure that all documentation is accurate and complete. They help keep the mortgage process organised and running smoothly.

Mortgage Compliance Officer

Mortgage Compliance Officers ensure that Mortgage Advisory practices comply with regulatory standards and legal requirements. They monitor internal processes, conduct audits, and provide training to staff on compliance issues. They work in financial services companies, regulatory bodies, mortgage brokerages.

Learn how to read and analyse financial statements with our Financial Management Course – Join today!

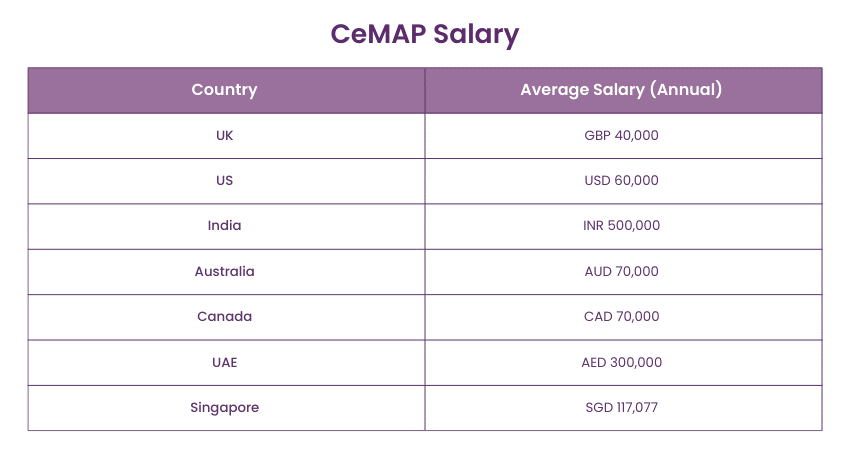

CeMAP Salary Based on Location

Below is a table showing the average salaries of Mortgage Advisors in the specified countries:

Source: Glassdoor

Note: Please remember that these figures depend on factors such as experience, location, and company size.

CeMAP Salary Based on Experience

Here is a table showing the Mortgage Advisors Salary in the UK. This data shows the potential earnings for professionals in this field at different career stages.

|

Experience Level |

Average Salary in the UK |

|

Entry Level |

£26,000 |

|

Mid-Level |

£35,000 |

|

Senior Level |

£45,000 |

|

Expert Level |

£60,000+ |

Source: Glassdoor

CeMAP Salary Based on Job Roles

The salary is based on their specific job title. Below is an overview of different roles and their salary ranges to help understand CeMAP’s compensation.

|

Job Title |

Average Salary in the UK |

|

Mortgage Advisor |

£40,000 |

|

Mortgage Broker |

£64,522 |

|

Mortgage Underwriter |

£30,458 |

|

Mortgage Manager |

£47,443 |

|

Mortgage Administrator |

£23,418 |

Source: Glassdoor

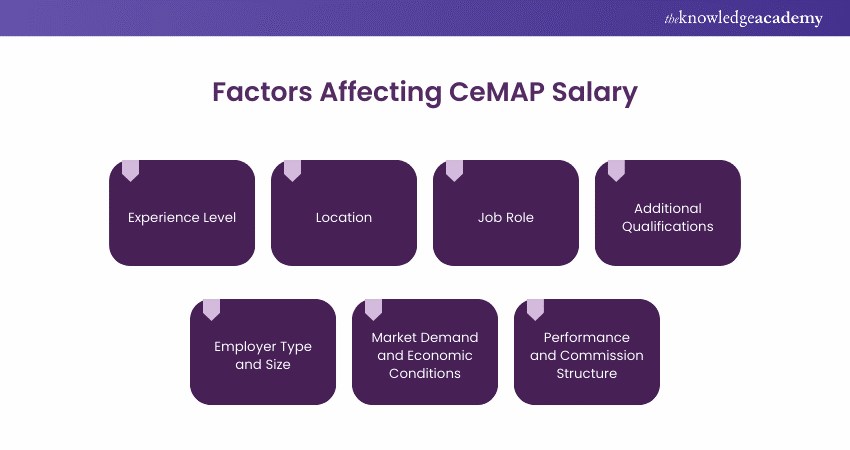

Factors Affecting CeMAP Salary

While the average salaries of each job role are mentioned above, several factors can influence a candidate's salary after completing the CeMAP qualification(s). Some key factors are as follows:

a) Experience Level: As with any profession, experience plays a vital role in determining salary. CeMAP Advisors with more years of experience tend to command higher salaries.

b) Location: Salaries can depend on the location. Major cities with a higher cost of living generally offer higher salaries to CeMAP professionals.

c) Job Role: The specific role within the mortgage industry can also impact salary. Senior positions such as mortgage consultants or Advisors typically receive higher compensation.

d) Additional Qualifications: Holding additional certifications or qualifications related to mortgage advising can positively impact your salary potential.

e) Employer Type and Size: The type and size of the employer can influence your CeMAP Salary. Large financial institutions or established mortgage companies often have more resources and can offer higher salaries than smaller firms or independent mortgage brokerages.

f) Market Demand and Economic Conditions: The need for mortgage professionals and the overall economic conditions can affect CeMAP salaries. In a competitive job market with high demand, salaries may be more competitive, whereas salaries may be impacted during economic downturns or low demand.

g) Performance and Commission Structure: Your organisation’s performance and commission structure can directly impact your CeMAP Salary. Meeting or exceeding targets, achieving high customer satisfaction, and earning commissions based on loan origination or sales can contribute to higher overall compensation.

Improve your understanding of Mortgage Advice and Practice with our CeMAP Course (Level 1,2 And 3) - Join today!

Conclusion

Completing the CeMAP qualification opens up a range of job opportunities in the financial services industry, from Mortgage Advisor to Compliance Officer. Each role offers unique challenges and rewards, with potential for career growth and development. Understanding the factors that affect CeMAP Salary can help you plan your career path effectively. With CeMAP, you’re well-equipped to succeed in this field of mortgage advice and practice.

Gain in-depth knowledge about the components of financial systems with our Diploma for Financial Advisers DipFA – Join today!

Frequently Asked Questions

How Much do you Usually pay a Mortgage Advisor?

Mortgage Advisors typically earn between £20,000 and £60,000 a year, depending on experience and location. Their pay can also include commissions based on the number of mortgages they arrange.

How do Mortgage Advisors get Clients?

Mortgage Advisors get clients through referrals from real estate agents, existing clients, and their professional network. They may also use advertising, online marketing, and attending industry events to attract new clients.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is the Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various CeMAP Courses, including the CeMAP Course (Level 1,2 And 3), Financial Management Course, and Diploma for Financial Advisers DipFA. These courses cater to different skill levels, providing comprehensive insights into Mortgage.

Our Business Skills Blogs cover a range of topics related to Mortgages, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Mortgage knowledge, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 7th Apr 2025

Mon 9th Jun 2025

Mon 18th Aug 2025

Mon 27th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please