We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

- CMI Level 7 Diploma in Strategic Management and Leadership Practice Training

- CMI Level 6 Award in Professional Management and Leadership Practice Training Course

- CMI Level 7 Award in Strategic Approaches to Equality, Diversity and Inclusion Training Course

- CMI Level 7 Award in Strategic Approaches to Health and Wellbeing Training Course

In the high-stakes world of corporate finance, a captivating duel unfolds in the corridors of power: Chief Investment Officer (CIO) vs Chief Financial Officer (CFO). Have you ever wondered who truly steers the financial ship and how their roles shape businesses' fortunes? As the core of financial strategy, each position carries distinct responsibilities and skill sets that significantly impact organisational success.

Explore with us the nuanced realms of Chief Investment Officer vs Chief Financial Officer —where every decision echoes through boardrooms and financial markets alike. Join us as we unravel the dynamic interplay between CIO and CFO, illuminating their paths to leadership and influence.

Table of Contents

1) Who is a Chief Investment Officer?

2) Roles and Responsibilities of CIO

3) Essential Skills of a CIO

4) Who is a Chief Financial Officer?

5) Roles and Responsibilities of CFO

6) Essential Skills of a CFO

7) Difference Between Chief Investment Officer and Chief Financial Officer

8) Similarities Between Chief Investment Officer and Chief Financial Officer

9) Conclusion

Who is a Chief Investment Officer?

A Chief Investment Officer is a senior executive responsible for managing an organisation's investments by establishing investment strategies and styles. The CIO oversees the entire investment process, including managing the organisation’s investment portfolio and developing both short- and long-term investment plans. They report on the progress, requirements, and performance of investments to a board of trustees or directors.

CIOs must have a robust financial background, and many organisations prefer candidates with specialised knowledge, such as a Chartered Financial Analyst (CFA) designation. In some cases, the CFO may also perform the duties of a CIO due to the overlap in their responsibilities.

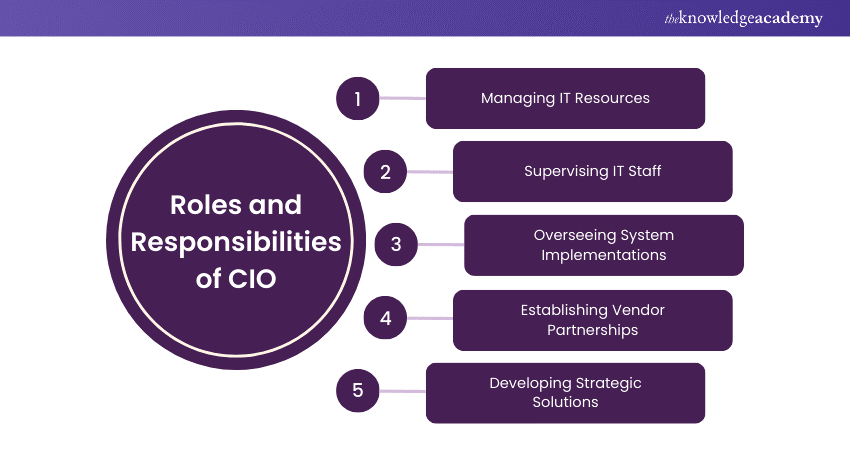

Roles and Responsibilities of CIO

A Chief Investment Officer plays a crucial role in ensuring the technological and strategic advancements of an organisation. Their responsibilities include:

1) Managing IT Resources: CIOs oversee the IT department’s budget and decide on the procurement and utilisation of essential equipment.

2) Supervising IT Staff: CIOs manage and mentor IT department staff, ensuring they perform their duties effectively and stay abreast of technological advancements.

3) Overseeing System Implementations: They plan and supervise each step of implementing complex systems, ensuring proper expertise is applied.

4) Establishing Vendor Partnerships: The CIO builds and maintains positive relationships with IT suppliers to ensure the procurement of high-quality equipment and services.

5) Developing Strategic Solutions: CIOs create and implement custom technological strategies and solutions to meet the firm’s needs and enhance employee productivity.

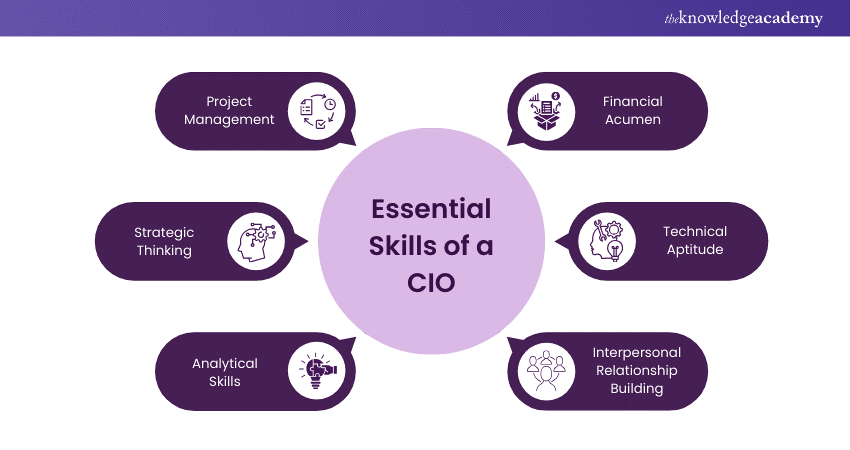

Essential Skills of a CIO

A successful Chief Investment Officer must possess a diverse set of skills to navigate the complexities of their role. These skills include:

1) Project Management: The capability to effectively plan, execute, and oversee projects to make sure they are completed on time and within budget.

2) Strategic Thinking: The ability to create and execute long-term strategies that align with the organisation’s goals.

3) Analytical Skills: Proficiency in analysing complex data and making informed decisions based on the insights.

4) Financial Acumen: Understanding and managing financial systems to support and enhance the organisation’s financial health.

5) Technical Aptitude: Strong knowledge of current and emerging technologies and their applications within the organisation.

6) Interpersonal Relationship Building: The ability to build and maintain positive relationships with teammates, stakeholders, and external partners.

Start your CMI Level 7 Diploma now with our CMI Level 7 Diploma In Strategic Management And Leadership Practice Training – sign up today!

Who is a Chief Financial Officer?

A Chief Financial Officer is an upper-level manager who oversees an organisation's financial operations. Straightly reporting to the Chief Executive Officer (CEO) and the board of directors, the CFO often holds a board seat. They collaborate closely with the Chief Operating Officer (COO) on business finance matters, sharing authority similar to that of a Chief Information Officer and COO.

The CFO builds and manages the organisation's financial department and is responsible for financial planning, record-keeping, risk management, resource allocation, profit and capital adjustments, and financial reporting. Working alongside accounting and finance teams, CFOs analyse the potential impacts of operational decisions.

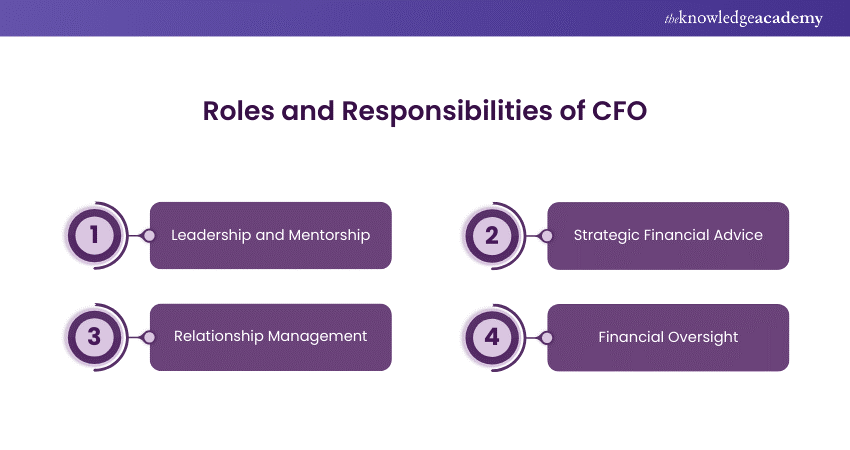

Roles and Responsibilities of CFO

As a pivotal figure in an organisation’s financial landscape, the Chief Financial Officer holds crucial responsibilities:

1) Leadership and Mentorship: Providing direction and mentorship to finance and accounting teams to ensure operational efficiency.

2) Strategic Financial Advice: Advising senior management on long-term business and financial planning strategies to maximise profitability and manage investment portfolios effectively.

3) Relationship Management: Cultivating strong relationships with senior management, external partners, and stakeholders to support collaborative efforts.

4) Financial Oversight: Overseeing financial, human resources, and IT procedures from a finance perspective to ensure compliance and efficiency.

Essential Skills of a CFO

A successful CFO must possess a wide range of skills to navigate the complexities of their role. These skills include:

1) Technical Proficiency: Essential technical skills for effective Financial Management and decision-making.

2) Data Analytics: Ability to analyse financial data to derive insights that support strategic decisions.

3) Budget Management: Expertise in managing budgets to optimise financial resources.

4) Financial Acumen: In-depth understanding of finance principles and practices.

5) Relationship Building: Capability to establish and maintain positive relationships internally and externally to advance organisational goals.

Explore CMI Level 7 Award In Strategic Approaches To Equality, Diversity And Inclusion Training for transformative leadership skills today!

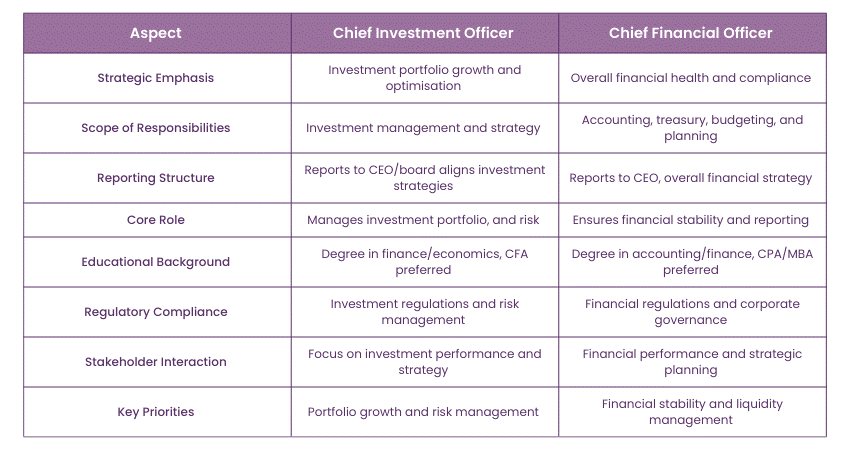

Difference Between Chief Investment Officer and Chief Financial Officer

The following are differences between Chief Investment Officer and Chief Financial Officer:

1) Strategic Emphasis

a) CIO: Focuses on the growth and optimisation of the organisation’s investment portfolio, aiming to maximise returns and manage risks.

b) CFO: Concentrates on the overall financial health of the company, including budgeting, financial reporting, and compliance.

2) Scope of Responsibilities

a) CIO: Primarily responsible for investment management, including the creation and implementation of investment strategies.

b) CFO: Oversees a broader range of financial activities such as accounting, treasury, budgeting, and financial planning.

3) Reporting Structure

a) CIO: Often reports to the CEO or the board of directors and works closely with other senior executives to align investment strategies with corporate objectives.

b) CFO: Typically reports to the CEO and is a key member of the executive management team, accountable for the overall financial strategy and direction of the company.

4) Core Role

a) CIO: Centres on managing the organisation’s investment portfolio, including risk assessment and market analysis.

b) CFO: Ensures the financial stability of the organisation, handling financial planning, analysis, and reporting.

5) Educational Background

a) CIO: Usually holds degrees in finance, economics, or related fields, often supplemented by certifications like Chartered Financial Analyst.

b) CFO: Generally, possesses a background in accounting or finance, with qualifications such as Certified Public Accountant (CPA) or Master of Business Administration (MBA).

6) Regulatory Compliance

a) CIO: Must ensure compliance with investment regulations and standards, focusing on ethical investment practices and risk management.

b) CFO: Responsible for adhering to financial regulations and standards, including auditing, financial reporting, and corporate governance.

7) Stakeholder Interaction

a) CIO: Interacts with stakeholders primarily regarding investment performance and strategy.

b) CFO: Engages with stakeholders on broader financial issues, including financial performance, projections, and strategic financial planning.

8) Key Priorities

a) CIO: Prioritises portfolio growth, investment performance, and risk management.

b) CFO: Focuses on financial stability, liquidity management, and overall financial strategy.

Achieve excellence with the CMI Level 7 Certificate In Strategic Management And Leadership Practice Training – join now!

Similarities Between Chief Investment Officer and Chief Financial Officer

Despite their differences, the CIO and CFO share several similarities:

a) Both play an important role in ensuring the financial success of the organisation.

b) Both positions require strong analytical skills, strategic thinking, and the ability to make data-driven decisions.

c) Both need to communicate effectively with stakeholders, including the board of directors and investors.

d) Both roles need an in-depth understanding of financial markets and regulations.

Excel in CMI Level 7 Strategic Management and Leadership with our CMI Level 7 Award In Strategic Management And Leadership Practice Training – join now!

Conclusion

Exploring the roles of Chief Investment Officer vs Chief Financial Officer reveals a dynamic interplay vital for organisational prosperity. From managing investments to ensuring financial health, their combined expertise shapes business strategy, driving sustainable growth and success. This synergy not only supports day-to-day operations but also sets the stage for long-term innovation and resilience in an ever-evolving business landscape.

Start your leadership journey with CMI Level 7 Training and unlock your full potential today!

Frequently Asked Questions

No, CFOs typically do not make direct investment decisions. Their focus is on financial planning, management, and reporting, ensuring compliance with regulations and supporting overall financial strategy within the organisation.

The Chief Executive Officer (CEO) is typically above the Chief Financial Officer (CFO). The CEO oversees the entire organisation's strategic direction and operations, while the CFO manages financial planning, risk management, and reporting. The CFO reports directly to the CEO, aligning financial strategy with the company's overall goals.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various CMI Level 7 Training, including CMI Level 7 Award In Strategic Management And Leadership Practice Training Course, CMI Level 7 Diploma In Strategic Management And Leadership Practice Training, CMI Level 7 Award In Strategic Approaches To Equality, Diversity And Inclusion Training Course. These courses cater to different skill levels, providing comprehensive insights into How to Become a CFO.

Our ILM, CMI Leadership & Management Blogs cover a range of topics related to CIO, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Leadership and Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming ILM, CMI Leadership & Management Resources Batches & Dates

Date

CMI Level 7 Award in Strategic Management and Leadership Practice Training Course

CMI Level 7 Award in Strategic Management and Leadership Practice Training Course

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please