We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Without a steady hand on the wheel, even the most cutting-edge vehicle can drift off course or worse.... head for a collision course! In the case of any company on the high-stakes and constantly evolving road of business, strong leadership is that steady hand. But leadership goes beyond mere charisma - it's rooted in sound Corporate Governance, and with it comes the invaluable function of Corporate Governance Best Practices.

From onboarding and educating directors and prioritising ethical conduct to aligning risk strategies with organisational goals, these Corporate Governance Best Practices guide companies through bumpy roads and towards long-term success. This blog sheds light on the best practices with a proven track record of organisational success. So read on and steer your organisation towards excellence with renewed strength and integrity.

Table of Contents

1) What is Corporate Governance?

2) Corporate Governance Best Practices to Implement Today

a) Onboard and Educate Directors

b) Define Roles and Responsibilities

c) Foster effective presentations

d) Hold directors accountable

e) Produce accurate financial reports

f) Align Risk Strategies with Organisational Goals

g) Prioritise Integrity and Ethical Conduct

h) Communicate Transparently with Shareholders

3) Conclusion

What is Corporate Governance?

Corporate Governance refers to the system of rules, practices, and processes through which a company is directed and controlled. Implementing these practices involves balancing the interests of a company's many stakeholders, including employees, senior management, shareholders, suppliers, local/state/federal government and customers.

When implemented across all management and operations levels, good Corporate Governance can:

1) Provide investors and other stakeholders with a clear idea of a company's direction and business integrity

2) Build trust with investors, public officials and the community

3) Ensure long-term financial viability, returns and opportunity

4) Facilitate the raising of capital and contribute to rising share prices

5) Improve customer retention

6) Reduce the potential for financial loss, risks, and corruption

Corporate Governance Best Practices to Implement Today

Corporate Governance Best Practices incorporate diverse aspects of board work. They entail critically examining Board Directors' qualities and characteristics, who they are as people, and how they approach governing an organisation. This is why effective Corporate Governance incorporates many different practices which are explored in detail below:

Onboard and Educate Directors

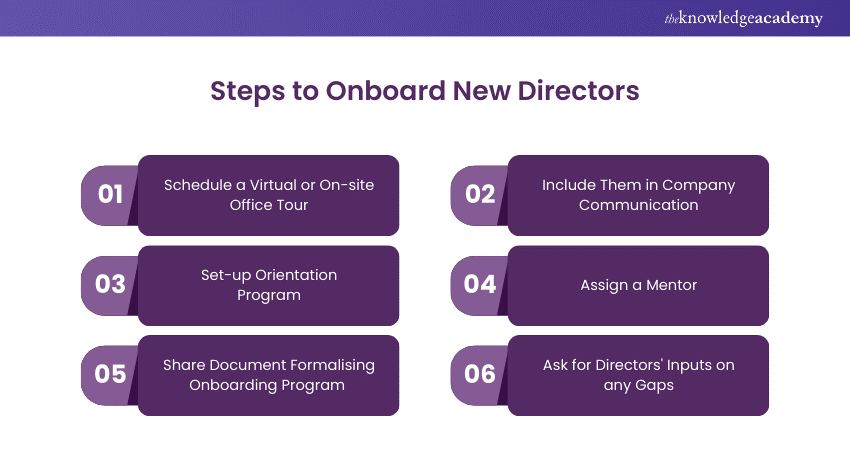

Corporate Governance Best Practices uphold corporations having a formalised process for Board Director orientation. The information being conveyed must include the organisation’s history, key accomplishments and a proper review of the board's organisational policies.

New Board Directors must be aware of their fiduciary and legal responsibilities and receive a copy detailing their duties and responsibilities. It's important for new Board Directors to receive the most recent copies of meeting minutes, financial statements, and the annual strategic plan.

Master the art of team Performance Management in our detailed Senior Management Training – Register now!

Define Roles and Responsibilities

Another feature of Corporate Governance Best Practices is to differentiate between the roles of the CEO and board Chair and have distinct roles for each. All Board Directors must have job descriptions and an outline that details their duties and responsibilities.

Boards may need to delegate some of their responsibilities to committees as needed, such as the:

a) Audit committee

b) Nominating committee

c) Compensation committee

This makes collaboration especially important.

Foster Effective Presentations

Boards oversee increasingly more aspects of a company. From incorporating Environmental, Social, And Governance (ESG) to enhanced Cyber Security rules, boards have enormous workloads with ballooning agendas to accompany them.

As board agendas grow, leaders and directors must deliver effective presentations to ensure no oversight. Boards can help leaders make the most of their time by implementing best practices related to boardroom presentations.

Hold Directors Accountable

The countless scandals that made headlines demonstrate why accountability has a strong position among the best practices for Corporate Governance. Boards must develop strong internal controls and monitor them regularly.

Accurate and transparent reporting systems with essential checks and balances are important elements of Corporate Governance best practices. Consider the following:

a) Ensure the board and management agree upon Quantifiable Performance Metrics/Key Performance Indicators (KPIs).

b) Monitor how these metrics and KPIs are reported.

c) Look into the board's disclosure practices and their transparency in its internal and stakeholder communications.

Additionally, such accountability includes:

a) Deciding on the correlation between attracting the most talented board nominees

b) Providing board nominees with enough compensation to make the board work worthwhile without creating a conflict of interest.

Master how to build and maintain trust with remote teams in our comprehensive Managing Remote Teams Course – Sign up now!

Produce Accurate Financial Reports

Thorough financial reporting is a legal mandate and essential to effective Corporate Governance. While regulations require comprehensive internal controls over financial reporting, ongoing financial reports are how boards gain insight into the organisation’s performance now and in the future.

It’s a best practice to provide the board with monthly financial reports that provide visibility into how the organisation’s finances have changed and the reasons for these changes. The financial reports must be clear and easy to read so even those new to the board can extract actionable information.

Monthly financial reports are often brief overviews. Therefore, accounting teams must be ready to deliver more specific data as requested by the board.

Align Risk Strategies with Organisational Goals

Another effective best practice pertains to boards aligning their Risk Management activities and strategies with the overarching goals of the company. Here are some points to consider:

a) Boards must use their Human Resources (HR) and other tools to identify and evaluate all forms of risk.

b) The board must work to develop the company's risk tolerance and risk profile.

c) The board must ensure the company has the proper framework and controls to monitor and mitigate risk when necessary.

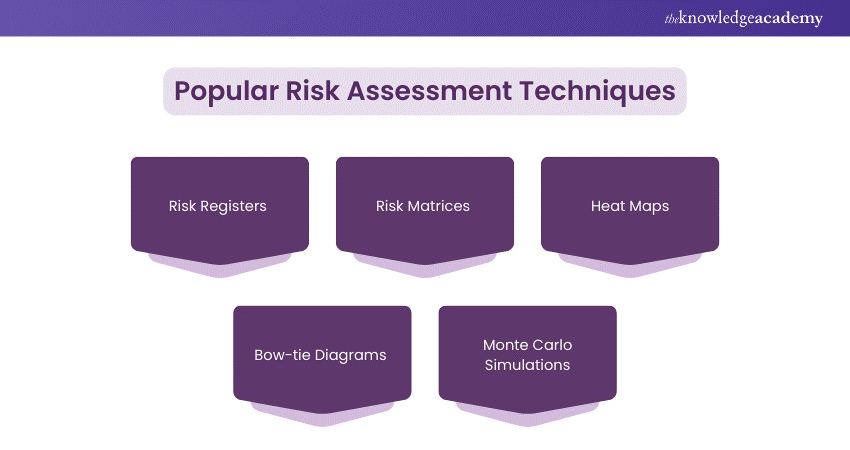

d) The board must engage in routine oversight of Enterprise Risk Management (ERM), be it in the form of a heat map, risk register, or other framework.

Prioritise Integrity and Ethical Conduct

Since Board Directors serve as the corporation's voice, they receive frequent requests to make public presentations. Good Corporate Governance requires Board Directors to regard their fiduciary duties when speaking for the corporation. The best nominees are people who exhibit the following:

a) A high level of ethics in their work.

b) A high level of honesty in their speech.

c) A high level of integrity in their relationships with others.

To support integrity and ethical dealings, boards must carefully write three important policies:

a) A conflict of interest policy.

b) A code of business conduct policy.

c) A whistleblower policy.

While Board Directors must declare conflicts of interest, they should refrain from voting on such matters.

Communicate Transparently with Shareholders

Shareholder activism has recently increased, particularly as ESG remains a fixture on board agendas. Effective Corporate Governance finds ways to understand and affirm shareholders' points of view.

While it’s natural to want to start greasing the wheels with shareholders immediately, the best governance practice is proactively identifying and responding to shareholder concerns.

Boards must work with their teams to monitor activist investors and develop response strategies to remedy any discontent. This helps organisations create a collaborative and productive environment for the annual meeting and beyond.

Conclusion

In conclusion, strong Corporate Governance is vital for ensuring effective leadership and long-term business success. Companies can build trust, elevate their reputation, and drive sustainable growth by adhering to Corporate Governance Best Practices such as ethical decision-making, transparency, and stakeholder engagement. This ultimately ensures resilient organisational leadership that can handle diverse challenges.

Struggling to improve team productivity in your new leadership role? Remedy that now by signing up for our Management Training for New Managers Course!

Frequently Asked Questions

The five features of Corporate Governance are:

a) Responsibility

b) Accountability

c) Transparency

d) Fairness

e) Risk Management

A Corporate Governance framework is designed to balance the interests of various stakeholders, including management, customers, shareholders, suppliers, financiers, government, and the community.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Management Courses, including the Management Training for New Managers Course and the Introduction to Managing People Course. These courses cater to different skill levels, providing comprehensive insights into How to Become a Board Member.

Our Business Skills Blogs cover a range of topics related to Corporate Governance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Leadership Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Directors Development Training Course

Directors Development Training Course

Thu 16th Jan 2025

Thu 13th Mar 2025

Thu 15th May 2025

Thu 10th Jul 2025

Thu 11th Sep 2025

Thu 13th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please