We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Navigating the maze of Council Tax Empty Property premium charges can feel like a daunting task for property owners. When your property sits empty and unfurnished, these extra costs can sneak up and haunt your budget. But fear not! This blog is your trusty guiding light through the twists and turns of these premium charges.

It's essential to know when and why Council Tax Empty Property premiums apply, and how to dodge those pesky fees. So, read on and master the art of managing your Council Tax like a pro, keeping your wallet happy and your property in check!

Table of Contents

1) Council Tax on Empty Property

2) Second Homes Council Tax Premium

3) Empty Property Premium Charges Examples

4) Council Tax on Second Homes or Empty Properties

5) How to Avoid Paying Council Tax on an Empty Property?

6) Conclusion

Council Tax on Empty Property

Council Tax on empty properties can vary depending on the local council’s policies. Generally, you will have to pay Council Tax on an empty property, but there are some exceptions and potential discounts:

1) Short-term Exemptions: If your property has recently become empty and unfurnished, you might be eligible for a short-term exemption, usually up to one month.

2) Major Repairs: If your property is undergoing significant repairs or renovations, you may be exempt from Council Tax for a specific period.

3) Special Circumstances: Some properties, such as those owned by charities or uninhabitable due to major damage, may qualify for long-term exemptions.

4) Deceased Owners: If you are handling the property sale for a deceased owner, you do not need to pay Council Tax until probate is granted. After probate, you might get an additional six-month exemption if the property remains unoccupied.

Second Homes Council Tax Premium

For Council Tax purposes, a second home is a dwelling that is not one's sole or primary home but is substantially furnished. Consider these points associated with Second Homes Council Tax Premium:

1) Section 80 of the Levelling Up and Regeneration Act 2023 permits us to apply a premium on second homes.

2) The Act requires that the first decision to impose this class of premium be taken 12 months before the financial year to which it would apply. The City of London decided to apply this premium on 7 March 2024.

3) The city intends to add a 100% Council Tax premium to the bill for any property liable for Council Tax and classed as a second home from 1 April 2025, resulting in a 200% Council Tax charge.

Are you struggling with the intricacies of Tax filing processes? Remedy that with our Tax Filing Course now!

Empty Property Premium Charges Examples

An additional Council Tax premium is applied to properties that have been empty and substantially unfurnished for one year or more. (Before 1 April 2024, this premium was applied after two years or more.) The premium is tied to the property, so a change in Council Tax liability does not affect it.

If you purchase or lease a property that has already been empty and substantially unfurnished for more than one year, and it remains so after you assume liability, you will be required to pay the additional charge. Here are some examples of empty property premium:

Property Empty Entry-Level (Between 1-5 Years)

|

Council Tax Charge |

£1,000 |

|

Empty Property Premium Charge |

£1,000 |

|

Total Amount Payable |

£2,000 |

Property Empty Mid-Level (Over 5 Years But Less than 10)

|

Council Tax Charge |

£1,000 |

|

Empty Property Premium Charge |

£2,000 |

|

Total Amount Payable |

£3,000 |

Property Empty Expert-Level (Over 10 Years)

|

Council Tax Charge |

£1,000 |

|

Empty Property Premium Charge |

£3,000 |

|

Total Amount Payable |

£4,000 |

Council Tax on Second Homes or Empty Properties

It's crucial to determine if your property qualifies for a Council Tax discount while it's empty and understand the charges for a second home. Let’s explore it in more details:

1) Second Homes and Between Lets: If your property is furnished and used as a second home or between lets, you generally won't qualify for a Council Tax discount unless the property is required for your job. If you must live in a second property for work, while your main home is elsewhere and you pay Council Tax on it, you can claim a 50% discount on the second property.

2) Empty and Unfurnished Properties: If you own or rent a property that becomes empty and unfurnished, you can apply for a 100% Council Tax discount. You can apply for it for one month from when it first became empty and unfurnished. If the property remains empty and unfurnished after one month, the full Council Tax becomes due, and you must pay the total charge. Additional surcharges apply to properties that remain empty and unfurnished for two years or more as shown below:

|

From |

Period |

Empty Homes Premium Charged |

|

1st April 2013 |

Property remains empty and unfurnished for two years or more |

50% on top of the full council tax charge |

|

1st April 2019 |

Property remains empty and unfurnished for two years or more |

100% on top of the full council tax charge |

|

1st April 2020 |

Property remains empty and unfurnished for five years or more |

200% on top of the full council tax charge |

|

1st April 2021 |

Property remains empty and unfurnished for ten years or more |

300% on top of the full council tax charge |

|

1st April 2024 |

Property remains empty and unfurnished for one year or more |

100% on top of the full council tax charge |

Want to understand the implications of GST on business operations? Register for our GST Course now!

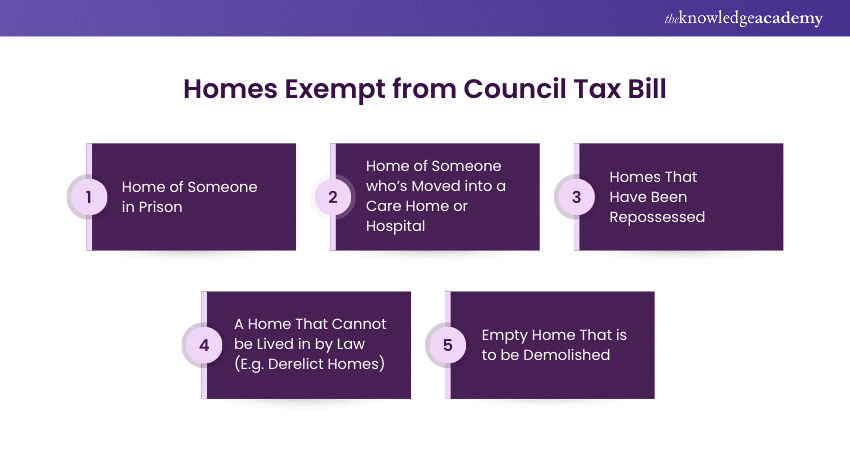

How to Avoid Paying Council Tax on an Empty Property?

Let’s explore a few ways you can avoid paying Council Tax on an empty property:

1) Contact Your Council: You may be entitled to a council tax exemption for various reasons. If a property is being refurbished, you may qualify for a temporary exemption. This also applies to empty homes of individuals in full-time residential care or those who have passed away. You can also opt for challenging the Council Tax band on derelict properties.

2) Let Your Property Out: Renting out your property transfers the responsibility of paying Council Tax to the new tenants at whatever rate band your property is in. This is a straightforward way to avoid paying Council Tax on an empty property.

3) Appoint a Property Guardian: For property owners who need flexibility, appointing property guardians can be beneficial. Guardians on a 28-day notice period offer the advantages of full-time occupants without long-term commitment.

Conclusion

In conclusion, understanding Council Tax Empty Property premium charges and exploring exemptions, letting options, or appointing property guardians can help you avoid unnecessary costs. We hope this blog encourages you to stay informed and proactive about effective property management.

Want to elevate your expertise in procedures for filing tax returns? Our Introduction to UAE Corporate Tax Training will guide you - Sign up now!

Frequently Asked Questions

You are not required to pay council tax when handling the property sale for a deceased owner as long as the property stays vacant until probate is granted.

Council tax is paid by only one person, the ‘liable person’, but the council tax bill is a joint liability for adults living together. Any sufficiently able adult, not on a low income and living with his or her parents, is jointly liable.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Tax Courses, including Tax Filing Course, GST Course and VAT Training. These courses cater to different skill levels, providing comprehensive insights into Different Types of Wealth Management.

Our Business Skills Blogs cover a range of topics related to properties, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your wealth management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

GST Course

GST Course

Fri 29th Nov 2024

Fri 24th Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 25th Jul 2025

Fri 26th Sep 2025

Fri 28th Nov 2025

Halloween sale! Upto 40% off - Grab now

Halloween sale! Upto 40% off - Grab now

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please