We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Feeling weighed down by the burden of Council Tax as a pensioner? You're not alone in this struggle. As the cost of living continues to rise, many pensioners find themselves stretching their fixed incomes to cover essential expenses. This is where a Council Tax Reduction for pensioners can make a significant difference, offering much-needed financial relief.

So, what are the secrets to lowering your Council Tax bill? How can you ensure you're not missing out on valuable support? This blog delves into the various provisions available for pensioners, helping you uncover potential reductions and take control of your finances. Let's explore the ins and outs of Council Tax reduction for pensioners and help you keep more money in your pocket.

Table of Contents

1) Do Pensioners Pay Council Tax?

2) Who is Eligible for Council Tax Support?

3) How to Claim Council Tax Support?

4) Council Tax Reduction: If you get the Guarantee Part of the Pension Credit

5) Council Tax Reduction: If you get the Savings Part of the Pension Credit but not the Guaranteed Part

6) Council Tax Reduction: If you Don't get Pension Credit

7) Conclusion

Do Pensioners Pay Council Tax?

Yes, Council Tax is mandatory for pensioners, just like other residents. Council Tax is a local tax charged on residential properties to fund various local services such as rubbish collection, policing, and street maintenance. It is typically paid by the occupants of a property, which includes pensioners.

However, paying Council Tax can be a significant financial burden for pensioners, especially those living on a fixed income. Recognising this, the government and local councils have introduced several provisions and reductions specifically designed to ease the financial strain on pensioners.

Who is Eligible for Council Tax Support?

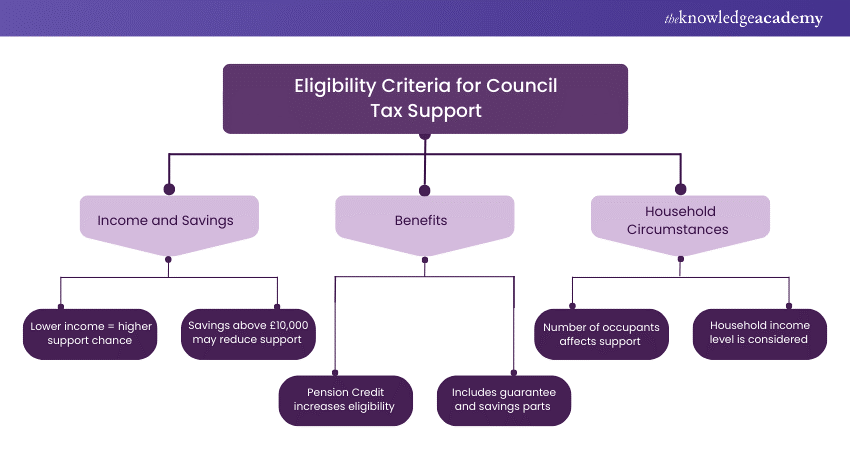

Eligibility for Council Tax support depends on several factors, including income, savings, and the specific benefits one receives. Pensioners may qualify for different levels of support, ranging from partial to full reductions. Here’s a breakdown of the key criteria:

1) Income and Savings: Pensioners with lower incomes and modest savings are more likely to qualify for support. The threshold for savings usually excludes the first £10,000, but anything above this amount may reduce the level of support.

2) Benefits: Receiving certain benefits can increase eligibility for Council Tax support. These benefits include pension credit, which includes both the guarantee and savings parts.

3) Household Circumstances: The number of people living in the household and their income levels can also affect eligibility.

Unlock comprehensive GST knowledge with our GST Course and become an expert in navigating complex tax regulations today!

How to Claim Council Tax Support?

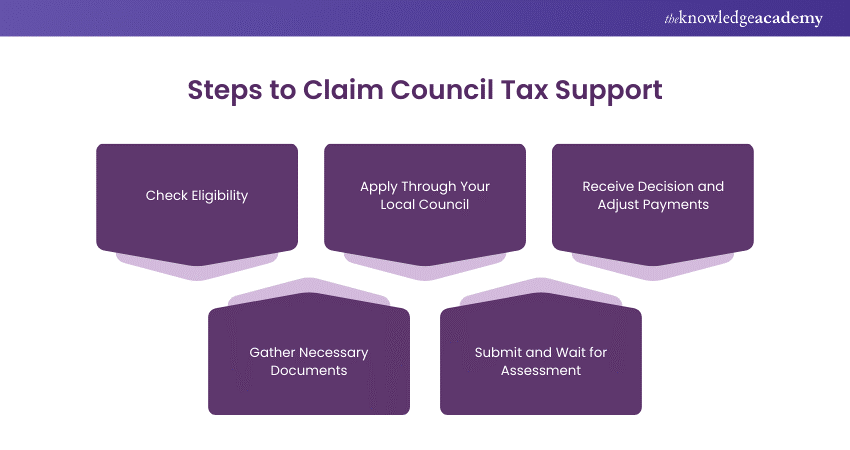

Claiming Council Tax support involves a few straightforward steps. Here’s a step-by-step guide:

1) Check Eligibility: Before applying, ensure you meet the eligibility criteria. Use online calculators provided by local councils or government websites to get an estimate.

2) Gather Necessary Documents: Prepare documents that prove your income, savings, and benefits. These might include bank statements, benefit letters, and pension statements.

3) Apply Through Your Local Council: Applications are usually made through your local council’s website. Most councils offer an online application process, but paper forms are also available if preferred.

4) Submit and Wait for Assessment: After submitting your application, your council will assess it and determine your eligibility and the level of support you can receive. This process may take a few weeks.

5) Receive Decision and Adjust Payments: If approved, your Council Tax bill will be adjusted accordingly. Make sure to check your new bill and understand the reduced amount you need to pay.

Transform your career with our comprehensive Accounting Courses – register now to gain essential skills for success!

Council Tax Reduction: If You Get the Guarantee Part of the Pension Credit

Receiving the guarantee part of the Pension Credit typically entitles pensioners to the most significant level of Council Tax support. This benefit is designed to ensure a minimum income level for pensioners. If you qualify:

1) Full Reduction: Many councils offer a full reduction in Council Tax, meaning you may not have to pay anything at all.

2) Automatic Qualification: If you receive the guarantee part of the Pension Credit, you often automatically qualify for this reduction without the need for additional assessments.

Enhance your understanding of credit control and streamline financial processes with our expert-led Introduction To Credit Control Course!

Council Tax Reduction: If You Get The Savings Part of The Pension Credit But Not The Guaranteed Part

Pensioners receiving the savings part of the Pension Credit but not the guarantee part may still be eligible for Council Tax reduction, though the level of support might be lower. Here’s what you need to know:

1) Partial Reduction: You may receive a partial reduction in your Council Tax. The exact amount depends on your income and savings.

2) Means-tested Support: This reduction is typically means-tested, meaning the council will assess your financial situation in more detail to determine how much support you qualify for.

Unlock the secrets of VAT with our in-depth VAT Training and boost your skills in tax compliance!

Council Tax Reduction: If You Don't Get Pension Credit

Even if you don't receive pension credit, you might still be eligible for a reduction in council tax. Other factors are considered to ensure those in need receive support:

1) Low-income Pensioners: If your income is low, you may still qualify for a reduction. Each council has specific criteria, so it's essential to check with your local authority.

2) Disability Benefits: Receiving certain disability benefits can also make you eligible for Council Tax reduction.

3) Single-person Discount: If you live alone, you can apply for a single-person discount, which reduces your Council Tax bill by 25%.

Discover how to master tax filing with our expert-led Tax Filing Course - gain essential skills and boost your career!

Conclusion

Council Tax Reduction for Pensioners offers valuable financial relief through various discounts and exemptions. By understanding eligibility criteria and the application procedure, pensioners can significantly reduce their tax burden. Embrace these opportunities to enjoy a more comfortable and stress-free retirement with extra funds for life's little luxuries.

Advance your career with our in-depth Tax Courses - and acquire beneficial skills and knowledge to excel in the field!

Frequently Asked Questions

What Entitlements and Benefits Are Available to me as a Pensioner?

As a pensioner, you may be entitled to Council Tax reductions, Pension Credit, winter fuel payments, free bus passes, and potential discounts on utility bills. Eligibility varies based on income and benefits received.

What is Council Tax Reduction For Pensioners?

Council Tax Reduction for Pensioners is a financial relief scheme designed to help seniors lower their Council Tax bills. It provides various discounts and exemptions, easing the burden on those with fixed incomes.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Tax Courses, including Tax Filing Course, GST Course and VAT Training. These courses cater to different skill levels, providing comprehensive insights into Financial Management.

Our Business Skills Blogs cover a range of topics related to Tax, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Tax Filing Course

Tax Filing Course

Fri 21st Mar 2025

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please