We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Ever found yourself puzzled by the term CTC in job offers? You’re definitely not alone! CTC, or Cost to Company, is essential for grasping your total compensation package, far beyond just your take-home pay. In this blog, we’ll demystify the CTC Full Form and break down its components, including basic salary, bonuses, and allowance.

Whether you’re stepping into a new role or negotiating your salary, understanding CTC can empower you to make informed career decisions. Ready to discover what CTC truly means for you? Let’s dive in and explore the details together!

Table of Contents

1) Full Form of CTC

2) What is CTC?

3) What are the Components of Cost to Company?

4) How to Calculate CTC?

5) What is Gross Salary?

6) What is In-hand Salary?

7) Difference Between CTC, Gross Salary & In-hand Salary

8) Which Advantages are Covered Under CTC?

9) What Does CTC Document Stand for?

10) What Does CTC Factory Stand for?

Full Form of CTC

CTC stands for Cost to Company. It is a term used by employers to describe the total amount of money they spend on an employee in a year. CTC includes all the benefits and expenses associated with hiring an employee, such as salary, allowances, and any other perks.

What is CTC?

CTC is the total salary package that a company offers to an employee. It encompasses all the direct and indirect benefits that an employee receives from the employer. While it includes the take-home salary, it also covers other components like bonuses, allowances, and even some non-cash benefits. Understanding CTC helps employees know their total earnings from a job beyond just the basic salary.

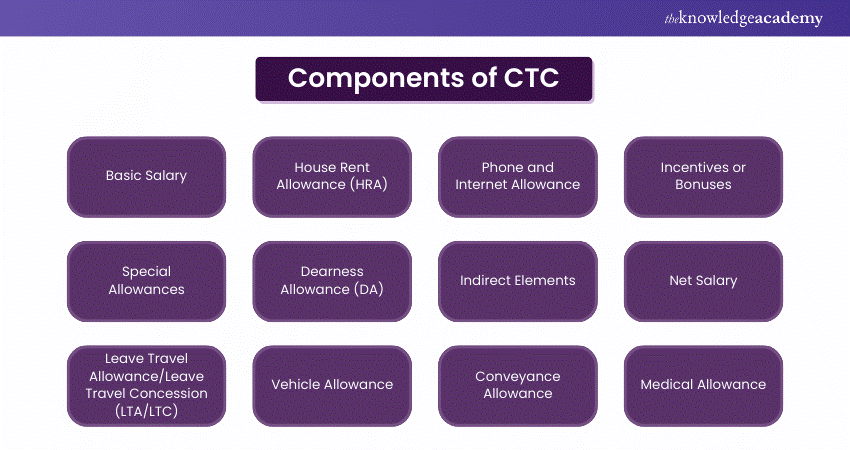

What are the Components of Cost to Company?

CTC is made up of various components that together form the total compensation package. Here are the key components of CTC:

a) Basic Salary: The basic salary is the core part of an employee's salary. It forms the foundation of the CTC and is typically a fixed amount that does not include any allowances or bonuses.

b) House Rent Allowance (HRA): It is an allowance given to employees to cover their housing expenses. It is usually a percentage of the basic salary and varies based on the city of residence. Employees can streamline their HRA Calculation in Excel to determine the exact exemption amount based on salary components and tax regulations.

c) Phone and Internet Allowance: Some companies offer allowances to cover phone and internet expenses, especially if the job requires frequent communication or remote work.

d) Incentives or Bonuses: Incentives or bonuses are additional payments given to employees based on their performance or the company’s performance. These can be annual bonuses, sales incentives, or performance-linked bonuses.

e) Special Allowances: Special allowances are additional payments that depend on the company’s policies and the employee’s role. These may include allowances for travel, meals, or other specific needs.

f) Dearness Allowance (DA): It is an allowance provided to employees to help them manage the rising cost of living due to inflation. It is often a fixed percentage of the basic salary and is revised periodically.

g) Indirect Elements: Indirect elements of CTC include benefits that aren’t paid directly to the employee but are part of their total compensation package. These may include contributions to provident funds, gratuity, and health insurance.

h) Net Salary: It is the amount an employee takes home after deductions. It is the actual salary that an employee receives in their bank account.

i) Leave Travel Allowance/Leave Travel Concession (LTA/LTC): LTA or LTC is an allowance provided to employees to cover travel expenses when they go on leave. It is often subject to certain conditions and tax exemptions.

j) Vehicle Allowance: Some companies offer a vehicle allowance to employees who need to use their personal vehicles for work-related purposes. This allowance helps cover fuel and maintenance costs.

k) Conveyance Allowance: A conveyance allowance is provided to employees to cover their daily commute expenses from home to work and back.

l) Medical Allowance: Medical allowance is an amount given to employees to cover medical expenses. It can be a fixed amount or reimbursement based on actual expenses incurred.

Learn the latest HR trends with our HR Strategy Training – Join today!

How to Calculate CTC?

Calculating CTC involves adding up all the components. The formula for calculating CTC is:

CTC = Basic Salary + HRA + Allowances + Bonuses + Indirect Benefits

To get a clearer picture of what you’ll receive, you can also subtract any statutory deductions like provident fund contributions and taxes to find the net salary.

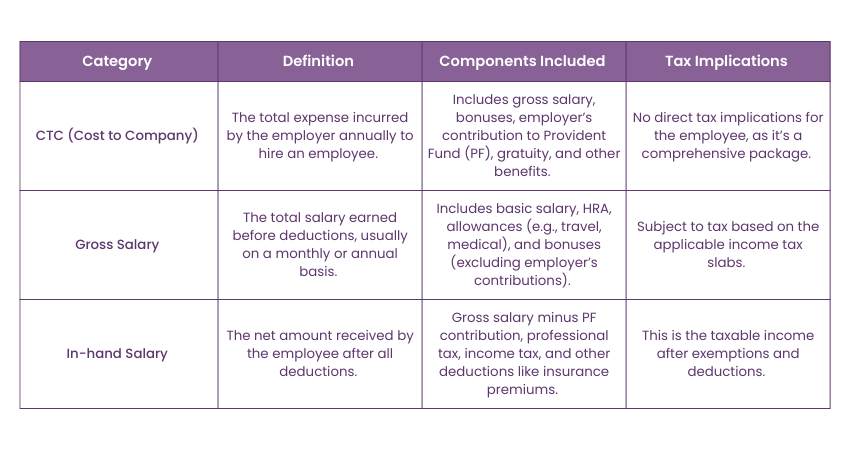

What is Gross Salary?

Gross Salary is the total salary before any deductions like taxes or provident fund contributions. It includes the basic salary, HRA, allowances, and bonuses. Gross Salary is a part of the CTC and is usually mentioned in job offers.

What is In-hand Salary?

In-hand Salary refers to the amount an employee receives after all deductions. It is also known as take-home pay and is the actual salary that gets credited to an employee’s bank account. In-hand Salary can be calculated by subtracting deductions from the Gross Salary.

Difference between CTC, Gross Salary & In-hand Salary

Understanding the difference between CTC, Gross Salary, and In-hand Salary is crucial. This table summarises the difference between the three:

Which Advantages are Covered Under CTC?

CTC covers a wide range of advantages that may include:

a) Financial Benefits: These include the basic salary, allowances, and bonuses that contribute to an employee’s earnings.

b) Health Benefits: Companies often include health insurance, which includes medical expenses for employees and their families.

c) Retirement Benefits: Contributions to provident funds and gratuity are part of the CTC, helping employees save for retirement.

d) Other Perks: Some companies offer additional perks like free meals, gym memberships, and wellness programs.

Enhance your earning potential with our HR Analytics Course – Join today!

What Does CTC Document Stand for?

A Certified True Copy (CTC) of a board resolution is a physical document that must be printed on the Company's letterhead. It affirms the outcome of a particular resolution passed by the Board of Directors.

What Does CTC Factory Stand for?

In employment terms, "CTC" stands for "Cost to Company," representing the total annual expense a company incurs for an employee. This includes the gross salary, allowances, bonuses, benefits, and any additional perks provided. It's important to understand that CTC is not equivalent to the take-home salary, as it represents the overall cost of employing an individual.

Discover everything about Appraisals Learn their purpose, process, and benefits with our detailed guide.

Discover LinkedIn Salary Insights to explore competitive pay trends and advance your career decisions!

Conclusion

In conclusion, grasping the CTC Full Form is crucial for both employers and employees. It offers a comprehensive view of an employee’s compensation, encompassing both monetary and non-monetary benefits. By dissecting the components of CTC, you can truly understand your earnings and what an employer is offering. Knowing how to calculate CTC and understanding its elements will guide you towards informed decisions regarding your career and finances.

Understand the structure of the HR department with our Human Resource Budgeting Training – Join today!

Frequently Asked Questions

What is a CTC Invoice?

Continuous transaction controls (CTC) allow law enforcement agencies, such as tax administrations, to collect data on business activity in their respective countries. Unlike traditional invoice reporting, data is obtained directly from data management systems in real-time.

What is CTC Compliance?

CTC Compliance refers to a regulatory framework where businesses must submit transaction data to tax authorities in real-time.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various HR Leadership Courses, including Human Resource Budgeting Training, HR Analytics Course, and HR Strategy Training. These courses cater to different skill levels, providing comprehensive insights into HR Interview Questions

Our HR Blogs cover a range of topics related to HR, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your HR Budgeting skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please