We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The ever-changing landscape of Cyber Security is encouraging more complex threats in the financial and banking sector. Financial institutions like banks allow people to save and increase their wealth. Besides, banks also lend money to companies that are willing to expand their operations. Thus, the growth of a country’s economy is directly related to the banking sector.

However, banking technology has undergone significant changes due to digitalisation. Digitalisation is giving rise to major Cyber Security threats in the financial sector. 71% of the total data breaches are related to the theft of financial resources.

A Cyber threat is carried out by cybercriminals to steal or disrupt an organisation’s reputation by stealing their sensitive data. Besides, the primary source of Cyber Security threats is data breaches, computer viruses, and denial of services. In this blog, you’ll learn about the following topics:

Table of Contents

1) What is the need for Cyber Security in Banking?

2) Benefits of Cyber Security in Banking sector

3) Common Cyber Security threats faced by Banking sectors

4) How to implement Cyber Security practices in Banking?

5) Best Cyber Security framework for the banking sector

6) Conclusion

What is the need for Cyber Security in Banking?

Cyber Security helps organise methods, procedures, and technologies to minimise cyber threats. So, Cyber Security Essentials protect networks, programs, and devices against malware, hackers, data thefts, unauthorised access, and viruses.

From the banking industry's perspective, Cyber Security practices help safeguard users' assets. However, banks need help strengthening their Cyber Security practices as more individuals are cashless.

Besides, individuals rely on digital modes like debit cards or credit cards to carry out their transactions. Due to such reasons, banks should implement Cyber Security practices that can prevent data theft or leakage. Consequently, it ensures the financial resources of bank holders and people involved in the transactions are safe

Are you interested in acquiring skills to mitigate cyber-related risks? Then, register with the CCNA Cybersecurity Operation Training now!

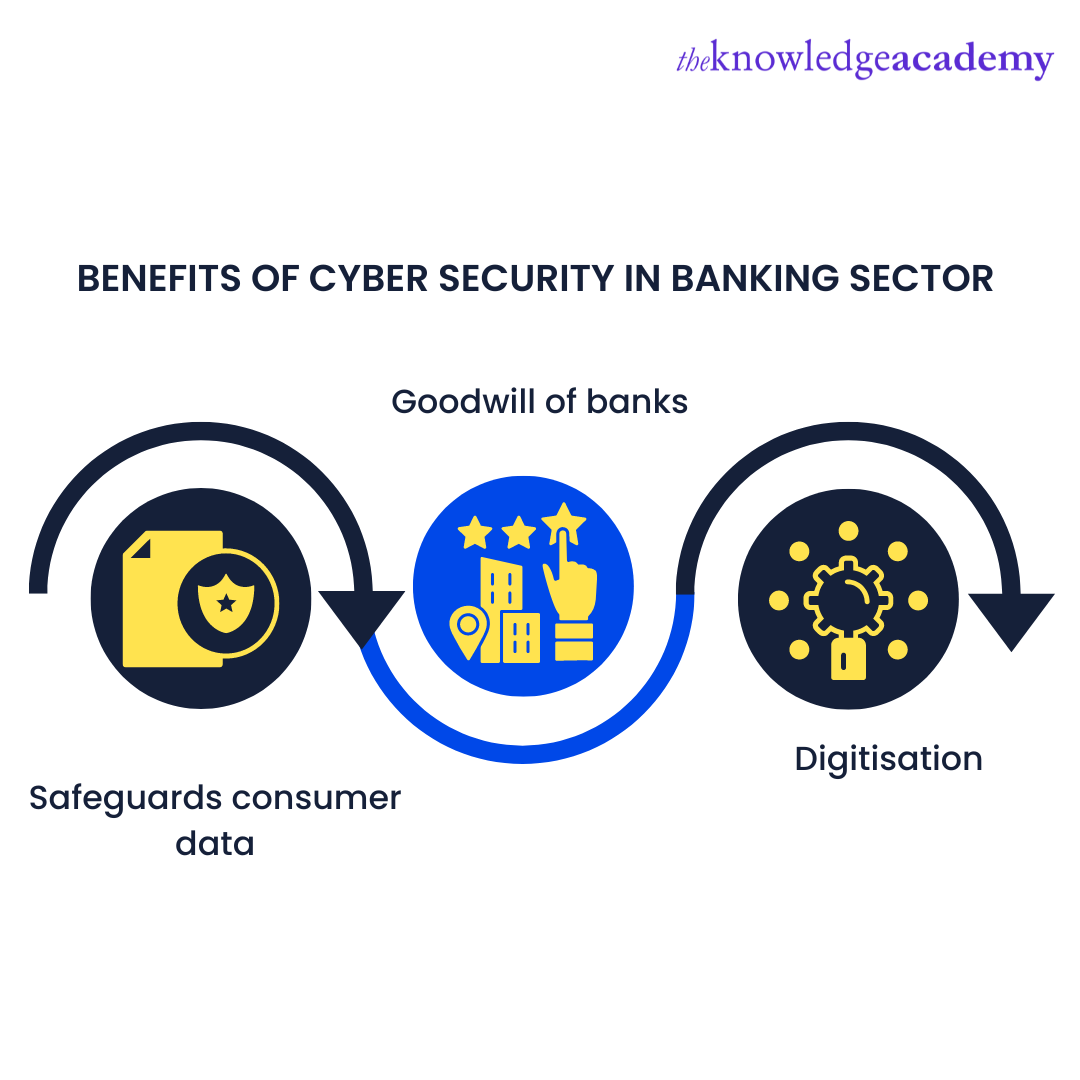

Benefits of Cyber Security in Banking sector

The use of Cyber Security is no longer limited to IT-based organisations. It benefits almost all types of businesses, regardless of the size and nature of the operation. Mainly, Cyber Security works as a backbone of the banking industry.

Banks must have the ability to handle over a million transactions per day. Thus, banks should implement security practices to protect their data against malicious attacks. Cyber Security offers the below-mentioned benefits to customers:

Safeguards consumer data

A single cyber-attack can damage a bank's reputation and lead to the loss of consumer assets. Where card fraud is involved, bank account holders can retrieve their lost money from the bank. However, in cases where data infringement is involved, retrieving funds becomes time-consuming. Moreover, it can give rise to doubts among customers. So, all banks should implement Cyber Security practices to safeguard consumer data.

Goodwill of banks

A data breach is a significant issue in banks as it can lead to the loss of consumer data. Consequently, consumers prefer to use something other than the services of banks that can safeguard their valuable data. Furthermore, the reason behind data breaches is the need for robust Cyber Security practices. Thus, having a Cyber Security measure helps banks assess current security measures' efficiency and shield essential data.

Digitisation

Digitisation trends are ruling every industry. As a result, people rely on digital platforms to send money, conduct meetings, and transfer funds. So, to align with these trends, banks should upgrade their functions by implementing an effective Cyber Security strategy. It prevents hackers from accessing banking apps.

Do you want to identify attacks and vulnerabilities before infiltration professionally? You can now register with the CompTIA Cybersecurity Analyst CySA+ Certification course for expert training and help.

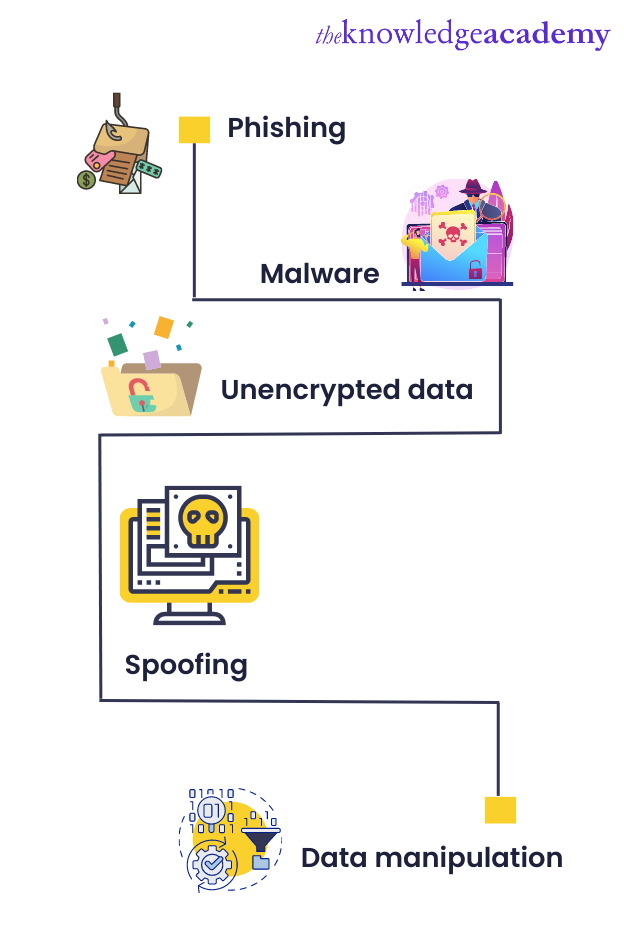

Common Cyber Security threats faced by banking sectors

Technological advancements encourage cybercriminals to polish their skills and carry out more dangerous attacks. As a result, the number of cybercrimes is increasing daily in the financial industry. Even large and well-known bankers find it difficult to stop the cyber-attacks each time. Some of the common Cyber Security attacks performed on banks are as follows:

Phishing

Phishing attacks aim to obtain confidential data of bank account holders like debit cards, credit card details, etc. Malicious attackers carry out these attacks at the time of electronic interaction. Here, the attackers trick users into revealing sensitive data such as OTPs and login credentials.

Malware

Customer appliances such as mobile devices and computers perform digital transactions. Thus, it is essential to secure these end-to-end consumer appliances. If such end-to-end appliances are infected with malware, it can cause significant damage to the bank's security infrastructure.

It mostly happens when an end-to-end infected customer appliance is linked to the bank's network. The bank's network can undergo severe damage due to malware injection. Malware attacks occur when there's an interaction between confidential data and the user's device infected with malware.

Unencrypted data

One of the significant threats in the banking sector occurs when the data is not encrypted properly. This allows the hackers to alter and control the data according to their requirements. Consequently, it gives rise to severe data breaches in the banks. The information stored on the bank's computers and cloud platforms should be appropriately encrypted to prevent this issue. It prevents hackers from accessing the data or using it.

Spoofing

Hackers use spoofing as the latest tool to carry out cyber-attacks. Most cyber threats that occur within financial institutions are related to spoofing. Here, the hackers create a fake website URL of a bank to trick the bank account holders. This website looks similar to the original website, and it functions in the same manner. So, the customers enter the data, such as login credentials, and the hackers steal it. The hackers use this data later on to steal money.

Data manipulation

Due to technological advancements, cyber-attacks are no longer limited to data theft. However, it's false because data manipulation attacks allow hackers to gain unauthorised access. Data manipulation attacks occur due to the entry of a dangerous actor into an organisation's system.

Next, the issue becomes severe when the hacker makes unwanted changes to the recorded data to cause havoc in the bank's IT infrastructure. For example, detecting when a worker modifies customer information data becomes hard.

This makes the data appear accurate and disrupt how data is recorded in future. When manipulations are left undetected for a long time, they can lead to more destruction.

Are you an advanced professional with high experience and knowledge in a wide range of security areas? Then check out our Microsoft Cybersecurity Architect SC100 course now!

How to implement Cyber Security practices in banking?

One of the significant objectives of Cyber Security in the banking sector is to protect consumers' assets and data. Nowadays, most consumers prefer to go cashless. Therefore, it is increasing the popularity of online banking transactions. You can safeguard the banking institutions by following the below-mentioned Cyber Security measures:

United security

Banks invest a lot of money, effort, and time to utilise the best technology. However, banks may need help to handle the technology from a centralised platform. This can increase the chances of data breaches and third-party interventions. So, it's highly recommended for banks adopt a united security solution. The elements of a united security solution are connected and work together.

Multi-factor authentication

Multi-factor Authentication (MFA) technique is used for verification purposes. Here, the customer only gets access to the system after entering two to three login credentials. A customer's login credentials include opts, fingerprints, and passwords. Banks should use MFA as it offers protection for sensitive information.

Consumer awareness

Consumer awareness is the critical element of a Cyber Security plan. Here, the user should be informed about the importance of securing their credentials. In addition, banks should encourage consumers to report any suspicious activity detected in the bank account in real time.

Anti-malware and antivirus applications

A firewall helps to improve security. However, a firewall can only prevent attacks when anti-malware and antivirus products are already installed. In addition, banks can switch to the firewall's latest application to prevent attacks that can destroy the systems.

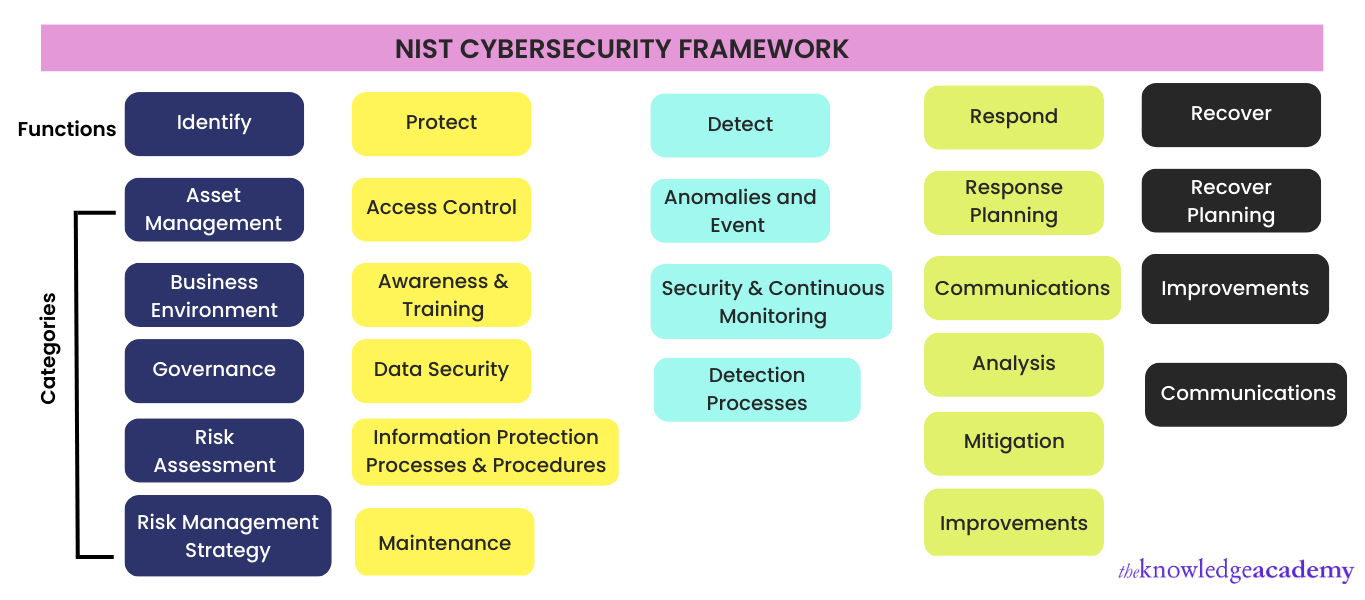

Best Cyber Security framework for the Banking sector

Cyber Security issues are impacting almost all types of organisations. Mainly, it harms large banks that store a massive volume of personal data and a list of transactions. So, banks should implement Cyber Security procedures and solutions to attain the best results. There are two crucial Cyber Security frameworks, as follows:

NIST Cyber Security Framework

The National Institute of Standards and Technology (NIST) framework requires organisations to follow a standard method and language. It is helpful in the following ways:

a) It helps to define Cyber Security posture of an organisation that is being implemented currently.

b) It helps to explain the Cyber Security measures an organisation should focus on.

c) It allows organisations to identify and focus on growth-based opportunities included in the risk management framework.

FFIEC Cyber Security Assessment Tool

Federal Financial Examination Council (FFIEC) conducts various programs to spread awareness related to Cyber Security risks. Most importantly, it aims to teach financial institutions how to evaluate and detect Cyber Security risks. It also helps financial organisations to devise plans to minimise cyber threats.

Conclusion

The Banking sector and its operations are becoming highly dependent on digitalisation and technical trends. But unfortunately, hackers use this as an opportunity to carry out cyber-attacks like embezzling funds and stealing their consumers' necessary credentials. As a result, there’s a rise in cyber theft in the banking and financial industry.

Financial institutions are facing huge losses due to data theft and theft of funds. Several banks also launched complaints related to the unauthorised access of third parties on their portal. Banks should have well-planned Cyber Security practices to minimise risks associated with bank and user data or funds.

To enhance your skills and gain in-depth knowledge in Information security you can register for our CISSP Training courses now.

Upcoming IT Security & Data Protection Resources Batches & Dates

Date

Certified Cyber Security Professional (CCS-PRO)

Certified Cyber Security Professional (CCS-PRO)

Fri 21st Mar 2025

Fri 23rd May 2025

Fri 22nd Aug 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please