We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In this era of digitalisation, all sectors of the economy are going through rapid transformation. The Banking sector is no exception. Digital Transformation in Banking means a shift from the conventional method of providing services to offering online or digital services. It also means a change in the backend, which is required to support this transformation.

After the Covid-19 pandemic, a severe need for contactless banking services was felt. According to McKinsey Digital’s report, the number of digital bank users has increased by 23% in the past two years. This makes it relevant to learn about Digital Transformation in Banking. Let us now understand how it works and why it is so important for the banking sector.

Table of Contents

1) What does Digital Transformation in Banking mean?

2) Need for Digital Transformation in Banking

3) Tools and technologies used in Digital Transformation in Banking

4) What are the main factors driving the notable shift toward Digital Transformations in the Banking Industry?

5) How has digitalisation in Banking appealed to younger generations?

6) How has the Banking sector used technological advancements?

7) What is the influence of fintech startups in the Digital Transformation in Banking?

8) How are banks handling cybersecurity challenges?

9) Benefits of Digital Transformation in Banking

10) Conclusion

What does Digital Transformation in Banking mean?

Digital Transformation in Banking means shifting to digital and online services. But it is not as simple as it sounds. To provide digital and online services, huge changes in backend processes are also required. This is necessary to facilitate automation and digitalisation. To make it possible, banks must deliver end-to-end digital customer experience. It requires integrating technologies into business processes, strategies, and products so that they perform tasks that were earlier done manually.

The Banking sector today is witnessing rapid change, and Banks of all sizes need better coordination among them. Enhanced branding, expansion, loyal customer base, and new areas of services are a few advantages of increased cooperation. With the help of digitalisation, Banks can collaborate with each other and other financial institutions. It helps them come up with new innovative products and ideas for customers. It boosts the productivity, efficiency and profitability of banks.

Transform your IT skills with our comprehensive Artificial Intelligence (AI) for IT Professionals Course. Join now and unlock your true capabilities!

Need for Digital Transformation in Banking

Why do Banks need a shift from traditional to digital platforms? The reason is simple: their customers are also shifting to digital platforms. Today, life has become faster, and people don’t have time for traditional and time taking Banking services. Customers now don’t prefer to use cheques and drafts that frequently. They need a faster and more convenient way of Banking services-especially transactions. It has decreased the demand for traditional Banking services associated with payment methods, and the demand for digital payment methods has increased parallelly.

This shift in consumer preferences and expectations has made the Banking industry undergo major changes. The focus of Banks' digital strategy revolves around meeting customer needs and exceeding their expectations. Banks now deliver customers a personalised product experience, transparency, and security.

Banks that don't adapt to the latest trends in technology will be expensive to manage. For the staff also, it will be harder to work in such organisations. While on the consumers’ part, it will become less accessible.

The covid-19 pandemic has been another big factor that told us about the need for the digitalisation of Banking. Through the digitalisation of Banking services, social distancing could be maintained. Today, even big tech firms like Amazon and Google also accept the importance of providing financial services.

Tools and technologies used in Digital Transformation in Banking

Digital Transformation can be implemented in the Banking sector with the help of the following tools and technologies:

1) Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are the most commonly used digital tools and techniques for providing digital banking services. Artificial Intelligence has the potential to be employed within the banking sector for the purpose of suggesting products and services that align with individual customer requirements. It can also provide information through personalised or targeted Banking. It does not only help the Banks retain their customers but also identify their potential customers.

For example, AI can be programmed to detect a particular set of customers and inform them about a specific insurance policy through e-mails or messages. AI can track the behaviours and specifications of the customers, such as their gender, income, profession etc. and then recommend similar products of their interest. Segmentation of customers is very important in Banking.

The next most used feature of AI in Banking is customer satisfaction through automated responses. Chatbots are the best example. They respond to the queries of the customers and provide personalised solutions. These days, banks have started using local languages to enhance user experience.

2) Cloud Computing: Cloud Computing is another popular and useful technology in Banking. Cloud Computing represents a form of readily available service that can be accessed as needed. It provides access to shared data, applications and storage online. It enables banks to store and process data on remote servers. This way, it reduces the dependency on local systems. This technology has transformed the banking sector drastically.

Storing data on the Cloud offers Banks increased security, faster processing and, most importantly, better coordination among different branches. Banks use Cloud Computing for the following purposes:

a) Customer Relationship Management (CRM): Banks use Cloud Computing to manage customer data and interactions. This is known as Customer Relationship Management (CRM).

b) Fraud detection: Banks use the Cloud for fraud detection by analysing any suspicious activity.

c) Data analysis: Banks also use Cloud Computing for advanced data analysis from multiple sources.

d) Mobile applications: Mobile applications, or ‘apps’ as popularly known, are the most visible face of Banking digitalisation. These apps are designed in a way that they should be very user-friendly. With Banking apps, customers get hold of their financial data, bank accessibility, personal financial management and many other services.

3) Blockchain technology: Blockchain technology is a chain containing digital information stored in a public database called blocks. It is a distributed database existing on multiple systems at the same time. Blockchain is very helpful in the banking sector. It can help in the following ways:

a) Security: Blockchain can avoid the risks of payment fraud involved in Banking transactions by adopting a secure distributed ledger platform.

b) Authenticity: Blockchain ensures the integrity of data.

c) Economic benefits: Blockchain makes all Banking operations effective and efficient. It reduces transaction fees across cross-borders, corporate payments and remittances.

What are the main factors driving the notable shift toward Digital Transformations in the Banking industry?

There are several factors which are driving a considerable shift towards Digital Transformations in the Banking Industry. These factors are as follows:

a) The younger generations are preferring online banking for everyday as well as for any major transactions.

b) Due to a huge advancement in the technological industry, transactions have become faster, easier and safer. Customers of the Banking sector are now expecting these smooth and efficient Banking experiences.

c) People are more accustomed to more technologies and the personalised services that they receive from them. Therefore, they want these personalised services in the Banking sector as well.

d) Customer expectations to create more robust mobile Banking applications have been on the rise. The features such as balance inquiries, fund transfers, bill payments, etc., will provide convenience and efficiency to conduct financial transactions on their mobile devices.

How has digitalisation in Banking appealed to younger generations?

It is observed that the younger generations prefer self-service, fast and convenience, in every sector. After the Banking sector had started implementing digitalisation in the Banking industry, they are more attracted towards different financial policies and other features which they can use to make any kind of transaction through their mobile devices. Several financial apps like PayPal, gPay, Venmo, etc., has features like account opening, loan applications, and the ability to manage and update their financial details.

Moreover, with Digital Transformation in Banking sector, there is 24/7 customer support, through several digital channels, which provides instant assistance and feedback in case of any difficulties. Moreover, these new additions in the Banking sector, has allowed the younger generations to receive personalised Banking services. With the help of AI, they can now get their personalised financial goals, get saving tips, get investment ideas, and more, based on their income and financial behaviour.

How has the Banking sector used technological advancements?

With the help of technological advancements, the Banking sector is more fuelled towards maximum digitalisation. Rapid improvements as well as developments in mobile devices, AI, Machine Learning, etc., this sector is now able to provide quick and easy to understand solutions to their customers. As the number of mobile devices have increased, digital Banking has taken a new turn. Customers can make payments easily on the go without having to stand in long queues. With the help of AI and ML, customers can now track their expenses and form their financial plans and goals which are personalised only for them.

What is the influence of fintech startups in the Digital Transformation in Banking?

Fintech startups have some significant influences in the Digital Transformation in Banking. Some of these key areas are:

a) These startups majorly utilise any new and advanced technologies, for example, blockchain, AI, etc., which help them push any previous traditional practices. This allows them to stay relevant and increase their chances to stay on top of the market.

b) These fintech companies majorly focus on improving user experience and offer them digital services which are fast, easy and convenient. This facilitated a rapid Digital Transformation in Banking industry.

c) Fintech startups mainly provide their financial services through digital channels. This also influenced the Banking industry to implement software’s and technologies to provide financial services to their customers.

d) Fintech startups have many new business models that they are implementing. This is making them stay ahead in the financial market. The traditional Banking sector is also now reconsidering their old and traditional business models and implementing new ones which will help them stay relevant in the market and be at par with these startups.

e) Fintech startups are also inspiring the Banking sector to implement new and advanced risk management strategies and security technologies.

How are Banks handling cybersecurity challenges?

Banks are implementing some strategies which are helping them to handle various cybersecurity challenges. Some of these strategies are as follows:

a) Banks are investing in new and advanced cybersecurity technologies such as encryption, firewalls, etc., which are helping them to protect against all unauthorised access, data breaches and other cyber threats.

b) They are also conducting regular cybersecurity assessments which are helping Banks to identify their vulnerabilities and errors through which they can get potential threats.

c) Banks are continuously training their employees so that in any case of cybersecurity incidents the employees can handle any minor cybersecurity threat, firsthand.

d) Banks are implementing measures so that they can have incident response plans in place and quickly respond to any cybersecurity incidents.

e) They are also adopting ML and several other technologies so that they can enhance their cybersecurity efforts. Using these technologies, are allowing them to detect and respond to any threat quickly and accurately.

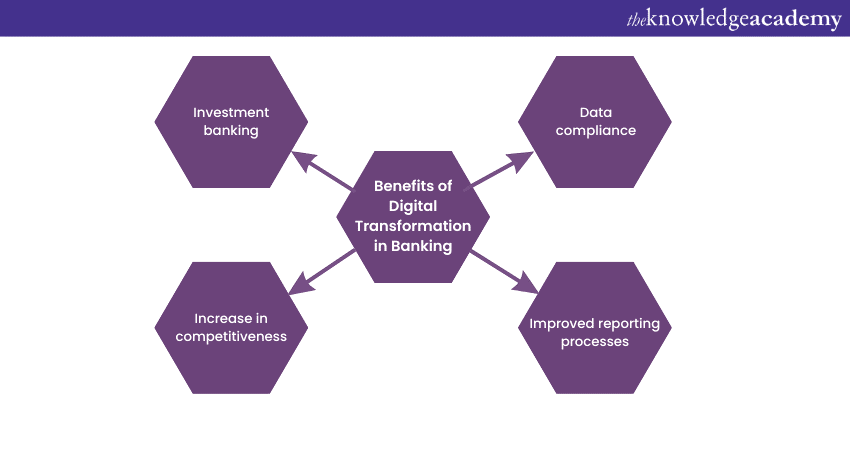

Benefits of Digital Transformation in Banking

Here are a few benefits of Digital Transformation in Banking:

a) Investment Banking: The digitalisation of Banking has reduced intermediate processes and substitute methods to access intellectual data. It has made transactions easier and faster. Digitalisation in Banking has replaced investment Banks with small investors brought together on one centralised digital platform.

It has also made investment Banks focus on short-term goals and let immediate customer requirements guide their technology investments which have proved good for digital enterprises and businesses.

b) Data compliance: Shifting to digital platforms has also made it easier for banks to abide by data compliance. Now the data can be stored safely and shared on multiple platforms simultaneously. Also, the Cloud system gives timely updates, which reduces Banks’ worries about updating related regulations.

c) Increase in competitiveness: Banks that adopt new technologies to facilitate their customers stay ahead of their competitors. It also makes them more client-inclusive and tech-savvy.

d) Improved reporting processes: With the help of digitalisation, Banks can now ensure real-time and consolidated data. It significantly improves how quickly and accurately Banks can handle reporting. Banks can now keep an eye on changing trends and detect problems in their early stages. These facilities allow the management to generate reports easily.

Conclusion

Digital Transformation in Banking is a deep concept. It does not only mean an operational shift towards integrating digital technology. It has a deeper meaning of what we can say is a ‘cultural shift.’ It means adapting the mindset and optimising operations and value delivery to customers. When executed successfully, it will help banks compete in the global market.

Take charge of your professional growth with our Digital Transformation Certification Course!

Frequently Asked Questions

These are some of the challenges that are faced by Banks upon digitalisation:

a) Regulatory compliance

b) Organisational silos

c) Security concerns

d) Customer experience

e) Change management

Here are some benefits of digital Banking:

a) 24*7 availability

b) Paperless Banking

c) Automatic payments of bills

d) Online payments for online shopping

e) Remote areas can also facilitate Banking services.

The Knowledge Academy offers various Digital Transformation, including Digital Transformation Certification. These courses cater to different skill levels, providing comprehensive insights into Artificial Intelligence in Banking.

Our Business Improvement blogs cover a range of topics related to Digital Transformation, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

Upcoming Business Improvement Resources Batches & Dates

Date

Digital Transformation Certification

Digital Transformation Certification

Wed 5th Feb 2025

Thu 27th Mar 2025

Wed 14th May 2025

Wed 3rd Sep 2025

Wed 3rd Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please