We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Let’s assume that you’re managing your business finances, but the sheer volume of data is overwhelming. Given this scenario, you might be looking for a tool that can simplify everything. Understanding How to Use Excel for Accounting can be your key to transforming chaos into clarity. Wondering how it can save you time and reduce errors?

In this blog, we’ll explore How to Use Excel for Accounting to handle everything from basic to complex financial analysis. Excel’s powerful features can help you manage your finances more effectively. Let’s dive in and explore its potential for your accounting needs!

Table of Contents

1) What is Excel in Accounting?

2) How to Use Excel for Accounting?

a) Reconciling Bank Accounts With Excel

b) Tracking Unpaid Invoices in Excel (A/R)

c) Managing Unpaid Bills in Excel (A/P)

d) Monitoring Cost of Goods Sold Using Excel

e) Generating Amortisation Schedules in Excel

f) Operating a General Ledger Through Excel

g) Cash-basis Accounting in Excel

3) How to Implement Accrual Accounting in Excel?

4) Conclusion

What is Excel in Accounting?

Excel is a valuable accounting tool for self-employed individuals or very small businesses with basic accounting needs. It is simple to use yet highly adaptable. For many small businesses already using the Microsoft 365 Office suite, Excel is cost-effective as it is included in the package, unlike specialised accounting software which would incur additional costs.

Although Excel can be set up to generate comprehensive financial statements using true double-entry accounting methods, building such tools requires significant effort. Additionally, the manual workload involved in performing the actual accounting tasks can be labour-intensive and prone to errors.

How to Use Excel for Accounting?

Microsoft Excel is indeed an invaluable tool for accountants, offering capabilities beyond traditional bookkeeping software. Here are several ways you can use Excel to enhance your accounting:

1) Reconciling Bank Accounts with Excel

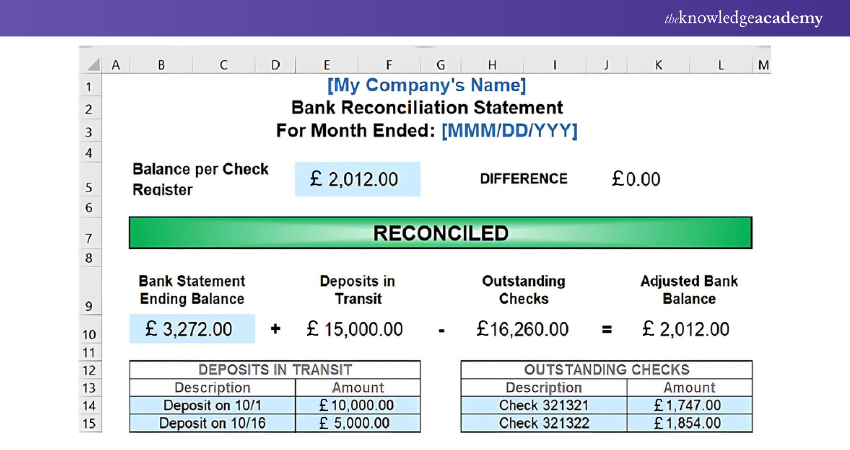

To assure accuracy, bank account reconciliation with Excel involves contrasting recorded transactions in accounting records with those mentioned in bank statements. Excel's sorting and filtering features make it simple for users to find any differences between the two sets of data.

By using this technique, accounts can be properly reconciled and ensure that the bank statement and the financial records indicate the same activities. Accountants can avoid errors and speed reconciliation tasks by utilising Excel's data organisation and analysis features.

Also, customers may customise their reconciliation procedures to meet their unique accounting requirements because of Excel's flexibility. All things considered, the process of balancing bank accounts with Excel improves Financial Management's efficiency, accuracy, and transparency. This enables organisations to keep accurate records and make decisions based on trustworthy information and financial data.

2) Tracking Unpaid Invoices in Excel (A/R)

Track unpaid Invoices in Excel for (A/R) Accounts Receivable Management, utilising templates, ageing analysis, and conditional formatting to enhance cash flow. Excel offers diverse templates and functions for this task, facilitating ageing analysis, maintaining customer balances, and creating invoice tracking sheets.

![]()

Users can efficiently identify overdue invoices in Excel using conditional formatting and formulas. They then implement proactive follow-up strategies to enhance cash flow management. This process enables businesses to maintain tighter control over their receivables, minimise payment delays, and foster stronger customer relationships.

Excel's customisable features empower users to tailor their invoice tracking systems. This optimisation supports overall financial health and enhances A/R management. By customising tracking systems, businesses can adapt to specific requirements, ensuring efficient management of Accounts Receivable and fostering financial stability.

Boost your Data Management skills by joining our Microsoft Excel Courses – book your spot now!

3) Managing Unpaid Bills in Excel (A/P)

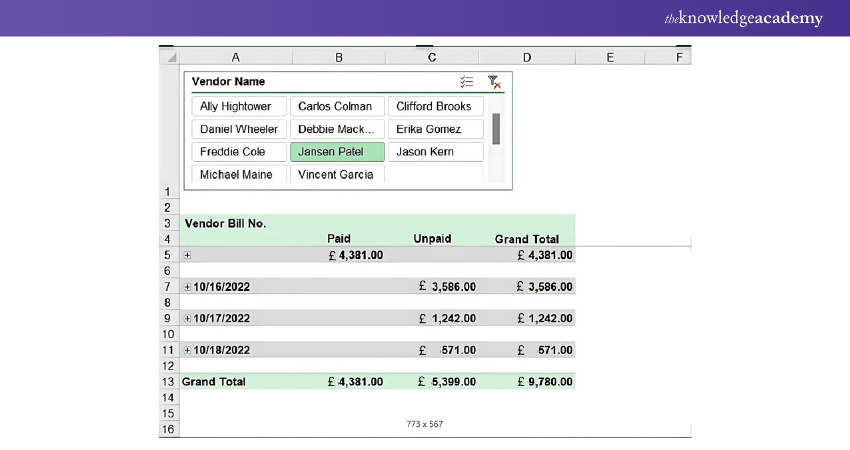

Managing unpaid bills in Excel for Accounts Payable (A/P) involves tracking and overseeing outstanding invoices owed to suppliers. Excel offers templates and functions for efficient monitoring of unpaid bills, including vendor balances, due dates, and ageing reports.

By organising vendor information and payment schedules within Excel, businesses can effectively avoid late payments and cultivate positive relationships with suppliers. This ensures financial stability, timely payments, and trust with suppliers, bolstering reliability and reinforcing business relationships.

Using Excel for A/P management streamlines the invoicing process and promotes efficient communication with vendors. This enhances cash flow management and ensures sustainable operations.

Boost project management skills with Excel Training with Gantt Charts now!

4) Monitoring Cost of Goods Sold Using Excel

Excel is used to track the Cost of Goods Sold (COGS) through various tools and functionalities. It helps to keep track of the direct expenses incurred in creating the items or services that a company provides. Spreadsheets for tracking inventory, where companies may enter and update sales, costs, and inventory levels, make this process easier for Excel users.

Cost allocation formulas in Excel allow for the allocation of expenses related to production, such as raw materials and labour, to calculate the total COGS accurately. Excel's sales analysis reports offer insights into product performance, sales trends, and margins, aiding profitability assessment and pricing decisions, which can be made more efficient with Excel Shortcuts for Accountants.

By accurately monitoring COGS in Excel, businesses can optimise their pricing strategies. They can also identify cost-saving opportunities and maximise profitability in a competitive market environment.

5) Generating Amortisation Schedules in Excel

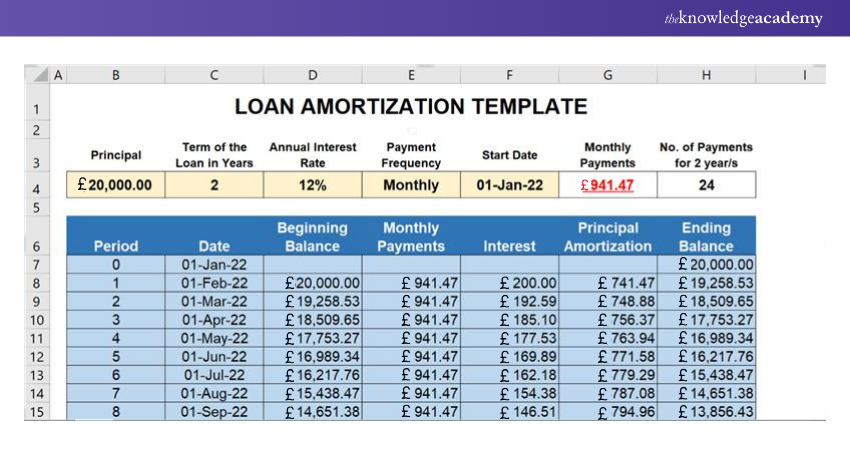

Using Excel templates and tools to monitor the repayment of loans or loss of assets over a period is required for developing amortisation plans. Loan payment formulas in Excel allow users to calculate monthly payments depending on loan terms, interest rates, and principal amounts.

Additionally, depreciation formulas in Excel allow businesses to calculate the gradual reduction in the value of assets over their useful lives. Excel-generated amortisation tables offer a thorough analysis of principal and interest payments made throughout the course of the loan or the asset's depreciable life.

By creating amortisation schedules in Excel, businesses gain visibility into future financial obligations, allowing them to plan and budget effectively. This enables companies to manage their finances effectively, make informed decisions, and ensure timely repayment of loans and asset replacement.

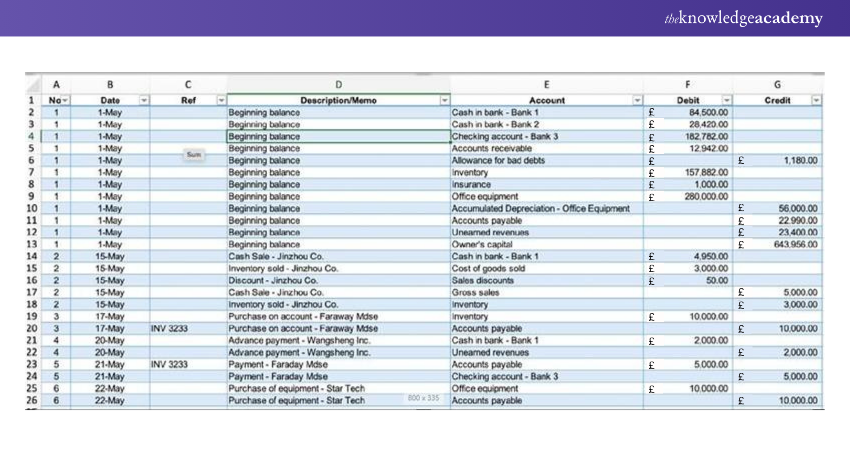

6) Operating a General Ledger Through Excel

Operating a General Ledger through Excel entails using its customisable templates and functions. These tools help manage all financial transactions of a business efficiently. Excel offers features such as journal entry forms, trial balance sheets, and financial statement templates. These tools provide a comprehensive platform for organising financial data efficiently.

By maintaining a general ledger in Excel, businesses can track transactions in a structured manner. Preparing accurate financial statements is made easier by identifying patterns or trends in financial activities.

This central repository enables efficient monitoring of revenue, expenses, assets, and liabilities. It facilitates informed decisions and maintains financial transparency for businesses. Excel is an effective Financial Management tool for businesses of all sizes, thanks to its user-friendly interface and flexibility. It also ensures compliance with accounting standards.

7) Cash-basis Accounting in Excel

Cash-basis accounting, a method commonly utilised By small businesses, records transactions only when cash is exchanged, simplifying income and expense tracking. Accounting for Small Business Using Excel provides a range of templates and functions tailored for cash-basis accounting, making it easier to manage financial records efficiently. These facilitate the creation of essential financial documents such as cash flow statements, cash receipts journals, and cash disbursements registers.

These tools enable businesses to monitor their cash flow meticulously, ensuring that income and expenses are accurately recorded. With Excel's user-friendly interface and powerful analytical capabilities, businesses can efficiently manage their finances and track incoming and outgoing cash.

Additionally, they can gain insights into their financial health through comprehensive data analysis and reporting functionalities. By using Excel for cash-basis accounting, small businesses ensure transparency, make informed financial decisions, and plan for growth effectively.

Streamline your Project Management approaches by investing in our Excel Training With Gantt Charts Course now!

How to Implement Accrual Accounting in Excel?

Implementing Accrual Accounting in Excel involves several steps to ensure your financial records accurately reflect your business’s financial position. Here’s a step-by-step guide:

1) Set Up Your Chart of Accounts:

a) Create a list of all your accounts, including assets, liabilities, equity, revenues, and expenses.

b) Organise these accounts in separate sheets or sections within a sheet

2) Record Transactions:

a) Enter all financial transactions as they occur, including sales, purchases, and other expenses.

b) Use columns for the date, description, account, debit, and credit to ensure each transaction is recorded accurately.

3) Adjusting Entries:

a) At the end of each accounting period, make adjusting entries to account for Accrued Expenses and revenues.

b) For example, if you have earned revenue but haven’t yet received payment, record it as an accrued revenue.

4) Prepare Financial Statements:

a) Use Excel formulas to summarise your data and prepare financial statements such as the income statement, balance sheet, and cash flow statement.

b) Pivot tables can be particularly useful for generating these reports

5) Reconcile Accounts:

a) Regularly reconcile your accounts to ensure that your records match your bank statements and other financial documents.

b) This helps to identify and correct any discrepancies

6) Automate with Macros:

a) Consider using Excel macros to automate repetitive tasks, such as monthly adjusting entries or report generation.

b) This can save time and reduce the risk of errors

Conclusion

In conclusion, learning How to Use Excel for Accounting can be a game-changer for your business. With its powerful features and flexibility, Excel can handle everything from basic bookkeeping to complex financial analysis. To get the most out of it, mastering the Basic Excel Formulas for Accounting is essential. So, leverage Excel and take your accounting to the next level!

Enhance your analytical capabilities by registering for our Business Analytics With Excel Course!

Frequently Asked Questions

How is Excel Useful in Accounting?

Excel is essential for managing financial data, creating budgets, tracking expenses, and generating financial reports in accounting. Its ability to handle complex calculations and large datasets makes it ideal for accurate bookkeeping and financial analysis.

What is the Most Used Excel Function in Accounting?

The SUM function is the most widely used in accounting, allowing professionals to quickly total columns and rows of financial data for precise reporting.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Microsoft Excel Trainings, including Microsoft Excel Course, Excel for Accounting Course and Business Analytics with Excel Course. These courses cater to different skill levels, providing comprehensive insights into Excel for Finance.

Our Office Applications Blogs cover a range of topics related to Microsoft Excel, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Excel skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Office Applications Resources Batches & Dates

Date

Microsoft Excel Course

Microsoft Excel Course

Mon 7th Apr 2025

Mon 9th Jun 2025

Mon 8th Sep 2025

Mon 1st Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please