We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Fintech is a constantly evolving field, with new trends emerging rapidly. These trends promise to revolutionise how we manage our finances, invest, and transact. Failing to keep up with these trends can lead to missed opportunities and reduced competitiveness. Understanding the latest FinTech Trends can help you stay ahead and thrive in this dynamic environment.

If you want to learn about the latest FinTech Trends, this blog is for you. Let's delve in deeper to learn more!

Table of Contents

1) Forecasted FinTech Market Trends

a) Digital credit cards

b) Embedded finance

c) Purchase Now, Pay Later (PNPL) 2.0

d) Lending alternatives

e) PropTech: Digital mortgages

f) Differential payment streams

g) Stablecoins: The Bitcoin of the future

h) Digitalisation of the capital market

i) Financial Technology using AI and ML

j) The rapid increase in biometrics adoption

2) Which FinTech Trends are currently out of style?

3) Conclusion

Forecasted FinTech Market Trends

In this section, we will explore the forecasted FinTech market trends set to reshape the financial landscape in the coming years.

1) Digital credit cards

Digital credit cards are at the forefront of the latest FinTech Trends, revolutionising how we make payments and manage our finances. Let's explore the impact of digital credit cards on the Financial Industry:

1) Reduced reliance on physical cards: As more consumers embrace digital credit cards, the demand for physical cards may decrease, impacting the card manufacturing industry.

2) Increased security standards: The adoption of biometrics and tokenisation for digital cards is driving the industry towards higher security standards.

3) Faster payment processing: Contactless payments through digital cards lead to quicker transaction processing, benefiting both consumers and merchants.

4) Evolving banking apps: Banks and financial institutions are updating their mobile apps to accommodate digital credit card functionality, improving the overall user experience.

2) Embedded finance

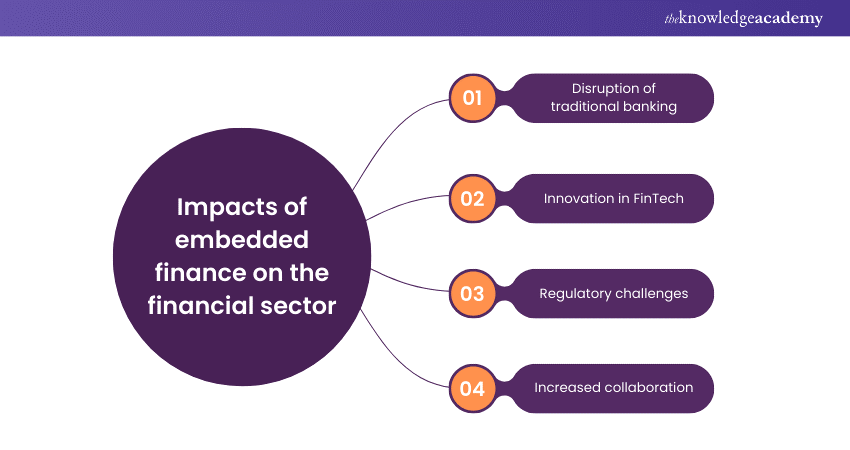

Embedded finance is a flourishing trend reshaping how financial services are integrated into various industries and everyday activities. It refers to the smooth integration of financial services into non-financial platforms, products, and services.

Instead of relying solely on traditional institutions, consumers can access financial services within the applications and platforms they already use daily. It's like having financial services embedded into your favourite apps and services. Here are the impacts of embedded finance on the financial industry:

1) Disruption of traditional banking: Traditional banks are facing competition from non-financial companies that can offer financial services more conveniently.

2) Innovation in FinTech: FinTech startups are thriving by providing the technology and infrastructure needed for embedded finance solutions.

3) Regulatory challenges: Regulators are adapting to ensure consumer protection, data privacy, and fair competition within this evolving landscape.

4) Increased collaboration: Collaboration between FinTech firms, traditional financial institutions, and non-financial businesses is critical for implementing embedded finance successfully.

3) Purchase Now, Pay Later (PNPL) 2.0

PNPL 2.0 is a dynamic trend in the Financial Technology sector, redefining how consumers purchase and manage their finances. Let's explore the advantages of PNPL 2.0

1) Financial flexibility: PNPL 2.0 provides consumers a more flexible way to manage their budget, making it easier to afford larger or unexpected expenses.

2) Interest-free financing: The absence of interest charges distinguishes PNPL 2.0 from traditional credit cards, saving consumers money.

3) Convenient checkout: It simplifies the online shopping experience, reducing the need for credit card information and providing a quicker and smoother checkout process.

4) Budgeting assistance: Some PNPL 2.0 platforms offer budgeting tools and spending insights to help users manage their finances effectively. While these platforms provide more modern, data-driven solutions, many individuals still rely on traditional budgeting methods to track and control their finances. Combining both approaches can provide a balanced strategy for achieving financial stability.

4) Lending alternatives

Lending alternatives represent a dynamic trend in the FinTech industry, offering innovative ways for individuals and businesses to access financing outside traditional banking channels. Lending alternatives encompass a variety of non-traditional lending methods. These have gained popularity due to their ability to provide faster, more accessible, and flexible financing solutions.

Technology and data-driven decision-making processes often drive these alternatives, redefining how borrowers and lenders connect. Let's take a look into the impact of lending alternatives on the financial industry:

1) Competition for traditional banks: Lending alternatives challenge traditional banks by offering quicker and more convenient financing options.

2) Digital transformation: Traditional banks are adapting by investing in digitalisation and improving their online lending services.

3) Increased access to capital: Borrowers benefit from increased access to capital through these platforms, especially those with limited credit histories.

4) Regulatory challenges: Regulators are adjusting to ensure consumer protection, fair lending practices, and adequate oversight of emerging lending alternatives.

5) Investment opportunities: Investors are exploring new avenues for lending and investment, diversifying their portfolios beyond traditional assets.

5) PropTech: Digital mortgages

PropTech encompasses a range of technological innovations designed to enhance and streamline different aspects of the real estate sector. These FinTech Innovations leverage data, automation, and digital platforms to enhance property management, investment, and transactions.

Digital Mortgages:

Digital mortgages are a key element of PropTech, revolutionising how individuals and businesses finance real estate acquisitions. Here's how they work:

1) Application process: Borrowers can apply for mortgages online through user-friendly interfaces. Digital platforms guide applicants through the entire process, simplifying form submissions and document uploads.

2) Automated underwriting: Advanced algorithms and Artificial Intelligence (AI) are used to assess the borrower's creditworthiness and determine the mortgage terms. This automated underwriting process speeds up approvals.

3) Document verification: Digital mortgages often include automated document verification, reducing the need for manual reviews and paperwork.

4) E-signatures: Borrowers can electronically sign documents, eliminating the need for physical signatures and expediting the closing process.

Elevate your financial expertise with our Financial Management Course now!

6) Differential payment streams

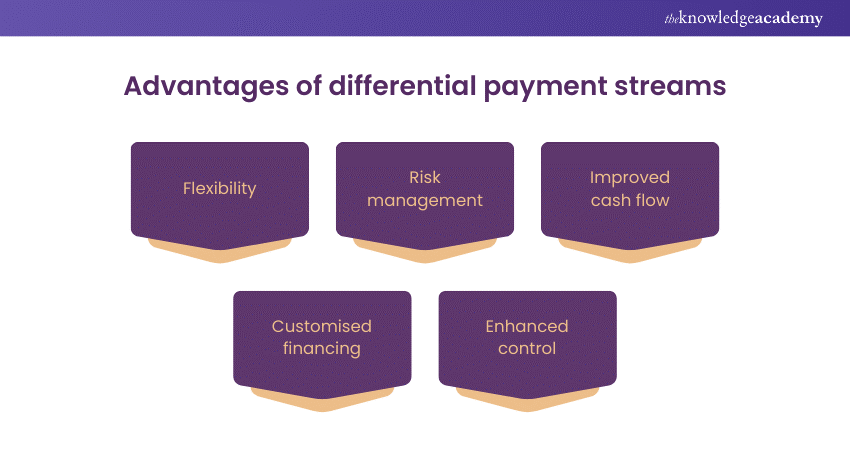

Differential payment streams are a cutting-edge development in the world of finance, offering innovative ways to manage and process payments. Differential payment streams involve the division of a payment into multiple, smaller components.

These components are disbursed or received at different times or intervals. Let's explore the advantages of differential payment streams:

1) Flexibility: Differential payment streams provide flexibility in managing payments, allowing for tailored solutions to meet varying financial needs.

2) Risk management: They enable risk mitigation by structuring payments in a way that aligns with revenue streams or project milestones.

3) Improved cash flow: Businesses can optimise cash flow by receiving or making payments when it is most advantageous.

4) Customised financing: Differential payment streams are beneficial for financing options, as they can accommodate diverse terms and conditions.

5) Enhanced control: Parties involved in the transaction can exercise greater control over the payment process, ensuring compliance with agreed-upon terms.

7) Stablecoins: The Bitcoin of the future

Stablecoins have emerged as a prominent and transformative trend in the world of cryptocurrencies. They are often referred to as the "Bitcoin of the future”. Stablecoins are a category of cryptocurrencies designed to maintain a stable value by pegging their worth to traditional assets.

Traditional assets include fiat currencies (e.g., GBP, USD, EUR) or commodities (e.g., gold). Unlike highly volatile cryptocurrencies like Bitcoin or Ethereum, Stablecoins aim to offer price stability. This makes them perfect for everyday transactions and as a store of value. Here's how Stablecoins impact the cryptocurrency ecosystem:

1) Mainstream adoption: Stablecoins are gaining traction in both the crypto and traditional financial sectors due to their stability and utility.

2) Payment solutions: They are increasingly used for online purchases and remittances and as a means of transferring value across borders.

3) Financial services: Stablecoins serve as the foundation for Decentralised Finance (DeFi) projects, offering lending, borrowing, and yield farming opportunities.

4) Central Bank interest: S Some Central Banks are exploring the concept of Central Bank Digital Currencies (CBDCs), which are essentially government-backed Stablecoins.

5) Regulatory scrutiny: The rise of Stablecoins has prompted regulatory bodies to evaluate and establish guidelines for their use and issuance.

Get ready for success with the most common Fintech Interview Questions. Download now for a head start!

8) Digitalisation of the capital market

The digitalisation of the capital market signifies a substantial transformation in the financial sector. This transformation is propelled by technological advancements and shifts in investor preferences. The digitalisation of the capital market refers to the amalgamation of technology and digital platforms into traditional financial processes and market activities.

Further, it encompasses various innovations, from electronic trading platforms to blockchain-based securities. Let's explore the key aspects of digitalisation in the capital market:

1) Electronic trading: The adoption of electronic trading platforms has revolutionised how stocks, bonds, and other financial instruments are bought and sold. These platforms provide faster, more efficient, and transparent trading mechanisms.

2) Blockchain and tokenisation: Blockchain technology enables the tokenisation of assets, making it possible to represent ownership of securities and other assets digitally. This can streamline settlement processes and enhance security.

3) Digital asset management: Robo-advisors and digital asset management platforms use algorithms and AI to automate investment strategies, providing cost-effective and accessible investment solutions.

4) Regulatory technology (Regtech): Digitalisation has led to the development of Regtech solutions that enhance compliance and reporting by automating regulatory processes and Data Analysis.

5) Global accessibility: Digitalisation has made it easier for investors worldwide to access international markets and assets, increasing market liquidity.

9) Financial Technology using AI and ML

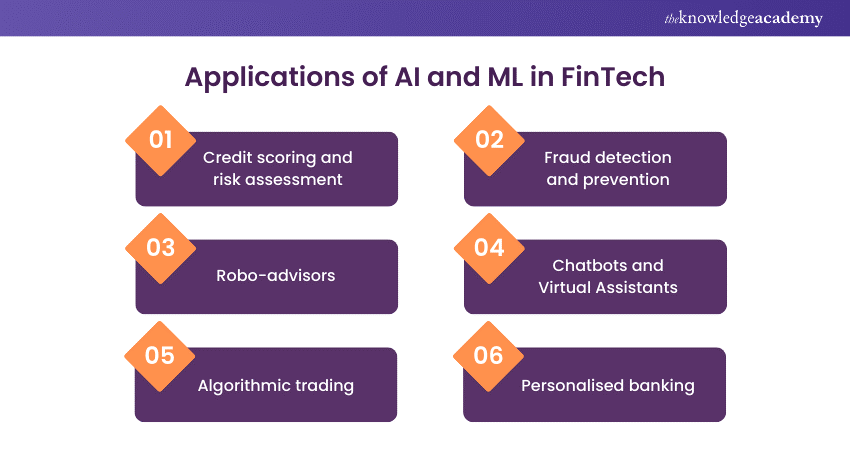

The convergence of Financial Technology with Artificial Intelligence and Machine Learning (ML) is reshaping the financial industry. Financial Technology refers to the innovative use of technology to provide financial services and solutions. Integrating AI and ML in FinTech involves leveraging advanced algorithms and Data Analytics.

This integration aims to enhance various financial processes and decision-making through automation. Let's explore the applications of AI and ML in FinTech:

1) Credit scoring and risk assessment: AI and ML algorithms analyse vast datasets to assess creditworthiness, enabling more accurate lending decisions and reducing the risk of defaults.

2) Fraud detection and prevention: Machine Learning models can detect fraudulent activities in real time by identifying unusual transaction patterns and anomalies.

3) Robo-advisors: AI-driven Robo-advisors offer automated investment recommendations and portfolio management, making financial planning more accessible and cost-effective.

4) Chatbots and Virtual Assistants: AI-powered chatbots and Virtual Assistants enhance customer support and streamline interactions, providing instant responses to queries and resolving issues.

5) Algorithmic trading: AI and ML algorithms are used for high-frequency trading, optimising trading strategies, and identifying market trends.

6) Personalised banking: FinTech companies use AI to provide personalised financial insights, budgeting tips, and product recommendations to users.

10) The rapid increase in Biometrics adoption

The adoption of Biometrics technology is experiencing an unprecedented surge across various sectors, revolutionising security and user authentication. Biometrics includes the use of unique physical or behavioural characteristics for user identification and authentication.

This technology got traction due to its accuracy, security, and convenience. As a result, it has become an integral part of modern authentication systems. Let's take a look into the impact of Biometrics adoption on security and user authentication:

1) Financial services: Banks and FinTech companies use Biometrics for secure customer authentication in online banking and mobile apps.

2) Smartphones: Most modern smartphones integrate facial recognition, fingerprint scanning, or iris scanning for unlocking devices and authorising payments.

3) Airport security: Biometrics streamlines airport check-ins, boarding processes, and immigration procedures for a more efficient and secure travel experience.

4) Government services: National ID programs and e-passports use Biometrics to verify the identity of citizens, enhancing security.

5) Healthcare: Biometrics safeguard patient data and grant access to authorised personnel in healthcare facilities.

6) Access control: Businesses and organisations use Biometrics for secure access to facilities, data centres, and confidential information.

Transform your career with our Accounting & Finance Training – Sign up today!

Which FinTech Trends are currently out of style?

While the FinTech industry is known for its rapid evolution, certain trends that were once in the spotlight have started to lose their lustre. In this section, we will explore the Neobanks and Fintech trends that are currently considered out of style:

1) Coronavirus-related initiatives

At the beginning of the COVID-19 pandemic, FinTech companies launched various initiatives to address the unique challenges posed by the crisis. These initiatives included contactless payment solutions, digital lending for small businesses, and remote financial advisory services.

However, as the world adapts to the new normal, the urgency for coronavirus-specific FinTech solutions has diminished.

2) Cryptocurrency exchanges

Cryptocurrency exchanges experienced exponential growth during the crypto bull run, drawing significant attention from retail and institutional investors. However, concerns about regulatory oversight, security breaches, and the volatility of cryptocurrencies have dampened the enthusiasm for these platforms.

Many governments are working on implementing stricter regulations, which could impact the functioning of cryptocurrency exchanges.

3) (Un) Stablecoins

Stablecoins are cryptocurrencies pegged to traditional assets like the US dollar. They initially gained traction as a stable and efficient means of transferring value within the crypto ecosystem. However, the emergence of regulatory scrutiny and concerns about the reserves backing these Stablecoins have raised questions about their long-term viability.

Central Banks and governments are also exploring the development of their own Central Bank Digital Currencies (CBDCs), potentially challenging the dominance of Stablecoins. It's important to note that the FinTech industry is dynamic, and trends can evolve rapidly.

While these trends may currently be out of style, they could potentially reemerge or adapt to changing circumstances in the future.

Unlock Your FinOps Potential – Master the core principles with our curated FinOps Interview Questions and take your career to the next level.

Conclusion

We hope you read and understand everything about the latest FinTech Trends and how the FinOps Strategy can help businesses align cloud financial operations with overall business objectives. While some trends are gaining momentum, others are facing challenges or evolving. Staying updated with these trends is indispensable for both businesses and consumers to navigate the dynamic FinTech landscape effectively.

Unlock the potential of Financial Technology with our FinTech Course – Sign up today!

Frequently Asked Questions

Why is it important to stay updated with FinTech Trends?

Staying updated with FinTech Trends is crucial for many reasons. It allows businesses and individuals to utilise the latest financial management, investment, and transaction innovations. Adapting to these trends may result in missed opportunities and less efficient financial operations in an increasingly digital world.

Are traditional financial institutions keeping pace with these FinTech Trends?

Traditional financial institutions are actively adapting to FinTech Trends. Many are partnering with FinTech startups, investing in digitalisation, and incorporating AI and blockchain technologies to remain competitive. However, the pace of innovation varies, and some legacy systems may face challenges in fully embracing these trends.

What are the other resources and offers provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is the Knowledge Pass, and how does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are related FinTech courses and blogs provided by The Knowledge Academy?

The Knowledge Academy offers various Accounting & Finance Courses, including FinTech Course, Finance for Non-Financial Managers, Financial Management Course and more. These courses cater to different skill levels, providing comprehensive insights into What is Credit Risk.

Our Business Skills Blogs cover a range of topics related to FinTech, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting & Finance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

FinTech Course

FinTech Course

Fri 13th Jun 2025

Fri 15th Aug 2025

Fri 10th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please