We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Fixed Assets are crucial for any company, serving as long-term investments that support operations and generate value over time. These assets, like property, equipment, and machinery, are not meant for immediate sale but are vital for maintaining and expanding business capabilities.

In this blog, we'll walk you through the fundamental aspects of fixed assets, including their classification, importance, and impact on a company's financial health. We'll also discuss the benefits of investing in fixed assets, the challenges they present, and best practices for managing them effectively.

Whether you're new to the concept or looking to deepen your knowledge, this blog will provide valuable insights to optimise your approach to fixed assets.

Table of Contents

1) What are Fixed Assets?

2) The Importance of Fixed Assets

3) Key Features of Fixed Assets

4) How to Compute Fixed Assets?

5) Examples of Fixed Assets

6) Advantages of Fixed Assets

7) Disadvantages of Fixed Assets

8) Conclusion

What Are Fixed Assets?

In terms of accounting, the Fixed Asset is generally the tangible property or equipment owned by the company or organisation. It is the investment of companies that hold a value, and they are recorded in the records as the properties, equipment's and plants. Machinery, Heavy duty vehicles, systems are in the category of Fixed Assets.

When any company acquires a Fixed Asset, it is included in the company's financial report and on the balance sheets. Excepting the land, the value of Fixed Assets decreases with time as they are used when they are given on lease. Giving Fixed Assets on lease is very common in businesses.

The Importance of Fixed Assets

Fixed Assets are important for the company not only in generating revenue, but they give a bright outlook to the investors when they are making up their mind to invest in the company. As they show the financial position of the company, the net worth captured on the financial balance sheets impacts the evaluation of the company. Besides this, intangible assets, such as patents and brand reputation, also play a vital role in enhancing overall value. It can further attract investors by highlighting potential future growth and competitive advantages.

Highly established companies use their Fixed Assets as the advantage against their competitors.

1) It shows the profitability and the financial status of the company or business.

2) Increase goodwill and positive attitude towards the investors and competitors.

3) Most of the times Fixed Assets are the high value items that also shows the growth of the company which is attractive for the acquisition partners.

4) The valuation of the company or business is increased by the Fixed Assets and raise the access to the capital.

Become an Asset Management Leader! Join our ISO 55001 Foundation Training to master effective asset management practices. Enroll now!

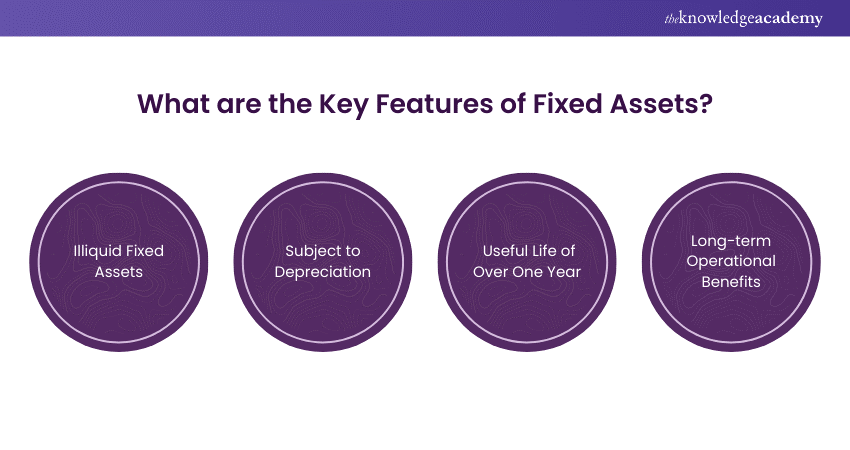

Key Features of Fixed Assets

Some of the important key features of the Fixed Assets are listed below:

Fixed Assets Are Illiquid

Illiquid assets include retirement accounts, real estate and other things that are difficult to sell and cannot be quickly sold. Selling these Assets will take time and proper valuation of the Asset which takes much effort. The value of these illiquid Assets depends on the market condition and sometimes to quickly converting these Assets into cash can lead to loss of value.

They Are Subject to Depreciation

Some things like building, computers, machinery and equipment's fall under the depreciation asset because of the expensing on these Assets. By the time these types of Assets require proper maintenance, the condition will also degrade with use. So, the original cost is subject to depreciation of Fixed Asset.

They Have a Useful Life of Over One Year

Fixed Assets are the tangible items that are owned by the company or business for the operations for more than one year. These Assets like plan property and equipment (PP&E) are listed in the balance sheets and noncurrent Asset of the company as their useful life extent beyond a year.

Long-term Operational Benefits

Fixed Assets are utilised by the company to produce goods and services, and their aim is to generate revenue for the company or business. The Assets which are used by the company itself for their work and purpose are not sold to the customers and for the objective of investment.

How to Compute Fixed Assets?

Fixed assets are measured at their acquisition cost less accumulated depreciation, commonly referred to as net Fixed Assets.

Formula A:

To evaluate the client’s ownership of net assets, you can use an alternative approach that excludes Fixed Asset liabilities—these are the debts and financial obligations associated with those assets.

Formula B:

Want to become lead auditor – Join our ISO 55001 Internal Auditor Training !

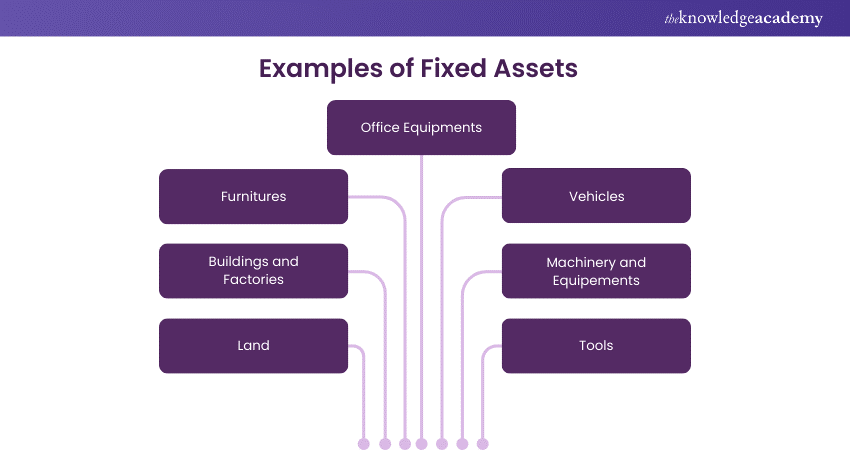

Examples of Fixed Assets

Usually, the Fixed Assets come in many different forms and are generally grouped into Asset categories which includes:

a) Land: Which includes the real estate owned by the company such as agriculture, constructing offices, or manufacturing plants.

b) Buildings and Factories: Office buildings, warehouses, factories, or any other constructed structures that are owned by the company.

c) Furnitures: This category includes all the desks, chairs, cabinets fall under this that are found in the company offices and workspaces.

d) Office Equipments: Computers, servers, IT hardware and software that are used in various purposes within the company.

e) Vehicles: In this category all the vehicles like Trucks, cars, forklifts, cranes, tractors, rollers are there which are used in the operations of the company like construction and manufacturing plans.

f) Machinery and Equipements: The tools and the machines that are used in the process of manufacturing falls under this category.

g) Tools: This includes all the specialised tools which are used in different industries for various types of work like construction tools, diagnostic equipment, or scientific devices.

These are all examples of Fixed Assets which have their different role in the company or the business for making their workplace and work life easier and enhance productivity.

Unlock Asset Excellence! Join our ISO 55001 Training today and elevate your organization's asset management to new heights. Sign up now!

Advantages of Fixed Assets

Fixed Assets of the business is the basic need and the foundation of that business or the company. Let’s take the example of bat companies which make bats from wooden logs and sell them but if they don’t have necessary equipment's they will not be able to produce the bats. Advantages of Fixed Assets are:

a) Long Term Income: Fixed Assets like machinery, vehicles and equipment's are important for any business or company to generate income for the long-term period.

b) Help Operations Run: The Fixed Assets of the company that are based on the latest technology like computers, hardware and software are the essential part to run the operations efficiently. The modern-day technology is based on the new techniques and strategies.

c) Assets that don’t Depreciate: The Fixed Assets of the company depreciate over time but not all of them, like the land, their value increases by the time when it is used in the operations.

Disadvantages of Fixed Assets

The company or the business needs Fixed Assets but the disadvantages of this includes:

a) Depreciation: From the wear and tear of the items, the Fixed Assets lose their value over the period from exposure to the natural environmental conditions, and everyday use. This is known as depreciation which is recorded as an expense of the company.

b) Financial Risks: It is a difficult task to convert the Fixed Asset into cash or to get their proper valuation when the company or the business is in downfall.

c) Maintenace and Upgrades: To prevent the wear and tear of these assets they require a routine maintenance and upgrades for smooth functioning and flow of the operations.

d) High Investments: When any company invests in the Fixed Asset, they require a lot of money for that because it majorly covers the large value items.

e) Operational Disruptions: They asset which are not managed properly can lead to the failures and poor functioning which will have disruptions in the operations and delay in the projects.

Access the ISO 55001 PDF today and explore the key guidelines for optimizing asset management in your business.

Conclusion

It’s important to have a comprehensive knowledge on Fixed Assets. This blog covers all the important key features and the questions that come into your mind while you hear the word Fixed Asset. As the asset is necessary and foundation of any company, industry or business you need to have proper knowledge, so this blog will help to solve all your problems.

Transform ordinary to audit success—Join our ISO 55001 Lead Auditor Training today!

Frequently Asked Questions

What is a Fixed Assets formula?

The Fixed Asset is calculated from the two different ways:

Formula A: Gross Fixed Assets — Accumulated Depreciation = Net Fixed Assets

Formula B: (Total Fixed Asset Purchase Price + Improvements to the Assets) - (Accumulated Depreciation + Fixed Asset Liabilities) = Net Fixed Assets

How do you Identify Fixed Assets?

Fixed Assets are identified from the characteristics like tangibility, length of ownership, long term financial benefit, depreciation, valuations of the company from owned vehicles, plants, land, properties, equipment. These are all the way and key points or characteristics to identify the Fixed Asset.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various ISO 55001 Training, including the ISO 55001 Training and Practitioner Course, and the ISO 55001 Lead Auditor Training Course. These courses cater to different skill levels, providing comprehensive insights into IT Service Management.

Our IT Service Management Blogs cover a range of topics related to Asset Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your ISO 55001 Training, The Knowledge Academy's diverse courses and informative blogs have got you covered

Upcoming IT Service Management Resources Batches & Dates

Date

ISO 55001 Foundation Training

ISO 55001 Foundation Training

Mon 19th May 2025

Mon 30th Jun 2025

Mon 20th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please