We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Have you ever wondered what separates successful traders from the rest? The answer lies in comprehending effective Forex Trading Strategies. Whether a novice starting out or an experienced trader refining their approach, understanding these strategies is crucial. For example, consider a trader who consistently profits by identifying market trends and executing timely trades. What secrets do they know? How can you apply these techniques to your own trading?

In this detailed blog, we’ll explore the best Forex Trading Strategies, providing you with the tools and insights needed to navigate the Forex market with confidence and precision. Dive in to boost your trading expertise and achieve your financial goals!

Table of Contents

1) What are Forex Trading Strategies?

2) Top 11 Forex Trading Strategies

3) Advanced Forex Trading Strategies

4) What are Some Strategy Modifiers?

5) How to Choose the Best Forex Trading Strategy?

6) Conclusion

What are Forex Trading Strategies?

Before moving on to the specific strategies, it's important to understand the basics of Forex Trading and its strategy:

Forex Trading involves the exchange of one currency for another in the global market. A Trading Strategy is a well-defined approach to making trade decisions. It involves analysing market conditions, identifying potential entry and exit points, and managing risk. A successful strategy considers both fundamental and technical factors, as well as the Trader's risk tolerance and psychological makeup. There are various Forex Trading Strategies available today.

Top Forex Trading Strategies

Here are the popular and advanced Forex Trading Strategies you can implement to succeed in the competitive market:

1) Forex Scalping Strategy

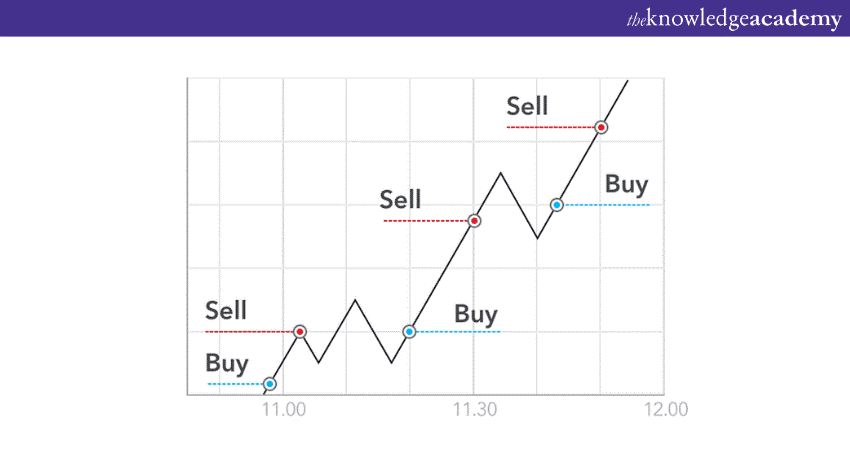

The Scalping Strategy is extensively regarded as a popular and speedy-paced Trading Strategy in the Forex market. Its primary goal is to harness minor price fluctuations and generate speedy profits.

This approach calls for Traders to execute a high quantity of trades, retaining positions for most effective and brief lengths, often mere seconds to a few minutes. While it needs precision, quick decision-making, and a strong Trading infrastructure, Scalping can offer the capacity for constant gains if completed efficaciously.

The key to success scalping lies in precision and fast execution. Scalping Traders carefully monitor the market and the use of technical analysis gear along with quick-term moving averages, Bollinger Bands, and stochastic oscillators. By identifying short-term charge moves and taking benefit of bid-ask spreads, scalpers can input and exit trades within seconds or minutes.

2) Forex Day Trading Strategy

Day Trading is a dynamic strategy characterised by the opening and closing positions within the confines of a single Trading Day. The main goal is to leverage transient price movements for short-term gains. This strategy involves closely monitoring market movements and analysing technical indicators to identify potential entry and exit points. This fast-paced approach demands a deep understanding of market dynamics, technical analysis, and Risk Management.

Day Traders often rely on charts with short timeframes, such as one-minute or five-minute intervals, to make quick decisions. They look for patterns like flags, pennants, and candlestick formations to anticipate price movements. Moreover, they pay close attention to volume and liquidity, as these factors can significantly impact short-term price trends.

Transform your trading skills by investing in our expert-led Day Trading Course – sign-up now!

3) Forex Swing Trading Strategy

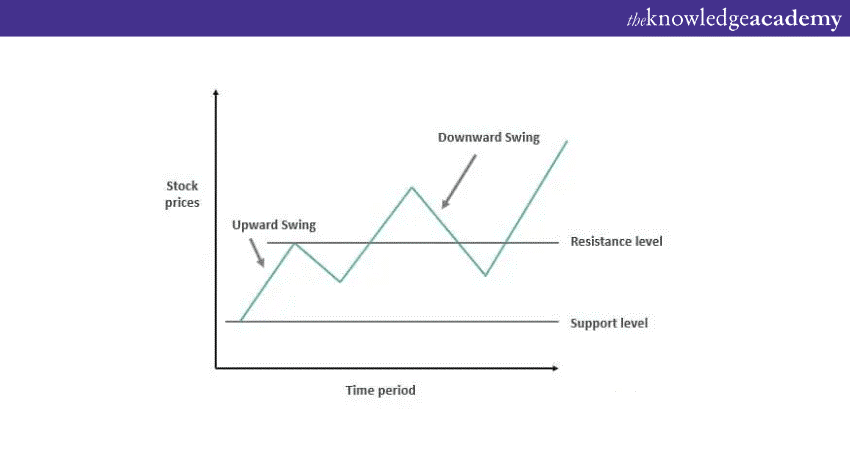

Swing Trading is one of the popular Forex Trading Strategies that capitalises on medium-term price movements within an established trend. Unlike Day Trading, which involves rapid execution of trades within a single Trading Day, Swing Traders hold positions for several days to weeks. The goal is to capture price swings – the oscillations between support and resistance levels – within the context of the broader market trend.

To effectively employ the swing Trading Strategy, Traders first identify the prevailing trend using technical analysis tools like moving averages, trendlines, and chart patterns. Once the trend is established, Traders seek optimal entry points near key support levels in uptrends and near resistance levels in downtrends. These support and resistance levels serve as reference points for potential reversals or breakout opportunities.

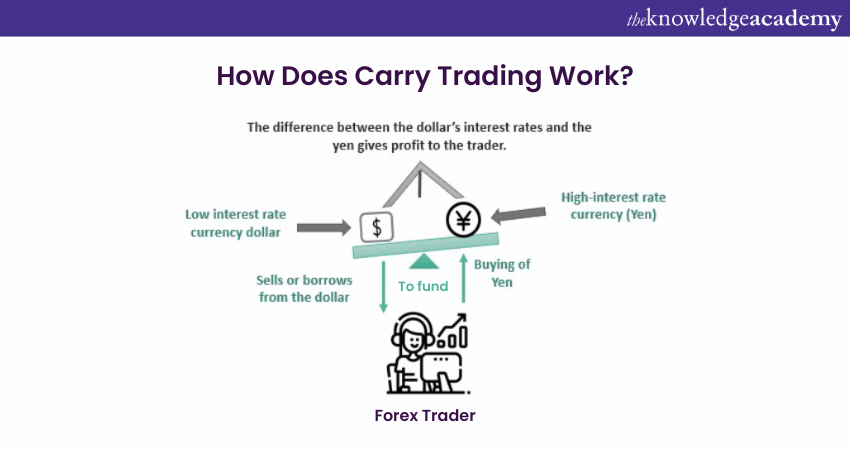

4) Carry Trade Strategy in Forex

Carry Trade Strategy is a Forex Trading method that exploits the interest rate differences between two currencies. It involves buying a currency with a high interest rate, selling a currency with a low interest rate, and holding the positions overnight. The goal is to earn the interest rate spread as profit.

However, this strategy is not as simple as it sounds. It requires a deep knowledge of global economics, interest rate trends, and Risk Management. To succeed in carry Trading, Traders need to consider the following factors:

1) Watch Monetary Policies Closely: Keep a close eye on the monetary policies and decisions of central banks, as they can influence interest rates. Stay informed about economic indicators like inflation rates, employment data, and GDP growth, as these can provide insights into potential interest rate shifts.

2) Stay Informed about geopolitical events: Stay aware of any geopolitical events that could impact currency movements. This includes elections, trade agreements, and conflicts that may affect currency values. For example, the value of the Russian currency, the Ruble, plummeted drastically in a short span of time due to sanctions imposed on its economy.

3) Mitigate Overnight Risk: Manage the risk of holding positions overnight, which could lead to market gaps. Consider setting stop-loss orders or other Risk Management measures to protect our trades.

4) Protect Against Losses: Utilise stop-loss orders and position sizing to limit potential losses. Implement stop-loss orders to automatically exit a trade if it reaches a predefined level of loss, and carefully determine position sizes relative to your account balance.

5) Position Trading

Position Trading is a Trading style that aims to profit from long-term trends while ignoring short-term fluctuations. Position Traders may keep their trades open for weeks, months, or even years in some cases.

This is one of the most challenging Trading Strategies to follow, as it requires a high level of discipline, patience, and resilience. Position Traders have to withstand the noise and volatility of the market and stay calm even when their trades go against them by hundreds of pips.

For instance, suppose you were bearish on stocks in early 2018. You decided to shorten the S&P 500 at the start of the year and hold the position for the whole year. You would have been happy with the price movements in the first and last quarters of the year. However, the rally from March to September would have been very stressful. Only a handful of Traders can maintain their positions for such a long duration.

Transform your Investment skills – join our expert-led Investment and Trading Training now!

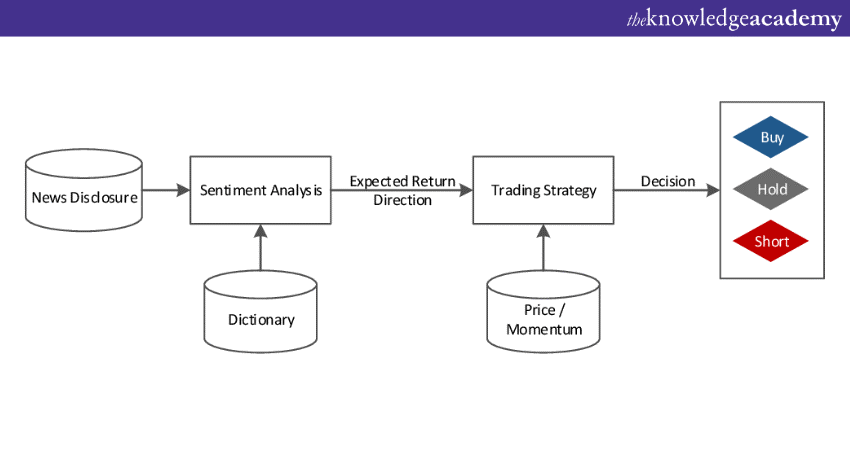

6) News Trading Strategy

The News Trading Strategy revolves around leveraging the impact of major economic or geopolitical events on the Forex market. Traders employing this strategy closely monitor economic indicators, central bank announcements, political developments, and other news releases that can influence currency values. When a major news event occurs, it often leads to rapid and substantial market movements.

To execute a News Trading Strategy effectively, Traders need to anticipate the market's reaction to the news. This requires understanding how certain indicators or events historically correlate with currency movements. Two common approaches are:

To execute a News Trading Strategy effectively, Traders need to anticipate the market's reaction to the news. This requires understanding how certain indicators or events historically correlate with currency movements. Two common approaches are:

a) Pre-news Analysis: Traders analyse the consensus forecasts and historical data of an upcoming economic release. By comparing these estimates with the actual data when released, Traders can anticipate market direction and volatility. For instance, a positive employment report might strengthen the currency of the reporting country.

b) Post-news Reaction: Some Traders prefer waiting for the news to hit the market before making a move. This approach avoids the risks associated with unexpected outcomes. As the news breaks, Traders evaluate the initial market reaction and make decisions based on the momentum and price movement.

7) Price Action Trading

Price Action Trading is yet another strategy that centres on the analysis of currency pair price movements using candlestick charts. This approach diverges from relying on external factors such as economic news or indicators. Instead, it empowers traders to identify Trading opportunities by discerning patterns and trends in price dynamics.

Price action is an extremely valuable strategy. However, it should be complemented by another Trading strategy like Swing Trading or Day Trading to provide a more comprehensive market perspective. Here are some key considerations when using this strategy:

1) Subjectivity: Price Action is subjective, and different Traders may interpret the same price action differently.

2) Diverse Interpretations: For instance, one Trader may identify an uptrend, while another may anticipate a reversal, even when examining the same currency pair and time frame.

3) Emotional Discipline: Successful Price Action Trading requires strong emotional discipline, as impulsive decisions can undermine its effectiveness.

4) Continuous Learning: Traders utilising price action should commit to ongoing learning and practice to refine their skills and interpretations over time.

Amplify your stock Trading prowess with our Stock Trading Course – sign up today!

Advanced Forex Trading Strategies

Now that you know about some basic strategies, it’s time to understand some of the advanced Forex Trading Strategies for professional Traders. Let's have a detailed look at each one of them:

1) Bounce Strategy

The Bounce Strategy is employed for in Trading financial markets, reliant on identifying pivotal levels of support and resistance on price charts. This approach capitalises on market behaviour, executing trades upon price rebounds from these established levels. The underlying premise rests on the inherent tendency of markets to revert to prior ranges following a significant movement.

Traders employing the Bounce Strategy must meticulously assess various factors, including market trends, the robustness of support and resistance levels, and the risk-reward ratio inherent in their trades. Successful implementation necessitates a comprehensive understanding of market dynamics and adept Risk Management strategies.

2) Running Out of Steam Strategy

The Running Out of Steam Strategy is a variation of the Bounce Strategy that targets temporary reversals or corrections in a trending market. The approach involves looking for signs of exhaustion or weakness in the price movement near a previous high or low and taking a position against the prevailing trend.

Traders who use this strategy must be precise and agile in timing their entries and exits, as the price could resume the trend at any moment. They must also use stop-loss orders and indicators to confirm the reversal signals.

3) Breakout Strategy

Resistance and support levels are dynamic and susceptible to price breakouts in either direction. If the price surpasses key support or resistance levels, a breakout is likely, which many traders may interpret as a significant shift in market sentiment. If a Forex pair reaches a high and sellers intervene, causing the price to drop, it indicates an overvalued market. However, if this previous high is breached, known as breakout resistance, it signifies a shift, with traders now willing to buy at prices they previously considered too expensive.

This can be an effective Forex Trading Strategy for identifying new trends. Every journey begins with a single step, and when market direction changes, the breakout trading strategy is often one of the first indicators.

4) Breakdown Strategy

Similar in function, but opposite to the breakout strategy, is the breakdown strategy. This Forex Trading approach aims to capitalise on a market move when it falls below a previous support level. Many traders may interpret this as a shift in market sentiment.

A level where buyers were previously content to purchase, viewing the market as undervalued and expecting a rise, has now been breached. This break of the support level can be seen as an opportunity to short sell and potentially profit from further price declines.

5) Overbought and Oversold

The overbought and oversold strategy helps Forex Traders identify potential market reversals using indicators like the Relative Strength Index (RSI). A currency pair is overbought when its price is significantly higher than its intrinsic value, often signalling a potential price drop. Traders look for RSI readings above 70 to consider selling.

Conversely, a currency pair is oversold when its price is well below its intrinsic value, indicating a possible rebound. RSI readings below 30 prompt traders to consider buying. This strategy aids in making informed entry and exit decisions, but it’s crucial to use it alongside other methods to confirm signals and avoid false positives.

What are Some Strategy Modifiers?

When employing any of the aforementioned Forex Trading Strategies, it’s prudent to be aware of methods to adapt your approach. Let’s delve into them:

1) Hedging Forex

Traders can hold both long and short positions to protect against unfavourable moves in a currency pair. This offsets potential losses but limits profits. It buys time to observe market trends and adjust positions, useful during short-term volatility. Hedging is ideal for long-term traders expecting a temporary adverse movement followed by a reversal.

2) Price Action Forex Trading Strategy

This strategy relies on analysing candlestick charts to identify trading opportunities based on price movements, without external factors like economic news. It should complement another strategy, such as swing or day trading, for better results. While it provides real-time insights, it’s subjective; different traders may interpret trends differently.

How to Choose the Best Forex Trading Strategy?

When selecting the optimal Forex Trading Strategy, it's crucial to consider certain factors to align with your goals and Trading style. Let’s explore some of them:

1) Time Frame: Choose a strategy that matches your availability and Trading approach. For active engagement, short-term strategies like day Trading are suitable, requiring constant market monitoring. Conversely, long-term strategies like position Trading involve holding trades for weeks or months, which is suitable for a more passive approach.

2) Number of Trading Opportunities: Assess the frequency of Trading signals your strategy provides. High-frequency strategies, such as scalping, offer numerous trades daily, while low-frequency strategies, like Swing Trading, offer fewer, more selective trades.

3) Position Size: Carefully plan how much capital to allocate per trade. Effective position sizing is key to Risk Management, ensuring that losses on individual trades don’t disproportionately affect your overall capital. This includes considering your total capital, risk tolerance, and the stop-loss level for each trade.

Conclusion

In conclusion, mastering the best Forex Trading Strategies can significantly enhance your trading success. By understanding and applying these strategies, you can navigate the Forex market with confidence and precision. With consistent practice and analysis, you’ll be well-equipped to make informed trading decisions and optimise your returns.

Learn the secrets to successful currency trading – register for our Foreign Exchange Training now!

Frequently Asked Questions

What are the key Benefits of Implementing Forex Trading Strategies?

Implementing Forex Trading Strategies offers key benefits such as maximising profit potential, managing risk effectively and maintaining discipline in trading decision. It can also aid in adapting to market conditions and providing a structured approach to trading. This results in improved consistency and long-term success.

How do Proven Forex Strategies Accelerate Career Success in Trading?

Proven Forex Strategies accelerate career success in Trading by enhancing decision-making skills, minimising losses, maximising profits, instilling discipline, and building confidence.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Investment and Trading Trainings, including Forex Trading Class, Cryptocurrency Trading Training and Day Trading Course. These courses cater to different skill levels, providing comprehensive insights into Forex Market Analysis.

Our Business Skills Blogs cover a range of topics related to Forex Trading, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Forex Trading skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Cryptocurrency Trading Training

Cryptocurrency Trading Training

Fri 14th Feb 2025

Fri 11th Apr 2025

Fri 13th Jun 2025

Fri 15th Aug 2025

Fri 10th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please