We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

If you're aiming for a career that combines finance, accounting, and management, understanding How to Become a Financial Manager is essential. Financial Managers play a significant role in overseeing an organisation's financial activities, including budgeting, forecasting, reporting, investing, and risk management. They also provide strategic advice to senior executives and stakeholders to enhance the organisation's financial performance and sustainability.

Becoming a Financial Manager requires a blend of education, experience, and skills. However, you don't need to worry. This comprehensive blog on "How to Become a Financial Manager" will guide you through all the essential steps and information you need to embark on your journey.

Table of Contents

1) Who is a Financial Manager?

2) Core duties of a financial manager

3) Steps to Become a Financial Manager

4) Financial Manager Salary and Career Outlook

5) A Day in the Routine of a Financial Manager

6) Demand for Financial Managers Across Countries

7) Responsibilities of a Financial Manager

8) Conclusion

Who is a Financial Manager?

A Financial Manager is responsible for overseeing an organisation’s financial health. They ensure adequate cash flow and liquidity through budgeting, accounting, and financial planning. Financial Managers also prepare reports to assess how well the organisation meets its budget goals.

Core Duties of Financial Manager

Responsibilities of a Financial Manager:

a) Preparing Financial Reports: Create financial statements and reports for upper management, executives, and company owners.

b) Evaluating Financial Health: Analyse trends and data to assess the organisation’s financial status.

c) Forecasting Financial Needs: Predict the business’s future financial requirements and income.

d) Identifying Cost-saving Opportunities: Find ways to reduce costs, increase earnings, and achieve long-term financial goals.

e) Reviewing Market Trends: Study industry trends to identify expansion opportunities.

f) Advising Management: Use financial data to guide key financial decisions.

g) Overseeing Finance Staff: Manage the performance of employees in accounting or finance roles.

h) Ensuring Compliance: Ensure adherence to accounting standards and financial reporting requirements.

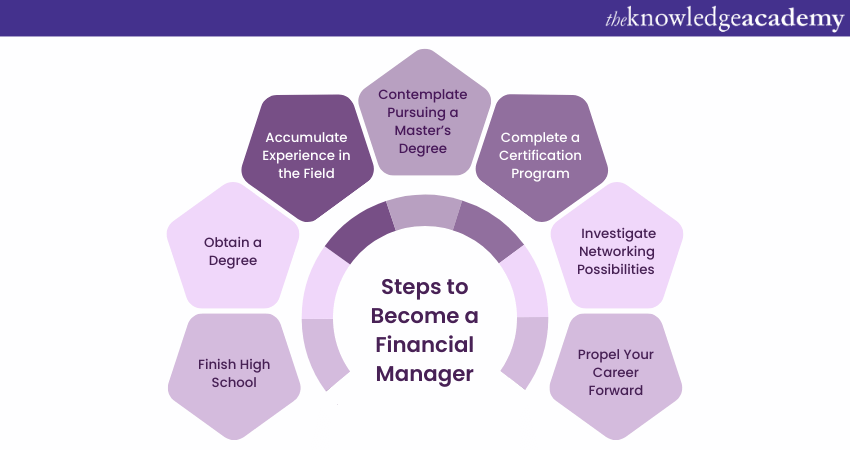

Steps to Become a Financial Manager

Becoming a Financial Manager involves acquiring the right education, qualifications, and certifications. Employers typically look for candidates with higher education and industry-specific certifications that demonstrate a solid understanding of financial concepts and the broader market. This foundation helps you gain relevant work experience and stand out during the application process. Here are the steps to guide you:

1) Finish High School

Start by achieving good grades in your secondary education, such as GCSEs or A-Levels. Focus on subjects like business, mathematics, statistics, or economics to build a fundamental understanding of core concepts. This sets you up for further education in relevant undergraduate and postgraduate courses. Use this time to research the finance sector.

2) Obtain a Degree

Next, earn an undergraduate degree in finance, accounting, or a specialised finance field. This demonstrates your knowledge and passion for the industry. Most finance degrees take three years, with some offering a four-year course, including a business placement. Consider a postgraduate degree, like an MSc in finance, to deepen your skills and open up opportunities in larger firms. Some of the courses you may take in a Finance-related degree include the following:

a) Financial Accounting

b) Managerial Accounting

c) Corporate Finance

d) Financial Statement Analysis

e) Financial Modelling

f) Financial Markets and Institutions

g) Investments

h) Portfolio Management

i) Risk Management

j) International Finance

k) Business Law and Ethics

l) Business Statistics

m) Business Communication

3) Accumulate Experience in the Field

Gain work experience in entry-level roles, such as in an accounts team or a bank, to learn about the financial sector and the role of Financial Managers. This experience not only strengthens your application but also provides a foundation for earning industry certifications. Seek mentorship from senior professionals.

4) Contemplate Pursuing a Master’s Degree

A bachelor’s degree is usually sufficient to become a Financial Manager. However, some employers may need candidates to have a master’s degree in a Finance-related field, such as a Master of Business Administration (MBA), a Master of Science in Finance (MSF), or a Master of Accountancy (MAcc).

A master’s degree will help you enhance your knowledge and skills in Finance and Management and get a competitive edge in the job market. You will also be able to specialise in a particular area of Finance, such as corporate Finance, Financial Engineering, Financial Risk Management, or Financial Reporting and Analysis. Some of the courses you may take to complete your master’s degree include the following:

a) Advanced Financial Accounting

b) Advanced Corporate Finance

c) Financial Econometrics

d) Financial Derivatives

e) Financial Strategy

f) Financial Regulation and Governance

g) Financial Innovation and Entrepreneurship

h) Financial Ethics and Sustainability

i) Financial Leadership and Communication

j) Financial Research Methods and Projects

4) Highlight Qualifications and Skills on Your CV

Before applying for roles, develop your CV to showcase your qualifications, certifications, and skills. Highlight your degrees in the achievements section and tailor your CV to each job application. A well-crafted cover letter can also enhance your application.

5) Earn Certifications

Obtain industry-specific certifications to build on your knowledge and demonstrate your skills to potential employers. These certifications can make you a more attractive candidate for Financial Manager positions.

6) Expand Your Network and Knowledge

Throughout your career, network with professionals across various roles and businesses. Building contacts and learning new skills within the financial sector is crucial. Engage with senior staff, especially Financial Managers, to gain insights into your career goals.

Master the essentials of Payroll Management – Join our Payroll Course today.

7) Acquire Necessary Skills

In addition to technical knowledge, develop soft skills such as attention to detail, organisation, and analytical abilities. These skills are essential for excelling as a Financial Manager and advancing in your career.

Image desc: Skills required for a Financial Manager

a) Technical Skills

b) Analytical Skills

c) Problem-solving Skills

d) Communication Skills

e) Interpersonal Skills

f) Leadership Skills

8) Propel Your Career Forward

The final step in Becoming a Financial Manager is to advance your career to the next level. You can do this by pursuing the following:

a) Continuing to learn and improve your knowledge and skills

b) Taking on more responsibilities and challenges

c) Seeking new opportunities and projects

d) Pursuing your career goals and aspiration

e) Seeking feedback and recognition from your employers, clients, and colleagues and showcasing your achievements and contributions

Some of the other ways to advance your career as a Financial Manager include the following:

a) Pursuing further education or certification in Finance or Accounting.

b) Seeking a promotion or a leadership role in your organisation.

c) Switching to a different organisation or industry that offers better prospects and rewards.

d) Starting your own business or consultancy in Finance or Accounting.

e) Mentoring and coaching other professionals and aspiring Financial Managers.

Take control of your financial success – join our Introduction to Credit Control Course today!

Financial Manager Salary and Career Outlook

According to Glassdoor, the estimated annual salary for a Finance Manager is £58,377 in the UK in 2024. However, the salary of these professionals may vary depending on factors, including the sector, industry, size, and location of the organisation, as well as the level of experience, education, and certification of the Financial Manager.

Demand for Financial Managers Across Countries

Financial Managers has high demands in various countries. Let’s discuss the demand of these professionals in United Kingdom (UK) and United State of America (USA).

1) United Kingdom

The demand for skilled resources in the UK has been steadily increasing. According to the Office for National Statistics (ONS), one in eight businesses experienced worker shortages in July 2023, with 38% of those businesses resorting to increased overtime work. This shortage presents a significant opportunity for skilled workers from other nations to find employment in the UK, particularly in Financial Management, which is among the most sought-after professions.

2) United States of America

In the United States, the demand for Financial Managers is projected to grow significantly. The Bureau of Labor Statistics (BLS) reports that employment for Financial Managers is expected to increase by 17% between 2021 and 2031, a rate much faster than the average for all occupations.

Typically, Financial Managers in the USA require a bachelor’s degree and at least five years of experience in business or financial roles such as Accountant, Securities Sales Agent, or Financial Analyst.

With the rising importance of financial awareness, Blockchain technology, and crypto trading, Financial Management skills are becoming increasingly valuable in both the UK and the USA.

Responsibilities of a Financial Manager

A Financial Manager's role is multifaceted, encompassing a wide range of responsibilities. Here are some of the core duties of a Financial Manager:

1) Developing financial strategies

2) Monitoring financial performance

3) Analysing market trends and economic indicators

4) Advising on investment decisions

5) Ensuring regulatory compliance

6) Managing financial risks

7) Overseeing budgeting and financial reporting

These responsibilities highlight the diverse and crucial functions that Financial Managers perform to ensure the financial health and success of an organisation.

Conclusion

Becoming a Financial Manager is a rewarding and challenging career path that needs a combination of education, experience, and skills. Financial Managers play an important role in an organisation's financial success and sustainability and can positively impact society and the economy. If you want to get insights on How to Become a Financial Manager, you can follow the steps outlined in the blog and pursue your career goals and aspirations.

Want to elevate your career in Accounting and Finance? Join today for our expert-led Financial Management Course and unlock a world of opportunities!

Frequently Asked Questions

A Financial Manager typically needs a bachelor’s degree in finance, accounting, economics, or a related field, along with five or more years of experience in financial roles such as accounting, securities sales, or Financial Analysis.

The Financial Management Course is highly regarded for Financial Managers, providing in-depth knowledge and skills in investment analysis and portfolio management.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Training, including the Finacial Management Course, Financial Modelling Course and Financial Analyst Training. These courses cater to different skill levels, providing comprehensive insights into Functions of Financial Management.

Our Business Skills cover a range of topics related to Financial Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting & Finance skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Financial Management Course

Financial Management Course

Fri 27th Dec 2024

Fri 24th Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 25th Jul 2025

Fri 26th Sep 2025

Fri 28th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please