We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Would you like to learn more about the Real Estate industry? Does people getting their dream homes excite you? Therefore, a career as a Mortgage Advisor might be appropriate for you. While we know this, the Real Estate market is very complicated nowadays, and it is also challenging to be a Mortgage Advisor. Fret not; we will address “How to become a Mortgage Advisor?” for you.

Here, we will examine the skills, knowledge, and requirements needed to become a successful Mortgage Advisor. We will unveil the mysteries of the housing market and make navigation simple for you to follow. What are you waiting for? Carry on reading, and you will know How to Become a Mortgage Advisor!

Table of Contents

1) Who is a Mortgage Advisor?

2) What are the skills necessary to become a Mortgage Advisor?

3) Qualifications required to become a Mortgage Advisor

4) Steps to become a Mortgage Advisor

5) Salary insights on Mortgage Advisor

6) Conclusion

Who is a Mortgage Advisor?

A Mortgage Advisor is a financial consultant expected to lead individuals in taking Mortgage loans. They determine a client's financial ability, compare different lenders' offerings, and give someone specific advice based on the individual client's circumstances so that the client might obtain the best Mortgage product.

Our Mortgage Advisors will teach you about the monthly instalments, the term of the loan, and alternative repayment plans. They will advise you to avoid debt troubles and make an informed decision suitable for your paycheck.

Being the ones who have the Mortgage industry at their fingertips and know the rules and guidelines that are in place puts Mortgage Advisors in a pivotal position to help their clients have a seamless experience buying a home.

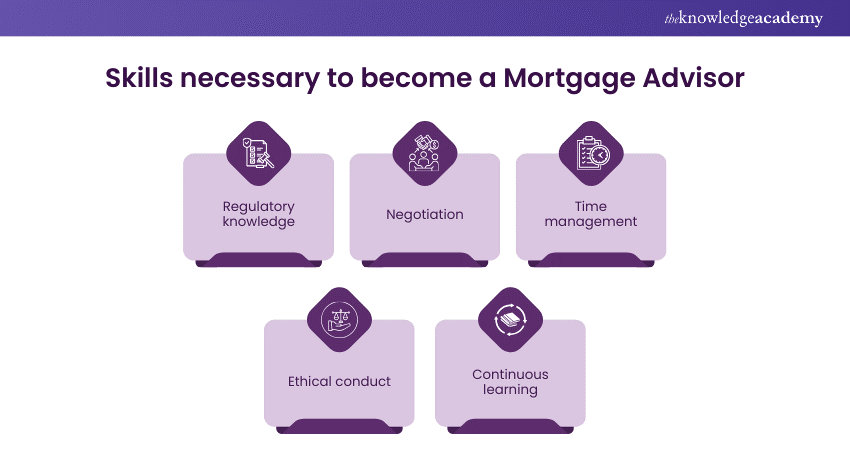

What are the skills necessary to become a Mortgage Advisor?

To excel as a Mortgage Advisor, there are many skills that you need to possess:

a) Financial analysis: You need to examine clients' financial statements, such as income statements, credit reports, and asset statements, to determine their fitness for the Mortgage loan process makes me a great individual.

b) Communication: Communication Skills are very important because they help clients understand complex terms and options, keeping the communication level high with lenders and others involved in this process.

c) Attention to detail: Precision in every detail is required when shorting the final Mortgage documents to avoid misspellings, mistakes in calculation, and correct completion of documents for delays and faults.

d) Problem-solving: The distinguishing element regarding finding possible problems or obstacles in the Mortgage process and later recommending feasible solutions may be presenting alternative financing options or negotiation conditions with lenders.

e) Customer service: Customers need to be treated amazingly, as this is the primary way to establish the connection, understand their requirements, and convey personalised guidance and support during the Mortgage application and approval stage.

f) Regulatory knowledge: Knowledge of Mortgage regulations and compliance requirements is a primary area of understanding to demonstrate compliance with legal and industry requirements and shield client interests.

g) Negotiation: You need to have good negotiation skills to negotiate for the best terms and conditions with the lenders, including the interest rate, the loan terms, and the closing costs, which can be provided for the clients. Therefore, the most favourable Mortgage may be secured.

h) Time management: Developing enhanced Time Management skills is vital for proper task prioritisation and meeting deadlines to complete the Mortgage process on time, including all necessary steps and documentation.

i) Ethical conduct: Maintaining the highest moral values and integrity during all interactions with clients, lenders, and all other people involved. The transparency and trustworthiness of the whole Mortgage Advisory practice should remain.

j) Continuous learning: The ability to keep up with changes in the Mortgage industry sector, such as regulatory changes, new financial technology reforms, and so on, to give clients the most recent and modern information and advice.

Do you want to improve your understanding about Mortgage? Then sign up now for our CeMAP Course (Level 1,2 And 3)!

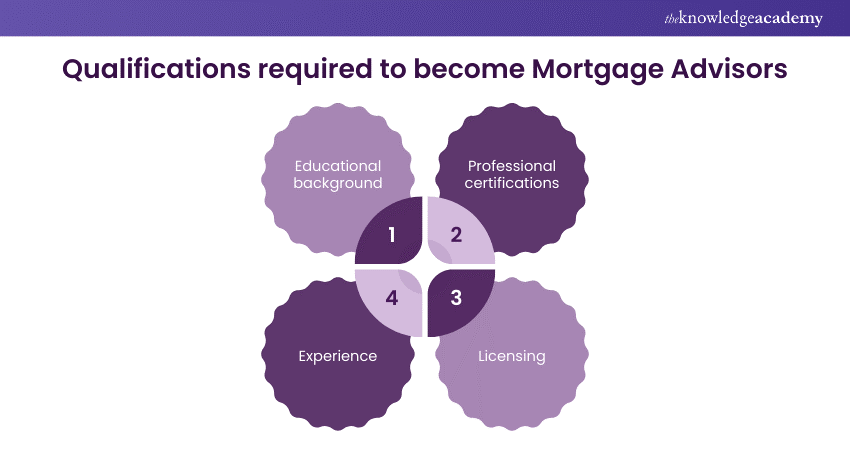

Qualifications required to become Mortgage Advisors

Becoming a Mortgage Advisor involves a combination of educational qualifications, professional certifications, and relevant experience. Here are the qualifications needed:

a) Educational background: Mortgage Advisors typically hold a Bachelor's degree in Finance, Economics, Business Administration, or a related field. This foundational education provides the necessary knowledge of financial principles and lending practices.

b) Professional certifications: Obtaining certifications specific to Mortgage advising enhances credibility and expertise. The UK's Certificate in Mortgage Advice and Practice (CeMAP) is the most recognised certification for Mortgage Advisors.

c) Licensing: Mortgage Advisors must obtain appropriate licenses to practice in their jurisdiction. This usually involves passing exams and meeting regulatory requirements set by government agencies or industry organisations. Licensing requirements vary by region and may include state-specific licensing and registration with regulatory bodies such as the UK's Financial Conduct Authority (FCA).

d) Experience: Gaining practical experience in the Mortgage industry is essential. This can be through entry-level positions in Mortgage lending, banking, or financial services, where advisors learn about loan products, underwriting processes, and customer relations.

Turn your passion for finance into a profession – Explore How to Become a Financial Advisor!

Steps to become a Mortgage Advisor

Becoming a Mortgage Advisor involves gaining relevant experience, completing formal training, and obtaining necessary certifications. Here are three key steps to consider:

Progression from related roles

Many Mortgage Advisors start their careers in related roles within the financial services industry. Positions such as Mortgage administrator, underwriter, or loan officer provide valuable insights into the Mortgage process and client interactions.

Working in these roles allows individuals to gain firsthand experience in assessing Mortgage applications, understanding lending criteria, and providing customer service.

Aspiring Mortgage Advisors can leverage their experience in these roles to transition into advisory positions. This progression often involves further education and obtaining relevant certifications, but the foundational knowledge and practical experience gained in related roles are invaluable.

Apprenticeships

If you dream of working as a Mortgage Advisor, you can pursue mentoring. In the UK, these programs blend on-the-job training with classroom-oriented learning, allowing the apprentices to learn the trade while earning qualifications relevant to Mortgage Advisory.

Training is often done on the job, where trainee counsellors work closely with experienced Mortgage Advisors, learning about different Mortgage products, regulatory obligations, and customer service. The apprenticeship period is usually one to two years, and at its climax, the learner will be awarded the Certification in the Advice and Practice of Mortgage (CeMAP).

Budding learners who are more inclined to experience something and gain knowledge from the start are perfect for these apprenticeships. They offer this opportunity to people who are motivated to begin a career in the Mortgage industry. After successful completion of this program, employment opportunities will likely be there for them.

Formal training schemes

Formal training schemes offered by financial institutions or industry organisations provide aspiring Mortgage Advisors with structured education and development opportunities. These schemes typically combine classroom-based training with on-the-job experience and may lead to recognised qualifications or certifications.

Training schemes cover various topics relevant to Mortgage advising, including Mortgage products, regulatory compliance, customer relationship management, and sales techniques. Participants receive guidance and mentorship from experienced professionals, helping them develop the skills and knowledge needed to excel in their roles.

Formal training schemes vary in duration and intensity, with some programs offering part-time or distance learning options to accommodate individuals' schedules. Completing a formal training scheme can provide a solid foundation for a career in Mortgage advising and enhance employment prospects within the industry.

Salary insights on Mortgage Advisor

Here, we will discuss the average salaries of different levels on Mortage Advisor:

|

Roles |

Average salary/year |

|

Trainee Mortgage Advisor |

£3,662 - £8,801 |

|

Mortgage Advisor |

£37,100 |

|

Financial Advisor |

£80,000 |

Source: Glassdoor

Are you interested in learning all Financial concepts? Then register now for our Finance for Non-Financial Managers Training!

Conclusion

Multiple pathways exist to becoming a Mortgage Advisor, including progression from related roles, apprenticeships, and formal training schemes. Each path offers unique advantages and opportunities for individuals to gain the necessary experience, qualifications, and skills to succeed in this rewarding profession.

Do you want to learn how to analyse Financial techniques? Then sign up now for our Financial Management Course!

Frequently Asked Questions

Is being a Mortgage Advisor easy?

To be successful as a Mortgage Advisor, you need a good understanding of financial tools, regulatory requirements, and excellent communication skills.

Can you be a Mortgage Advisor as a side hustle?

Yes, becoming a Mortgage Advisor can be a side hustle; it, however with training getting the necessary certifications and client meetings alongside your other commitments, could be difficult.

What are the other resources and offers provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is the Knowledge Pass, and how does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are related courses and blogs provided by The Knowledge Academy?

The Knowledge Academy offers various , including the CeMAP CeMAP CoursesCourse (Level 1,2 And 3). These courses cater to different skill levels, providing comprehensive insights into Mortgage Life Cycle.

Our Business Skills Blogs cover a range of topics related to Mortgage, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Mortgage Advisory skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 7th Apr 2025

Mon 9th Jun 2025

Mon 18th Aug 2025

Mon 27th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please