We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Becoming an Investment Banker is a sought-after career path that offers challenging work, substantial compensation, and a chance to shape the world of finance. If you're intrigued by the world of investments and financial transactions, this comprehensive blog guide will provide you with the insights and steps needed to embark on a successful journey as an Investment Banker.

According to Glassdoor, the average pay of an Investment Banker in the UK is about £52,535 per year. So, it is a very rewarding career, and if you are interested in pursuing it, then this blog is for you. In this blog, you will learn How to Become an Investment Banker, the roles and responsibilities, skills and qualifications required to become one.

1) Who is an Investment Banker?

2) Roles and responsibilities of an Investment Banker

3) How to become an Investment Banker?

4) Skills required to Become an Investment Banker

5) Conclusion

Who is an Investment Banker?

An Investment Banker is a financial professional who assists people and organisations with advisory services in relation to raising capital, mergers and acquisitions, and other financial transactions. Their job is to bridge the gap between corporations seeking to raise funds and investors seeking opportunities to invest their money.

Investment Bankers work with corporations, governments, and other entities, helping them navigate complex financial processes and the Investment they should be making at that point of time. They play a crucial role in facilitating the buying and selling of financial instruments, structuring deals, and providing strategic financial advice to clients. Their expertise lies in optimising financial outcomes, managing risks, and ensuring compliance with regulatory requirements in the dynamic landscape of global finance.

Roles and responsibilities of an Investment Banker

An Investment Banker's role encompasses vital functions within the financial domain. These professionals are instrumental in driving financial transactions, delivering advisory services, and aiding clients in strategic decision-making. Here's a comprehensive overview of their key roles and responsibilities:

1) Financial advisory: Investment Bankers assume the mantle of Strategic Financial Advisors, catering to a diverse clientele spanning corporations, governmental bodies, and institutions. Armed with in-depth insights into financial structures, they extend their expertise in areas like capital procurement and mergers and acquisitions. By assimilating intricate financial details, Investment Bankers empower clients to optimise their financial strategies, thereby fostering growth and stability.

2) Capital raising: A cornerstone of an Investment Banker's role lies in facilitating capital raising for clients. Through the issuance of stocks, bonds, and a myriad of financial instruments, Investment Bankers navigate the intricate terrain of market conditions. They meticulously construct funding strategies that align with clients' objectives and execute transactions with precision. This process infuses funds into ventures, enabling expansions, projects, and developmental pursuits.

3) Mergers and Acquisitions (M&A): Investment Bankers emerge as key orchestrators in the realm of M&A transactions. Their prowess extends to mediating negotiations, conducting exhaustive due diligence, and meticulously evaluating potential targets. By structuring deals that resonate with mutual benefit, Investment Bankers ensure favourable outcomes for all stakeholders involved. This pivotal role contributes to the dynamism of industries and economies alike.

4) Financial analysis: Investment Bankers are adept analysts, delving into intricate financial nuances. By meticulously scrutinising company financials, market trends, and broader industry performance, they unearth actionable insights. This intensive analysis forms the bedrock for informed investment recommendations and strategic decision-making. They serve as conduits of informed choices in an ever-evolving financial landscape.

5) Valuation: One of the hallmark responsibilities of Investment Bankers is determining the value of entities and assets. Armed with diverse valuation techniques, they navigate the complexities of mergers, acquisitions, and even Initial Public Offerings (IPOs). By providing an accurate financial estimation, they pave the way for well-informed transactions that lay the groundwork for sustainable growth.

These five core responsibilities underscore the integral role that Investment Bankers play in the intricate web of financial transactions and strategic guidance.

Unlock the art of strategic Investment Management in our Investment Management Masterclass – Sign up now!

How to become an Investment Banker?

If you're harbouring aspirations of becoming an Investment Banker, it's crucial to follow a strategic roadmap that will guide you toward success. Here's a step-by-step instruction on How to Become an Investment Banker:

1) Education

Start by acquiring a solid educational foundation. Pursue a Bachelor's degree in Finance, Economics, or a related field. This foundational understanding is indispensable for your future endeavours. Consider enhancing your qualifications by pursuing a Master's degree in Finance or even an MBA. These advanced degrees can set you apart and provide you with a deeper understanding of the financial landscape.

2) Gain practical experience

Practical experience is invaluable in the world of Investment Banking. Seek out internships or entry-level positions within financial institutions. This hands-on knowledge will help you understand the practical applications of your education and provide insights into the industry's dynamics.

3) Develop essential skills

Investment Banking demands a unique set of skills. Hone your analytical abilities to dissect intricate financial data and decipher market trends. Enhance your communication skills to effectively convey complex concepts to clients and colleagues. Cultivate problem-solving skills to navigate challenges and complexities.

4) Get licensed

Before commencing work as an Investment Banker in a UK-based firm, it's mandatory to register with the Financial Industry Regulatory Authority (FINRA). This involves taking an exam tailored to your specific area of Investment Banking, which can be completed during your initial training period. Additionally, consider pursuing industry-recognised certifications such as the Investment Management Certificate (IMC) for understanding UK regulations and the globally recognised Chartered Financial Analyst (CFA) certification to enhance your professional credentials in the field.

5) Secure entry-level positions

Start your Investment Banking journey as a Financial Analyst. These positions offer the opportunity to apply your skills and gain real-world experience. Research firms that align with your career goals and values and tailor your applications accordingly.

6) Seek growth opportunities

Consider pursuing certifications like the Chartered Financial Analyst (CFA) designation. This not only validates your expertise but also opens doors to more advanced roles. Explore specialisation in areas like mergers and acquisitions or trading to become a subject matter expert.

7) Advance to higher positions

Progress to Associate or Vice President roles as you accumulate experience. These positions come with increased responsibilities, including managing client interactions and leading projects.

The journey to becoming an Investment Banker is multifaceted and requires dedication, education, practical experience, and a continuous commitment to growth. By following these comprehensive steps, you can navigate the intricate world of Investment Banking and carve out a rewarding and successful career in finance.

Your career in finance awaits – learn How to Become a Financial Advisor!

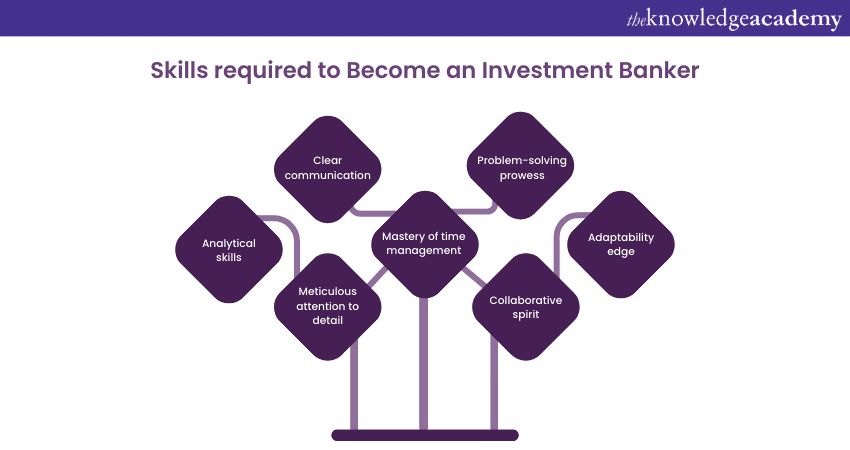

Skills required to Become an Investment Banker

In the pursuit of a successful career as an Investment Banker, developing a set of essential Investment Banking Skills is paramount. These skills not only contribute to your effectiveness in the role but also help you stand out in a competitive industry. Here's a closer look at “How to Become an Investment Banker?” and the skills you should focus on:

Analytical skills

Investment Bankers decode intricate financial data, assess market trends, and gauge risks and rewards. Adept analytical skills empower you to make informed decisions and offer invaluable insights to clients.

Clear communication

Effective communication is paramount in this profession. Conveying intricate financial concepts clearly to clients, colleagues, and stakeholders is pivotal. Strong communication is a game-changer when presenting findings, negotiating, or drafting reports.

Meticulous attention to detail

Precision is non-negotiable in finance. A sharp eye for detail ensures accuracy in financial models, valuations, and reports, fostering confidence in your work.

Mastery of time management

Juggling multiple projects with tight deadlines is the norm. Effective time management is indispensable to balancing tasks, meeting client expectations, and delivering quality outcomes under pressure.

Problem-solving prowess

Navigating intricate financial transactions demands quick thinking. Solid problem-solving skills empower you to surmount complexities, innovate solutions, and tackle challenges head-on.

Collaborative spirit

The financial sector hinges on team collaboration. Working harmoniously with analysts, traders, and experts is pivotal. Leveraging collective expertise fuels success.

Adaptability edge

Finance's fluidity mandates adaptability. Openness to learning, embracing new tech, regulations, and trends ensures your continued relevance and triumph.

Decision making

Investment Bankers play a pivotal role in guiding clients, both individuals and organisations, through crucial decision-making processes. Analysing trends and forecasts is integral to their expertise, enabling them to make informed and strategic investment decisions on behalf of their clients.

Cultivating these skills is an ongoing pursuit. By harnessing and refining these proficiencies, you'll not only thrive but also flourish as a standout Investment Banker, poised to excel in the ever-evolving finance realm.

Conquer the Stock Market with our Stock Trading Masterclass – Sign up today!

Conclusion

We hope you read and understood “How to Become an Investment Banker?” Investment Bankers are the architects of growth in the realm of finance. From financial analysis to capital raising, they are responsible for a lot of key activities and help reshape the industry.

Elevate your financial insight and prowess with our Investment and Trading Training – Sign up now!

Frequently Asked Questions

How long does it take to become an Investment Banker?

The duration to become an Investment Banker varies. Typically, it involves obtaining a bachelor's degree, which takes around three to four years, and gaining relevant work experience, which can take an additional two to three years. Pursuing advanced degrees, such as an MBA, can further extend the timeline. The overall process to establish oneself as a proficient Investment Banker may span from five to seven years, contingent on educational and career development paths.

Do Investment Bankers get paid well?

Yes, Investment Bankers typically receive substantial compensation for their services. Due to the demanding nature of their roles and the high level of expertise required, Investment Bankers are often well remunerated. Salaries are complemented by bonuses, creating a lucrative compensation structure. The financial industry recognises the value of their contributions, resulting in competitive pay packages that reflect the complexity and responsibility associated with the profession.

Do Investment Bankers get paid well?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is Knowledge Pass, and how does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the related courses and blogs provided by The Knowledge Academy?

The Knowledge Academy offers various Investment and Trading Trainings, including Stock Trading, Real Estate and Investment Banking courses. These courses cater to different skill levels, providing comprehensive insights into What is Trading.

Whether you are starting your journey or aiming to elevate your Investment and Trading expertise, immerse yourself in our Business Skills blogs to discover more insights!

Upcoming Advanced Technology Resources Batches & Dates

Date

Cryptocurrency Trading Training

Cryptocurrency Trading Training

Fri 11th Apr 2025

Fri 13th Jun 2025

Fri 15th Aug 2025

Fri 10th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please