We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you thinking of breaking free from the 9-to-5 grind and writing your own career success story? Being self-employed is the way to go, as you'll be clocking in to work for no one but yourself. But it takes more than just passion to become your own boss. From assessing your strengths and weaknesses and defining your business offerings to implementing system for taxes and administration, kickstarting your business can be an uphill battle.

But don't worry! This blog will help smoothen the process by delving into the essential steps on How to Become Self-employed. So read on, acquaint yourself with expert tips including the benefits and challenges, and turn your entrepreneurial dreams into a thriving reality.

Table of Contents

1) Understanding the Concept of Self-employment

2) Steps to Becoming Self-employed

3) Benefits of Self-employment

4) Challenges of Self-employment

5) Conclusion

Understanding the Concept of Self-employment

Self-employment involves earning income directly through one's own business rather than serving an employer as an employee. In self-employment, an individual is responsible for financing and managing their own business, including every aspect of sales, marketing, and financial management. Growth opportunities for self-employed individuals may differ significantly depending on the field of work and can fluctuate according to the economy's performance.

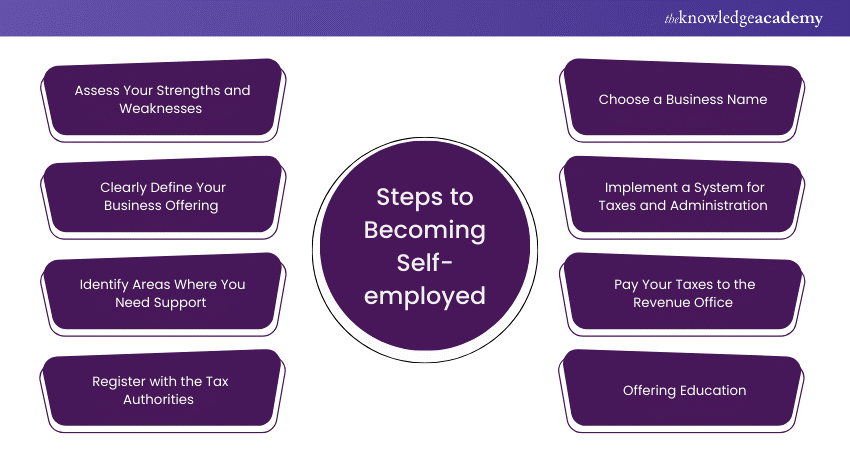

Steps to Becoming Self-employed

Being self-employed means being responsible for your business's wins and losses, filing your tax return, and performing other administrative duties. Here's a step-by-step route to success as a self-employed individual.

1) Assess Your Strengths and Weaknesses

Knowing your strengths and weaknesses is essential when starting your business. This can be especially helpful if you are a first-time business owner. Since becoming a sole trader involves taking on every responsibility, outlining the strengths and weaknesses can help decide what areas you need help with to make your business successful.

2) Clearly Define Your Business Offering

This step must not be overlooked. While many new business owners know their business area, they need help determining the specific products and services they must offer and the target customer base. Researching this area and knowing the available market for your offer is vital. The Local Enterprise Office offers help on all things related to self-employment.

3) Identify Areas Where You Need Support

In the beginning, you'll get hit with a multitude of new information to familiarise yourself with, and it can feel overwhelming. Knowing your exact necessities can help you prioritise the tasks you're good at. Hiring a virtual assistant or an accountant can help you when you start your own business.

4) Register with the Tax Authorities

Once the business offer is defined, it's time to sign on with the Revenue Office before you begin trading. This is where you pay taxes on the income and declare your annual return. You pay income tax not as an employee but as a sole trader, and you can also apply for certain tax reliefs. This is beneficial for getting the business off the ground.

5) Choose a Business Name

While having a business name is not necessary, some people prefer to incorporate the service into their business name. If you decide to use a business name, you must register it with the Companies Registration Office.

6) Implement a System for Taxes and Administration

When employed by a company, you don't have to worry about keeping track of tax information, invoices, expenses, and other administrative tasks. Once you have your own business, you keep track of and maintain these things in an orderly fashion. The essential records include sales, purchases, and all monies customers receive and what you've paid out. Bank statements and receipts are also vital for your records.

7) Pay Your Taxes to the Revenue Office

Once registered as a sole trader, you must pay your income tax, Pay Related Social Insurance (PRSI), and the universal social charge. As a self-employed individual, you pay your taxes under the self-assessment process available on the Revenue's website.

Alongside the preliminary tax, you must file your annual tax return and pay the taxes due. Every year, you file your return before October 31. Revenue charges interest on late payments if you cannot meet this deadline.

8) Focus on Growing Your Business and Setting Income Goals

It's easy to go from year to year and try to keep afloat. Being your own boss means you can decide on the pace at which to grow your business. Having a concrete business plan can help you secure work with collaborators and agencies. Building a solid marketing focus into your business can cultivate relationships and win new customers.

Learn about the principles of employee engagement and motivation in our Employee Relations Training now!

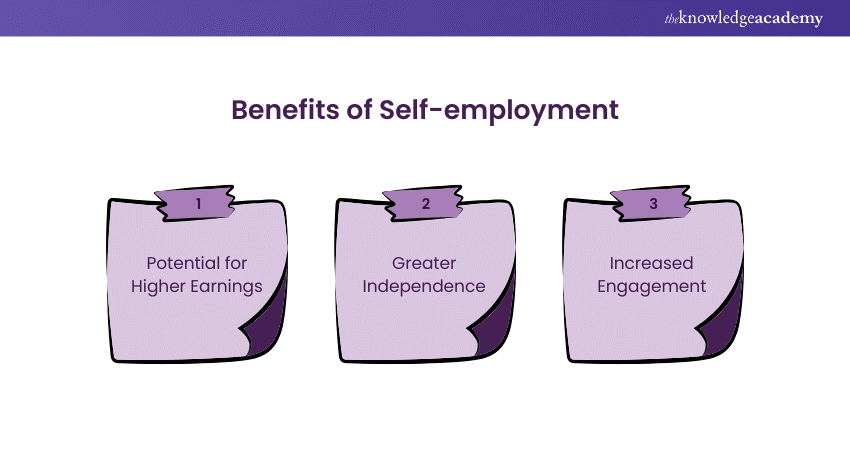

Benefits of Self-employment

A self-employed career can be highly rewarding and can offer you flexibility and opportunities beyond traditional jobs. Self-employment brings with it a plethora of advantages, of which the following three are the most prominent.

1) Potential for Higher Earnings

Additionally, because you are not working for wages determined by a company, you won't have a limit on the amount of money you can make. Between setting your own rate and taking on as many clients as you want, you typically have greater earning potential than salaried employees.

2) Greater Independence

For those who pursue self-employment as a career option, the best benefits are the sense of autonomy and independence over how and when they work. Depending on the nature of work, self-employed individuals can often control their hours, where they work, and how to complete their job best.

3) Increased Engagement

A self-employed individual dons many hats. You'll be in charge of selling products and services and managing marketing, administrative tasks, and operational duties. In other words, you’ll be completely engaged and rarely be bored if you're self-employed.

Want to be better equipped in identifying growth opportunities in your organisation? Sign up for our Strategic Planning and Thinking Course now!

Challenges of Self-employment

Despite the freedom, engagement and higher earning potential, self-employment carries its fair share of challenges. The most prominent drawbacks of being self-employed includes the following:

1) Managing Your Benefits

Self-employed individuals are often responsible for securing and managing benefits such as retirement savings, healthcare, and paid time off. This can become complicated for business owners who manage these benefits for their employees.

2) Income Instability

One of the biggest concerns involving self-employment is the lack of consistent income. For those whose income is dependent on the clientele or selling offerings that don’t yet have a solid customer base, earnings can fluctuate during a slow month or off-season.

3) Risk of Feeling Overwhelmed

Along with the lack of guaranteed benefits and inconsistent income, the demands of managing diverse business areas (outside of completing tasks related to a particular trade or skill) can overwhelm self-employed individuals.

Conclusion

The journey of self-employment is both extremely challenging and rewarding as it involves deciding your own success trajectory while handling every responsibility. From crafting a solid business plan to managing finances, self-employment is an ongoing journey that is shaped by the performances of the industry and the economy. Learning How to Become Self-employed is about taking the essential steps while weighing the benefits and drawbacks as outlined in this blog.

Hone your skills in measuring financial performance through our comprehensive Introduction to Managing Budgets Course now!

Frequently Asked Questions

Resourcefulness, networking and decision-making skills are among the most vital for self-employment.

Self-employed income includes:

a) Earnings from any independent pursuit of economic activity

b) Income earned by freelancers, sole proprietors, and independent contractors

c) Income reported on a 1099-MISC, 1099-NEC, or 1099-K

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Personal Development Courses, including the Introduction to Managing Budgets Course and the Building Business Relationships Course. These courses cater to different skill levels, providing comprehensive insights into What is Flexible Budget.

Our Business Skills Blogs cover a range of topics related to self-employment, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your business skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Contract Management Certification Training

Contract Management Certification Training

Thu 23rd Jan 2025

Thu 20th Mar 2025

Thu 22nd May 2025

Thu 17th Jul 2025

Thu 18th Sep 2025

Thu 20th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please