We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Picture this: you’ve just received an unexpected windfall and are contemplating the best way to use it. Should you save it, spend it, or invest it? Knowing How to Invest Money can be the key to growing your wealth and securing your financial future. Have you ever wondered how investing can help you achieve long-term goals like purchasing a home or enjoying a comfortable retirement?

In this blog, we will explore the fundamentals of investing, providing you with the knowledge and tools to make informed decisions. Let’s dive into the basics and set you on the path to financial success.

Table of Contents

1) What are Investments?

2) Why do People Invest?

3) Learn How to Invest Money

4) What is the Best Method to Invest Money?

5) What is the Ideal Time to Begin Investing?

6) What About Risk?

7) What Investment is Best for Beginners?

8) Conclusion

What are Investments?

Investments refer to assets or items acquired with the goal of generating income or appreciating in value.

Typically, individuals opt for one of four primary Investment categories, each sharing similar features. These categories are collectively termed ‘Asset Classes’:

a) Shares: In this, you buy a stake in a company

b) Cash: The savings you deposit in a bank or building society account

c) Property: You invest in a physical building. This can be commercial or residential

d) Fixed Interest Securities (Also Called Bonds): They are given in return for loaning money to a business firm or government.

The various assets possessed by an Investor are called a portfolio. Generally, spreading your money between the different types of asset classes helps reduce the risk of your portfolio underperforming. There are several different ways of Investing. Many people invest through collective or ‘pooled’ funds such as unit trusts.

Why do People Invest?

Investing is a powerful way for individuals to secure their financial future and maximise their wealth. Here are some key reasons why people choose to invest:

1) To Grow Wealth Over Time

Investing provides an opportunity for wealth to grow at a faster rate than standard savings, helping people build stronger financial foundations.

2) For Long-term Financial Security

By investing, individuals can ensure their financial stability in the future, whether it's preparing for retirement, buying a home, or building an emergency fund.

3) To Achieve Personal Financial Goals

Investors often put their money towards specific goals, such as paying for education, starting a business, or creating a comfortable retirement fund.

4) To Minimise Risk Through Diversification

Investing in a variety of assets helps reduce risk, balancing potential losses in one area with gains in others.

5) To Leverage the Power of Compounding

Investing allows returns to generate additional returns, making it possible for wealth to grow at an accelerating pace over time.

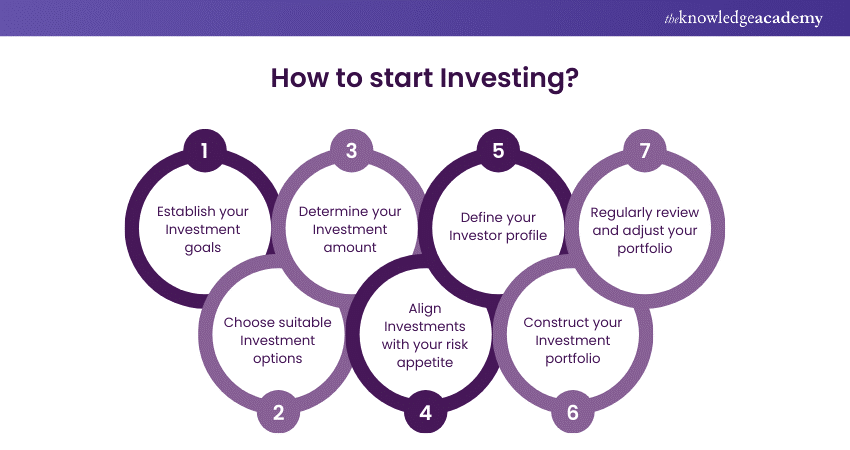

Learn How to Invest Money

Investing involves trying to figure out where exactly you want to go on your financial journey and matching those goals to the right Types of Investment that will help you get there. This implies you'll also have to understand and manage your relationship with risk over time. Just as with investments, understanding the difference between Self-Publishing and Traditional Publishing can be crucial when deciding how to invest time and effort into your writing career, balancing risks and rewards.

If you know what you want, you simply jump in. You also make the decision to Invest by yourself or seek help from a Financial Planner. Below are some detailed key steps to help get you started with investing.

1) Establish Your Investment Goals

Consider your goals before opening an account. Ask yourself if you are investing for the long term or seeking income generation. This will help you narrow down your options, decide on the risk you can take, and prioritise investment accounts.

For example, if investing for retirement, explore tax-advantaged accounts like ISAs or pensions. Keep emergency funds in accessible accounts like cash Individual Savings Accounts (ISAs) to avoid market risks.

2) Choose Suitable Investment Options

After setting your financial goals, choose the right investment vehicles. A brokerage account is ideal for those wanting an active approach, offering flexibility without income limits or withdrawal restrictions. However, it lacks tax advantages. Robo-advisors are good for straightforward needs, offering lower fees and automatic rebalancing. Remember, simply opening an account isn't enough; you need to make purchases within it.

Forecast property investments like a pro – sign up for our Real Estate Financial Modelling Training.

3) Determine Your Investment Amount

Decide how much to fund each account based on your goals and timelines. Generally, aim to invest 15% of your income annually for retirement, including employer matches. If 15% seems high, start small, even at 1%. The key is to begin investing, so your money can grow. Decide whether to invest all at once or in equal amounts over time, each having its merits.

4) Align Investments With Your Risk Appetite

Risk tolerance measures how much risk you are willing to take for higher returns. Use a risk tolerance questionnaire to understand your comfort level. Conservative investors might prefer bonds and cash, while aggressive investors might lean towards equities.

Remember, risk tolerance is about your emotional reaction to losses, while risk capacity considers your financial ability to take risks, factoring in job status and other priorities.

5) Define Your Investor Profile

Your investor profile depends on your risk tolerance, capacity, goals, and time horizon. Investors typically fall into short-term (trading) or long-term categories. Short-term investing can replace current income but is risky and difficult to profit from consistently. Long-term investments are generally taxed at a lower rate and are less affected by market volatility.

Unlock the secrets to thriving in Investment Banking – register for our Investment Banking Course.

6) Construct Your Investment Portfolio

With your goals set, risk tolerance understood, and investment amount decided, it's time to build your portfolio. This involves selecting the right combination of assets to meet your goals. Start by choosing the appropriate account type for your investment goal.

7) Regularly Review and Adjust Your Portfolio

Monitor and rebalance your portfolio a few times a year to account for market fluctuations. For example, if your allocation shifts from 70% stocks and 30% bonds to 80% stocks and 20% bonds, you may be taking on more risk than intended.

Rebalance to match your target allocation, typically when your portfolio drifts more than 5%. Robo-advisors can automate this process. Be cautious during market drops to avoid making impulsive decisions that could lead to losses.

What is the Best Method to Invest Money?

The best method to invest money depends on your financial goals, risk tolerance, and investment horizon. For most individuals, a diversified portfolio is recommended, combining a mix of stocks, bonds, and other assets to balance risk and return. Index funds and mutual funds are excellent choices for beginners, offering diversification and professional management.

Additionally, setting up a regular investment plan, such as a monthly contribution to a retirement account, can help build wealth over time. It's also important to stay informed and periodically review your investments to ensure they align with your goals.

Consulting with a financial advisor can provide personalised guidance tailored to your specific situation, helping you make informed decisions and optimise your investment strategy.

What is the Ideal Time to Begin Investing?

If your cash savings account holds extra money—that you have at the very least to cover for yourself three to six months—and you want it to grow over time, consider Investing some of it.

The kind of Investments or savings that are most appropriate to you will depend on several factors, such as your financial condition, capacity to take risks, and the goals you have set for the future.

Discover the strategies to make informed investment decisions – join our Investment Management Course.

What About Risk?

Risk is an inherent part of any investment. It's crucial to assess your risk tolerance and diversify your portfolio to mitigate potential losses. Understanding the risks involved helps in making informed decisions.

What Investment is Best for Beginners?

For beginners, low-risk investments like index funds or mutual funds are ideal. These options provide diversification and are managed by professionals, making them a safer choice for new investors.

Conclusion

Mastering the fundamentals of investing is your gateway to financial growth and security. By understanding How to Invest Money wisely, you can build a robust portfolio that withstands market fluctuations and achieves your financial goals. Start your investment journey today and pave the way for a prosperous future.

Unlock the secrets to trading Cryptocurrencies with confidence – register for our Cryptocurrency Trading Training.

Frequently Asked Questions

Is it Smart to Invest in Gold?

The decision to Invest in gold can sometimes be rational since it usually holds its value and serves as an inflationary hedge. On the other hand, it does not return capital in the way that Investment in stocks or bonds would, and over the long run, it may not be able to produce superior returns compared to other kinds of Investments.

Is £100 Enough to Start Investing?

Yes, £100 is a good amount to start with in terms of Investing. Most of the platforms allow you fractional shares or have a low minimum Investment; hence, with this amount, you could take your first step into the Investment arena and later increase it once you learn and start earning.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Digital Marketing Courses, including Social Media Marketing Course, SEO Course, and Pinterest Marketing Course. These courses cater to different skill levels, providing comprehensive insights into Content Marketing vs Digital Marketing methodologies.

Our Business Skills Blogs covers a range of topics related to Digital Marketing, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Digital Marketing skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Digital Marketing Resources Batches & Dates

Date

Content Marketing Course

Content Marketing Course

Fri 2nd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 7th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please