We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Have you ever thought about how businesses decide on the most effective level of production? The solution can be found in Marginal Cost, which is the cost of making one extra unit. It aids companies in achieving a balance between cost efficiency and maximising profits. Analysing Marginal Cost helps businesses determine whether to boost production or modify prices. Having a grasp on Marginal Cost is essential for determining if increasing production results in increased profits or unnecessary expenses.

In this blog, let’s understand this concept for effective decision-making, regardless of the size of the business. We’ll also see how your profits are affected by Marginal Cost.

Table of Contents

1) What is Marginal Cost?

2) The Marginal Cost Formula

3) Steps to Calculate Marginal Cost

4) The Impact of Output Changes on Marginal Cost

5) Advantages of Marginal Cost

6) Limitations of Marginal Cost Calculation

7) Marginal Cost Examples

8) Conclusion

What is Marginal Cost?

Marginal Cost plays a key role in decision-making, aiding businesses in assessing the effects of manufacturing additional units. It shows the extra expenses generated with each additional unit produced. This may involve costs such as materials, labour, and other fluctuating expenses.

Through an assessment of Marginal Cost, businesses can pinpoint the most efficient production level that maximises profit while avoiding excessive spending. If the selling price is lower than the Marginal Cost, it might not be beneficial to increase production. Comprehending this equilibrium enables companies to modify tactics, reduce expenses, and improve effectiveness, ultimately resulting in better pricing and production choices.

The Marginal Cost Formula

The calculation of Marginal Cost helps in determining the cost of producing one additional unit. It’s essential for optimising production and pricing strategies. Let's look at the formula:

Marginal Cost= Change in Total Cost/Change in Total Quantity

The formula is written as MC = ΔTC / ΔQ

where:

a) MC stands for Marginal Cost

b) ΔTC represents the change in total cost

c) ΔQ indicates the change in total quantity

Steps to Calculate Marginal Cost

Picture yourself managing an online store that sells artisanal jewellery. You begin making 100 bracelets daily, with a total cost of £500 including materials and labour. You opt to create an additional bracelet, making the count 101, resulting in a total cost of £505. The extra £5 represents the Marginal Cost.

Here’s the method for determining Marginal Cost:

1) Determine the Change in Quantity

Calculate the variation in the quantity of your product. This is typically a single unit, but it may differ.

2) Calculate the Change in Total Cost

Calculate how much your total cost changes with fluctuations in production. Deduct the original expenditure from the updated overall expenditure following the production boost.

3) Compute the Marginal Cost

Compute the Marginal Cost by dividing the difference in total cost by the difference in quantity.

Using the example:

Difference in amount = 101 bracelets - 100 bracelets = 1 bracelet

Total cost increased by £5, from £500 to £505

The cost for each additional unit is £5, resulting in a total cost of £5

The cost of producing an additional bracelet is £5

If the cost of producing one more bracelet is lower than the selling price of that bracelet, it could be advantageous to produce more. Yet, if the Marginal Cost increases, it might be prudent to keep production levels steady or decrease them or think about raising prices to expand production.

Elevate your business practices with our Business Sustainability Course – Register now!

The Impact of Output Changes on Marginal Cost

Variations in production can have a major impact on Marginal Cost, impacting businesses' decisions regarding production levels. Higher variable costs such as materials and labour can cause Marginal Cost to increase when output rises.

On the flip side, boosting efficiency or taking advantage of economies of scale can lower Marginal Cost, resulting in higher profits from expanded production. Businesses can make strategic decisions on pricing, production, and cost management by monitoring these changes.

Comprehending how changes in output affect Marginal Cost helps organisations streamline operations, reduce costs, and increase profits to stay competitive and meet market demands effectively.

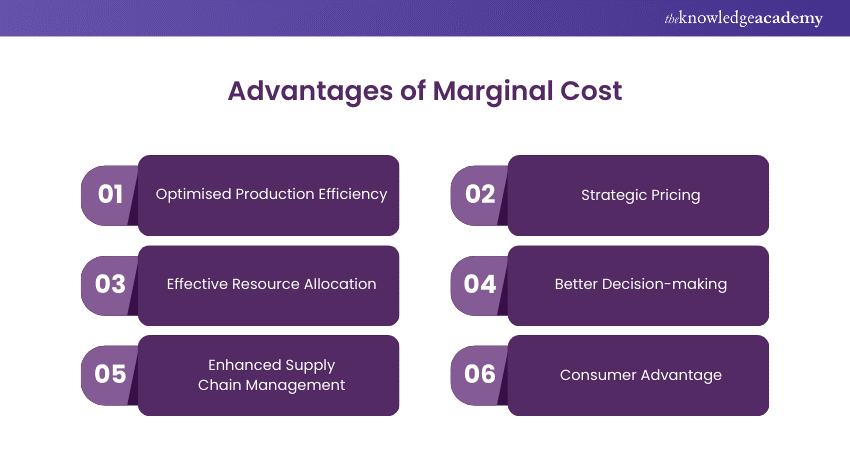

Advantages of Marginal Cost

Utilising Marginal Cost analysis assists managers in optimising business performance across multiple aspects such as production, pricing, and resource allocation. In addition to business, Marginal Costis important in environmental sustainability, government policy, and financial analysis.

1) Optimised Production Efficiency

The best production level happens at the point where the Marginal Cost curve changes direction. Analysing cost fluctuations based on varying output scenarios aids in pinpointing this moment. Maximising profits is achieved by determining the optimal production level through the combination of Marginal Cost and Marginal Revenue curves.

2) Strategic Pricing

Pricing strategy is influenced by calculating Marginal Cost, particularly during periods of low sales. If prices in the market drop below the Marginal Cost, cutting production can help avoid losses. It is uncommon for a product's price to equal its Marginal Cost in a perfect competition scenario.

Most markets consist of distinct products, with prices influenced by both demand and Marginal Cost. Companies have the option to establish a minimum price by considering Marginal Cost and including a markup informed by the market.

3) Effective Resource Allocation

Utilising Marginal Cost analysis efficiently distributes resources among different business lines to maximise total production.

4) Better Decision-making

It helps managers with decisions on expanding, investing, or reducing resources in product lines. This assists in determining which plants to trim, sell, or discontinue.

5) Enhanced Supply Chain Management

The cost of production is contingent upon relationships with suppliers. Marginal Cost analysis identifies cost increases, like in raw materials, and suggests finding new suppliers or negotiating better deals. It also aids in deciding whether scaling up production is beneficial considering the pricing of suppliers.

6) Consumer Advantage

The Marginal benefit represents what consumers are willing to pay for one more unit of a good. When the amount of goods available matches what is needed, the additional advantage is the same as the additional expense. If the benefits outweigh the costs, prices might go up; if not, production could be reduced or halted.

Keeping track of Marginal Costs and revenue enables managers to address declining consumer demand below the level of Marginal Cost.

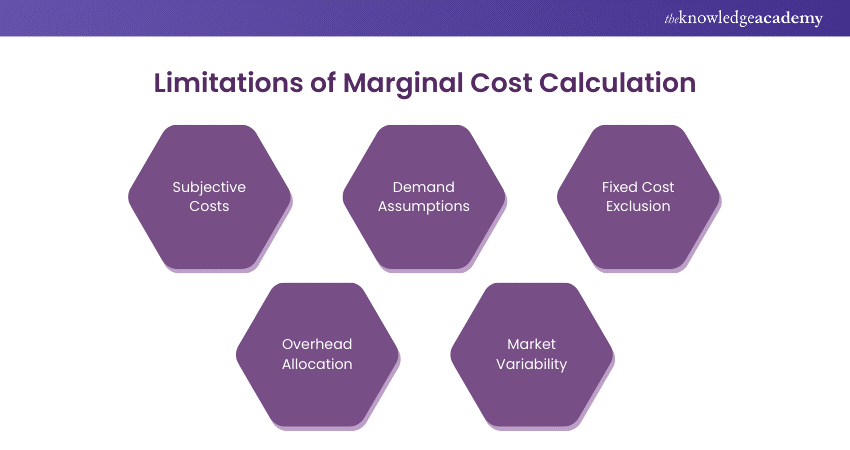

Limitations of Marginal Cost Calculation

The usefulness of Marginal Cost is limited by subjective costs and its imperfect correlation with prices and revenues.

1) Underlying Assumptions and Conditions

It is assumed in the Marginal Cost formula that fixed costs can be easily distinguished from variable costs, although this is often difficult. An example would be if employees on salary (fixed cost) end up receiving overtime wages (variable cost). Getting a new laptop is a constant expense, whereas fixing it can vary. The formula relies on the accurate allocation of fixed and variable costs to each product line, but overhead allocation is often at the discretion of management.

Furthermore, Marginal Cost analysis does not consider fluctuations in fixed expenses, which could result in inadequate coverage of such costs. Incorporating fixed expenses may mask fluctuations in variable costs, leading to inaccurate evaluations of production efficiency.

2) Real-World Variations

Marginal Cost operates under the assumption of steady consumer demand, ensuring that any rise in production will be met without affecting prices. Nevertheless, demand fluctuates based on market and economic conditions, frequently outside of the company's influence. Marginal Cost calculations exclude economic indicators and consumer surveys, potentially resulting in inaccurate production increase assessments. Managers need to analyse market and economic information before choosing to ramp up production.

Enhance your supplier quality with our Supplier Quality Management Training – Sign up now!

Marginal Cost Examples

Marginal Cost examples showcase how changes in production levels impact costs, helping businesses optimise pricing and output strategies.

1) Example 1

A jewellery company creates products made of beads. The cost of beads and string (variable costs) for each bracelet or necklace is £2. The factory faces fixed monthly expenses of £1,500. If the factory produces 500 items every month, each item accumulates £3 in fixed costs (£1,500 / 500 items).

The overall price for each item is £5, consisting of £3 fixed cost and £2 variable cost. When the production reaches 1,000 items, the fixed cost per item decreases to £1.50. The cost per item decreases to £3.50 (£1.50 fixed + £2 variable), reducing the Marginal Cost as production increases.

2) Example 2

Summer Mattress typically manufactures 12,000 units per year with a cost of £4 million. Rising market demand necessitates additional units, leading to increased recruitment and procurement of materials. This increases the production expenses to £8 million for a quantity of 20,000 units.

A Financial Analyst computes the incremental cost at £4 million divided by 8,000 new units, resulting in £500 per unit.

Get ready for your next role with top Management Interview Questions and Answers. Explore expert insights and ace your interview with confidence!

Conclusion

In conclusion, Marginal Cost is one of the important tools for businesses in production and pricing decisions as well as resource allocation. Once an organisation has identified production cost behaviour, it can manage its operations (and reduce prices) to improve profitability. Implementing Activity-Based Costing can provide even more detailed insights into how production costs are generated, helping businesses make more strategic decisions. However, these are also real-world variables such as the demand in the market or fluctuation of cost. Marginal Cost analysis leads businesses in aligning decisions with economic goals and market conditions, ensuring long-term operational viability.

Dominate your market with our Costing And Pricing Training today!

Frequently Asked Questions

What is the key Concept in Marginal Costing?

The main idea in Marginal Costing involves grasping the way costs fluctuate with different production levels. It concentrates on variable expenses linked to production, aiding businesses in calculating the cost of manufacturing an extra unit and in making choices to enhance profitability and efficiency.

What is the Main Principle of Marginal Cost?

The primary concept of Marginal Cost involves assessing the extra expenses involved in creating an additional unit of a product. It assists companies in finding the optimal production level and balancing Marginal Cost and Marginal Revenue to maximise profit without incurring unnecessary fixed cost increases.

Why is Marginal Cost Shaped?

Marginal Cost is determined by the interaction of variable and fixed costs when production levels shift. Initially, costs decrease due to economies of scale but rise later as production increases due to capacity constraints and higher input costs. This forms a U-shaped Marginal Cost curve.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Management Courses, including the Costing and Pricing Training, Supplier Quality Management Training, and Business Sustainability Course. These courses cater to different skill levels, providing comprehensive insights into Council Tax Reduction.

Our Accounting and Finance Blogs cover a range of topics related to Finance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting and Finance skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Costing and Pricing Training

Costing and Pricing Training

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please