We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In the digital age, where payment card transactions have become the norm, ensuring the security of sensitive cardholder data is paramount. This is where the Payment Card Industry Data Security Standard (PCI DSS) comes into play. PCI DSS is a robust security framework that sets guidelines and requirements for businesses handling payment card information. To truly understand its significance, it is essential to delve into the PCI DSS History, its evolution and milestones.

According to Payments Fraud and Control Report 2022, 71% of surveyed organisations experienced actual or attempted payments fraud. This is the primary reason why PCI DSS exists. This blog will explore the PCI DSS History from its beginning to the present and understand how this vital security standard has impacted businesses worldwide.

Table of Contents

1) Emergence of PCI DSS in the Internet Age

a) Primary objectives of PCI DSS

b) Birth of PCI DSS

2) Evolution of PCI DSS

3) PCI DSS version history

a) Integration with other standards and additional standards

b) Stronger emphasis on risk management

c) Periodic updates and minor revisions

4) Impact of PCI DSS on businesses

5) Conclusion

Emergence of PCI DSS in the Internet Age

In the late 90s, when the internet was taking the world by storm, many businesses were going online. However, in the early days of electronic transactions, businesses and consumers faced significant challenges in protecting payment information, leading to an urgent call for a unified security standard.

Merchants, financial institutions, and consumers realised the necessity of implementing standardised security measures to safeguard payment card data. The absence of a comprehensive framework left the payment card industry vulnerable to cyberattacks, leading to financial losses and compromised customer trust.

In response to the growing need for security in the payment card industry, major credit card companies took the initiative to establish PCI DSS. In 2004, American Express, Discover Financial Services, JCB International, Mastercard, and Visa Inc. joined forces to create a unified standard to protect cardholder data.

Primary objectives of PCI DSS

PCI DSS aimed to achieve several key objectives with the implementation of their guidelines:

1) Build a secure network: Businesses were needed to establish and maintain a secure network infrastructure to protect cardholder data during transmission.

2) Protect cardholder data: Stringent measures were implemented to encrypt and safeguard cardholder data stored by organisations.

3) Maintain a vulnerability management program: Regular scanning and testing for vulnerabilities became crucial to identify and address potential security weaknesses.

4) Implement strong access control measures: PCI DSS emphasised restricting access to cardholder data, ensuring only authorised personnel could access sensitive information.

5) Regularly monitor and test networks: Continuous monitoring and testing were essential to promptly detect and respond to security breaches.

6) Maintain an information security policy: Organisations were required to develop and implement a robust and comprehensive information security policy to guide their security practices.

Birth of PCI DSS

The initial version of PCI DSS, known as version 1.0, was released in December 2004. Its primary objective was to provide a comprehensive set of security requirements that businesses accepting card payments must follow to protect cardholder data.

The release of PCI DSS 1.0 marked a significant milestone in the industry's approach to security. It laid the foundation for a standardised framework, guiding businesses to establish robust security practices.

Learn how to implement PCI DSS and protect your organisation from data breaches with PCI DSS Implementer training.

Evolution of PCI DSS

Throughout the PCI DSS History, it has undergone significant enhancements and evolutions over time to adapt to emerging technologies, evolving threats, and industry needs. These revisions have strengthened the standard, ensuring its effectiveness in safeguarding cardholder data and mitigating security risks.

As technology advanced, new payment channels and methods emerged, necessitating updates to PCI DSS. The standard evolved to address these changes and provide guidance on securing evolving payment technologies, such as mobile payments, e-commerce platforms, and point-of-sale systems.

With each revision, PCI DSS introduced additional security requirements to address evolving threats and vulnerabilities. These PCI DSS requirements encompassed various aspects of data protection, network security, access controls, encryption, and vulnerability management. If you're preparing for a role related to PCI compliance, being well-versed in PCI DSS Interview Questions can help you understand these requirements better. The standard aimed to provide a comprehensive approach to safeguarding cardholder data by expanding the scope of security measures.

Learn the basics of PCI compliance and take the first step towards meeting the requirements with the PCI DSS Foundation training.

PCI DSS version history

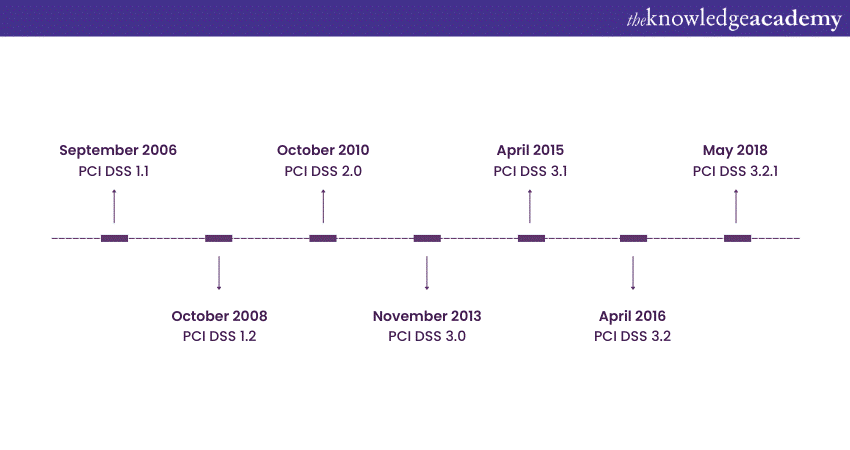

The guidelines were updated periodically, and the PCI DSS version history is given below.

1) PCI DSS 1.1 (September 2006): Clarification of requirements and additional guidance.

2) PCI DSS 1.2 (October 2008): Enhanced wireless security, secure coding practices, and mandatory penetration testing.

3) PCI DSS 2.0 (October 2010): Introduction of compensating controls, expanded scoping guidance, and integration with PA-DSS.

4) PCI DSS 3.0 (November 2013): Emphasis on a risk-based approach, enhanced penetration testing, strengthened encryption, and service provider validation.

5) PCI DSS 3.1 (April 2015): Migration from SSL and early TLS to more secure protocols.

6) PCI DSS 3.2 (April 2016): Multi-factor authentication, service provider management, and secure payment card device handling.

7) PCI DSS 3.2.1 (May 2018): Addressed SSL/TLS migration and minor clarifications.

8) PCI DSS 4.0 (expected release in Q1 2024): A more flexible, robust, and streamlined framework to address emerging technologies and threats.

Stay compliant and secure with the PCI DSS PDF. Download it now and dive into the best practices for protecting payment card information.

Integration with other standards and additional standards

PCI DSS has been integrated with complementary security standards to promote a holistic approach to data protection. For example, the Payment Application Data Security Standard (PA-DSS) was incorporated into PCI DSS 2.0 to address the security of payment applications. This integration ensured that security measures extended to the entire payment ecosystem, including the software for processing transactions.

PCI PTS (Payment Card Industry PIN Transaction Security)

PCI PTS is a security standard that ensures the secure management and processing of PIN-based transactions, including secure key management and device testing, to protect against fraud and unauthorised access.

PCI P2PE (Payment Card Industry Point-to-Point Encryption)

PCI P2PE is a standard that provides guidelines for encrypting payment card data from the point of entry at the merchant's location to its decryption within a secure environment, minimising the risk of data breaches.

PCI SSF (Payment Card Industry Secure Software Framework)

PCI SSF is a set of requirements and assessment procedures that guide the secure design and development of payment software applications to protect against vulnerabilities and potential exploitation, ensuring the integrity of payment transactions.

Get up to speed on Basel III and protect your organisation from financial risk with the Introduction To Basel III training.

Stronger emphasis on risk management

Throughout the PCI DSS History, it increasingly emphasised a risk-based approach to security to align with industry best practices. Organisations were encouraged to assess their unique risks and tailor security controls accordingly. This approach enabled businesses to allocate resources effectively and prioritise security measures based on the level of risk they faced.

Periodic updates and minor revisions

In addition to major version updates, PCI DSS has undergone periodic updates and minor revisions to address emerging issues, clarify requirements, and improve understanding. These updates ensured the standard remained up-to-date and responsive to the evolving threat landscape.

Impact of PCI DSS on businesses

Throughout the PCI DSS History, implementing its guidelines has had a significant impact on businesses operating within the payment card industry.

1) Enhanced data security: PCI DSS compliance mandates robust security measures like encryption and access controls, ensuring better protection of sensitive cardholder data against theft and unauthorized access. Additionally, adhering to standards such as ISO 9001:2008 PDF helps organizations maintain structured quality management alongside security compliance.

2) Mitigation of financial losses: Compliance reduces the risk of data breaches, fraudulent transactions, financial liabilities, and reputational damage, safeguarding businesses from significant financial losses.

3) Customer trust and confidence: Demonstrating PCI DSS compliance enhances customer trust, loyalty, and confidence in businesses, leading to stronger customer relationships and continued patronage.

4)Streamlined business operations: Compliance with standardised security measures improves operational efficiency, minimises disruptions caused by breaches, and strengthens overall business resilience.

5) Industry reputation and compliance mandates: PCI DSS compliance is often mandated by card brands and payment processors, ensuring businesses meet regulatory requirements and maintain positive relationships with partners.

6) Continuous security improvement: Compliance necessitates regular assessments, scanning, and testing, fostering a proactive approach to security and ongoing organisational improvement.

Conclusion

The PCI DSS History showcases its evolution as a crucial security standard for businesses in the payment card industry. PCI DSS has continuously adapted to address emerging threats, technological advancements, and industry needs since its early beginnings. The Importance of PCI DSS is evident in its impact on businesses, enhancing data security, mitigating financial losses, building customer trust, and driving continuous security improvement. As organisations strive to comply with PCI DSS and protect cardholder data, they contribute to a more secure payment card ecosystem.

Understand the general principles of consumer protection and protect yourself from financial risks. Sign up for the Consumer Protection Masterclass today.

Upcoming ISO & Compliance Resources Batches & Dates

Date

PCI DSS Implementer

PCI DSS Implementer

Thu 5th Jun 2025

Thu 7th Aug 2025

Thu 2nd Oct 2025

Thu 4th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please