We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Ensuring the security of payment card information is of paramount importance in the digital age of storing data. The PCI DSS provides a framework for organisations to safeguard sensitive cardholder data and prevent data breaches. Additionally, there are several PCI DSS Roles and Responsibilities that make the framework a shared responsibility among various entities in the ecosystem.

This blog explores the PCI DSS Roles and Responsibilities, shedding light on the key players involved in the ecosystem, and the obligations they must fulfil.

Table of Contents

1) PCI DSS: an overview

2) Importance of PCI DSS Roles and Responsibilities

3) Key PCI DSS Compliance Roles and Responsibilities

4) Benefits of fulfilling PCI DSS Roles and Responsibilities

5) Conclusion

PCI DSS: an overview

PCI DSS, which stands for Payment Card Industry Data Security Standard, is defined as a comprehensive set of security guidelines established by major payment card brands like Mastercard, Visa, and American Express. Its purpose is to ensure the protection of cardholder data and prevent data breaches within organisations that handle payment card information.

Compliance with PCI DSS is crucial for businesses as it helps establish a secure environment for processing, transmitting, and storing payment card data. By adhering to the standard's requirements, businesses can build trust with their customers, reduce the risk of data breaches, and avoid potential legal and financial consequences.

Importance of PCI DSS Roles and Responsibilities

The importance of PCI DSS Roles and Responsibilities can be summarised as the following key points:

a) Enhanced security: The roles and responsibilities in PCI DSS ensure that organisations implement robust security measures to protect cardholder data. By fulfilling their roles, merchants, service providers, and other stakeholders contribute to a secure payment card ecosystem, reducing the risk of data breaches and unauthorised access.

b) Trust and reputation: Compliance with PCI DSS builds trust among customers and stakeholders. By fulfilling their responsibilities, organisations demonstrate their commitment to data security and customer protection. This helps maintain a positive reputation, attract customers, and retain their trust in handling sensitive payment card information.

c) Legal and regulatory compliance: PCI DSS is not just a best practice; it is a mandatory requirement for businesses that handle payment card data. Fulfilling the designated roles and responsibilities ensures compliance with legal and regulatory obligations, protecting businesses from penalties, fines, and legal consequences.

d) Risk mitigation: Non-compliance with PCI DSS can expose organisations to significant risks, including financial losses, reputational damage, and customer attrition. By fulfilling their roles, enterprises mitigate these risks by implementing effective security controls, proactive monitoring, and incident response procedures.

e) Collaboration and accountability: PCI DSS compliance roles and responsibilities promote collaboration among various stakeholders involved in the payment card ecosystem. Clear delineation of roles and accountabilities ensures that all parties work together towards maintaining a secure environment for cardholder data.

Key PCI DSS Compliance Roles and Responsibilities

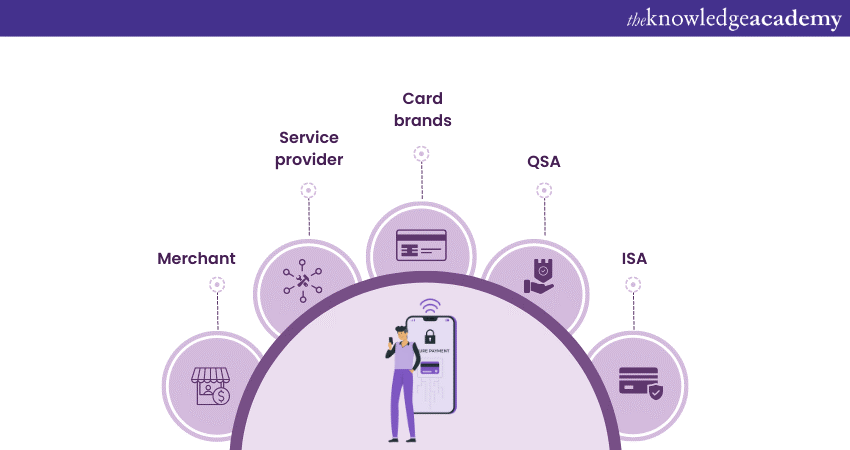

The key roles in PCI DSS and their responsibilities can be categorised as follows:

Merchant

Merchants are entities that accept payment cards as a form of payment. They have a direct relationship with the cardholders and are responsible for implementing necessary security measures to protect cardholder data. The responsibilities of a Merchant are as follows:

a) Secure network infrastructure: Merchants are responsible for implementing and maintaining secure network infrastructure, including firewalls, secured Wi-Fi networks, and regular vulnerability scanning.

b) Protect cardholder data: Merchants must employ strong encryption and tokenisation techniques to protect cardholder data during transmission and storage.

c) Regularly monitor and test networks: Merchants should continuously monitor their networks for suspicious activities and vulnerabilities through regular network monitoring and penetration testing.

d) Implement strong access control measures: Merchants must restrict access to cardholder data by implementing strong authentication mechanisms and access control policies.

e) Maintain an information security policy: Merchants should develop and maintain a comprehensive information security policy outlining security practices, responsibilities, and guidelines for employees.

Service provider

Service providers are third-party entities that handle, process, or store cardholder data for merchants. They play a crucial role in maintaining the security of the payment card ecosystem. The responsibilities of a service provider are as follows:

a) Ensure secure data storage and transmission: Service providers must implement robust security measures to protect cardholder data during storage and transmission.

b) Perform regular security assessments: Service providers should conduct regular security assessments, such as internal vulnerability scanning and external penetration testing, to identify vulnerabilities and ensure compliance.

c) Assist merchants with compliance: Service providers should offer guidance and support to merchants in achieving and maintaining PCI DSS compliance, providing resources, tools, and expertise.

d) Maintain a secure network: Service providers are responsible for maintaining a secure network infrastructure, including firewalls, intrusion detection systems, and monitoring tools.

Enhance the reputation of your enterprise by implementing PCI DSS standards! Learn more with the PCI DSS Implementer training course!

Payment card brands

Payment card brands, such as Mastercard, Visa, and American Express, establish and enforce the PCI DSS requirements. They work in collaboration with merchants and service providers to ensure compliance.

Qualified Security Assessor (QSA)

QSAs are independent security organisations validating an enterprise's PCI DSS compliance. They conduct audits and assessments to ensure that the necessary security controls are in place.

Internal Security Assessor (ISA)

ISAs are internal resources within an organisation that have undergone PCI DSS training and certification. They assist with internal compliance efforts and work closely with QSAs during audits.

Enhance the trust that consumers place in your organisation; sign up today for the Consumer Protection Masterclass!

Benefits of fulfilling PCI DSS Roles and Responsibilities

Fulfilling PCI DSS Roles and Responsibilities brings several benefits to organisations:

a) Improved operational efficiency: PCI DSS compliance requires organisations to establish standardised processes, documentation, and security controls. This leads to improved operational efficiency as employees follow streamlined procedures, reducing errors and enhancing productivity.

b) Expanded market reach: Many businesses require PCI DSS compliance from their partners or vendors before engaging in transactions. By fulfilling roles and responsibilities, businesses can expand their market reach by attracting partnerships with other PCI DSS-compliant entities. This opens up new business opportunities and collaborations.

c) Better incident response: PCI DSS roles and responsibilities include incident response planning and preparedness. By implementing robust incident response procedures, organisations can respond effectively to security incidents, minimise damage, and recover quickly. This proactive approach helps protect the enterprise's reputation and reduces the impact of potential breaches.

d) Long-term data protection: PCI DSS compliance fosters a culture of ongoing data protection. By fulfilling roles and responsibilities, businesses establish sustainable practices for safeguarding cardholder data. This ensures the long-term protection of sensitive information, even as technology and security landscapes evolve.

e) Competitive advantage: PCI DSS compliance sets organisations apart from their competitors. It demonstrates a commitment to security and data protection, giving them a competitive edge in the marketplace. Customers are much likelier to choose enterprises that prioritise the security of their payment card information.

f) Cost savings: While investing in security measures may incur initial costs, fulfilling PCI DSS roles and responsibilities can result in long-term cost savings. Preventing data breaches and associated financial losses, as well as avoiding non-compliance penalties, ultimately leads to financial savings for the organisation.

Conclusion

PCI DSS Roles and Responsibilities play a vital role in maintaining the security of payment card data. Merchants, service providers, payment card brands, QSAs, and ISAs all have distinct obligations that contribute to a secure payment card ecosystem. By fulfilling these responsibilities, organisations can mitigate risks, protect sensitive information, and build trust with customers.

Cultivate a culture of integrity and information ethics with our Compliance Training courses. Sign up now!

Frequently Asked Questions

Upcoming ISO & Compliance Resources Batches & Dates

Date

PCI DSS Implementer

PCI DSS Implementer

Thu 23rd Jan 2025

Thu 6th Feb 2025

Thu 3rd Apr 2025

Thu 5th Jun 2025

Thu 7th Aug 2025

Thu 2nd Oct 2025

Thu 4th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please