We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Private Wealth Management is the professional management of an individual's or a family's wealth, typically conducted by financial experts, such as financial planners, investment advisors, or private bankers. As we know, our financial markets are rapidly changing; therefore, to provide the best strategies and solutions for individuals and families, this service helps them to grow and prosper. In this blog, you will learn about Private Wealth Management, its essential functions and how to select a Private Manager.

Table of Contents

1) What is Private Wealth Management?

2) Key functions of Private Wealth Management

3) How does Private Wealth Management function?

4) Services provided by Private Wealth Management

5) Types of Private Wealth Managers

6) What are the advantages and disadvantages of Private Wealth Management?

7) Conclusion

What is Private Wealth Management?

Private Wealth Management is a highly specialised financial advisory service tailored for high-net-worth individuals, families, and organisations. It goes beyond standard financial planning, focusing on managing substantial assets and diverse investment portfolios. Wealth Managers are certified financial planners or investment advisors who work closely with clients to understand their unique financial objectives, risk tolerance, and long-term goals.

This tailored approach involves customised investment strategies encompassing various assets, including stocks, bonds, real estate, and alternative investments. Wealth Managers employ sophisticated techniques to optimise tax efficiency, minimise risks, and enhance wealth growth. They also provide comprehensive services such as estate planning, retirement planning, and succession planning, ensuring the seamless transfer of wealth across generations.

Key functions of Private Wealth Management

Now that you have an idea about Private Wealth Management, let’s look at some more points to understand the important functions of Private Wealth Management. These functions are as follows:

Income generation

Income generation is a fundamental aspect of Private Wealth Management. It is crucial for sustaining a high-net-worth individual or family's financial well-being.

a) Diversification of income sources: Wealth Managers diversify income streams from investments, businesses, real estate, and other assets to enhance stability and reduce risk.

b) Strategic investment allocation: Wealth Managers strategically allocate assets in dividend-paying stocks, bonds, and real estate investment trusts (REITs) to generate regular income.

c) Exploration of alternative investments: Wealth Managers explore alternative assets like private equity and annuities, evaluating their potential to provide unique income opportunities.

d) Tax-efficient income strategies: Wealth Managers implement tax-efficient strategies, utilising tax-deferred accounts and structuring income to minimise tax liabilities, thereby maximising after-tax income.

e) Retirement income planning: Wealth Managers assist in developing sustainable income strategies for retirement, ensuring retirees have a reliable cash flow to cover living expenses and other financial obligations.

Safeguarding assets and preserving capital

Private Wealth Management also helps in safeguarding assets and preserving capital. Let us see how:

a) Risk management strategies: Wealth Managers employ diversification techniques. These techniques involve investing in a mix of assets across various sectors and geographic regions to spread risk and minimise the impact of market volatility on the overall portfolio. By avoiding over-concentration in any single investment, they safeguard assets from significant losses.

b) Asset protection through legal structures: It helps clients establish legal systems such as trusts and family limited partnerships, which provide a layer of protection for assets. These structures can shield assets from creditors, lawsuits, and other potential threats, preserving family wealth for future generations.

c) Insurance and hedging instruments: Wealth Managers assess the need for insurance products and hedging instruments to protect assets against unforeseen events. This can include property insurance, liability insurance, and derivatives contracts that mitigate risks associated with currency fluctuations and interest rate changes.

d) Continuous monitoring and rebalancing: Wealth Managers continually monitor the performance of investments and market conditions. Regular reviews enable them to identify underperforming assets and make necessary adjustments to the portfolio. By rebalancing investments, they ensure that the portfolio aligns with the client's risk tolerance and financial goals, preserving capital over the long term.

e) Tax-efficient strategies: Wealth Managers implement tax-efficient strategies to minimise capital depletion due to taxation. This includes utilising tax-sheltered accounts, optimising capital gains, and employing strategies to reduce estate taxes. By mitigating the impact of taxes, they help preserve a more significant portion of the assets, ensuring wealth longevity.

Efficient tax management

Here is how Wealth Managers in Private Wealth Management bring efficient tax management:

a) Tax-optimised investment strategies: Wealth Managers design investment portfolios that consider tax implications, aiming to maximise after-tax returns. They strategically allocate assets, favouring tax-efficient investments like index funds and municipal bonds. Additionally, they employ techniques such as tax loss harvesting to offset gains and minimise taxable income.

b) Utilisation of tax-deferred and tax-free accounts: They leverage tax-advantaged funds like 401(k)s, Individual Retirement Accounts (IRAs), and Roth IRAs to defer taxes on contributions or enjoy tax-free growth. By strategically distributing assets across these accounts, they optimise tax efficiency, allowing clients to retain a more significant portion of their earnings.

c) Estate tax planning: They assist in developing comprehensive estate plans that minimise estate taxes upon transfer of assets to heirs. They may employ tools such as trusts and gifting strategies to reduce the taxable value of the estate. By structuring investments intelligently, they help preserve wealth for future generations.

d) Tax-efficient withdrawal strategies: During retirement, they develop strategies that minimise tax liabilities. They carefully plan the sequence of withdrawals from different accounts, considering tax implications at various stages of retirement. By managing leaves strategically, they optimise income while minimising taxes, ensuring a sustainable retirement income stream.

e) Continuous tax law monitoring and adaptation: They stay abreast of changing tax laws and regulations, adapting their strategies accordingly. By proactively adjusting financial plans to align with new tax codes, they ensure clients benefit from available tax incentives, credits, and deductions, optimising overall tax efficiency.

Are you interested to learn in-depth knowledge and practical skills in Accounting and Finance? Register now for our Accounting & Finance Training!

How does Private Wealth Management function?

Private Wealth Management is a highly personalised and strategic financial advisory service tailored for affluent individuals, families, and organisations. It begins with a thorough understanding of the client's economic landscape, including their goals, risk tolerance, cash flow needs, and existing assets. The process involves several key steps:

a) Assessment and goal setting: Wealth Managers conduct in-depth discussions with clients to assess their financial objectives, whether it's wealth preservation, income generation, tax optimisation, or legacy planning.

b) Financial planning: Based on the assessment, Wealth Managers develop a customised financial plan. This plan encompasses investment strategies, risk management, tax optimisation, estate planning, and retirement planning tailored to the client's unique needs and objectives.

c) Investment management: Wealth Managers create diversified investment portfolios aligned with the client's risk tolerance and financial goals. They monitor market trends, analyse assets, and make informed investment decisions to optimise returns while managing risks.

d) Continuous monitoring and adjustment: Wealth Managers continuously monitor the performance of investments, adapting the strategies based on changing market conditions, financial goals, and life events.

e) Comprehensive services: They provide a wide range of services, including estate planning, tax advisory, insurance analysis, and philanthropic planning. They also assist with legal and accounting services, ensuring all aspects of the client's financial life are seamlessly integrated and optimised.

Learn how to improve your financial career with our Capital Market Training. Join now!

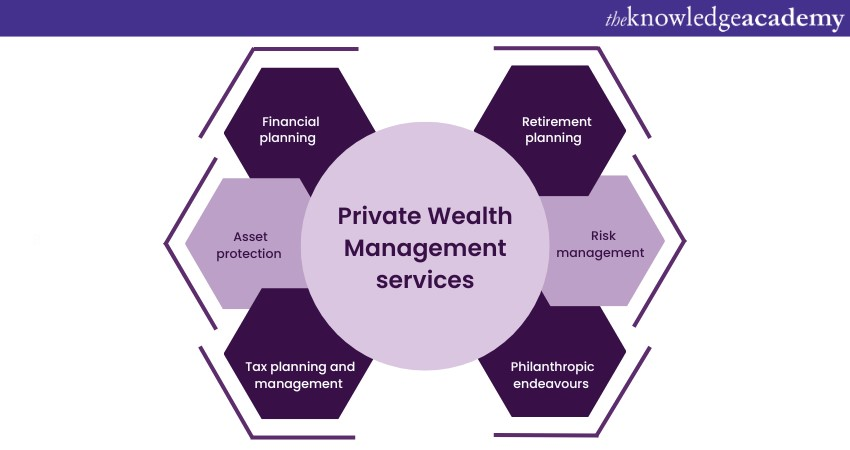

Services provided by Private Wealth Management

Private Wealth Management offers sophisticated financial services tailored to high-net-worth individuals and families, designed to optimise wealth growth, preserve capital, and ensure financial security across generations. These services include:

Financial planning

Financial planning is an important service that Private Wealth Management offers. This service ensures clients' economic well-being and long-term security. Wealth Managers meticulously analyse clients' financial situations, including income, expenses, investments, and liabilities, to develop a customised financial roadmap. This process involves setting clear, achievable goals, whether funding education, securing a comfortable retirement, or estate planning.

Wealth Managers assist clients in creating realistic budgets, optimising cash flow, and managing debt effectively. They design comprehensive investment strategies aligned with the client's risk tolerance and financial objectives. Moreover, financial planning within Private Wealth Management includes tax optimisation, which ensures clients benefit from tax-efficient investment choices and strategies.

Regular reviews and adjustments are conducted to adapt the financial plan to life changes and evolving market conditions, ensuring the plan remains relevant and effective over time. By providing expert guidance, they can help clients make informed decisions, navigate financial challenges, and achieve their economic aspirations with confidence and peace of mind.

Asset protection

Asset protection is a vital component of Private Wealth Management, focusing on safeguarding an individual's or a family's wealth from potential risks and liabilities. Wealth Managers employ various strategies to shield assets, such as establishing trusts, Limited Liability Companies (LLCs), and family partnerships. By creating legal structures, they can separate personal assets from business or investment-related liabilities, reducing the risk of loss in the event of lawsuits or financial downturns.

Additionally, insurance products, including liability insurance and umbrella policies, are often utilised to mitigate risks associated with property, legal liabilities, or professional practices. They also assess and strengthen estate plans, ensuring that assets are transferred seamlessly to heirs while minimising tax implications. Regular reviews and adjustments are conducted to adapt protection strategies to changing financial landscapes, legal regulations, and individual circumstances, which helps ensure that the wealth remains secure for current and future generations.

Tax planning and management

Tax planning and management are critical aspects of Private Wealth Management, aiming to optimise financial strategies while minimising tax liabilities. Wealth Managers employ a comprehensive approach, analysing clients' income, investments, and estate to develop tax-efficient plans. They explore deductions, credits, and exemptions within the legal framework, strategically timing income and deductions to minimise tax brackets.

Furthermore, they leverage tax-advantaged accounts, like IRAs and 401(k)s, and employ asset location strategies, placing tax-inefficient assets in tax-deferred accounts to maximise after-tax returns. Estate tax planning ensures assets are transferred efficiently, often involving trusts and gifting techniques to reduce tax burdens for heirs.

Retirement planning

Retirement planning within Private Wealth Management is a meticulous process to ensure individuals and families enjoy financial security during their post-work years. Wealth Managers assess clients' current financial status, anticipated retirement expenses, and investment portfolios to create a tailored retirement plan. This plan incorporates strategies for wealth accumulation, such as tax-advantaged retirement accounts and diverse investment options, aligning with the client's risk tolerance and long-term objectives.

They also focus on creating sustainable income streams for retirement, utilising annuities, pensions, and Social Security benefits alongside investment dividends and interest. They calculate withdrawal rates to ensure retirees can maintain their lifestyle without outliving their savings, considering inflation and potential healthcare costs.

Risk management

Risk management in Private Wealth Management is a strategic approach to identifying, assessing, and mitigating potential financial risks that could impact an individual's or a family's wealth. Wealth Managers meticulously analyse various risks, including market volatility, economic downturns, inflation, and unexpected life events like illness or job loss. They employ diversification techniques, spreading investments across different asset classes and geographic regions to minimise the impact of a single economic event.

Insurance products, such as life insurance, health insurance, and liability coverage, are strategically utilised to protect against specific risks. They also assess legal structures and estate planning tools, ensuring assets are shielded from potential creditors or legal disputes.

Philanthropic endeavours

Philanthropic endeavours within Private Wealth Management involve strategic and purposeful charitable giving, reflecting the values and aspirations of high-net-worth individuals and families. Wealth Managers assist clients in establishing philanthropic goals, guiding them through creating foundations, charitable trusts, or donor-advised funds. These vehicles facilitate impactful giving by providing structured, tax-efficient mechanisms for supporting philanthropic causes.

They analyse clients' financial positions to optimise charitable contributions, ensuring they align with their financial objectives. They also help clients identify causes and organisations that resonate with their values, providing donations to create meaningful social impact.

Want to learn about data analysis, mathematical modelling, and risk management and how you can implement them in Quantitative Finance? Register now for our Quantitative Finance Training!

Types of Private Wealth Managers

If you want some specific services from Private Wealth Management for your needs, you need to know the kind of Wealth Managers that you are going to hire. Here are two different types of Wealth Managers:

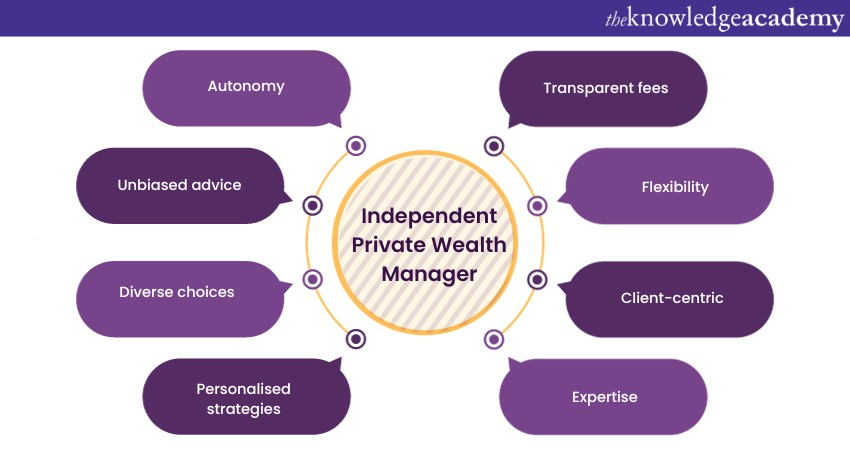

Independent

An independent Wealth Manager is a professional financial advisor who operates autonomously, free from the constraints of a specific financial institution or company. Unlike advisors tied to large banks or corporations, independent Wealth Managers have the flexibility to offer unbiased, personalised financial advice tailored to clients' unique needs and objectives. They can select from a broad range of financial products and services available in the market, focusing solely on the client's best interests. This independence allows them to provide objective guidance, create customised investment strategies, and offer a holistic approach to wealth management, fostering trust and transparency in the client-advisor relationship.

Bank-affiliated

A bank-affiliated Wealth Manager is a financial advisor employed by a specific financial institution, such as a bank or a large financial firm. Unlike independent Wealth Managers, these professionals operate within the framework of the bank's policies and product offerings. They provide financial advice and wealth management services to clients, leveraging the resources and products provided by their affiliated institutions.

While they offer convenience through seamless access to banking services, their recommendations may be influenced by in-house products, potentially limiting the scope of choices for clients. Clients benefit from the stability of a reputable institution, but it's essential to recognise the potential bias towards in-house financial products when working with bank-affiliated Wealth Managers.

Enhance your analytical skills and make strategic financial decisions with our Forecasting and Analysing Cash Flow Training!

What are the advantages and disadvantages of Private Wealth Management?

Here are some more advantages and disadvantages of Private Wealth Management:

Advantages

The advantages are as follows:

a) Personalised approach: Private Wealth Managers provide tailored financial strategies, considering individual goals, risk tolerance, and economic complexities.

b) Expertise and guidance: Clients benefit from the knowledge and expertise of seasoned professionals who can navigate complex financial markets and provide sophisticated investment advice.

c) Comprehensive services: Private Wealth Managers offer a wide array of services, including investment management, tax planning, estate planning, and philanthropic advice, ensuring holistic financial solutions.

d) Diversification: They help diversify investments, spreading risks across various assets to optimise returns and protect against market fluctuations.

e) Peace of mind: Clients gain peace of mind, knowing their wealth is prudently managed, allowing them to focus on other aspects of their lives.

The disadvantages are as follows:

Disadvantages

The disadvantages of Private Health Management are:

a) Cost: Private Wealth Management services can be expensive, often involving management fees and commissions, impacting overall investment returns.

b) Conflict of interest: Advisors might be incentivised to recommend specific financial products, potentially leading to biased advice.

c) Limited control: Clients may have limited control over day-to-day investment decisions, relying heavily on the expertise of their Wealth Manager.

d) Minimum investment requirements: Some Private Wealth Management firms have high minimum investment thresholds, excluding individuals with lower levels of wealth.

e) Market risks: While diversification helps manage risk, investments are subject to market fluctuations, potentially leading to losses.

Are you interested to learn essential strategies to enhance liquidity and maximise profitability? Sign up now for our Cash Cycle Management Training!

Conclusion

Private Wealth Management offers personalised financial expertise tailored to high-net-worth individuals, providing comprehensive solutions, expert guidance, and peace of mind. While it involves costs and potential conflicts, the advantages of tailored strategies, diversified investments, and holistic financial planning make it a valuable choice for those seeking optimised wealth management and long-term financial security.

Are you interested in exploring innovative technologies, blockchain, and digital finance solutions? Register now for our Introduction to FinTech Training!

Frequently Asked Questions

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Financial Management Course

Financial Management Course

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 25th Jul 2025

Fri 26th Sep 2025

Fri 28th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please