We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Day Trading can be a thrilling yet demanding pursuit, drawing in many with the allure of swift profits and the independence of being your own boss. However, it’s essential to grasp both the Pros and Cons of Day Trading before diving in.

This comprehensive blog will guide you through the Pros and Cons of Day Trading, offering a balanced view. By the end, you’ll have a better sense of whether these high-stakes strategies fit your financial goals and risk tolerance.

Table of Contents

1) What is Day Trading?

2) Pros of Day Trading

a) Potential for High Returns

b) Independence and Flexibility in Trading

c) Rapid Decision-Making Ability

d) Limited Drawdowns in Day Trading

e) Liquidity and Accessibility

f) Immediate Feedback on Trading Performance

3) Cons of Day Trading

a) High Risk and Possibility of Significant Losses

b) Time and Commitment Required for Success

c) Emotional and Psychological Strain

d) Transaction Costs and Associated Fees

e) Potential for Addiction to Trading

f) Necessity for Thorough Research and Analysis

4) Conclusion

What is Day Trading?

Day Trading is a dynamic strategy that involves buying and selling financial instruments within the same Trading day. Traders aim to profit from small price movements, often using significant amounts of capital to amplify gains. This method is commonly applied to stocks, forex, commodities, and cryptocurrencies. Unlike long-term investing, Day Trading emphasises short-term gains, demanding rapid decision-making and constant market monitoring.

Success in Day Trading requires a deep understanding of market trends, technical analysis, and the ability to act quickly on emerging opportunities. The fast-paced nature of Day Trading makes it both challenging and potentially rewarding, appealing to those who thrive under pressure and enjoy the excitement of the markets.

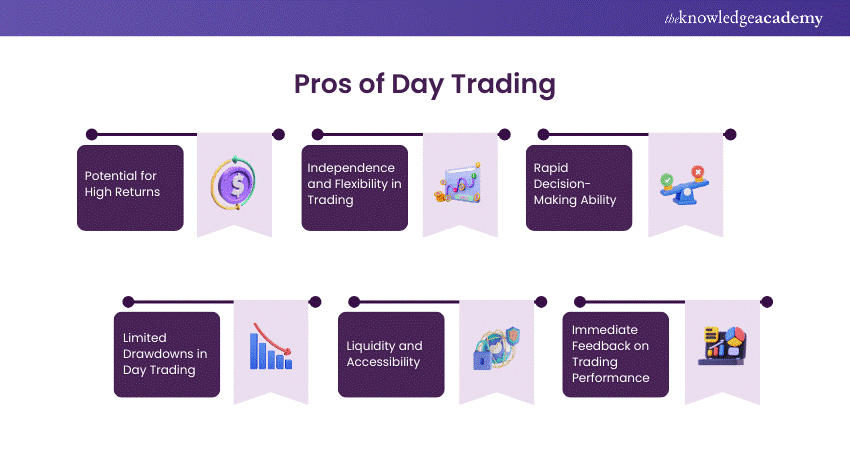

Pros of Day Trading

Day Trading may sound like a risky business, but it also has quite a few benefits. Here are some Pros of Day Trading for you to consider:

1) Potential for High Returns

Day Trading can offer substantial profits if executed correctly. The ability to leverage Trades means that even small price movements can result in significant returns. Skilled Traders who can consistently predict market trends and act swiftly can enjoy considerable financial rewards.

2) Independence and Flexibility in Trading

One of the most appealing aspects of Day Trading is the independence it offers. Traders have the flexibility and ease of working from anywhere with an internet connection. They can set their own hours and strategies as per their liking. This autonomy is a major draw for those looking to escape the Traditional 9-to-5 grind.

3) Rapid Decision-Making Ability

Day Trading sharpens your decision-making skills as you must quickly analyse market conditions and execute Trades. This fast-paced environment can be intellectually stimulating and rewarding for those who thrive under pressure.

4) Limited Drawdowns in Day Trading

Since Trades are closed by the end of the Trading day, there is no risk of overnight market changes affecting your positions. This can limit potential drawdowns, providing a sense of control over your investments.

5) Liquidity and Accessibility

Day Trading in highly liquid markets means buyers and sellers are always available, allowing you to easily enter and exit Trades. Additionally, technological advancements and online Trading platforms have made Day Trading more accessible than ever.

6) Immediate Feedback on Trading Performance

Day Trading provides immediate feedback on your strategies and decisions. This real-time evaluation allows you to quickly learn from mistakes and refine your approach, potentially accelerating your development as a Trader.

Ready to redefine your Trading strategy? This Day Trading Course is all you will need to guide you! - register now!

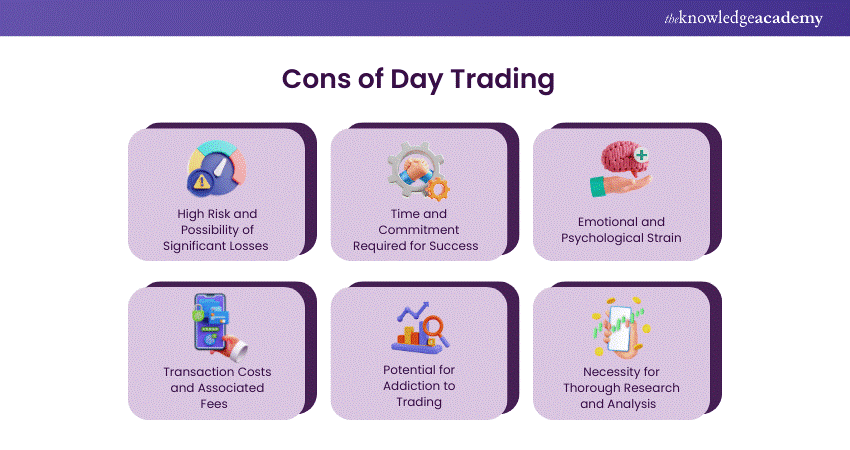

Cons of Day Trading

Like Spiderman said, with great power comes great responsibility. A fun take on that would be with great profit comes great risks. Here are a few cons of Day Trading to consider before you start Trading.

1) High Risk and Possibility of Significant Losses

The flip side of high returns is high risk. Day Trading is notoriously risky, with the potential for significant financial losses. Even experienced Traders can suffer substantial losses if market conditions are unfavourable or if they make poor decisions.

2) Time and Commitment Required for Success

Day Trading is a full-time job that requires immense dedication and commitment. Successful Traders spend countless hours analysing markets, developing strategies, and monitoring Trades. It demands a significant amount of your time and effort to be invested.

3) Emotional and Psychological Strain

The emotional and psychological strain of Day Trading can be overwhelming. The constant pressure to make quick decisions, the fear of losses, and the elation of gains can create a rollercoaster of emotions. Managing stress and maintaining emotional balance is crucial for long-term success.

4) Transaction Costs and Associated Fees

Frequent Trading incurs significant transaction costs and fees. This cost can eventually add up and eat into your profits. It's essential to factor in these costs when planning your Trading strategy to ensure they don't outweigh your gains.

5) Potential for Addiction to Trading

The thrill of Day Trading can be addictive, leading some individuals to develop unhealthy Trading habits. This addiction can result in reckless decision-making and significant financial losses. It's important to maintain a balanced approach and recognise when Trading is becoming detrimental.

6) Necessity for Thorough Research and Analysis

Successful Day Trading requires you to do thorough research and analysis. Traders must stay informed about all the market trends, news, and economic indicators. This level of commitment to staying updated can be time-consuming and demanding.

Enjoy the risks of Trading but want to take it a step further? Sign up for our Cryptocurrency Trading Training to know how!

Conclusion

This blog helps understand the Pros and Cons of Day Trading, which is essential for anyone considering this Trading strategy. While the potential for high returns and the independence it offers can be enticing, the high risks, emotional strain, and significant time commitment cannot be overlooked. Weighing these factors carefully will help you determine if Day Trading aligns with your financial goals and risk tolerance.

Want to up your investment game? Sign up for our Investment Management Course to kick off your investment ventures.

Frequently Asked Questions

Only about 10-20% of Day Traders are consistently successful, with many facing substantial losses.

Profitability varies widely; while some Traders earn significant returns, many struggle to break even or incur losses.

The best strategy depends on individual preferences and market conditions. Popular ones include scalping, momentum Trading, and swing Trading.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers Day Trading course alongside stock Trading. These courses cater to different skill levels, providing comprehensive insights into Investment Management.

Our investment training blogs cover a range of topics related to Investment and Trading, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Trading skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please