We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine being able to peek into your business's future and taste a tantalising glimpse of what's coming down the financial road. This is precisely what the process of Revenue Forecasting helps you accomplish. It's the guiding light that spotlights future revenue based on historical data, market trends, and strategic planning for both startups and established companies.

This blog unravels the craft of Revenue Forecasting in detail, encompassing its various methods, benefits, and challenges. So, dive in and plan your investments the smart way!

Table of Content

1) What is Revenue Forecasting?

2) Why is Revenue Forecasting Crucial?

3) Methods of Revenue Forecasting

4) Steps to Forecast Revenue

5) Advantages of Revenue Forecasting

6) Challenges in Revenue Forecasting

7) Common Revenue Forecasting Mistakes to Avoid

8) Conclusion

What is Revenue Forecasting?

Revenue Forecasting estimates how much money a company may earn selling products or services on a monthly, quarterly, or annual basis. By examining the state of the business, previous performance, and forces outside the company, you can make educated assumptions to predict future gross sales.

A revenue forecast evaluates the overall business, not just the marketing efforts, sales targets, or other activities executed by revenue operations teams. It must also consider a company’s competitive landscape, its capacity in terms of staffing and production, and economic trends. The revenue forecast is one of the essential first assumptions in establishing a company’s budget.

Why is Revenue Forecasting Crucial?

Revenue Forecasting shapes how a company thinks about its future and business decisions. The outlook on future revenue determines your budget for marketing campaigns, new hires, facilities and equipment, and research and product development.

Finance teams will then apply forecasts to every element on the cost side of the income statement necessary to achieve that sales target. This helps them estimate the profit and cash flow to be generated.

Methods of Revenue Forecasting

There are two key methods of Revenue Forecasting depending on the measurability of data, statistical techniques and expert opinions. These two methods are explored in detail below

Qualitative Methods

Qualitative methods rely on unmeasurable data and expert opinions. These methods are often used when a business enters a new market or historical data is limited. Some standard qualitative methods include:

a) Expert Opinions: This involves consulting industry experts (or internal stakeholders) to gather opinions and insights on the market and future revenue growth.

b) Market Research: This involves conducting interviews, surveys, or focus groups with customers and potential customers to understand their preferences and willingness to buy a product or service.

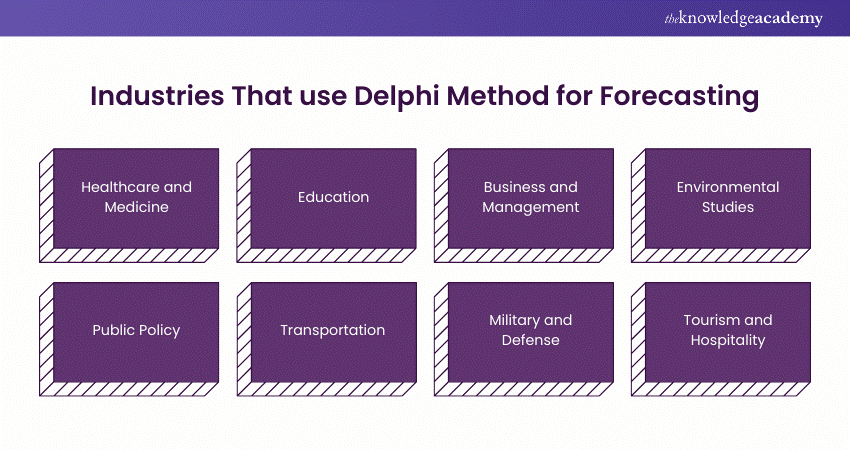

c) Delphi Technique: The Delphi Technique is a structured communication process involving a panel of experts who anonymously answer a series of questions about future revenue potential. Each round of questionnaires refines the group's collective opinion.

Quantitative Methods

Quantitative Revenue Forecasting methods rely on statistical techniques and measurable data to predict future revenue based on current trends and historical performance. Some standard quantitative methods include:

a) Straight-line Method: This simple forecasting method uses historical figures and trends to predict future revenue growth. It assumes a constant growth rate and extrapolates it into the future.

b) Moving Average: This method averages a series of historical data points, which typically involves adding all revenue numbers from one year and dividing them by the number of months in that year. The resulting average monthly revenue is projected forward.

c) Exponential Smoothing: This weighted average method prioritises the most recent data points. As the data points get older, the weights decline exponentially.

d) Regression Analysis: This statistical technique identifies the relationship between two or more variables, such as revenue and advertising budget or revenue and sales. It uses this relationship to forecast future revenue based on the changes in those variables.

Master modern investment strategies and portfolio management with our comprehensive Investment Management Course – Sign up now!

Steps to Forecast Revenue

By examining historical performance, the current state of your business, and external factors, you can estimate future revenue. Forecasting revenue takes preparation and discipline. Here are some steps you can take to accomplish it.

1) Collect Accurate Financial Data

Data helps you gain an understanding of an organisation’s history. Balance sheets, income statements, and cash flow statements provide the base. To gather such information, you may rely on software that automatically monitors transactions, categorises expenses, and generates financial statements.

2) Define the Forecasting Time Frame

It is typical to have an annual revenue forecast in addition to some smaller increments. While forecasting revenue for the next few years can be helpful, more extended forecasts are naturally less certain.

3) Evaluate Internal Growth Factors

This starts with your products and services, including geographic expansions or new offerings. You must factor in capacity in production, logistics, staffing, etc. Strategy, such as major marketing campaigns or acquisitions, also plays a major role.

4) Consider External Influences

These factors (also known as drivers) can fuel or slow your business growth. They include seasonality, consumer demand, regulatory or legal changes, economic conditions, or significant local, national and global events.

5) Identify Constraints and Risks

You should find answers to the following questions:

a) How sensitive is your forecast to business investment or consumer spending?

b) Could supply constraints such as skilled labour, material inputs, or transportation limit capacity?

These factors can influence the probability of your forecast and the range of possible outcomes.

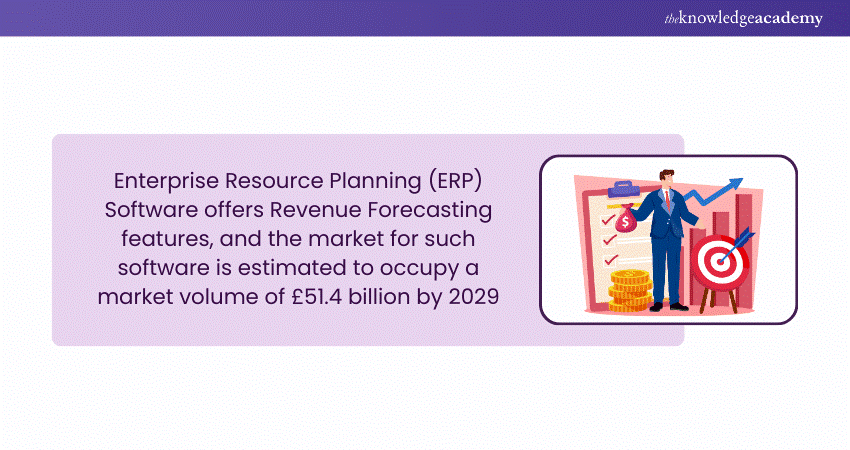

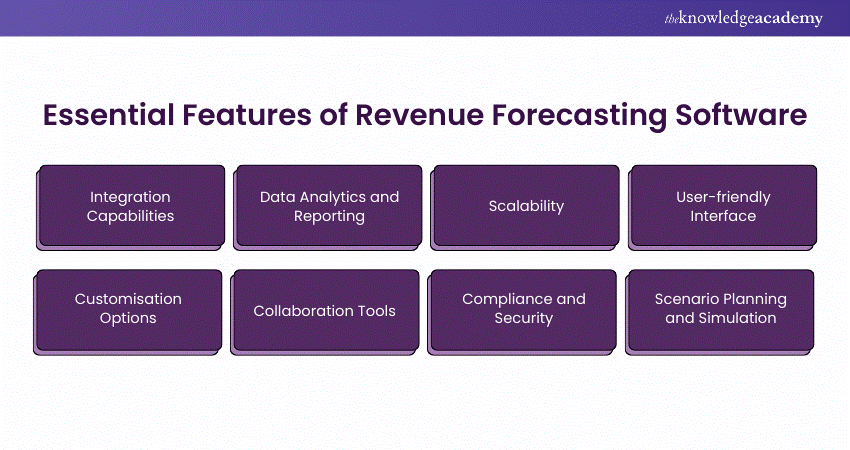

6) Utilise Forecasting Software

This could be anything from a spreadsheet to sophisticated financial forecasting software. Dedicated software can help consolidate the forecasting process, automate data gathering and analysis, and offer access to prebuilt forecasting models.

7) Select the Right Forecasting Method

With the data, assumptions and tools in place, you can move on to choose which forecasting methods best fit your business model. Multiple potential forecasting methods are available, including time-series analysis, regression analysis, and financial modelling techniques. Some are suited for seasonal businesses, while others are designed for companies that scale in a predictable manner.

8) Track and Adjust Your Forecast

You can set up dashboards to report on budget variances and revise the prediction based on actual revenue and changing economic conditions.

Advantages of Revenue Forecasting

Revenue Forecasting offers businesses a wealth of benefits, enabling them to improve resource allocation and navigate the ever-changing market landscape with greater agility. The biggest advantages are highlighted below:

1) Forecasting business models can direct investments towards areas with the highest potential for growth and profitability, minimising wastage and maximising returns.

2) A Revenue Forecasting model plays a significant role in avoiding cash flow shortfalls and preventing unexpected financial surprises.

3) Revenue Forecasting enables you to set realistic sales targets for marketing campaigns and track the progress of the sales pipeline towards achieving them.

Challenges in Revenue Forecasting

Revenue Forecasting is not without its share of formidable challenges, as detailed below:

1) Acquiring precise and dependable historical data points is a significant hurdle in Revenue Forecasting. Data manipulation, human error, or external factors beyond a company’s control can undermine the accuracy of data sources.

2) Another challenge is the inherent unpredictability of external events. Changes in consumer preferences, technological advancements, economic fluctuations, and regulatory changes can profoundly impact revenue projections.

3) Human error is a constant threat in Revenue Forecasting. Manual data entry, computational errors, and subjective judgments can introduce inaccuracies that undermine the integrity of the Revenue Forecasting models.

4) The intricate nature of contemporary business models further amplifies the challenges of Revenue Forecasting. Modern businesses operate within interconnected markets, rendering accurate predictions of revenue streams increasingly difficult.

5) Ever-shifting customer behaviour poses a persistent challenge for Revenue Forecasting. Purchasing patterns, consumer preferences, and market trends are in perpetual flux, making it arduous for businesses to keep pace.

Looking to master the best Revenue Forecasting methods? Our Revenue Management Course will help you out – Sign up now!

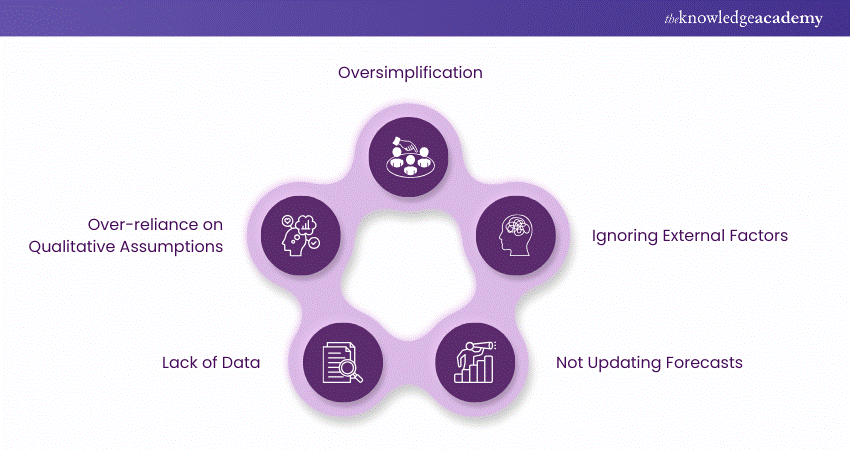

Common Revenue Forecasting Mistakes to Avoid

Now that you know the benefits and challenges associated with Revenue Forecasting, here are a few mistakes to avoid:

1) Lack of Data: Startups need help forecasting because historical data is absent. To boost their predictions, businesses must seek out market research, industry benchmarks, or competitor information.

2) Relying Solely on Qualitative Assumptions: Although qualitative data can provide valuable context, it's essential to balance this with quantitative data. Utilising historical trends and hard data can help produce a more accurate forecast, mitigating the possibility of bias.

3) Oversimplification: Businesses must avoid making overly simplistic projections, as this can lead to inaccurate estimates that negatively impact resource allocation and strategic decisions.

4) Ignoring External Factors: External factors such as regulatory changes, economic fluctuations or competitor activities must be monitored continuously. Ignoring these factors can hamper business progress.

5) Not Updating Forecasts: Revenue projections must be viewed as an evolving process, with regular updates to ensure they remain relevant.

Conclusion

In conclusion, Revenue Forecasting is a powerful tool that enables you to stay ahead in the market by predicting your future business revenue with greater precision. From collecting accurate financial data and utilising forecasting software to tracking and adjusting forecasts, the steps outlined in this blog will help you secure financial success.

Navigate the intricacies of financial markets with ease through our Investment Banking Course – Sign up now!

Frequently Asked Questions

What is the Best Method to Forecast Revenue?

Regression analysis, time series forecasting, and lead-driven forecasting are among the best methods to forecast revenue.

What are the Skills of Revenue Forecasting?

The skills required for Revenue Forecasting include:

a) Quantitative and Analytical Proficiency

b) Strategic Revenue Management

c) Technical Savvy with Revenue Systems

d) Financial Modelling

e) Data Visualisation

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Investment and Trading Courses, including Revenue Management Training and the Investment Management Course. These courses cater to different skill levels, providing comprehensive insights into Types of Investments.

Our Business Skills Blogs cover a range of topics related to Revenue Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Revenue Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Revenue Management Training

Revenue Management Training

Fri 2nd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 7th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please