We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Did you know that Robotic Process Automation (RPA) allows organisations to automate financial tasks like preparing financial statements and reconciling accounts? RPA empowers finance teams to move beyond routine data processing, enabling them to focus on strategic, high-value business decisions. By improving speed, accuracy, and efficiency, RPA transforms financial operations.

A report by McKinsey reveals that RPA can automate up to 42% of financial tasks. Using advanced scripts within applications, RPA software streamlines repetitive processes like data entry, enhancing data quality and operational effectiveness. In this blog, discover how RPA in finance revolutionises workflows and reallocates resources effectively.

Table of Contents

1) What is RPA in Finance?

2) Why do we Need RPA in the Finance Industry?

3) RPA's Advantages and Their Use Cases in Finance

4) How do Financial Institutions use RPA?

5) Future of RPA in Finance

6) Conclusion

What is RPA in Finance?

Robotic accounting, sometimes called Accounting Process Automation (APA), uses tools like RPA Blue Prism and UiPath to reduce the human labour required to handle accounting and finance department activities. The majority of the work is spent on routine data entering, and no matter what step of the business process data capture occurs, it takes time and produces problems that need to be fixed.

RPA in Finance helps in gaining the most valuable resource of all time. Everyone from the C-suite to sales needs structured financial data and insights to help them make timely business decisions. Yet, financial departments are overloaded in terms of both time and resources. Using a Blue Prism Work Queue Guide can help streamline these processes, making data more accessible and efficient for decision-making.

Robotic Process Automation (RPA), used in various industries, uses low-code software "bots" to complete time-consuming, repetitive tasks that human workers would otherwise handle. Such tasks include processing invoices, data entry, and compliance reporting, etc. Exploring the differences between AI and RPA technologies helps clarify when RPA is appropriate for automating repetitive tasks and when AI might be better suited for more dynamic decision-making processes.

Why do we Need RPA in the Finance Industry?

Factors considered in developing a business case:

a) Process efficiency improvement

b) Lowering data capture error rates and enhancing the quality of the data

c) Allowing employees to work on other projects.

The Breadth-First Search (BFS) industry struggles to remain relevant and competitive in a changing financial automation market. By automating manual activities and reducing errors with advanced RPA software, businesses may enhance operational effectiveness. They can also cut costs, raise accuracy, and adhere to regulatory requirements.

Accounting allows financial and accounting operations workers to manage work more efficiently by reducing data transfer work. RPA can be used smartly as part of a broader process improvement initiative or appropriately to automate existing processes. RPA offers a good return on investment, improved accuracy, and efficient management of heavy workloads.

Benefits of RPA in the finance industry:

1) Helps in Computerising and managing processes

2) Avoiding mistakes in managing tasks

3) Computerising documentation and standardisation

4) Improving efficiency and returns

Learning the fundamentals will help you explore the realm of Robotic Process Automation. Register right away for our training on Robotic Process Automation using UiPath!

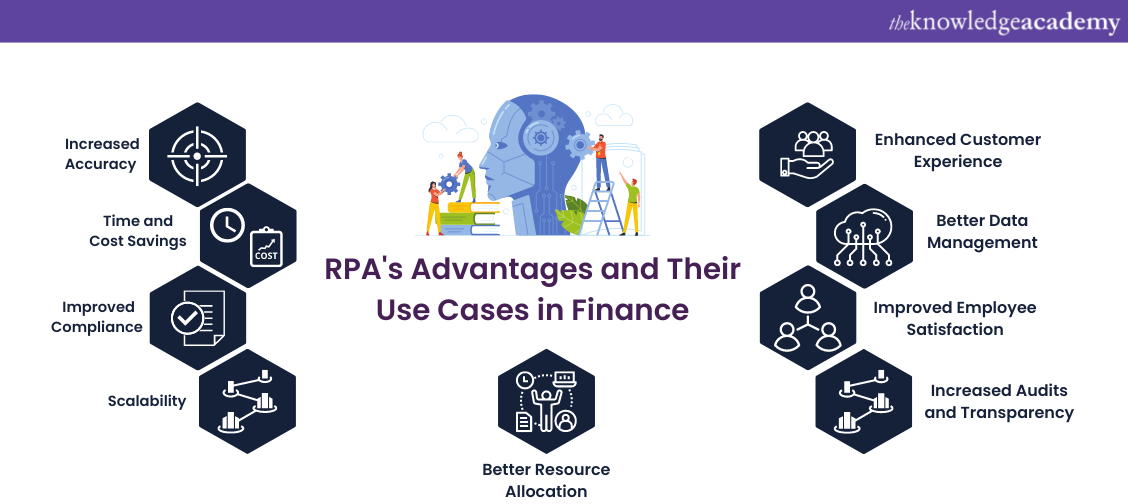

RPA's Advantages and Their Use Cases in Finance

All the process changes come with their own set of benefits and risks. Let’s take a look at the advantages of RPA and its application in finance:

a) Increased Accuracy: RPA can execute repetitive tasks without making errors, reducing the risk of human mistakes and enhancing accuracy in financial processes such as data entry, account reconciliations, and financial reporting. To understand how to implement this automation effectively, an RPA Tutorial can provide valuable insights and guidance.

b) Time and cost saving: RPA can perform tasks much faster than humans, significantly reducing processing time, increasing efficiency and reducing costs associated with manual processing. This can free up employees to work on more strategic tasks.

c) Improved Compliance: RPA can enforce compliance by adhering to defined business rules, policies, and procedures and ensuring that all transactions are executed according to legal and regulatory requirements.

d) Scalability: RPA can be scaled up or down as the workload changes, enabling organisations to adapt quickly to changing business needs.

e) Enhanced Customer Experience: RPA can automate routine tasks such as account opening, loan processing, and customer queries, which can help organisations to respond faster to customer needs and improve the overall customer experience.

f) Better Data Management: RPA can integrate with multiple data sources, providing real-time insights and enabling financial departments to make informed decisions.

g) Improved Employee Satisfaction: RPA can take on the repetitive and mundane tasks that employees might find boring, allowing them to focus on more complex and rewarding tasks. This can lead to improved employee satisfaction and retention.

h) Increased Audits and Transparency: RPA can provide a complete audit trail of all actions taken, providing transparency into the financial processes and ensuring that all actions can be traced back to their source.

i) Better Resource Allocation: RPA can analyse data and identify areas where resources are being underutilised or where there is excess capacity. These Use Cases of RPA can help financial departments better allocate resources to areas where they are needed most, maximising efficiency and reducing waste.

Discover the creation of web-integrated Open Span solutions. Sign up for our OpenSpan RPA Training!

How do Financial Institutions use RPA?

Financial institutions increasingly use Robotic Process Automation (RPA) to automate repetitive tasks and streamline operations. Here are some of the ways how financial institutions use RPA:

a) Account Opening and Management: Financial institutions can use RPA to automate the account opening process, including data entry, verification, and document processing. RPA can also automate Account Management tasks, such as updating customer information and sending account statements.

b) Compliance and Risk Management: Financial institutions are subject to strict compliance and Risk Management regulations, and RPA can help automate compliance checks, fraud detection, and other Risk Management activities. RPA can also help ensure all compliance requirements are met and reduce the risk of human error.

c) Loan Processing: RPA can help automate the loan processing workflow, including data collection, credit checks, underwriting, and document processing. This can help financial institutions speed up the loan approval process and improve customer service.

d) Customer Service: Financial institutions can use RPA to automate customer service tasks, such as responding to inquiries, processing requests, and resolving issues. This can help improve customer satisfaction and reduce the workload of customer service agents.

e) Accounting and Finance: RPA can help automate accounting and finance tasks, such as accounts payable and receivable, general ledger entries, and financial reporting. This can help reduce the risk of errors and improve the accuracy and speed of financial operations.

f) Reconciliation and Settlement: Financial institutions use RPA to automate the process of reconciling and settling transactions between different systems and counterparties. This can help reduce the risk of errors, speed up the reconciliation process, and improve the accuracy of settlement data.

g) Data entry and Processing: Financial institutions often have to process large volumes of data, such as customer information, transaction data, and market data. RPA can automate data entry and processing tasks, including data extraction, validation, and transformation.

h) Fraud Detection and Prevention: Financial institutions can use RPA to automate fraud detection and prevention activities, such as monitoring transactions for suspicious patterns or anomalies. RPA can also be used to flag suspicious transactions for further investigation automatically.

i) Trade Processing: Financial institutions can use RPA to automate trade processing tasks, such as trade confirmation, settlement, and matching. This can help reduce manual errors and speed up the trade processing workflow.

j) Compliance Reporting: Financial institutions must submit regular compliance reports to regulatory agencies, which can be time-consuming and complex. RPA can help automate the preparation and submission of compliance reports, including data extraction, formatting, and validation.

k) Human Resources: Financial institutions can use RPA to automate human resources tasks, such as employee onboarding, payroll processing, and benefits administration. This can help reduce manual errors and free up HR staff to focus on more strategic initiatives.

Eager to learn more about Robotic Process Automation, refer to our blog on "RPA testing"

Future of RPA in Finance

The future of Robotic Process Automation (RPA) in finance looks promising, thanks to new trends and technologies. Key developments include:

a) Integration with AI and ML: Combining RPA with Artificial Intelligence (AI) and Machine Learning (ML) to handle complex tasks, improve decision-making, and offer personalised services.

b) Hyperautomation: Using multiple technologies (RPA, AI, ML) together to automate entire business processes, increasing efficiency.

c) Natural Language Processing (NLP): Allowing RPA systems to understand and process human language, automating customer service and analysing unstructured data.

d) Robotic Process Discovery: Using AI tools to find and analyse business processes, uncovering automation opportunities and improving efficiency.

e) Advanced Data Analytics: Integrating RPA with advanced analytics for real-time insights, better risk management, fraud detection, and strategic decision-making.

These advancements will help financial institutions boost efficiency, improve customer experiences, and stay competitive.

Prepare with confidence for your RPA interview! Review the top RPA Interview Questions and strengthen your knowledge of robotic process automation to land your next role.

Conclusion

RPA can help financial institutions improve efficiency, reduce costs, enhance customer service, and ensure compliance with regulations, all while minimizing the risk of human error. The Benefits of RPA also include faster processing times, increased accuracy, and the ability to scale operations seamlessly. However, understanding and addressing RPA Challenges is crucial for successful implementation. Hope this blog gives you enough insights about RPA in Finance, its uses, and some of its advantages in the finance industry.

Learn automation technology with our Robotic Process Automation Training. Sign up now to streamline your business processes.

Frequently Asked Questions

What is the Rule of 5 in RPA?

The rule of 5 in RPA suggests automating tasks that require five or fewer decisions and steps. It simplifies the automation process, making it ideal for repetitive, rule-based tasks with minimal complexity. This ensures quick implementation, reduced errors, and greater efficiency in routine operations.

What is a 3-way Match with RPA?

A 3-way match with RPA automates the process of verifying purchase orders, invoices, and goods receipts to ensure data consistency. RPA cross-checks these documents, identifies discrepancies, and flags issues, reducing manual effort and improving accuracy in financial transactions and procurement workflows.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Robotic Process Automation Training, including Robotic Process Automation using UiPath Course, Robot Framework Training and OpenSpan RPA Training. These courses cater to different skill levels, providing comprehensive insights into Robotics And Artificial Intelligence.

Our Advanced Technology Blogs cover a range of topics offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Software Testing skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Advanced Technology Resources Batches & Dates

Date

Robotic Process Automation using UiPath

Robotic Process Automation using UiPath

Thu 12th Jun 2025

Thu 14th Aug 2025

Thu 9th Oct 2025

Thu 11th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please