We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Do you know how your local cafe keeps track of the hustle and the number of assorted coffees and snacks sold? The secret lies in the Single Entry System—the simplest financial recording method ideal for small businesses and startups.

In this blog, we'll understand what Single Entry System is, its key features, benefits, limitations, key differences between single-entry and double-entry systems, and more!

Table of Contents

1) What is a Single Entry System?

2) Features of Single Entry System

3) Advantages of Single Entry System

4) Disadvantages of Single Entry System

5) Single Entry System Examples

6) Single Entry System vs Double-Entry System: Key Differences

7) Conclusion

What is a Single Entry System?

Single Entry System is a financial transaction tracking technique that records only cash inflows and outflows without capturing detailed information about how the transactions are performed, the recurring amounts, etc. It is the most straightforward form of financial tracking suitable for smaller businesses and startups.

Features of Single Entry System

The key features of Single Entry Systems are described below:

1) It is a simplified bookkeeping method where each transaction is recorded once.

2) The system focuses mainly on cash flow, especially the ways to track cash inflows and outflows.

3) It is ideal for small businesses due to its ease of use and cost-effectiveness.

4) The system provides limited financial detail, not offering information on assets, liabilities, or equity.

5) It is characterised by simplicity and recording only income and expenses, requiring accounting knowledge.

6) The Single Entry System is suitable for small-scale operations that do not need detailed financial reports.

Advance in project profitability analysis- sign up for our Project Accounting Course today!

Advantages of Single Entry System

The key advantages of a Single Entry Systems are illustrated below:

1) It is easy to use due to its simplicity and is suitable for businesses with straightforward financial transactions.

2) It requires less accounting knowledge and fewer records compared to double-entry systems.

3) Single Entry Systems are time-efficient and cost-effective, allowing business owners to focus more on other important tasks.

4) It provides a seamless way to track cash flow and daily expenses without relying on complex bookkeeping processes.

Disadvantages of Single Entry System

Below listed are some of the advantages of Single Entry System:

1) It does not track assets, liabilities, or equity; thus, it provides incomplete financial information.

2) It is not suitable for businesses with complex financial needs. The main reason behind this is it cannot support comprehensive reporting or auditing.

3) Single Entry Systems could result in Increased risk of inaccuracies and fraud due to the absence of a systematic double-entry structure.

4) Errors and discrepancies are challenging to identify in this technique without the applications of cross-referencing accounts.

5) Its hard to maintain accurate financial records, leading to issues during tax preparation or financial evaluations.

Decode financial statements like a pro – join ours Accounting And Financial Statement Analysis Training!

Single Entry System Examples

The vital examples of Single Entry Systems are given below:

1) Freelance Photographer: A freelance photographer tracks income from client payments and records expenses like equipment purchases and software subscriptions.

2) Small Retail Store: A small grocery store records daily sales as income and stock purchases as expenses.

3) Local Cafe: A small cafe uses a Single Entry System to record daily earnings from sales and expenses for ingredients and utilities.

Elevate your asset management techniques with our Fixed Assets Accounting And Management Course- register today!

Single Entry System vs Double-Entry System: Key Differences

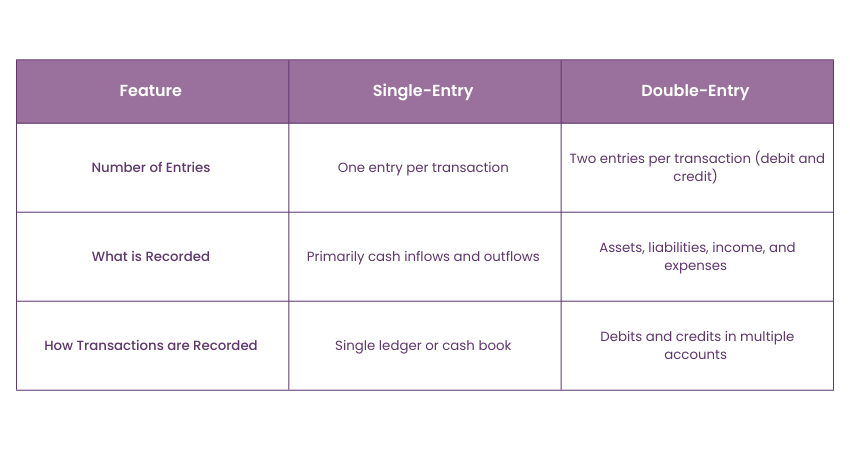

The key differences between Single Entry and Double Entry Systems are described below:

1) Number of Entries

In a Single Entry System, each transaction is recorded only once, which focuses on either income or expense. For example, if a sale is made, only the cash received is recorded. In contrast, the Double-Entry Accounting system records two entries—one debit and one credit—ensuring both sides of the transaction are captured, thereby promoting accuracy.

2) What is Recorded?

A Single Entry System majorly tracks cash inflows and outflows, giving a limited view of the business’s finances. It does not record assets, liabilities, or equity, which makes it insufficient for detailed financial reporting. The double-entry system, on the other hand, captures all aspects, including assets, liabilities, income, and expenses.

3) How are Transactions Recorded?

In single-entry bookkeeping, transactions are logged in a single ledger, focusing on one aspect, like cash received or paid. In contrast, double-entry bookkeeping records each transaction in two accounts, such as a debit to equipment and a credit to cash, ensuring balanced and precise financial records.

Conclusion

We hope you understand what a Single Entry System is. A Single Entry System is a straightforward method for bookkeeping, which is ideal for smaller businesses. It efficiently tracks basic financial activities like income and expenses. However, it lacks detailed insight into double-entry systems, making it suitable only for businesses with simple financial needs.

Advance in inventory financial control with our Inventory Accounting And Costing Course – sign up today!

Frequently Asked Questions

What Are the Rules of a Single Entry System?

The Single Entry System records each transaction only once by keeping a strong focus on cash inflows and outflows. It tracks income and expenses without accounting for assets or liabilities. Moreover, it’s simple, easy to maintain, and ideal for small businesses and those with straightforward financial needs.

What Are the Two Types of Single-entry?

The two types of Single Entry Systems are Pure Single Entry, which tracks only personal accounts and cash, and Simple Single Entry, which includes limited financial records such as individual and cash accounts.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Accounting Courses, including the Book Keeping Course, Treasury Management Training Course, and Inventory Accounting And Costing Course. These courses cater to different skill levels, providing comprehensive insights into 15 Cash Flow Strategies to Improve Capital Management.

Our Accounting and Finance Blogs cover a range of topics related to financial management and reporting, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your accounting and financial analysis skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Book Keeping Course

Book Keeping Course

Fri 6th Jun 2025

Fri 1st Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please