We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Day Trading and Swing Trading are quite popular in the stock market. Both hold securities for a specific period and once the target is achieved, the positions are squared off. The traders make a profit or loss as per analysis and view of the market. Before entering the trading, have a basic understanding of Swing Trading vs Day Trading.

Initially, everyone asks this eternal question for several reasons—some in hope, others in optimism. But for you, it’s better to overview both styles and know the pros and cons to make a calculated decision. That is where Swing Trading vs Day Trading comes in handy. This way, you reduce losing money and open doors to new trading strategies.

Table of Contents

1) What is Day Trading?

2) What is Swing Trading?

3) Difference Between Day Trading and Swing Trading

4) Which is Better Day Trading or Swing Trading?

5) Conclusion

What is Day Trading?

In the market, Day Trading (aka Intraday) means buying and selling financial securities or commodities on the day itself. Here, the trader takes and exits their position before the closing time of the market. Profits or losses depend on short-term market volatilities. The gap between the buying and selling amount becomes the trader’s profit.

For example, when the market opened, you bought 100 shares of ABC stock at £ 20 per share. After an hour, the price increased and reached £23 per share. Upon exit, you made a profit of £300. After 3 hours, you bought 100 shares of the same company at €15 per share. Instead of increasing, the stock price decreased to £13 per share. Now, you made a loss of £200 on the same day.

Advantages of Day Trading

Stock performance decides your profit or loss making. Given below are some advantages for Intraday:

a) High Profit: Intraday has potential for high profit making. Traders can make quick bucks from small price fluctuations in a single day.

b) Easy Entry and Exit: High liquidity enables traders to make easy entry and exit positions. Thus, providing a seamless experience to traders.

c) It’s Interesting: Trading gives continuous learning experience as it keeps traders updated with the latest trends, and happenings.

d) Minimal Risk: Trader's entry and exit positions within the same day, so the risk associated with Intraday is minimal compared to Swing Trading.

e) Independency: Intraday provides both flexibility and independence to work from anywhere. Traders can schedule their work as per this.

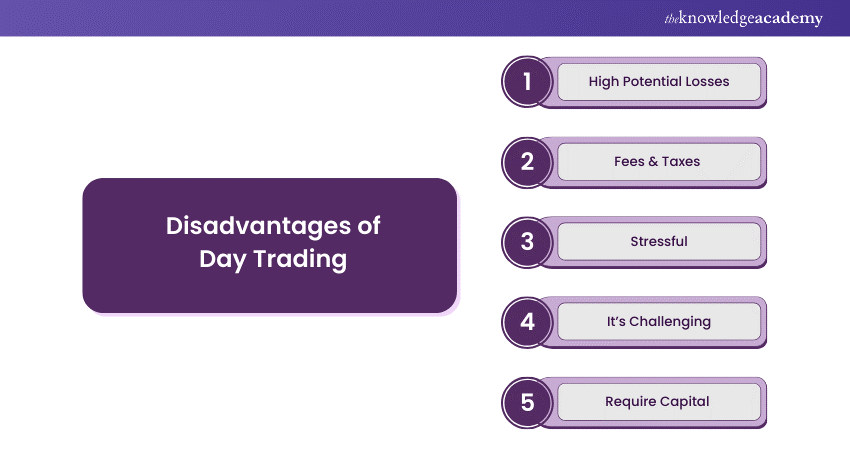

Disadvantages of Day Trading

Day trading, the practice of buying and selling financial instruments within the same trading day, can be lucrative for some, but it comes with several disadvantages that are important to consider. Here are the key disadvantages of day trading:

a) High Potential Losses: Inexperienced traders can lose their capital due to high volatility of the market. Also, lack of strategy and emotional decision making can result in setbacks.

b) Fees & Taxes: Trading comes with transaction costs in the form of fees, taxes, and commissions.

c) Stressful: Trading demands research and analysis. So, this can be stressful and time-consuming at the same time.

d) It’s Challenging: Trading is challenging as it can wipe out your capital if you make any wrong decision or analysis.

e) Require Capital: Intraday traders require a good sum of money to compensate fees & taxes incurred on trades taken.

Learn Swing & Day trading with our Day Trading Course- Sign up now!

What is Swing Trading?

Another short-term trading style is Swing Trading. Traders hold financial securities or commodities for several days to weeks. Traders prefer to swing highs or lows to enter and exit positions. Swing Trading requires proper technical and fundamental analysis to evaluate the stock.

For example, a trader bought the stock of ABC Company to its recent high of £35. After two weeks, it went to £45, and he made a profit.

Advantages of Swing Trading

With good market understanding and price momentum analysis, traders can make profits and reap given below advantages.

a) High-profit Potential: Swing Traders reap profits over trend movement in an upward direction.

b) Overnight Risk: Sudden news or events can break the backbone of your trade. For example, CEO succession, transition or poor management.

c) Part-time Job: Since Swing Trading doesn't require you to sit all day in front of the screen, you can make decisions at your pace.

d) Low Transaction Costs: Compared to Intraday, it has lower transaction costs from the broker's side.

Disadvantages of Swing Trading

Swing Trading comes with some setbacks, which are as follows:

a) Short-term Gain: Both Swing and Intraday Traders make profits on market movements. The only difference lies in the timeframe they use.

b) Time-consuming: Swing trading is time consuming as traders need to wait for days and weeks to make profit.

c) Less Opportunities: Swing traders often miss long-term opportunities as they use higher timeframes for trading.

Become Familiar with All Crucial Aspects of Investing and Trading with Our Investment and Trading Training!

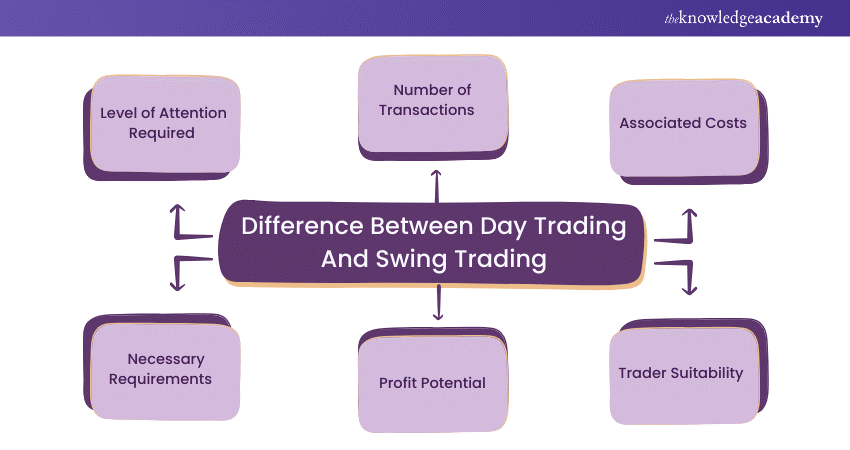

Differences between Day Trading and Swing Trading

Both trading styles follow different frameworks and strategies, so some differences are expected. We’ve compiled it so let’s discuss it in detail:

1) Level of Attention Required

Intraday trading needs constant chart monitoring to maximise market opportunities during the day. On the other hand, Swing trading requires time only for stock analysis. The trader must check the balance sheet and other fundamentals.

2) Number of Transactions

Day Traders can make more transactions, while Swing Traders require days to weeks. Swing Traders have fewer opportunities than Day Traders because they can’t make frequent transactions. You can opt for Day Trading if you can work in high-frequency trading.

3) Associated Costs

Since Intraday facilitates frequent transactions, the brokerage charges are also huge. On the other hand, swing traders need to pay less charges. The charges in Day Trading are higher compared to Swing Trading, as you need to enter and exit more than one time.

4) Necessary Requirements

Day Traders and Swing Traders need a demat and trading account to make trades. To avoid scams, one must open a demat and trading account from a recognised broker. You can easily find the best trading brokers online.

5) Profit Potential

Swing traders go home with high profits or losses, while Intraday traders make small profits or losses on each transaction. Both trading styles have pros and cons. Day Trading can make quick profits but comes with huge risks. On the other hand, Swing Trading makes less profit but is more secure.

6) Trader Suitability

Day trading demands quick decision-making, while swing trading requires less dependency of yours. Swing traders don't have to make huge commitments, and day traders like to sit for long hours in front of charts. Hence, you can pick Swing Trading if you can’t meet this requirement.

Unlock the Future of Finance! Enroll in Cryptocurrency Trading Course Today and Master the Skills to Profit in the Digital Currency Market!

Which is Better, Day Trading or Swing Trading?

Swing Trading and Day Trading use different approaches to benefit from the stock market. You can decide which suits you well depending on your time availability and capital. If you are someone who is generally calm, then Swing Trading is best for you. Otherwise, go with Day Trading, where you must monitor your trades. Always pick a trading style depending on risk-taking attitude, time allocation, stress tolerance, decision-making skill and passion.

Conclusion

In Conclusion, understanding Day Trading vs Swing Trading is mandatory to make decent profits. This way, you will know your availability for trades better. Working people can go with Swing Trading, while financial firms opt for Day Trading. In short, proper research and risk management can let you thrive in the market.

Master stock market basics with our Stock Trading Course- join today!

Frequently Asked Questions

Swing Trading needs a short to medium period to hold securities. So, the profit per transaction is more than that of intraday trading. The profitability of Swing Trading depends on factors like experience, market conditions, strategy, and risk tolerance. Swing Trading could best fit you if you can wait for at least one week.

Swing Traders reap high profits as they hold stocks for a longer time. However, day traders with better market understanding can also make decent daily profits. Swing Traders make less profit as they need to wait for profit and manage risk simultaneously. The profitability of both styles varies because of capital and risk management.

Usually, Swing Traders look for four hours and daily charts to make informed decisions. Day Traders use one hour and 15 min charts to enter and exit trades. Swing Trading is manageable as it requires less commitment than day trading. However, the time needed depends on experience, strategy, and conditions.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Day Trading Courses, including Stock Trading Course. These courses cater to different skill levels, providing comprehensive insights into What Is Trading Psychology: An Introduction.

Our Business Skills Blogs cover a range of topics related to Forex Trading, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance yourTrading skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Day Trading Course

Day Trading Course

Fri 21st Feb 2025

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please