We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Ever curious about how companies keep their financial ship sailing smoothly year after year? The secret’s often in the sails of Traditional Budgeting. It’s like the captain’s log, charting a course for spending and saving that’s stood the test of time.

Dive into our blog, and we’ll take you on a journey through the nuts and bolts of Traditional Budgeting. You’ll learn how to map out your money, steer through the setup, and balance the pros against the cons. Whether you’re a budgeting rookie or a fiscal navigator, mastering Traditional Budgeting can be your compass to financial triumph!

Table of Contents

1) What is Traditional Budgeting?

2) How to Use Traditional Budgets?

a) Align the Budget with Your Organisation's Strategy

b) Update Last Year's Figures

c) Factor in New Initiatives

d) Negotiate the Budget

e) Implement the Budget

3) Advantages and Disadvantages of Traditional Budgeting

4) Conclusion

What is Traditional Budgeting?

Traditional Budgeting is a financial planning technique where future expenses and revenues are estimated, usually for a fiscal year. This method uses historical data and makes incremental changes to develop a detailed financial plan. Its structured nature helps organisations create a clear financial roadmap, making it a widely adopted approach.

By relying on past performance and adjusting for expected changes, Traditional Budgeting provides a systematic way to allocate resources and manage finances. This approach ensures alignment with an organisation's strategic goals and objectives, facilitating effective Financial Management and planning.

How to Use Traditional Budgets?

Let's explore how to set up and use a traditional budget to monitor financial performance effectively.

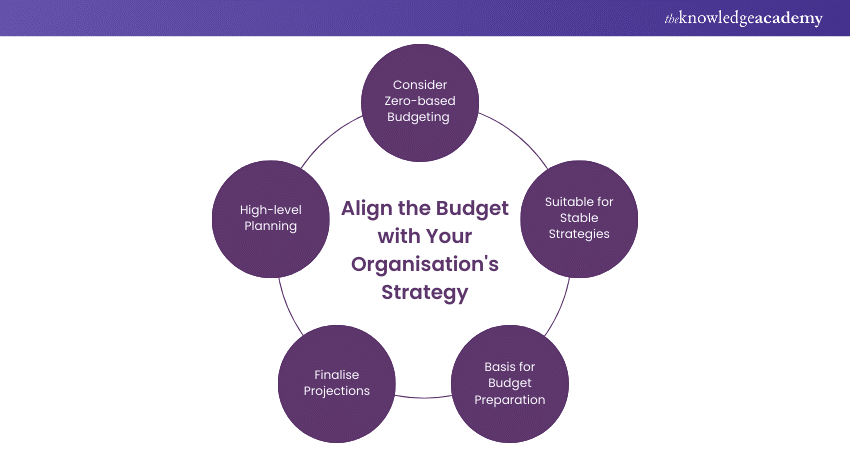

1) Align the Budget with Your Organisation's Strategy

The budgeting process typically begins at a high level as part of the organisation's strategic planning. At the conclusion of strategic planning, executives finalise sales and profit projections, economic forecasts, and other assumptions impacting revenue and expenses.

Once these factors are agreed upon, they form the basis for preparing the budget for the upcoming period, usually the next fiscal year. If the strategy remains largely unchanged from the previous year, with only minor modifications, a traditional budget is suitable. However, if the strategy has significantly shifted, you might need to consider a zero-based budget.

2) Update Last Year's Figures

Begin by reviewing last year's budget and then adjust each line item based on anticipated changes for the coming year.

With the organisation's strategy in mind, consider the following:

a) What is the projected revenue for this year?

b) Will additional spending on marketing or commissions be necessary to achieve these sales figures?

c) Are there plans to expand into new territories, and what are the associated costs?

d) Do you need to account for cost-of-living wage adjustments or union agreements?

e) Are utility or raw material costs expected to rise or fall?

f) Are there other factors that will vary or new items to include or eliminate?

Boost your Financial Management skills with our Financial Management Course -sign up today for expert training!

3) Factor in New Initiatives

Incorporate new items into the budget based on the goals and needs for the upcoming period.

a) Will new equipment purchases be necessary?

b) Are there plans to hire additional staff?

c) Is there a new product or service being introduced?

d) Are any major projects planned that require additional resources?

e) Conversely, are there projects or activities that will be cut or eliminated?

4) Negotiate the Budget

Once you have submitted your proposed budget, anticipate challenges and negotiations. Desired budgets are often ambitious, and costs must be controlled to ensure the organisation remains profitable.

This stage involves significant negotiation as various departments vie for a limited budget. Be prepared to present a strong business case for your budget, demonstrating how it supports the organisation's strategy.

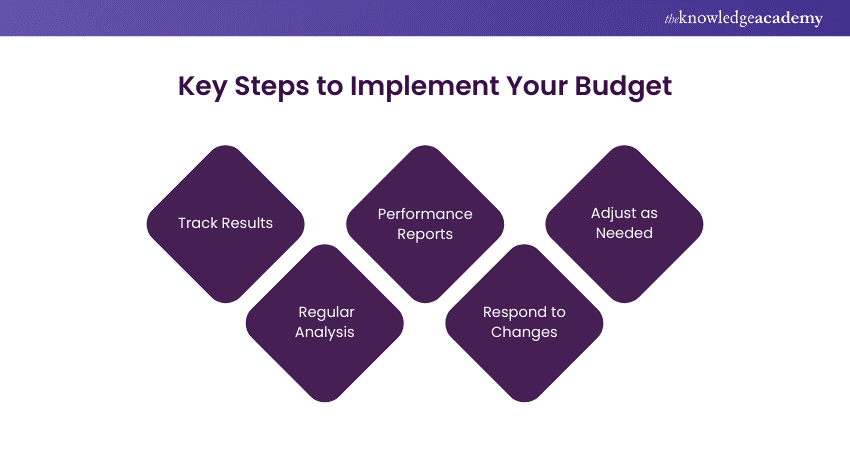

5) Implement the Budget

After the final budget approval, use it to track actual results against your predictions.

Throughout the year, regularly analyse your budget and calculate variances. Many organisations require periodic performance variation reports to monitor financial performance. These reports help identify how to align expenses with the budget.

If unexpected changes occur, take appropriate actions to realign with the budget. Modify the budget to reflect the new situation and the planned response more accurately. This process may be challenging, as deviations can affect the organisation's earnings targets, drawing significant attention and requiring careful management.

Register in an Introduction To Managing Budgets Course today and take control of your financial planning!

Advantages and Disadvantages of Traditional Budgeting

Understanding the strengths and weaknesses of Traditional Budgeting can help organisations determine if it is the right approach for their financial planning needs. Let’s explore the advantages and disadvantages of Traditional Budgeting:

Advantages

Traditional budgets offer several advantages in managing an organisation’s financial activities. Let’s delve into them:

a) Provides a Robust Framework: Traditional budgets rely on historical data from the previous year, creating a solid foundation. This reference point simplifies budget management and execution.

b) Promotes Decentralisation: By involving everyone in reviewing last year’s spending and shaping the next year’s budget, decentralisation occurs. Top management can focus on other critical tasks without micromanaging budget details.

c) Ingrains Organisational Culture: Traditional Budgeting becomes ingrained in the company’s culture due to its simplicity. It perpetuates over time. Introducing new methods, like “zero-based budgeting,” can be risky for the business.

Disadvantages

Traditional Budgeting has its share of drawbacks. Let’s explore them:

a) Higher Risk of Human Errors: Relying on numerous spreadsheets increases the likelihood of mistakes. These errors can prove costly for businesses.

b) Time-consuming Process: Traditional Budgeting involves extensive spreadsheet work. Comparing the previous year's spending with expected expenses, accounting for inflation, and other factors consumes significant time.

c) Lack of Incentives for Desired Behaviours: Traditional budgets don’t incentivise innovative or loyal behaviours. Departments that prioritise organisational goals may not receive adequate budget allocation.

d) Misalignment With Strategy: Each year brings new strategic objectives. Yet, traditional budgets often replicate past spending patterns, hindering alignment with evolving organisational goals.

e) Inaccurate Predictions: Basing next year’s budget solely on the previous year’s data points lacks precision. To improve accuracy, consider strategic plans and adapt accordingly.

Boost your skills with expert training Personal Development Courses - sign up today!

Conclusion

Traditional Budgeting is a cornerstone of financial strategy, harnessing the power of past figures to shape future finances. Its systematic method for divvying up funds and reigning in spending keeps it in favour, even with a few hitches. Adopting Traditional Budgeting paves, the way for financial forecasts that are both reliable and regulated.

Enhance your productivity by signing up for the Organisational Skills Course and mastering effective management today!

Frequently Asked Questions

Technology streamlines Traditional Budgeting by automating data collection, analysis, and reporting, reducing errors, saving time, and enhancing accuracy. It also facilitates real-time monitoring and easier adjustments to financial plans.

Technology streamlines Traditional Budgeting by automating data collection, analysis, and reporting, reducing errors, saving time, and enhancing accuracy. It also facilitates real-time monitoring and easier adjustments to financial plans.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various blogs on Personal Development Courses, including Introduction to Managing Budgets, Organisational Skills, Building Business Relationships and more. These courses cater to different skill levels, providing comprehensive insights into Corporate Entrepreneurship.

Our Business Skills Blogs cover a range of topics related to Budgeting, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Budgeting skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Introduction to Managing Budgets

Introduction to Managing Budgets

Fri 14th Feb 2025

Fri 11th Apr 2025

Fri 13th Jun 2025

Fri 8th Aug 2025

Fri 10th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please