We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Understanding the Types of GST is essential for both businesses and consumers. These tax categories not only simplify the complex tax landscape but also streamline transactions by ensuring transparent and fair tax distribution. Whether you're a business navigating compliance or a consumer purchasing goods, knowing how these GST types function can help you better understand the impact on pricing and operations.

Table of Contents

1) What is GST?

2) Purpose of GST

3) Components of GST

4) Types of GST Taxes

5) Current Usage of Various GST Types

6) Taxes Replaced by GST

7) Who Must Pay GST?

8) Benefits of GST

9) Conclusion

What is GST?

Goods and Services Tax (GST) is a value-added surcharge applied on items for domestic consumption. It serves as an all-around, unified indirect tax law across the entire country. GST is ingrained in the final price of a product, meaning customers pay a price that includes tax. The business or seller collects this tax and subsequently remits it to the government. It replaced most indirect taxes, creating a unified domestic tax system applied at every stage of value addition.

In India, the Central Government administers GST, aligning with the Objectives of GST to create a unified tax system. For intrastate commerce, the tax is divided between the central and state governments under the Central GST (CGST) and State GST (SGST) frameworks. Enforced on 1 July 2017 through the 101st Constitutional Amendment, GST replaced multiple central and state taxes, supporting its objective of streamlining taxation. This date is now celebrated as GST Day.

Purpose of GST

GST is a complete reform that replaced indirect taxes like service tax, VAT and excise duty in India.

Essential purposes of GST include:

Eliminating the Cascading Tax Effect: GST applies only to the net value added at each production stage, effectively removing the "tax-on-tax" scenario, which lowers the overall cost of goods.

Subsuming Indirect Taxes: Most indirect taxes charged by state and central governments are now consolidated under GST, streamlining the tax procedure.

Reducing Corruption and Tax Evasion: GST upholds ethical principles, including transparency in intricate details, thereby reducing tax evasion and fraudulent ITC in GST claims.

Improving Tax Compliance: GST aims to simplify processes like registration and return filing, particularly for small and unorganised businesses, thus improving overall tax compliance.

Boosting Productivity and Efficiency: GST is expected to improve business productivity and operational efficiency, mainly by removing entry taxes, eradicating logistical restrictions and simplifying input tax credit claims.

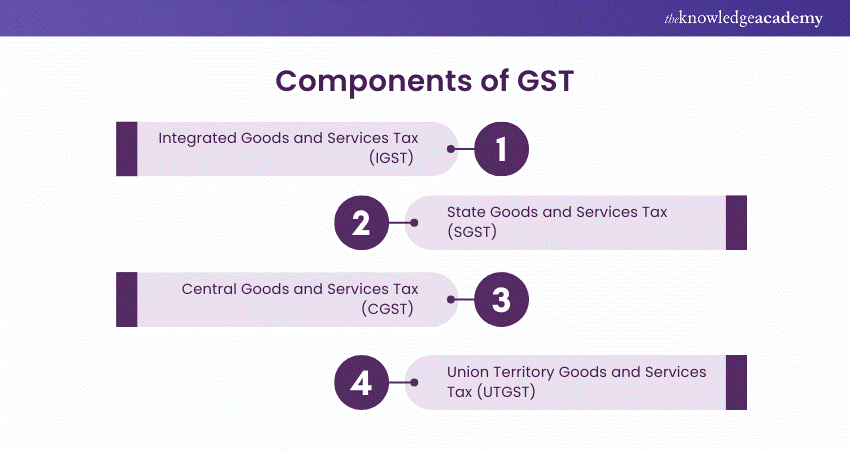

Components of GST

India's GST system is divided into four key types:

1) Integrated Goods and Services Tax (IGST)

2) State Goods and Services Tax (SGST)

3) Central Goods and Services Tax (CGST)

4) Union Territory Goods and Services Tax (UTGST)

Each category serves specific transaction scenarios, and the government has established varying tax rates for goods and services under each type. These rates are applied accordingly to ensure proper taxation based on the nature of the transaction and location.

State Goods and Services Tax (SGST)

Under India's GST plan, the State Goods and Services Tax is a tax imposed on intrastate trades, meaning transactions occurring within the same state. In such cases, both the State GST (SGST) and the central GST (CGST) are applied.

For example, if a trader in Karnataka sells goods worth ₹5,000 to a consumer within the same state, and the applicable GST rate is 18%, the amount will be split equally between CGST and SGST, each 9%. The total amount charged will be ₹5,900. The amount under SGST (₹450) will be handed over to the West Bengal government as state tax revenue.

Central Goods and Services Tax (CGST)

The Central Goods and Services Tax is applied to intrastate transactions under India's GST system, similar to the State GST (SGST). The CGST Act controls it and collects revenue for the Central Government.

For example, if a merchant in Karnataka sells goods worth ₹5,000 to a consumer within the state, the GST on this transaction will consist of CGST and SGST. If the total GST rate is 18%, it is equally divided into 9% CGST and 9% SGST. The total price to the consumer will be ₹5,900, with ₹450 of that collected by the Central Government as CGST.

Integrated Goods and Services Tax (IGST)

The Integrated Goods and Services Tax is a tax applied to interstate transactions (between two states) and imports and exports under the GST system in India. It is overseen by the IGST Act, with the Central Government accountable for managing the tax. The collected IGST is then distributed between the individual states by the Central Government.

For example, if a trader in West Bengal sells goods worth ₹5,000 to a consumer in Karnataka, IGST will apply, as it is an interstate dealing. If the fitting GST rate is 18%, the total amount charged by the merchant will be ₹5,900, with ₹900 as IGST, which the Central Government will collect.

Union Territory Goods and Services Tax (UTGST)

The Union Territory Goods and Services Tax is similar to the State Goods and Services Tax (SGST). However, it is mainly imposed on the supply of goods and services within India's Union Territories (UTs). The UTGST Act governs it and applies to Union Territories like the Andaman and Nicobar Islands, Chandigarh, Daman and Diu, Dadra and Nagar Haveli, and Lakshadweep.

The Union Territory governments collect UTGST and replace SGST in these regions. In Union Territories, both UTGST and Central GST (CGST) are applied to transactions, ensuring that the tax system remains consistent across states and territories.

Streamline your tax filing process with our expert-led Tax Filing Course today!

Types of GST Taxes

GST is classified into different types depending on the nature of the transaction. These types determine how the tax is applied and distributed between the central and state governments:

Inter-State Transactions

Inter-state transactions refer to the supply of goods or services between two different states. The IGST is used in such cases. The IGST is collected by the Central Government, which then allocates a share to the state where the goods or services are consumed. Additionally, businesses can claim a GST Refund Process on the IGST paid in certain situations. This ensures that the revenue helps the state where the consumption happens, even though the supply may have stemmed in a separate state.

Intra-State Transactions

Intra-state transactions occur when the supply of goods or services happens within the same state. Both the CGST and SGST are imposed for these transactions. The total GST is divided equally between the central and state governments where the transaction happens. The central government collects CGST, while the state government collects SGST, guaranteeing both governments gain from the transaction occurring within the state.

Current Usage of Various GST Types

The table below illustrates the current usage of different Types of GST based on various transaction scenarios:

Taxes Replaced by GST

GST has unified most of the Taxes in India. Here are the key taxes that were replaced by the implementation of the Goods and Services Tax:

Central Taxes Replaced by GST:

a) Central Excise Duty

b) Service Tax

c) Additional Excise Duty

d) Additional Customs Duty (also known as Countervailing Duty)

e) Special Additional Duty of Customs (SAD)

f) Central Surcharges and Cesses (related to supply of goods and services)

State Taxes Replaced by GST:

a) Value Added Tax (VAT)

b) Sales Tax

c) Central Sales Tax (CST)

d) Entertainment Tax (except those levied by local bodies)

e) Octroi and Entry Tax

f) Purchase Tax

g) Luxury Tax

h) Taxes on Lottery, Betting, and Gambling

i) State Cesses and Surcharges (related to goods and services)

Who Must Pay GST?

The following classes of people and entities are accountable to pay GST:

a) Individuals registered under GST who are engaged in making taxable supplies.

b) GST-registered persons who are required to pay tax under the reverse charge mechanism.

c) Persons registered under GST who are obligated to deduct tax at source (TDS).

d) E-commerce operators registered under GST, responsible for collecting tax at source (TCS).

e) Agents providing goods & services on behalf of a supplier or manufacturer.

Get ahead with our Introduction To UAE Corporate Tax Training today!

Benefits of GST

Here are the key benefits of GST:

a) Eliminating the Cascading Tax Effect: GST removes the "tax on tax" scenario by taxing only the value added at each stage of production and distribution, leading to lower overall costs for companies and customers.

b) Simplification of the Tax System: GST converges different indirect taxes into a single tax system, decreasing complexity and making it easier for businesses to comply with tax regulations.

c) Increased Transparency: By making the entire tax process digital and standardised, GST encourages transparency in the tax system, lowering the scope for tax evasion and fraud.

d) Boost to the Economy: GST helps boost economic growth and competitiveness by encouraging a more efficient tax system and lowering business compliance costs.

e) Broader Tax Base: GST broadens the tax base by bringing more businesses and transactions under the tax net, leading to higher revenue collections for the government.

Conclusion

In conclusion, the Types of GST—CGST, SGST, IGST, and UTGST play a crucial role in simplifying India's tax system for businesses and consumers. By ensuring fair tax distribution across states and central authorities, these GST types promote transparency, reduce tax burdens, and foster seamless transactions, ultimately contributing to a more efficient economy and smoother business operations.

Master VAT regulations with our expert-led VAT Training. Sign up today!

Frequently Asked Questions

How Many Types of GST Forms Are There?

Over 20 Types of GST forms are used for different objectives, including registration, filing returns, payment, and refunds. These forms help simplify taxpayer obedience and assure proper tax reporting and payment within the GST system.

Why is GST Important?

GST is necessary because it simplifies India's tax system by reducing multiple indirect taxes into one. It fosters clarity, lowers the cascading tax effect, improves adherence, and promotes economic growth by making it easier for businesses to operate nationwide.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Tax Courses, including the GST Course, Tax Filing Course, and Introduction to UAE Corporate Tax Training. These courses cater to different skill levels, providing comprehensive insights into Revenue Cycle Management.

Our Accounting and Finance Blogs cover a range of topics related to Taxation, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Taxation skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

GST Course

GST Course

Fri 23rd May 2025

Fri 25th Jul 2025

Fri 26th Sep 2025

Fri 28th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please